What to Include in a Winning Trading Plan for Beginners; The Ultimate Guide to Creating: Strategies to Dominate the Markets

If you’re a beginner looking to succeed in trading, having a winning trading plan is non-negotiable. A well-crafted plan not only helps you stay disciplined but also maximizes your chances of profitability while minimizing risks. In this comprehensive guide, we’ll break down everything you need to know about creating a trading plan that works, backed by expert insights, trending data, and actionable tips. By the end of this article, you’ll have the tools and knowledge to start trading like a pro and achieve consistent results.

Table of Contents

Why a Trading Plan is Essential for Beginners

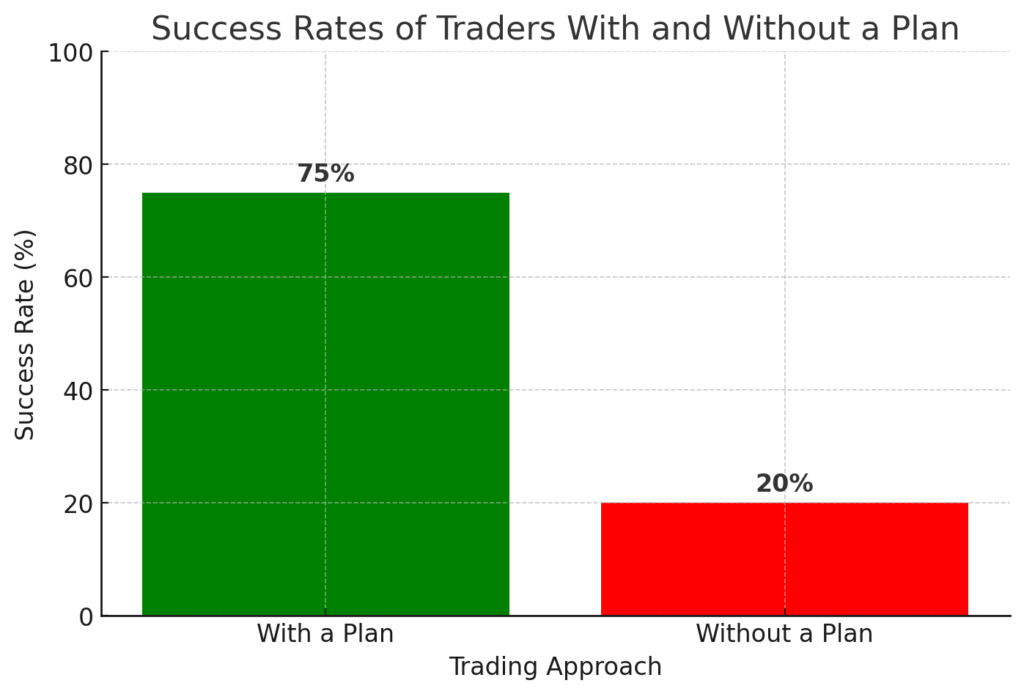

Trading without a plan is like sailing without a compass—you’re bound to get lost. A winning trading plan for beginners provides structure, reduces emotional decision-making, and ensures you stay focused on your goals. According to a study by Charles Schwab, traders with a written plan are 3 times more likely to succeed than those who trade impulsively. Whether you’re trading stocks, forex, or cryptocurrencies, a solid plan is your key to long-term success.

Key Components of a Winning Trading Plan

- Set Clear and Realistic Goals

Define what you want to achieve through trading. Are you looking for supplemental income, or are you aiming for financial independence? Your goals will determine your trading style, risk tolerance, and time commitment. - Choose the Right Market and Trading Style

Different markets (stocks, forex, crypto) require different strategies. Similarly, your trading style—whether it’s day trading, swing trading, or long-term investing—should align with your personality and schedule. - Develop a Proven Trading Strategy

Your strategy should include specific rules for entering and exiting trades. Use tools like technical analysis, chart patterns, and indicators (e.g., moving averages, RSI) to make informed decisions. Backtest your strategy to ensure its effectiveness. - Master Risk Management

Never risk more than 1-2% of your trading capital on a single trade. Use stop-loss orders to limit losses and protect your account from significant drawdowns. - Keep a Detailed Trading Journal

Document every trade, including the rationale behind it, the outcome, and lessons learned. A trading journal helps you identify patterns, refine your strategy, and track your progress over time. - Stay Disciplined and Emotionally Balanced

Stick to your plan, even during market volatility. Avoid impulsive decisions and emotional trading, which are the biggest enemies of success.

Trending Insights from Experts

Recent articles from top financial blogs like Investopedia and BabyPips emphasize the importance of education and adaptability in trading. According to Investopedia, 90% of beginner traders fail due to a lack of planning and poor risk management. Meanwhile, BabyPips highlights the value of using demo accounts to practice trading strategies without risking real money. [FinansieraTrading.com]