Global markets have experienced unprecedented volatility in recent years, with inflation, rate hikes, and economic uncertainty reshaping how everyday investors think about their money. Amid this shifting landscape, more people are seeking ways to make their money work for them instead of relying solely on paychecks or traditional savings accounts that barely keep up with inflation. Dividend investing has emerged as a compelling strategy for building resilient, long-term wealth because it combines the potential for capital growth with consistent cash flow.

This matters now more than ever. With retirement timelines extending and living costs rising, millions are realizing that relying on a single income source leaves them vulnerable. Dividend-paying stocks offer a way to generate income without selling assets—putting cash back in your pocket through regular dividend distributions. Whether you’re navigating retirement, paying off debt, or planning a dream lifestyle, understanding how to create a passive income stream through dividends can give you a financial edge.

In this article, you’ll learn what dividend investing really means, how it works, and practical steps to build and grow a passive income stream. You’ll also discover key strategies to choose the right stocks, manage risk, and create a sustainable plan that aligns with your financial goals.

How Savvy Americans Are Turning Market Turbulence Into Dividend Opportunity

Why Dividend Investing Matters in Today’s Market

In 2025, U.S. markets are grappling with shifting expectations about Federal Reserve rate cuts and rising inflation concerns. After a string of Fed moves aimed at balancing growth and price stability, dividend‑paying stocks increasingly attract income‑seeking investors who want cash flow without selling shares. This is especially true as bonds and savings accounts struggle to keep pace with inflation.

How Dividend Payments Are Actually Growing

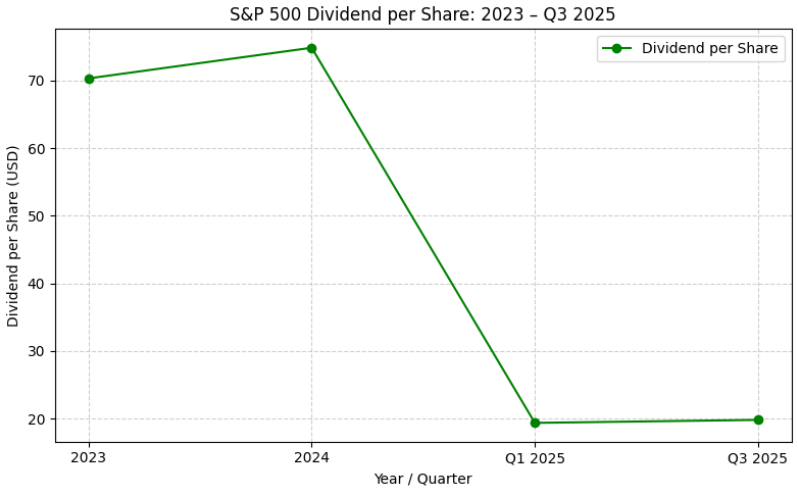

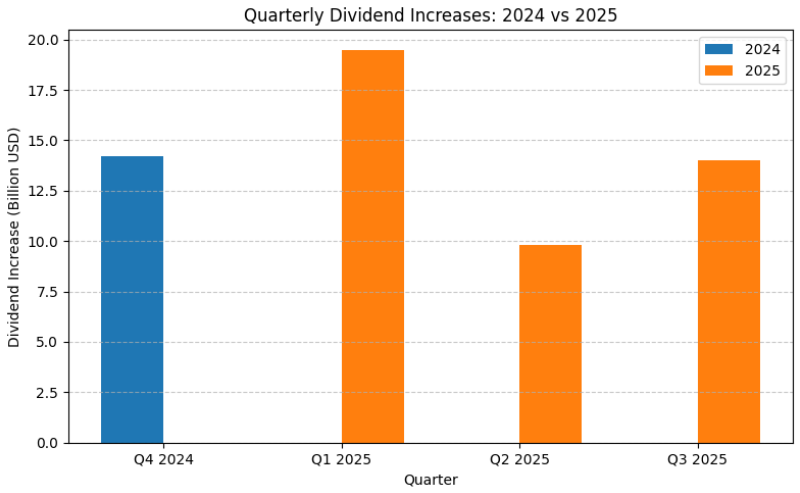

Data from S&P Dow Jones Indices shows that U.S. companies continued to raise dividends through 2025, but growth slowed compared with prior years. Q3 dividend increases totaled $14 billion, up from Q2’s $9.8 billion, although net indicated increases are below 2024 levels. These trends suggest companies are committed to dividends — just more cautiously amid economic uncertainty and tighter business conditions.

Top Dividend-Paying S&P 500 Companies (2025)

| Company | Dividend Yield (%) | Payout Ratio (%) | Dividend Growth (YoY) | Sector |

|---|---|---|---|---|

| LyondellBasell (LYB) | 12.6 | 80 | +2% | Materials |

| Conagra Brands (CAG) | 8.2 | 65 | +3% | Consumer Staples |

| Altria (MO) | 7.3 | 75 | +1.5% | Consumer Staples |

| UPS (UPS) | 6.9 | 55 | +4% | Industrials |

| Verizon (VZ) | 6.6 | 50 | +2% | Telecom |

| Pfizer (PFE) | 6.6 | 45 | +3% | Healthcare |

| Realty Income (O) | 5.5 | 60 | +2.5% | REIT |

Real‑World Impact on Everyday Investors

For folks building passive income streams, this slower but consistent dividend growth highlights both challenge and opportunity. It’s not about chasing the highest yield; it’s about finding sustainable dividends from companies that can deliver cash flow year after year. This environment rewards patience and a long‑term view — especially when inflation bites into other income sources.

Quarterly Dividend Increases – 2024 vs 2025 (Billions USD)

| Quarter | Dividend Increase 2024 | Dividend Increase 2025 |

|---|---|---|

| Q4 2024 | 14.2 | — |

| Q1 2025 | — | 19.5 |

| Q2 2025 | — | 9.8 |

| Q3 2025 | — | 14.0 |

The Dividend Story Hidden in Big U.S. Companies and Index Trends

Why Big Names Still Pay Big Dividends

Major U.S. companies remain at the heart of many dividend portfolios. Some iconic firms like Coca‑Cola and American Express have decades of dividend growth, helping investors through market ups and downs. Even tech giants like Microsoft have raised dividends alongside explosive growth in AI and cloud revenue.

Dividend Portfolio Allocation by Sector (Example)

| Sector | Portfolio Allocation (%) | Avg Dividend Yield (%) |

|---|---|---|

| Technology (e.g., Microsoft, Apple) | 25 | 1.8 |

| Consumer Staples (e.g., Coca-Cola, Altria) | 20 | 3.5 |

| Healthcare (e.g., Pfizer, Johnson & Johnson) | 15 | 3.2 |

| Industrials (e.g., UPS, Honeywell) | 15 | 2.8 |

| Utilities (e.g., Duke Energy, NextEra) | 10 | 3.9 |

| REITs (e.g., Realty Income, Simon Property) | 10 | 5.5 |

| Telecom (e.g., Verizon, AT&T) | 5 | 6.6 |

How Index Dividends Reflect Broader Market Health

The S&P 500’s dividend yield has historically been modest compared with small‑cap or value stocks. But it’s still meaningful when dividends are reinvested. Over long periods, dividends have accounted for a sizeable portion of total market returns through reinvestment compounding — a reality many investors overlook when focusing only on price gains.

What This Means for Your Portfolio

Rather than stress over short‑term price swings, investors who anchor part of their portfolio in high‑quality, dividend‑paying companies can build reliability into their passive income plan. Whether you’re using individual stocks or dividend‑focused ETFs, the key is diversification and choosing companies with stable earnings and a history of dividend commitment.

Beyond Yield: The Human Side of Dividend Investing Success

Why Dividend Stories Matter More Than Numbers

Dividend investing isn’t just about yield percentages on a spreadsheet. It’s about creating real monthly or quarterly income that supports life goals — paying bills, funding travel, or retiring early. People with even modest portfolios have shared stories of earning several hundred dollars a month in passive income by consistently reinvesting dividends over time.

How Compounding Makes Small Starts Huge

Take an investor who started with less than $10,000 and used dividend growth and reinvestment strategies: in just a few years, that income can grow to thousands annually. The power isn’t just the payment — it’s how those payments buy more shares, which then generate even more dividends. Over the decades, this compounding effect becomes the real wealth engine.

Real Investors, Real Freedom

These stories illustrate how everyday Americans are using dividends to fund goals that once felt out of reach. It’s why many financial planners now recommend dividend investing not as a speculative bet but as part of a disciplined income plan — especially in the face of uncertain markets and lower interest rates that leave traditional savings struggling.

How to Choose Dividend Stocks That Don’t Disappoint

Why High Yield Isn’t Always Better

Many see a 6 % or 7 % dividend and assume it’s a great deal. But extremely high yields can signal trouble — companies paying out most of their cash flow to dividends might struggle if profits dip. Recent market analysis finds that some high‑yield names had to rely on cash to sustain payouts, which isn’t ideal for long‑term investors. Barron’s

How to Evaluate Dividend Safety

Look beyond headline yield to payout ratio, earnings stability, and debt levels. Firms that consistently grow earnings and dividends from strong cash flow — like those on the Dividend Aristocrats list — are often more reliable over decades than newer companies with unsustainably high yields.

What This Means for Your Money

For investors building passive income, this discipline pays dividends of its own. Choosing quality over yield alone reduces the likelihood of cuts or dividend suspensions when the economy slows. Over time, this approach creates a more resilient income stream and helps smooth out volatility.

The Path From First Dividend to Financial Freedom

Why Starting Matters More Than Timing

Many potential investors hesitate, waiting for the “perfect” market timing. But dividend investing rewards consistency and patience more than precision. Starting with modest amounts and reinvesting dividends regularly often outperforms trying to time buys or chase fleeting high yields.

How Systematic Plans Build Momentum

Creating a systematic dividend reinvestment plan (DRIP) or using dividend‑focused ETFs helps automate the journey. As dividends flow back into your portfolio, each payment becomes a building block toward future income. Over years, these contributions snowball.

Your Future Income, Realized

For the investor willing to commit and stay disciplined, dividend investing can deliver more than cash — it delivers confidence and financial flexibility. Whether your goal is $500 monthly or $2,000, the combination of quality stock selection, reinvestment, and time can turn a passive income dream into reality.

How Savvy Americans Are Turning Market Turbulence Into Dividend Opportunity

Why Dividend Investing Matters in Today’s Market

In 2025, U.S. markets remain sensitive to Federal Reserve moves, inflation trends, and geopolitical uncertainty. Many Americans are realizing that relying on savings or bonds may not generate meaningful income. Dividend-paying stocks offer a practical way to earn cash flow while holding long-term equity. Why this matters now: consistent dividends can act as a buffer when market volatility spikes.

How Dividend Payments Are Actually Growing

According to S&P Dow Jones Indices, Q3 2025 dividend increases totaled $14 billion, up from $9.8 billion in Q2. Although growth is slower than in prior years, the steady increases indicate that companies remain committed to rewarding shareholders. Investors looking for passive income can focus on stability over chasing sky-high yields.

Real-World Impact on Everyday Investors

Even a modest portfolio can generate reliable quarterly payouts if reinvested. What this means for investors: the key is patience and focusing on companies that have demonstrated consistent dividend growth. Looking ahead, disciplined dividend reinvestment could form the backbone of a long-term passive income strategy.

The Dividend Story Hidden in Big U.S. Companies and Index Trends

Why Big Names Still Pay Big Dividends

Blue-chip companies such as Coca-Cola, Microsoft, and American Express continue to reward shareholders. Even in uncertain markets, their dividends remain a reliable source of income. Why this matters now: investors seeking safety and steady cash flow often turn to these household names during periods of economic turbulence.

How Index Dividends Reflect Broader Market Health

The S&P 500 dividend yield remains modest at around 1.9–2%, but reinvested dividends significantly boost long-term returns. This illustrates that steady dividend growth is often more impactful than short-term stock price gains.

What This Means for Your Portfolio

Allocating part of your portfolio to dividend-focused ETFs or Aristocrats can reduce risk and smooth cash flow. Looking ahead, incorporating dividend-paying stocks can help investors navigate inflation while building wealth steadily.

Beyond Yield: The Human Side of Dividend Investing Success

Why Dividend Stories Matter More Than Numbers

Dividend income is tangible: it helps cover bills, fund travel, or support retirement goals. Stories from real investors show that even small portfolios can generate hundreds of dollars per month through disciplined reinvestment. Why this matters now: income stability is increasingly valued in a world of rising living costs.

How Compounding Makes Small Starts Huge

A $10,000 initial investment, reinvesting dividends, can snowball over several years. Each payout buys more shares, generating even more income. The compounding effect can transform modest beginnings into significant passive income streams.

Real Investors, Real Freedom

What this means for investors: dividends offer more than money—they provide financial flexibility and confidence. Looking ahead, consistent dividend reinvestment can enable a lifestyle less dependent on salary or volatile market swings.

How to Choose Dividend Stocks That Don’t Disappoint

Why High Yield Isn’t Always Better

Yields above 6–7% may signal financial stress. Investors chasing these numbers risk exposure to unsustainable payouts. Why this matters now: market corrections or earnings drops could lead to dividend cuts if investors aren’t careful.

How to Evaluate Dividend Safety

Examine payout ratios, earnings stability, and debt levels. Dividend Aristocrats — companies with decades of growth — often offer the safest returns.

What This Means for Your Money

Investing in quality over yield alone creates a more reliable income stream. Looking ahead, selecting companies with strong fundamentals can minimize disruption and sustain passive income.

The Path From First Dividend to Financial Freedom

Why Starting Matters More Than Timing

Many delay investing, waiting for perfect conditions. Dividend investing rewards consistency over perfect timing. Why this matters now: starting small and reinvesting early can compound into meaningful income over years.

How Systematic Plans Build Momentum

Dividend reinvestment plans (DRIPs) or dividend-focused ETFs automate growth. Regular payouts become building blocks toward future income.

Your Future Income, Realized

What this means for investors: a disciplined approach can gradually produce $500–$2,000+ monthly income. Looking ahead, dividend investing can help achieve financial freedom while providing flexibility and security in unpredictable markets.

Building a reliable passive income stream through dividend investing is no longer just a niche strategy—it’s becoming a cornerstone for Americans seeking financial stability in an uncertain economy. From blue-chip companies to carefully selected ETFs, the combination of steady payouts, disciplined reinvestment, and long-term planning can transform even modest portfolios into meaningful income sources. Experts at the Federal Reserve and leading financial institutions continue to emphasize the importance of diversified income streams, especially as inflation and interest rate trends evolve.

Looking ahead, investors who focus on sustainable dividends, monitor company fundamentals, and reinvest strategically are positioned to weather market volatility while steadily growing wealth. While yields may fluctuate in the short term, the compounding power of dividends ensures that patient, informed investors can build a resilient foundation for financial freedom. Explore more expert insights, real-world strategies, and practical tips on our site to continue growing your knowledge and income potential.

Subscribe to trusted source like FinansieraTrading.com for continuous updates.