Why Understanding Market Cycles Can Boost Your Portfolio Returns

Market cycles are the heartbeat of financial markets, dictating the rise and fall of asset prices and shaping the fortunes of investors worldwide. But what if you could decode these cycles to consistently boost your portfolio returns? Whether you’re a seasoned investor or just starting, understanding market cycles is the key to making smarter, more informed decisions that stand the test of time.

In this blog, we’ll break down the four phases of market cycles—expansion, peak, contraction, and trough—and show you how to leverage them to your advantage. From sector rotation strategies to monitoring key economic indicators, you’ll discover actionable insights to align your portfolio with the prevailing economic conditions. By the end, you’ll have the tools to not only survive market volatility but thrive in it.

Ready to take control of your financial future? Let’s dive into the world of market cycles and unlock the secrets to long-term investment success.

Table of Contents

What Are Market Cycles and Why Do They Matter?

Market cycles are the natural ebb and flow of financial markets, driven by factors like economic growth, interest rates, inflation, and investor sentiment. These cycles typically consist of four phases:

- Expansion: Economic growth accelerates, corporate earnings rise, and investor confidence soars.

- Peak: Growth slows, valuations become stretched, and risks increase.

- Contraction: Economic activity declines, earnings fall, and markets correct.

- Trough: The economy bottoms out, setting the stage for recovery.

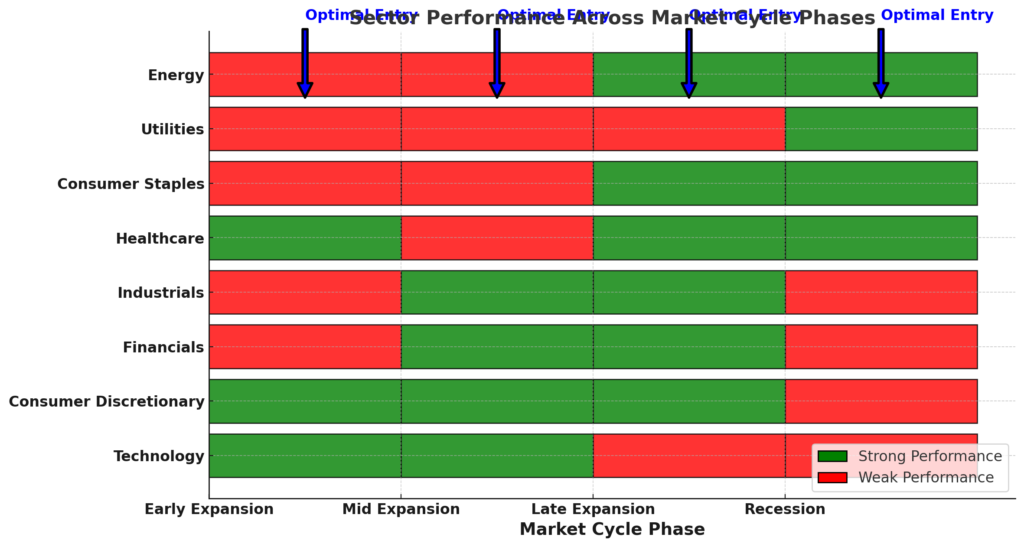

Understanding these phases allows investors to align their portfolios with the prevailing economic conditions. For example, during expansion, growth stocks and cyclical sectors like technology and consumer discretionary thrive. In contrast, defensive sectors like utilities and healthcare perform better during contractions.

How to Leverage Market Cycles for Maximum Returns

Sector Rotation: The Dynamic Strategy

Sector rotation involves shifting investments across different sectors based on their performance in each phase of the market cycle. For instance:

- Expansion: Invest in technology, consumer discretionary, and industrials.Peak: Rotate into defensive sectors like healthcare and utilities.Contraction: Focus on high-quality bonds and dividend-paying stocks.Trough: Prepare for recovery by investing in undervalued growth stocks.

Economic Indicators: Your Navigation Tools

Key economic indicators like GDP growth, unemployment rates, inflation, and interest rates provide valuable insights into the current phase of the market cycle. For example:

- Rising interest rates often signal a shift toward value stocks.

- Falling unemployment rates indicate economic expansion, favoring growth stocks.

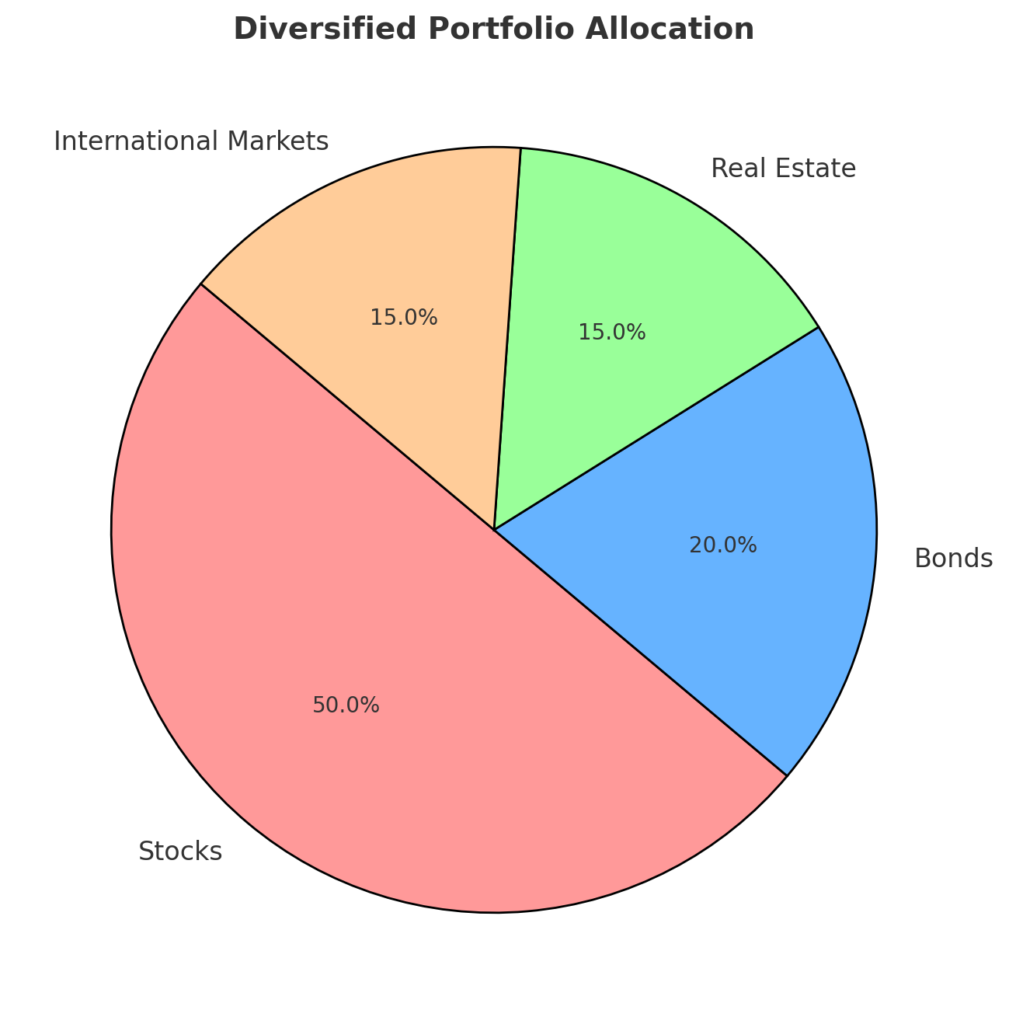

Long-Term Perspective and Diversification

While market cycles are essential, maintaining a long-term perspective is equally important. Diversification across asset classes, sectors, and geographic regions helps mitigate risks and ensures steady growth. For example, during the 2020 market crash, investors with diversified portfolios recovered faster than those concentrated in a single sector.

Advanced Strategies for Cycle-Based Investing

- Momentum Investing

Momentum strategies focus on sectors or stocks showing strong recent performance. For example, during the tech boom of 2021, momentum investors capitalized on the rapid growth of companies like Tesla and NVIDIA. - Mean Reversion Strategies

Mean reversion strategies target undervalued sectors or stocks poised for a rebound. For instance, energy stocks often rebound after prolonged downturns, offering lucrative opportunities for savvy investors.

Conclusion: Master Market Cycles to Unlock Your Portfolio’s Full Potential

Understanding market cycles is more than just a skill—it’s a game-changer for investors aiming to maximize returns and minimize risks. By recognizing the four phases of market cycles (expansion, peak, contraction, and trough) and leveraging strategies like sector rotation and economic indicators, you can align your portfolio with the prevailing economic conditions. Whether you’re a seasoned investor or just starting, these insights empower you to make smarter, data-driven decisions that stand the test of time.

Remember, market cycles are not about predicting the future with certainty but about positioning yourself to capitalize on opportunities while safeguarding against downturns. The key lies in staying informed, maintaining a long-term perspective, and diversifying your investments across sectors and asset classes.

Now it’s your turn to take action! Start by analyzing your current portfolio and identifying areas where you can apply these strategies. Share your thoughts in the comments below—what phase of the market cycle do you think we’re in right now? Don’t forget to share this post with fellow investors and subscribe for more expert insights on mastering the art of investing.

As the saying goes, “The best time to plant a tree was 20 years ago. The second-best time is now.” Take the first step today, and watch your portfolio grow with the rhythm of the market. [FinansieraTrading.com]