Introduction to Bank Investing

Bank investing refers to the process of putting money into the banking sector with the expectation of a return. Given the pivotal role banks play in the economy, investing in them can offer both opportunities and challenges.

2. Why Invest in Banks?

- Stability: Banks, especially well-established ones, are often seen as stable investments due to their integral role in the financial system.

- Dividends: Many banks offer dividends, providing a steady income stream for investors.

- Economic Barometer: The performance of banks can give insights into the broader economy’s health.

3. Types of Bank Investments

- Retail Banks: These are the most common banks that offer services to the general public.

- Commercial Banks: Cater to businesses, offering loans, credit, and payment services.

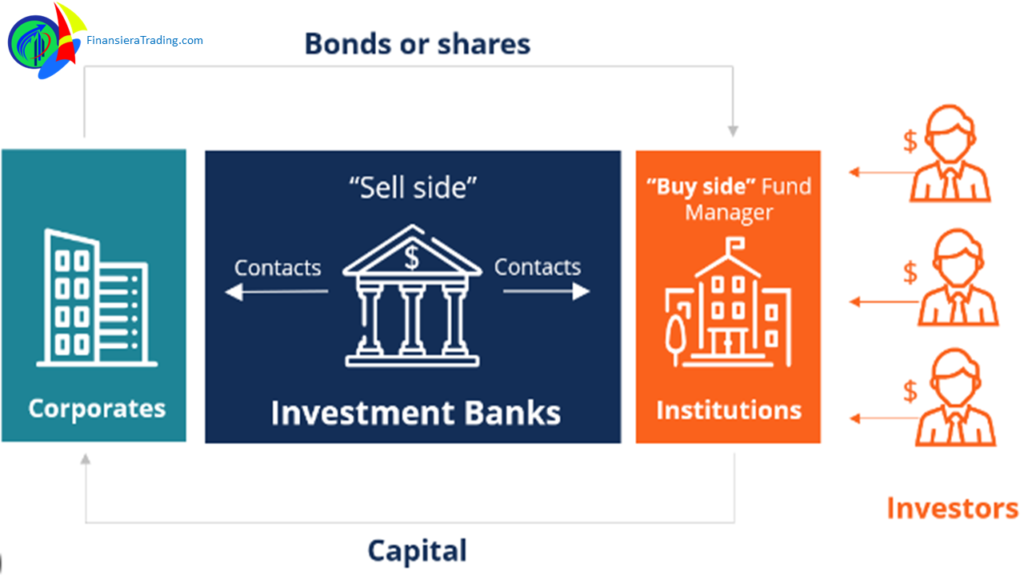

- Investment Banks: Specialize in helping companies and governments raise capital.

4. Risks Involved in Bank Investing

- Economic Downturns: Banks are sensitive to economic cycles. In downturns, loan defaults can rise, affecting profitability.

- Regulatory Changes: The banking sector is heavily regulated. Any changes in regulations can impact bank operations and profitability.

- Technological Disruptions: With the rise of fintech, traditional banking models face challenges from digital and mobile banking platforms.

5. Evaluating Bank Stocks

- Financial Health: Look at key metrics like return on equity, loan-to-deposit ratio, and non-performing loan ratio.

- Dividend Yield: A higher yield can be attractive, but it’s essential to ensure the bank’s earnings support the dividend.

- Growth Prospects: Consider the bank’s expansion plans, new product launches, and potential for increasing its customer base.

[cnn.com]

6. Tips for Bank Investing

- Diversify: Don’t put all your money into a single bank stock. Diversify across different types of banks and geographies.

- Stay Informed: Keep up with economic news, as macroeconomic factors can significantly impact banks.

- Long-term Perspective: Bank stocks can be volatile in the short term. It’s often best to have a long-term investment horizon.

Bank investing offers opportunities for steady returns, especially through dividends. However, like all investments, there are risks involved. By understanding the banking sector, staying informed, and diversifying, investors can navigate the challenges and capitalize on the opportunities in bank investing.