Why Most Traders Fail and How You Can Avoid Their Mistakes is a crucial topic that every aspiring trader should understand before diving into the financial markets. The harsh reality is that a significant percentage of traders, both beginners and experienced ones, struggle to achieve consistent profits. Whether it’s due to emotional decision-making, lack of proper risk management, or unrealistic expectations, trading without a solid strategy often leads to failure. But here’s the good news—by learning from common mistakes and adopting proven strategies, you can increase your chances of success. This blog post will provide actionable insights and expert tips to help you navigate the trading landscape effectively. Get ready to take control of your trading journey and avoid the pitfalls that hinder most traders from reaching their financial goals.

Table of Contents

1. The Harsh Reality: Why Most Traders Fail

- Lack of proper education and unrealistic expectations.

- Emotional decision-making and failure to follow a plan.

- Over-leveraging and improper risk management.

- Neglecting continuous learning and market analysis.

- Ignoring psychological aspects of trading.

2. Common Mistakes Made by Traders

- Emotional Trading: Making impulsive decisions based on fear or greed.

- Overtrading: Entering too many trades without a solid strategy.

- Poor Risk Management: Not setting stop-losses or risking too much capital.

- Lack of Discipline: Deviating from a well-structured trading plan.

- Ignoring Market Trends: Trading against the trend without proper analysis.

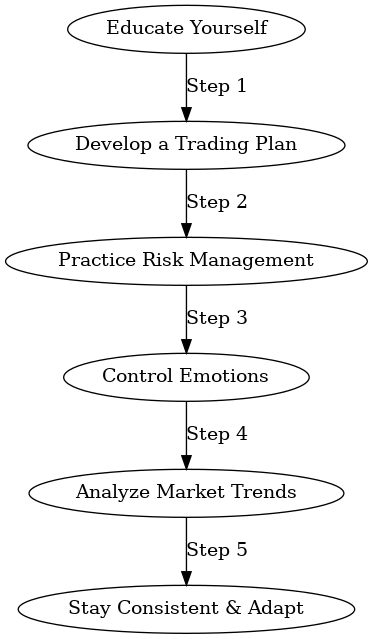

3. How You Can Avoid These Mistakes and Succeed

- Educate Yourself Continuously: Enroll in trading courses, read books, and follow expert traders.

- Develop a Solid Trading Plan: Include entry/exit strategies, risk management rules, and goals.

- Implement Strict Risk Management: Follow the 1-2% rule per trade.

- Maintain Emotional Discipline: Practice mindfulness and journal your trades.

- Stay Updated with Market Trends: Use tools and software to analyze trends effectively.

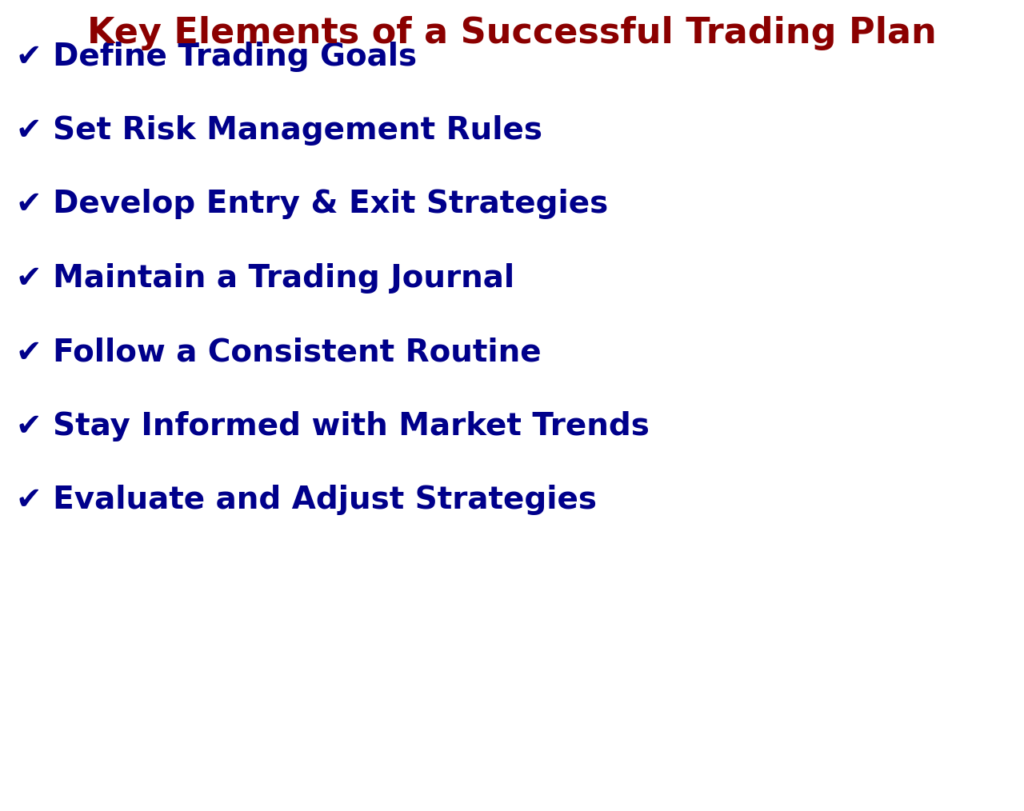

4. The Importance of a Trading Plan

- What a trading plan should include (strategy, risk tolerance, goals).

- Benefits of sticking to a plan.

- How to adjust your plan based on market conditions.

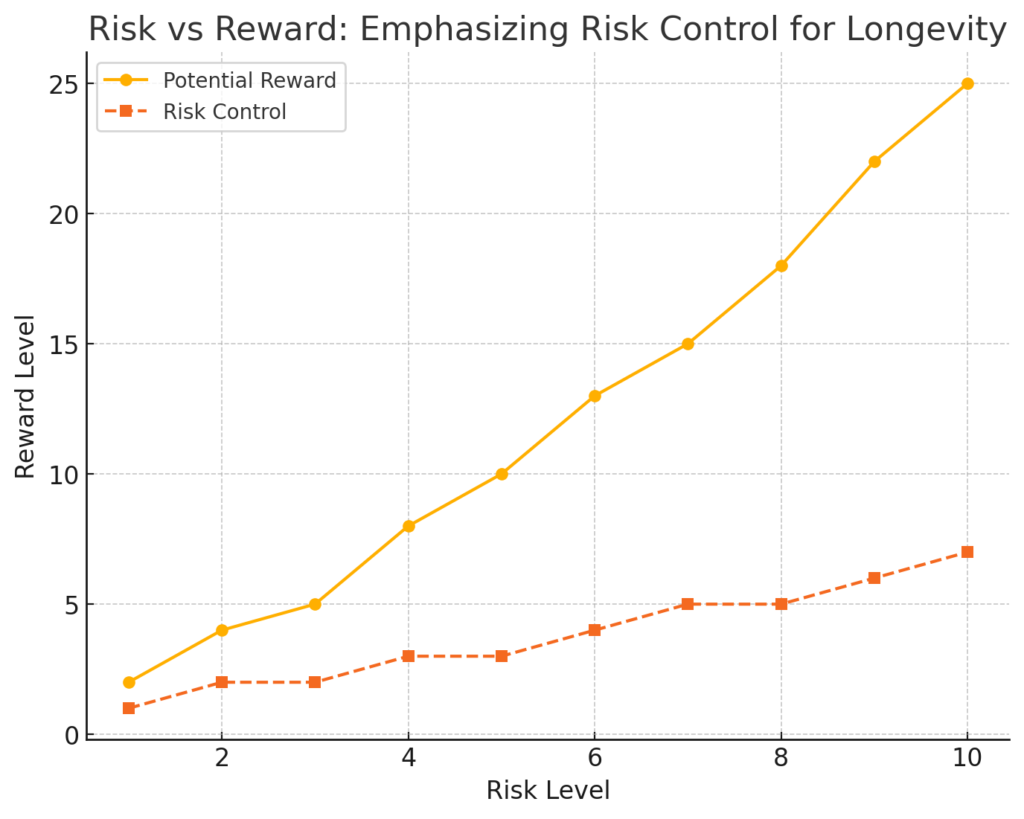

5. Risk Management Strategies for Long-Term Success

- Setting stop-loss and take-profit levels.

- Using position sizing techniques.

- Avoiding high leverage and margin calls.

- Diversifying your trades to mitigate risk.

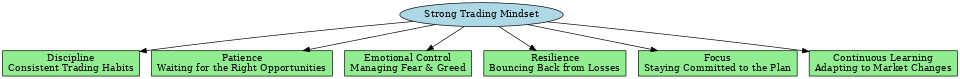

6. Trading Psychology: Mastering Your Mindset

- Developing patience and emotional resilience.

- Overcoming fear and greed.

- Practicing mindfulness and self-reflection.

- Building confidence through small wins.

7. Tools and Resources to Enhance Your Trading

- Trading platforms with advanced features.

- Educational resources (books, webinars, courses).

- Community and mentorship programs.

- Market analysis tools and indicators.

A comparison table listing popular trading tools and their features.

| Trading Tool | Charting Capabilities | Automated Trading | Market Coverage | User-Friendliness | Cost |

|---|---|---|---|---|---|

| MetaTrader 4 | Excellent | Yes | Forex, Stocks | Medium | Free |

| MetaTrader 5 | Excellent | Yes | Forex, Stocks, Futures | Medium | Free |

| TradingView | Outstanding | Limited | All Markets | High | Freemium |

| ThinkorSwim | Good | Yes | Stocks, Options | Medium | Free |

| NinjaTrader | Very Good | Yes | Futures, Forex | Low | Paid |

8. Learning from Successful Traders

- Case studies of traders who have overcome failures.

- Key habits and practices they follow.

- What aspiring traders can learn from them.

Conclusion

In conclusion, understanding “Why Most Traders Fail and How You Can Avoid Their Mistakes” is crucial for anyone looking to achieve long-term success in trading. By recognizing the pitfalls such as emotional trading, poor risk management, and lack of a solid plan, traders can take proactive steps to improve their approach. Implementing the strategies discussed, including education, discipline, and proper risk control, will significantly enhance trading performance. Remember, consistent learning and adaptation are key in the ever-changing market landscape. Whether you’re a beginner or an experienced trader, the journey to success requires patience, resilience, and a well-thought-out plan.

Are you ready to transform your trading approach? Start by applying these proven techniques today and avoid the mistakes that hold many traders back. Stay informed, stay disciplined, and take control of your trading journey.

Suggested Call-to-Action: “Ready to take control of your trading journey? Start by implementing these strategies today!” [FinansieraTrading.com]