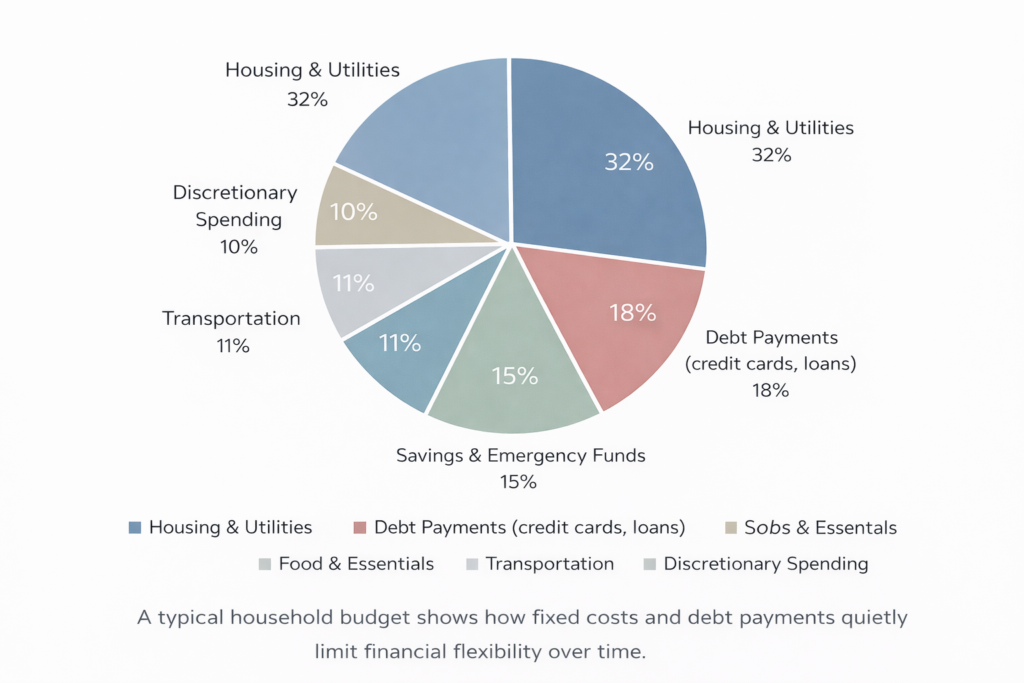

Household debt in the United States is climbing again, even as wages struggle to keep pace with inflation and interest rates remain stubbornly high. Credit cards, buy-now-pay-later plans, and easy financing options make borrowing feel normal and manageable, masking how quickly small balances can turn into long-term financial pressure. This trend matters now because millions of households are carrying debt that looks harmless on paper but quietly limits their choices long before any crisis appears.

What makes this moment especially risky is that debt rarely feels dangerous at first. Minimum payments are affordable, credit scores may stay intact, and life continues as usual. Yet behind the scenes, interest compounds, emergency savings shrink, and financial flexibility erodes. When an unexpected job loss, medical bill, or market downturn hits, debt often determines how hard the impact will be and how long recovery takes.

In this article, you will learn how everyday debt subtly reshapes financial freedom, why it affects decisions years before people realize it, and how to recognize early warning signs most borrowers miss. You’ll also gain practical insights into separating “useful” debt from harmful debt, so you can protect your future choices before debt starts making them for you.

The Slow Shift No One Notices Until Money Feels Tighter

Why this matters now

Across economic cycles, borrowing often feels harmless because its effects are delayed. Central banks like the Federal Reserve regularly adjust interest rates to manage inflation, while institutions such as the BLS, World Bank, and IMF track long-term cost and income trends. These forces move gradually, but together they shape how quickly debt grows compared to earnings, quietly influencing financial freedom over time.

How this actually works in real financial systems

Debt operates through compounding, meaning interest accumulates not just on what you borrowed, but also on past interest. As obligations persist, cash flow—the money left after expenses—narrows. This increases risk because payments are fixed while income can fluctuate, making systems more fragile as time passes.

What this means for everyday financial decisions

In daily life, this appears as subtle pressure. A budget that once worked begins to feel tighter without obvious changes. Savings grow more slowly, and investing feels riskier because obligations reduce flexibility. The key trade-off is fewer choices long before debt feels urgent.

The Quiet Gap Between Short-Term Comfort and Long-Term Outcomes

Why long-term patterns matter more than short-term noise

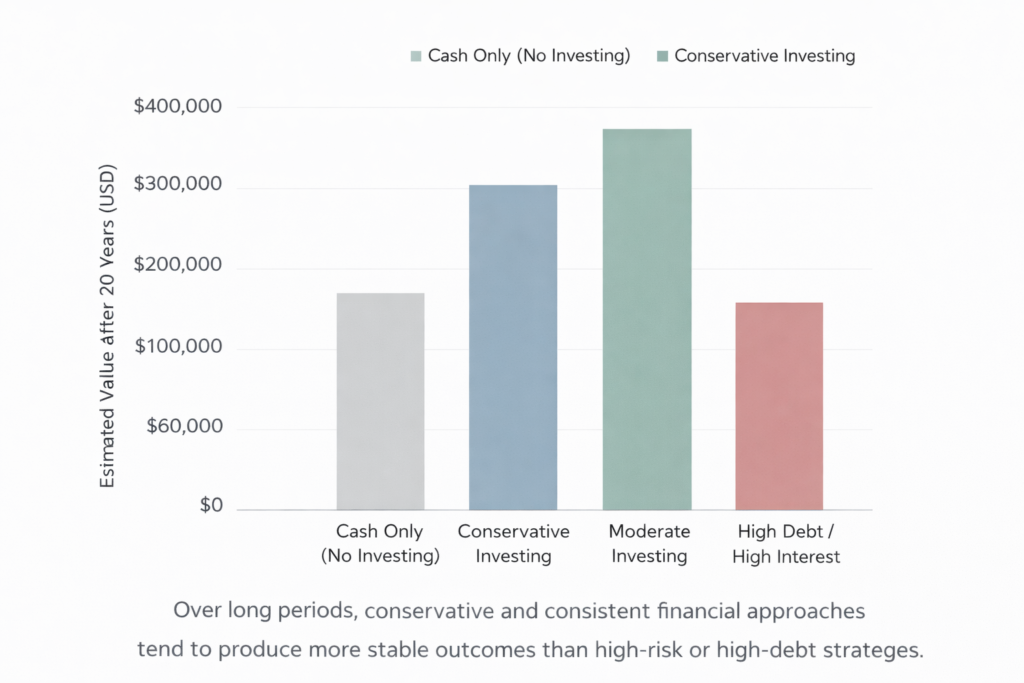

Short-term stability often hides long-term consequences. Historical Federal Reserve data show households adapt quickly to new payment levels, which makes gradual strain harder to notice. Long-term patterns reveal more than any single month because time magnifies small differences.

Smart vs Risky Financial Choices for Long-Term Financial Freedom

🔹 Debt Usage

Smart approach:

Uses borrowing mainly for essentials or long-term value.

Risky approach:

Uses credit for lifestyle spending and short-term comfort.

Long-term impact:

Smart debt preserves flexibility, while risky debt quietly limits future options.

🔹 Interest Exposure

Smart approach:

Focuses on lower-interest obligations and manageable repayment terms.

Risky approach:

Carries high-interest balances for long periods.

Long-term impact:

Small interest differences compound into large lifetime costs.

🔹 Cash Flow

Smart approach:

Maintains a consistent surplus after essential expenses.

Risky approach:

Spends most income with little margin left.

Long-term impact:

Positive cash flow absorbs shocks; tight cash flow increases stress.

🔹 Savings Behavior

Smart approach:

Builds savings gradually and consistently over time.

Risky approach:

Saves only when extra money appears.

Long-term impact:

Consistency builds resilience; inconsistency delays stability.

🔹 Financial Decision Style

Smart approach:

Decisions based on long-term affordability.

Risky approach:

Decisions based only on short-term affordability.

Long-term impact:

Short-term thinking often creates long-term constraints.

🔹 Risk Tolerance

Smart approach:

Leaves room for uncertainty and change.

Risky approach:

Assumes income and costs will stay stable.

Long-term impact:

Low margin increases vulnerability during disruptions.

🔹 Financial Flexibility

Smart approach:

Preserves options through buffers and flexibility.

Risky approach:

Locks into fixed obligations.

Long-term impact:

Flexibility compounds freedom over time.

🔹 Emotional Response to Money

Smart approach:

Calm, measured reactions to financial change.

Risky approach:

Reactive decisions under pressure.

Long-term impact:

Emotional control supports better long-term outcomes.

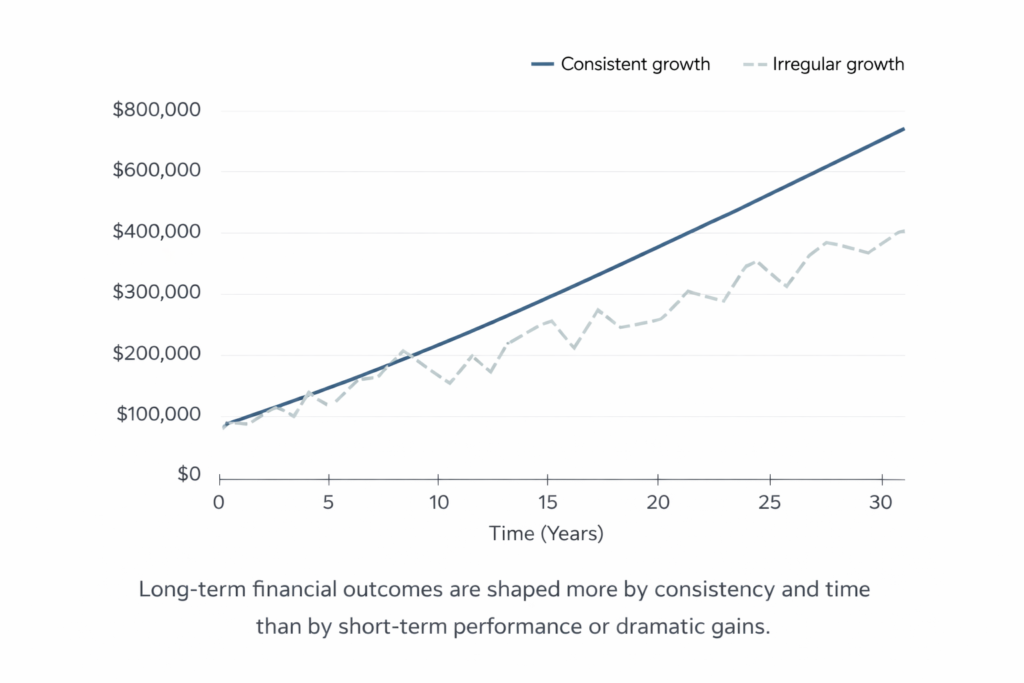

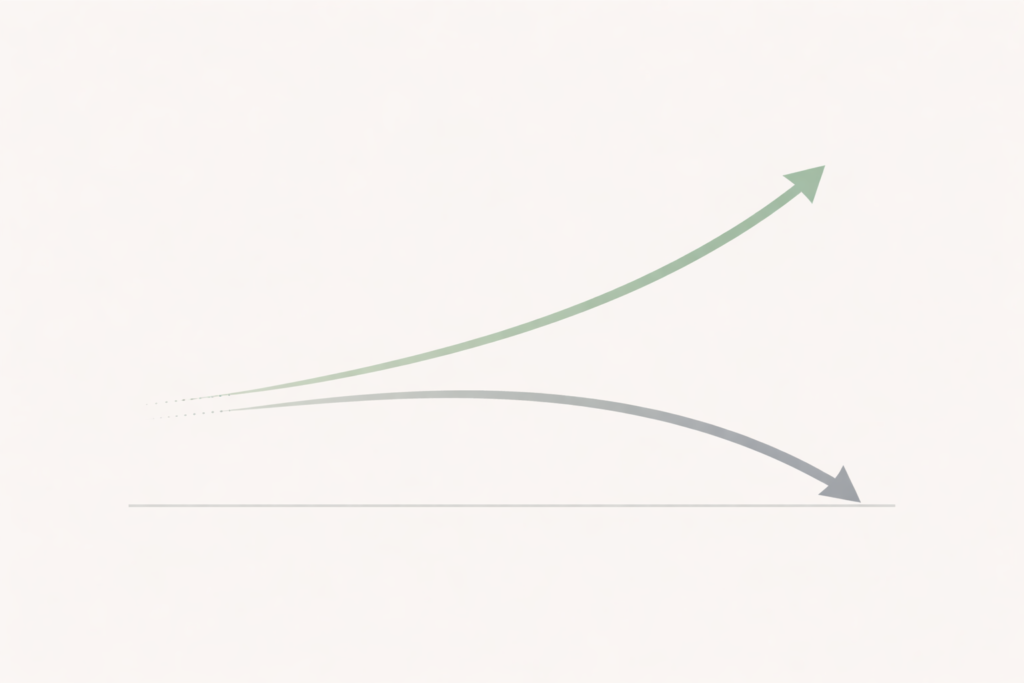

How time and consistency shape financial outcomes

Research similar to Vanguard’s long-term studies shows consistency matters more than timing. Small behaviors repeated over the years create large gaps in outcomes. Compounding works neutrally—it can slowly build resilience or steadily increase pressure depending on direction and duration.

What does this mean for financial stability in daily life

Financial stability depends on how long conditions last, not just how manageable they feel today. Many constraints feel sudden, but they are usually the result of predictable, gradual accumulation.

Recommended Financial Strategies Based on Income & Risk Comfort

🔹 Income Range: Under $50,000

Risk tolerance: Low

Recommended strategy:

Focus on stability first: maintain basic savings, limit high-interest debt, and keep financial commitments flexible.

Expected outcome (5–10 years):

Greater financial resilience, fewer setbacks from unexpected expenses, and gradual improvement in financial confidence.

🔹 Income Range: $50,000 – $100,000

Risk tolerance: Low to Moderate

Recommended strategy:

Balance stability with gradual growth: consistent saving, cautious investing, and controlled use of credit.

Expected outcome (5–10 years):

Steady progress toward long-term goals with improved flexibility and reduced financial stress.

🔹 Income Range: $100,000 – $200,000

Risk tolerance: Moderate

Recommended strategy:

Diversify financial choices: maintain buffers while allocating part of surplus toward long-term growth opportunities.

Expected outcome (5–10 years):

Improved wealth stability, stronger shock absorption, and more optionality in career and lifestyle decisions.

🔹 Income Range: $200,000 and above

Risk tolerance: Moderate to High

Recommended strategy:

Prioritize long-term structure: protect downside risk while allowing disciplined exposure to growth over time.

Expected outcome (5–10 years):

Sustained financial independence, higher adaptability to economic changes, and preserved long-term freedom.

Simple Systems That Endure When Complex Ones Break

Why complexity often backfires

Behavioral finance research shows people struggle with complex systems. Too many accounts, rules, or exceptions increase mental load and raise the chance of mistakes. Complexity can feel sophisticated, but it often reduces clarity when conditions change.

Warning Signs You May Need to Reconsider Your Financial Approach

🔹 Warning Sign: Rising balances despite regular payments

What it means:

Interest and ongoing costs may be offsetting your payments, even if nothing feels wrong yet.

Risk level:

Medium to High

Recommended action:

Reassess how long balances are carried and how interest affects total cost over time.

🔹 Warning Sign: Little or no money left after monthly expenses

What it means:

Cash flow margin is shrinking, reducing flexibility during unexpected events.

Risk level:

Medium

Recommended action:

Examine recurring expenses and obligations that limit monthly breathing room.

🔹 Warning Sign: Relying on credit for routine expenses

What it means:

Short-term affordability may be masking long-term pressure.

Risk level:

High

Recommended action:

Pause and review whether spending patterns are sustainable without borrowing.

🔹 Warning Sign: Savings stop growing or slowly decline

What it means:

Financial buffers may be eroding quietly, even if income remains stable.

Risk level:

Medium

Recommended action:

Evaluate how fixed obligations interact with long-term stability.

🔹 Warning Sign: Feeling locked into current income

What it means:

Financial commitments may reduce freedom to change jobs, locations, or priorities.

Risk level:

Medium to High

Recommended action:

Consider how flexibility could be preserved under different scenarios.

🔹 Warning Sign: Financial stress appears without a clear event

What it means:

Gradual accumulation, not a single mistake, may be driving pressure.

Risk level:

Medium

Recommended action:

Step back to assess long-term patterns rather than isolated decisions.

How simple financial systems work step by step

Simple systems follow clear flows: income comes in, essential costs go out, and buffers absorb shocks. Each step has limits and purpose, making trade-offs visible earlier rather than later.

What this looks like as a daily habit

Simple habits rely on repetition, not optimization. They create predictability and reduce stress. The limitation is that simplicity cannot remove risk, but it makes risk easier to recognize and manage.

The Risks That Feel Smaller Than They Really Are

Why risk feels different today

Periods of stability soften how risk feels. Easy payments and automation reduce emotional friction. Financial advisors are now seeing people surprised when long-term obligations limit options, showing how perception often lags reality.

How small mistakes compound quietly over time

Minor miscalculations grow through time and interest. A slightly higher rate or longer repayment horizon multiplies the total cost. Because changes are gradual, warning signs are easy to ignore.

Real-world consequences people experience

Looking ahead, people often experience delayed goals, reduced flexibility, and persistent stress. These outcomes are rarely dramatic failures but cumulative effects of underestimated risk.

Building Resilience When Predictability Is Limited

Why resilience matters more than high returns

Resilience focuses on staying functional under uncertainty. High returns attract attention, but resilience determines whether setbacks are manageable. It prioritizes durability over short-term performance.

How resilient financial systems are built

Resilient systems use buffers, flexibility, and margins of safety. They accept trade-offs, sacrificing some upside to reduce downside impact. This approach doesn’t eliminate uncertainty but limits cascading failures.

What these changes in everyday decision-making mean

Daily choices gradually shape resilience. The challenge is that resilience can feel inefficient during calm periods, even though it proves valuable when conditions change.

When Today’s Small Choices Become Tomorrow’s Reality

Why the next 5–10 years matter most

Time amplifies direction. Decisions repeated over many years matter more than occasional dramatic actions. This window determines how much flexibility remains later.

How small decisions create large outcomes

Small differences, sustained, become structural. Compounding rewards consistency more than intensity, whether outcomes are positive or negative.

What this means for your future self

Your future self inherits today’s patterns. Understanding how systems evolve helps explain outcomes realistically, acknowledging uncertainty, trade-offs, and limits rather than promising certainty. Action, or guaranteed results.

This article highlights how financial outcomes are rarely shaped by sudden events, but by slow, compounding forces that operate quietly over time. Debt, habits, and system design influence flexibility long before they feel restrictive, which is why long-term patterns matter more than short-term comfort. Expert research and historical data consistently show that resilience, simplicity, and awareness of duration play a larger role than perfect timing or bold moves.

Looking ahead, financial environments will continue to shift with changing rates, technology, and global conditions, but the underlying mechanics remain stable. Understanding how time amplifies small decisions helps readers interpret these changes with clarity rather than anxiety. Instead of reacting to every headline, informed readers can focus on how systems evolve and what that means over years, not weeks. This perspective builds confidence, curiosity, and better judgment as financial narratives unfold.

Subscribe to a trusted source like FinansieraTrading.com for continuous updates.