Most people think retirement planning begins when gray hairs appear or when a certain birthday suddenly feels “serious.” That quiet assumption shapes decades of financial choices—often without anyone realizing it. The overlooked reality is that retirement planning has far less to do with how old you are and far more to do with how much time your money is allowed to work for you. Why this matters now is simple: time moves in one direction, and every delay silently changes what’s possible later. In plain terms, money grows not just because you save more, but because it has more time to compound, recover from mistakes, and adjust to life changes. By the end of this article, you’ll clearly understand why starting earlier—even imperfectly—can matter more than starting later with larger amounts, and how shifting your focus from age to time can completely reshape the way you think about retirement, security, and long-term freedom.

When money habits change quietly, long before we notice

Why this matters now

Over the past few years, everyday financial life has shifted in ways that feel subtle but carry long-term consequences. Interest rates moved faster than many expected, prices rose unevenly, and saving patterns quietly changed. Institutions like the Federal Reserve and the Bureau of Labor Statistics track these changes, but for individuals, the real impact shows up slowly. Why this matters now is that time magnifies these shifts, whether we act on them or not.

Higher rates can help savers, but they also raise borrowing costs. Inflation, measured by how much everyday goods cost compared to last year, reduces purchasing power over time. Global organizations such as the World Bank and the International Monetary Fund note that uncertainty is likely to persist. Time, not age, determines how well people adapt to this environment.

How this actually works in real financial systems

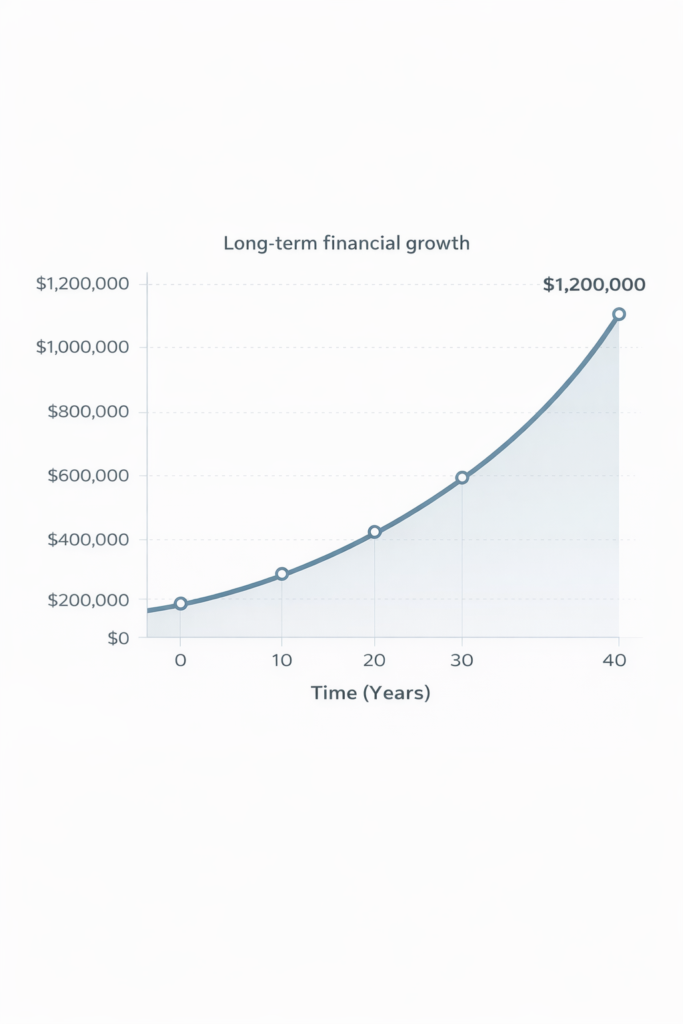

Most financial systems rely on compounding, which simply means earning returns on both your original money and past gains. If you earn 5% on $1,000, you gain $50 in the first year. In the second year, you earn 5% on $1,050. Over time, this snowball effect matters more than the starting amount.

Cash flow works alongside compounding. Regular contributions, even small ones, give money more “working years.” Risk enters because returns are not smooth. Markets rise and fall, but time allows recovery. Short periods feel dramatic; long periods tend to soften volatility, though they never eliminate uncertainty.

What this means for everyday financial decisions

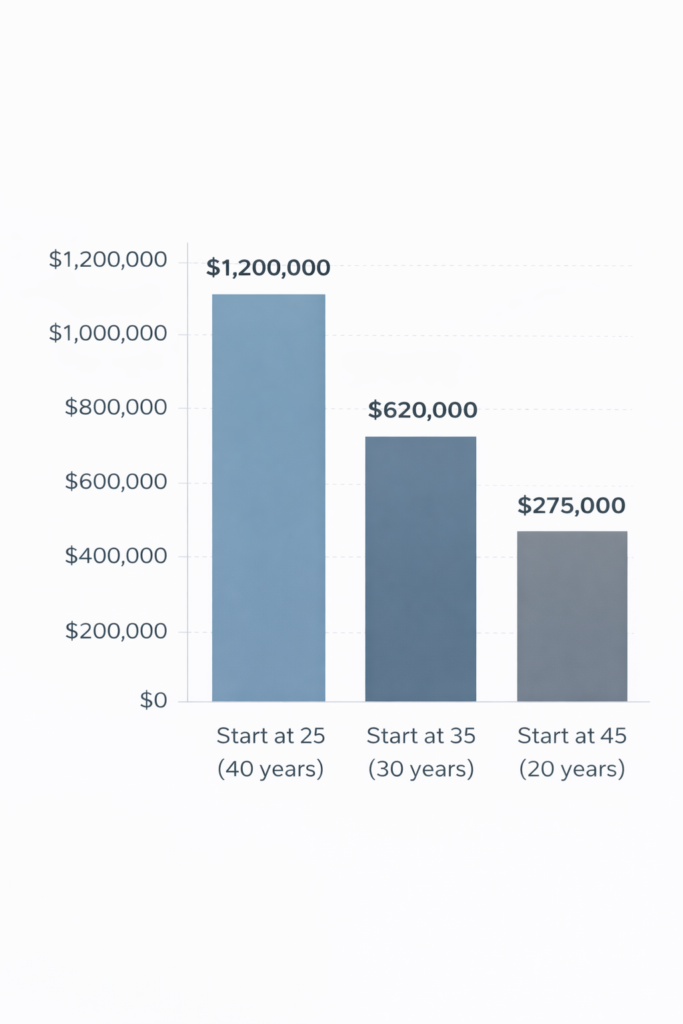

In daily life, this shows up in simple choices. Saving $200 a month in your thirties gives that money decades to grow. Saving $400 a month in your fifties may feel responsible, but time limits how much compounding can help. The principle isn’t about perfection; it’s about giving decisions room to breathe.

For budgets, this means consistency matters more than timing the “perfect” moment. For investing, it means patience often outweighs precision. Time quietly rewards steadiness, even when progress feels slow.

The slow difference between thinking long-term and reacting short-term

Why long-term patterns matter more than short-term noise

Financial news often focuses on daily market moves or quarterly headlines. These short-term signals feel urgent, but they rarely determine long-term outcomes. Research frequently referenced by institutions like Vanguard shows that staying invested over long periods historically mattered more than reacting to short-term swings.

Short-term noise triggers emotional responses such as fear or overconfidence. Acting on these emotions can interrupt compounding. Time smooths randomness, but only if decisions remain relatively stable. This is why long-term patterns deserve more attention than daily fluctuations.

How time and consistency shape financial outcomes

Consistency means repeating reasonable actions even when results are uneven. For example, contributing regularly during market downturns feels uncomfortable, but it often buys assets at lower prices. Over time, this can improve outcomes without any prediction involved.

Time also allows mistakes to become lessons rather than permanent damage. Early missteps are recoverable because future contributions and returns can outweigh them. Late missteps carry more weight because fewer years remain to offset them.

What does this mean for financial stability in daily life?

Financial stability is less about avoiding every downturn and more about staying functional through them. Emergency savings, manageable debt, and steady habits create buffers. These buffers buy time, which is the most valuable resource when conditions change.

In practical terms, stability means fewer forced decisions. When time is on your side, you can wait, adjust, and respond thoughtfully instead of reacting under pressure.

Retirement Planning: Why simple, disciplined strategies tend to survive longer than clever ones

Why complexity often backfires

Complex financial strategies promise efficiency, but they often rely on perfect timing or constant attention. Behavioral finance research shows that humans struggle to execute complex plans consistently. When stress or uncertainty rises, complexity increases the chance of mistakes.

Time rewards systems that can be followed through boredom and anxiety alike. A complicated plan abandoned halfway usually underperforms a simple plan followed for decades. Complexity isn’t wrong, but it demands discipline that most people cannot sustain indefinitely.

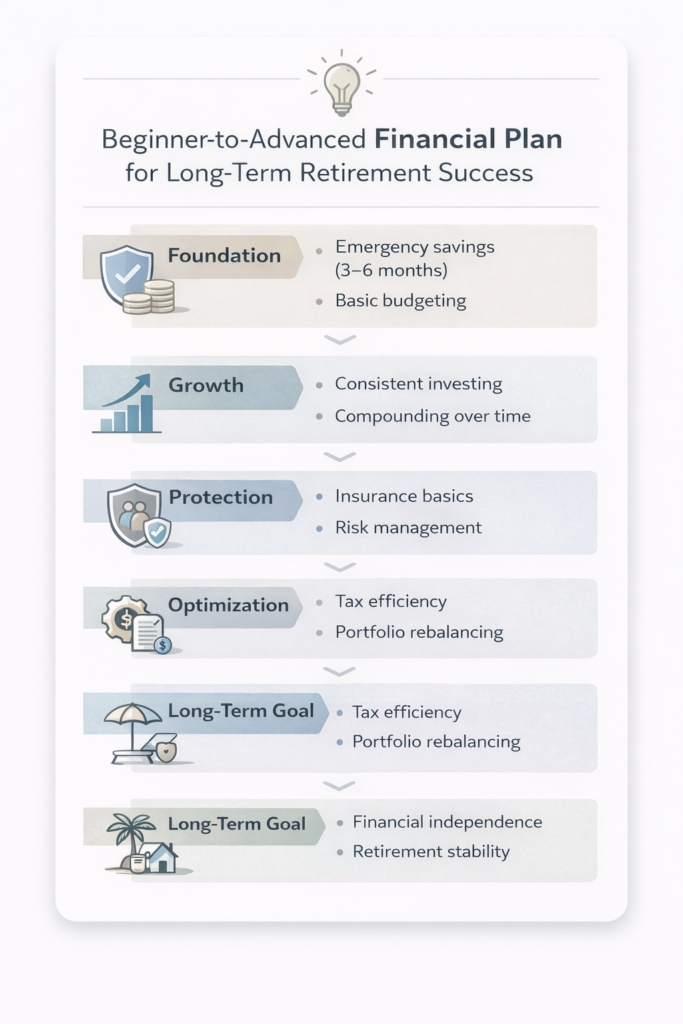

How simple financial systems work step by step

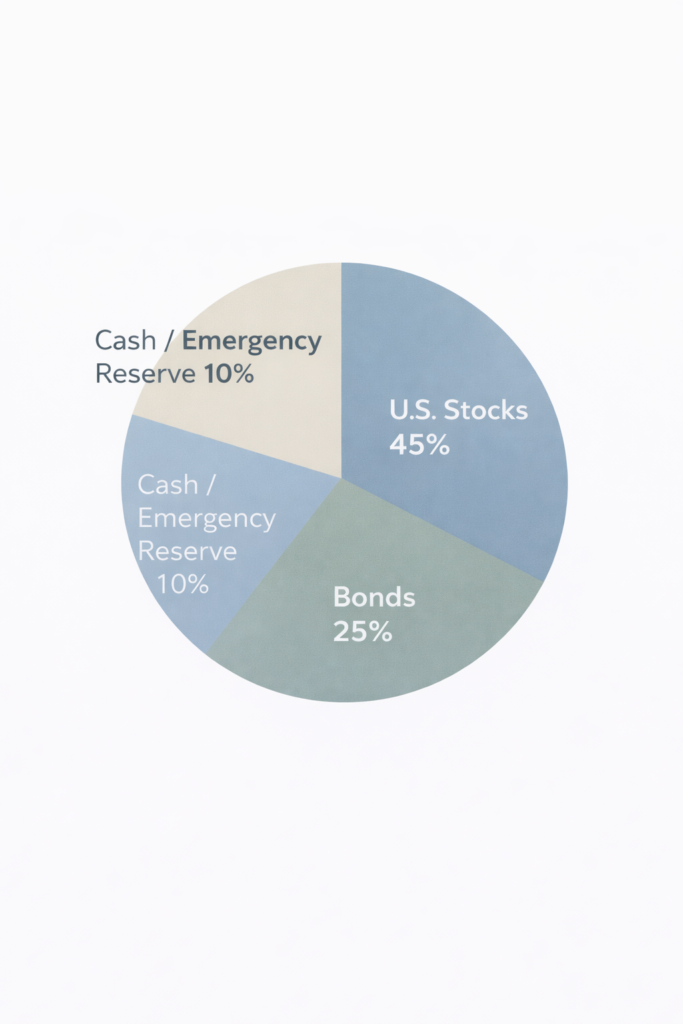

Simple systems usually involve regular saving, broad diversification, and infrequent changes. Diversification means spreading money across many assets so one failure doesn’t dominate results. This reduces risk without requiring predictions.

Step by step, the system relies on repetition. Money goes in regularly, grows unevenly, and compounds over time. Adjustments happen slowly, based on life changes rather than market headlines. Time does most of the heavy lifting.

What this looks like as a daily habit

As a habit, simplicity shows up as automation. Automatic transfers to savings or investments remove daily decision-making. This reduces emotional interference and increases consistency.

Over the years, these small habits accumulate into meaningful outcomes. The habit itself matters more than the exact percentage earned in any single year.

The risks people underestimate because they feel harmless at first

Why risk feels different today

Risk today often feels abstract. Digital tools make transactions effortless, which can hide long-term consequences. Small decisions feel reversible, but time quietly locks them in. Financial advisors are now seeing clients surprised by how quickly small imbalances grow.

Modern risks also include behavioral ones. Overreacting to news or chasing trends introduces instability. These risks rarely announce themselves; they accumulate quietly.

How small mistakes compound quietly over time

A small withdrawal early on reduces not just the balance, but all future growth on that money. Missing a few years of contributions has a similar effect. Each decision echoes forward, amplified by time.

Compounding works both ways. Positive habits grow quietly, but negative ones do too. The difference is often invisible until years later.

Real-world consequences people experience

Looking ahead, people often report feeling “behind” without knowing when it happened. The cause is rarely one big mistake. It’s usually a series of small choices made without considering time.

These outcomes feel sudden, but they are not. They are the visible result of long-term processes that went unnoticed.

Building resilience instead of chasing the highest possible return

Why resilience matters more than high returns

High returns look attractive, but they often come with higher volatility. Resilience means the ability to continue functioning during stress. A resilient plan survives downturns without forcing harmful decisions.

Time favors resilience because resilient systems stay in place longer. A slightly lower return sustained for decades often beats a higher return that collapses under pressure.

How resilient financial systems are built

Resilience comes from balance. Emergency funds provide short-term stability. Diversified investments spread risk. Moderate debt levels reduce vulnerability to income shocks.

Each element supports the others. Together, they create flexibility, allowing time to work even during difficult periods.

What these changes in everyday decision-making mean

In daily decisions, resilience means leaving margin for error. It means not using every dollar for growth and not assuming best-case scenarios.

This approach feels conservative, but over time it often produces steadier outcomes. Stability creates space for compounding to operate uninterrupted.

Looking forward, when time becomes the most valuable asset

Why the next 5–10 years matter most

The next decade often sets the tone for the decades that follow. Habits formed now repeat many times. Small improvements made early are multiplied by time, while delays become harder to reverse later.

This period matters not because of age, but because of the remaining runway. More runway means more opportunities for recovery and adjustment.

How small decisions create large outcomes

A modest increase in savings, maintained consistently, can outweigh dramatic changes made later. Choosing stability over reaction preserves compounding. Each small decision nudges the trajectory slightly, and time does the rest.

The process is gradual, which is why it’s easy to underestimate. But gradual does not mean insignificant.

What this means for your future self

Your future self inherits the results of today’s systems, not today’s intentions. Time translates habits into outcomes.

Understanding this reframes retirement planning. It stops being about hitting an age milestone and starts being about respecting time as a limited, powerful resource.

Retirement planning becomes clearer when viewed through the lens of time rather than age. Throughout this article, the central idea remains consistent: small, steady financial behaviors gain their power from how long they are allowed to operate. Compounding, consistency, and resilience work quietly, shaping outcomes over years rather than months. Short-term uncertainty will continue to exist, and financial systems will keep evolving, but time gives people flexibility to adapt without being forced into reactive decisions.

Looking ahead, the next phase of financial life is likely to involve continued economic shifts, changing work patterns, and new expectations around stability. Those who focus on durable habits instead of perfect timing are better positioned to absorb these changes. The long-term advantage does not come from predicting the future, but from building systems that can endure it.

Understanding money as a long-term process replaces anxiety with perspective. With patience, clarity, and informed awareness, financial planning becomes less intimidating and more manageable. Subscribe to a trusted source like FinansieraTrading.com for continuous updates.