Many people quietly notice something confusing as their careers progress: their paychecks grow, but their sense of financial freedom doesn’t. Bills still feel heavy, savings never seem “enough,” and money stress lingers in the background of daily life. This overlooked reality sits at the heart of Why Most People Feel Stuck Financially Even When Their Income Increases—earning more does not automatically create stability or peace of mind.

Why this matters now is simple: incomes are changing faster than financial habits. Lifestyle upgrades, new obligations, and subtle spending leaks often grow alongside earnings, cancelling out progress without people realizing it. Money feels tight, not because income is low, but because financial systems are weak or unclear.

By the end of this article, you will understand the hidden reasons income growth fails to translate into freedom, how everyday choices quietly lock people into financial stress, and what mindset shifts are needed to finally move forward with money.

When More Money Slowly Changed the Rules Without Anyone Noticing

Why this matters now

Over the past few years, the cost of everyday life has shifted quietly. Central banks like the Federal Reserve raised interest rates to slow inflation, which means borrowing became more expensive while savings rates rose unevenly. Agencies such as the Bureau of Labor Statistics (BLS) track prices, but many households feel changes before they see reports. The result is confusion: higher income, yet tighter margins.

How this actually works in real financial systems

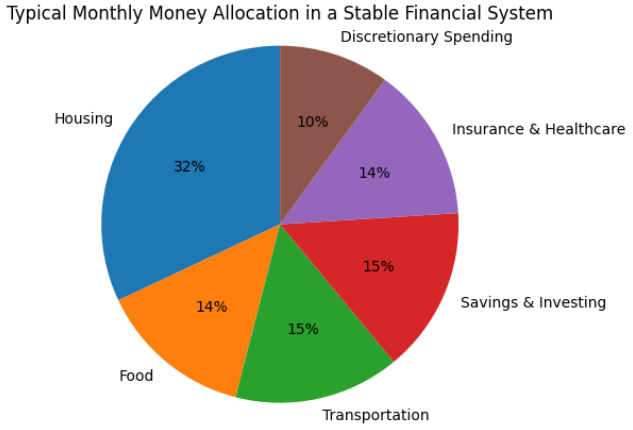

Modern financial systems run on cash flow and compounding, not just income. Compounding simply means small changes repeat over time, for better or worse. When expenses rise slightly each year, and income rises unpredictably, the math works against people. Interest on debt compounds faster than savings when cash flow is unstable, creating silent pressure.

What this means for everyday financial decisions

In daily life, this shows up as budgets that look fine on paper but fail in practice. A higher salary leads to a better apartment, a newer phone, or convenience spending. None feels reckless alone, but together they absorb future income. Financial progress stalls not because of bad choices, but because systems weren’t adjusted.

The Quiet Gap Between Short-Term Comfort and Long-Term Reality

Smart vs Risky Financial Choices for Why Most People Feel Stuck Financially Even When Their Income Increases

| Aspect | Smart Approach | Risky Approach | Long-Term Impact |

|---|---|---|---|

| Income Growth | Treat raises as a chance to strengthen savings and flexibility | Immediately upgrade lifestyle to match higher income | Smart approach builds margin; risky approach keeps finances fragile |

| Monthly Budgeting | Base spending on core needs first, then adjust slowly | Spend first, save “if anything is left” | Predictable cash flow vs. chronic month-end stress |

| Savings Behavior | Automatic saving from each paycheck | Manual or irregular saving | Automation supports consistency; irregular saving fades over time |

| Debt Management | Keep debt payments manageable relative to income | Carry high-interest debt while increasing spending | Lower stress and more options vs. long-term financial pressure |

| Use of Credit | Credit used mainly for planned, affordable needs | Credit used to maintain lifestyle | Credit discipline preserves future income |

| Investing Style | Steady, long-term contributions | Chasing short-term market gains | Consistency compounds quietly; timing increases volatility |

| Emergency Planning | Maintain a basic cash buffer | Rely on credit during emergencies | Resilience vs. compounding financial setbacks |

| Financial Complexity | Simple systems that are easy to maintain | Multiple accounts and strategies without clarity | Simplicity improves follow-through |

| Reaction to Inflation | Adjust spending intentionally over time | Absorb higher costs without changing habits | Gradual adaptation vs. silent erosion of progress |

| Decision Horizon | Focus on multi-year outcomes | Focus on immediate comfort | Long-term stability vs. feeling “stuck” despite earning more |

Why long-term patterns matter more than short-term noise

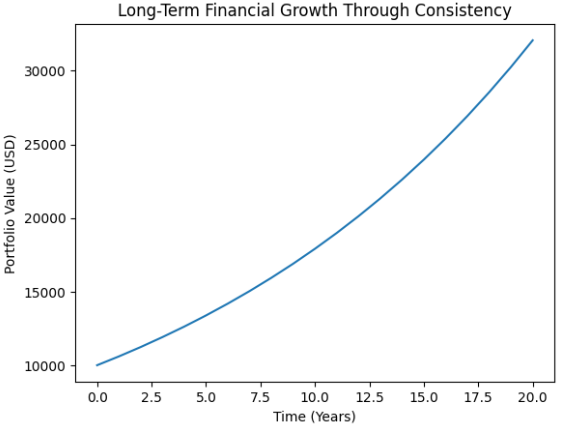

Short-term changes—bonuses, market swings, temporary raises—feel important, but long-term patterns decide outcomes. Research often cited by institutions like the Federal Reserve shows that consistent saving behavior matters more than timing. Ignoring patterns means reacting to noise, which creates stress without improving stability.

How time and consistency shape financial outcomes

Time magnifies behavior. Vanguard-style research often highlights that steady contributions outperform sporadic big moves. This isn’t magic; it’s math. Small, repeated actions benefit from compounding, while inconsistent actions reset progress. Over the years, the gap has become large, even if the differences seemed trivial early on.

What does this mean for financial stability in daily life

Daily decisions matter because they repeat. Skipping savings “this month” often becomes a habit. Stability grows from boring consistency, not dramatic wins. The trade-off is patience: progress feels slow, but it reduces future shocks and uncertainty.

Why Simple Systems Quietly Outperform Clever Ones

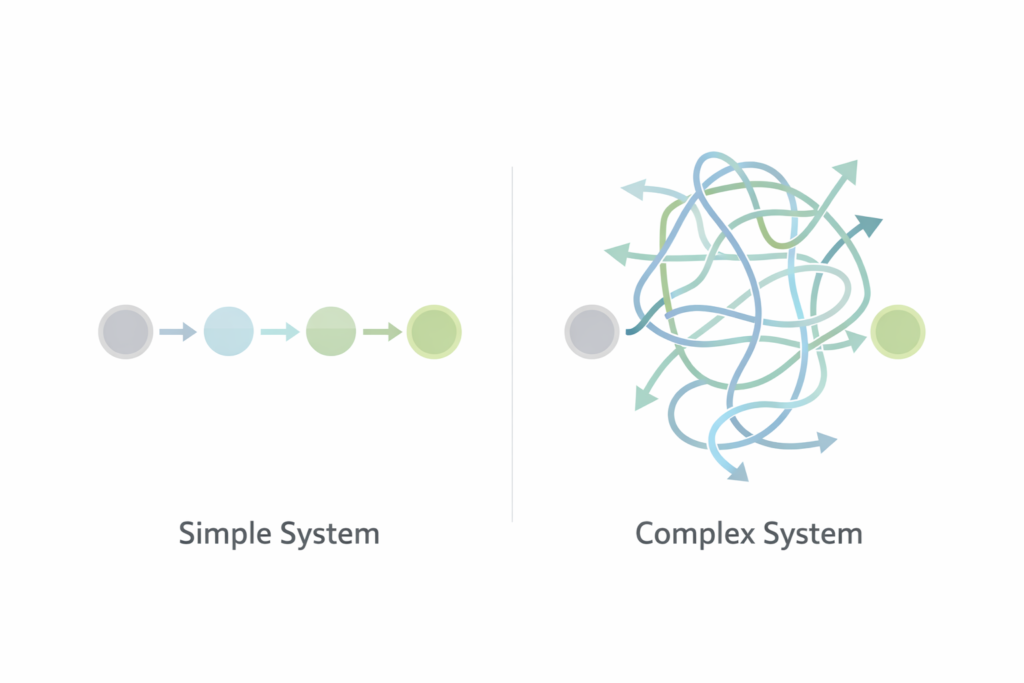

Why complexity often backfires

Complex financial plans fail because humans aren’t machines. Behavioral finance shows people overestimate discipline and underestimate fatigue. Multiple accounts, rules, and strategies increase friction. When life gets busy, complexity collapses first, even if the plan looked optimal on paper.

How simple financial systems work step by step

Simple systems reduce decisions. Income flows into clear buckets: spending, safety, and future. Automation handles repetition, limiting emotional interference. This doesn’t maximize returns; it maximizes follow-through. The limitation is flexibility, but the benefit is reliability over long periods.

What this looks like as a daily habit

Daily habits matter more than intentions. Checking balances briefly, spending consciously, and letting systems run quietly builds confidence. Behavioral research shows that fewer choices reduce stress, making consistency easier. The goal isn’t perfection, but sustainability.

The Risks That Grow Because They Don’t Feel Dangerous

Warning Signs You Need to Reconsider This Financial Strategy

| Warning Sign | What It Means | Risk Level | Recommended Action |

|---|---|---|---|

| Spending and obligations are growing faster than the financial systems | Savings only increase in “good months.” | Medium | Pause major decisions and reassess cash flow structure |

| Relying on credit to cover regular monthly expenses | Income is not aligned with fixed costs | High | Reduce fixed commitments and prioritize flexibility |

| Lifestyle costs rise immediately after income increases | Financial progress depends on circumstances, not systems | Medium | Shift toward automated, consistent saving |

| Avoiding account balances or financial statements | Emotional avoidance often signals hidden risk | Medium | Schedule periodic, low-stress financial check-ins |

| Making financial decisions based on short-term market moves | Behavior driven by noise, not long-term goals | Medium–High | Reduce frequency of financial decision-making |

| Lifestyle inflation may be locking in a higher risk | Reduce the frequency of financial decision-making | Medium | Delay upgrades until systems adjust |

| No emergency buffer or safety margin | Small shocks can cause large setbacks | High | Focus on stability before pursuing growth |

| Multiple financial strategies without clear coordination | Complexity increasing fragility | Medium | Simplify systems to improve follow-through |

| Assuming income growth will solve existing problems | Structural issues remain unaddressed | Medium | Address root causes before scaling income |

| Feeling “stuck” but unable to explain why | Lack of clarity often hides compounding risk | Medium | Feeling constantly stressed about money despite a higher income |

Why risk feels different today

Risk today is subtle. Inflation erodes value slowly, and variable interest rates shift monthly costs without drama. Financial advisors are now seeing clients surprised by how “manageable” decisions added up. The danger isn’t collapse—it’s a gradual loss of control.

How small mistakes compound quietly over time

Minor overspending or delayed saving compounds negatively. Just as interest grows savings, it grows debt and missed opportunities. Because effects are delayed, feedback is weak. People adjust too late, believing nothing is wrong until pressure becomes constant.

Real-world consequences people experience

Looking ahead, the consequences appear as delayed goals, higher stress, and limited choices. People feel trapped not by one mistake, but by years of unexamined patterns. Recovery is possible, but it requires acknowledging how small risks became structural.

Building Stability That Holds Up Under Pressure

Recommended Financial Actions Based on Income & Risk Level

| Income Range (USD) | Risk Tolerance | Recommended Strategy | Expected Outcome (5–10 Years) |

|---|---|---|---|

| $40,000 – $60,000 | Low | Focus on stable cash flow, basic emergency savings, controlled expenses | Reduced financial stress, ability to absorb small shocks, slow but steady improvement |

| $40,000 – $60,000 | Medium | Focus on stable cash flow, basic emergency savings, and controlled expenses | Gradual net worth growth, improved financial confidence |

| $60,000 – $90,000 | Low | Maintain lifestyle control, automate savings, prioritize flexibility | Stable finances with fewer setbacks, predictable progress |

| $60,000 – $90,000 | Medium | Balanced approach: steady investing, controlled spending increases | Moderate long-term wealth growth with manageable volatility |

| $90,000 – $130,000 | Medium | Increase long-term investing gradually, avoid rapid lifestyle inflation | Noticeable wealth accumulation, higher optionality |

| $90,000 – $130,000 | High | Diversified investing with risk limits, strong cash reserves | Higher growth potential with periodic fluctuations |

| $130,000+ | Low | Capital preservation focus, conservative asset allocation | Stable purchasing power, low stress, resilience during downturns |

| $130,000+ | Medium | Long-term diversified investing with disciplined contributions | Strong compounding effect, improved financial independence |

| $130,000+ | High | Carefully managed growth strategies with clear downside limits | Consistent saving, limited long-term investing, and minimal high-interest debt |

Why resilience matters more than high returns

Resilience means surviving uncertainty. High returns look attractive, but unstable systems fail during shocks. Resilient finances prioritize flexibility—cash buffers, manageable commitments, and room for error. The trade-off is slower growth, but with far fewer crises.

How resilient financial systems are built

Resilience is built through margins. Spending below limits, keeping obligations flexible, and avoiding fragile assumptions. Institutions like the IMF often stress shock-absorption at national levels; the same principle applies personally, just at a smaller scale.

What these changes in everyday decision-making mean

Every day choices become less about optimization and more about durability. Decisions consider “what if things change?” This mindset reduces anxiety and increases confidence, even when income fluctuates.

The Future Where Small Choices Finally Add Up

Why the next 5–10 years matter most

The next decade compounds everything already in motion. Habits formed now will shape options later. Because compounding accelerates over time, early adjustments matter more than late corrections.

How small decisions create large outcomes

Tiny, repeatable choices stack. Spending slightly less, saving slightly earlier, and avoiding unnecessary risk compounds quietly. The limitation is that results feel invisible at first, requiring trust in the process.

What this means for your future self

Your future self benefits from systems, not willpower. Financial freedom often looks ordinary in the moment but powerful in hindsight. Understanding this gap is what turns higher income into lasting stability.

Feeling financially stuck despite earning more is rarely about personal failure. It reflects how financial systems, habits, and risks interact over time. Institutions such as the Federal Reserve and Bureau of Labor Statistics (BLS) track inflation, wages, and interest rates, but lived experience often diverges from averages. Meanwhile, organizations like the World Bank and IMF consistently highlight that resilience and cash-flow stability matter more than headline income growth, especially during periods of economic transition.

The deeper pattern is clear: short-term comfort can quietly undermine long-term stability if systems don’t adapt. Simple, disciplined structures tend to outperform complex plans because they align with how people actually behave. Looking ahead, gradual adjustments—not dramatic moves—are likely to shape financial outcomes as global conditions continue to evolve.

What happens next is a slow but meaningful shift in awareness. As understanding improves, financial pressure often eases without urgency or drastic change. Readers who want to build that understanding may find value in exploring more thoughtful, evidence-based financial analysis that prioritizes clarity, balance, and long-term perspective.

Subscribe to a trusted source like FinansieraTrading.com for continuous updates.