Fidelity Investments is a prominent and highly diversified financial services firm based in the United States. Established in 1946 and headquartered in Boston, Massachusetts, Fidelity plays a significant role in the investment and wealth management industry. Here is a broader overview, along with important steps and information about Fidelity Investments:

Fidelity Investments:

- History and Reputation: Fidelity has a long history of providing financial services, earning a solid reputation for trustworthiness and expertise. It has grown to become one of the largest and most respected companies in the industry.

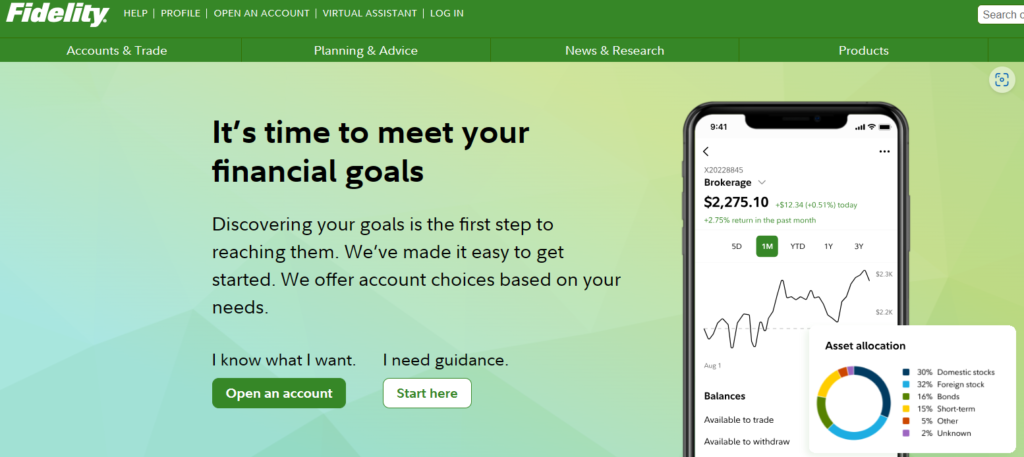

- Wide Range of Services: Fidelity offers a comprehensive suite of financial products and services designed to meet the needs of a diverse client base. These services include: [Fidelity investments]

- Mutual Funds: Fidelity is renowned for its extensive selection of mutual funds, encompassing various asset classes and investment strategies.

- Brokerage Services: Fidelity provides an online brokerage platform that allows investors to trade a variety of financial instruments, from stocks and bonds to ETFs and options.

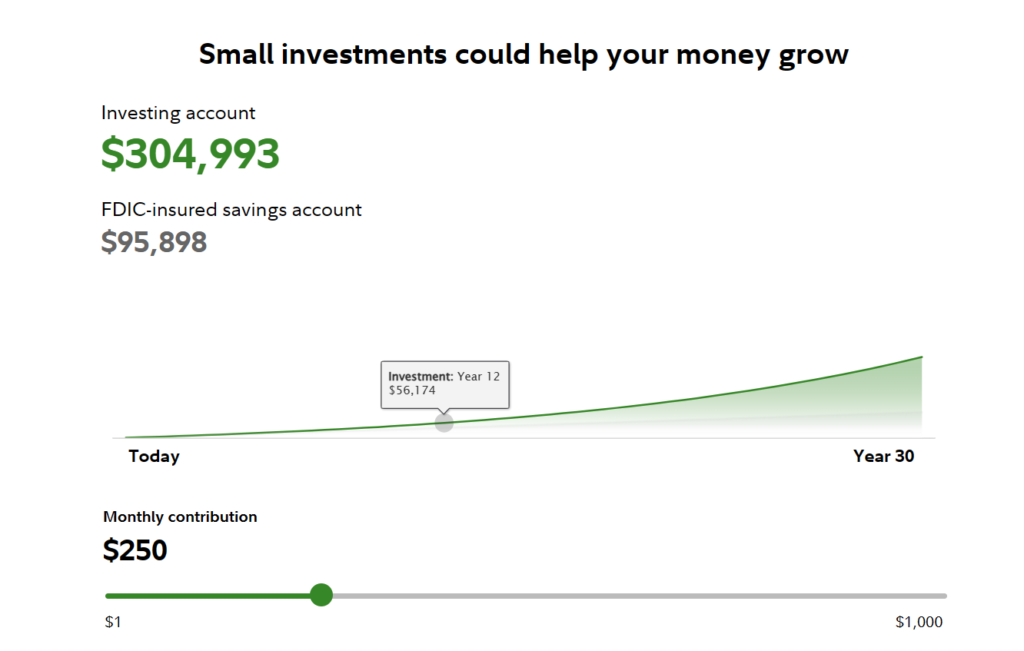

- Retirement Planning: Fidelity specializes in retirement planning, offering IRAs, 401(k) management, and retirement income solutions to help individuals plan for their financial futures.

- Wealth Management: High-net-worth individuals and families can access Fidelity’s wealth management services, which include financial planning, portfolio management, and estate planning.

- Insurance: Fidelity offers insurance products, such as life insurance, annuities, and long-term care insurance, to provide clients with additional financial security.

- Educational Resources: Fidelity provides a wealth of educational resources and research tools to empower investors with knowledge, including market insights and retirement planning guidance.

- Banking: Fidelity operates its own bank, offering traditional banking services like checking and savings accounts, certificates of deposit (CDs), and credit cards.

- Advisory Services: Clients can leverage Fidelity’s team of financial advisors who offer personalized advice and guidance tailored to their financial goals.

- Customer-Centric Approach: Fidelity is known for its focus on delivering exceptional customer service and has earned a reputation for providing a wide array of investment choices, competitive fees, and user-friendly online platforms.

- Online Accessibility: Fidelity offers robust online platforms and mobile apps, making it easy for clients to manage their investments, access research, and monitor their accounts from anywhere.

- Institutional Services: Fidelity serves not only individual investors but also institutional clients, including pension funds, endowments, and other large organizations, offering a wide range of institutional investment and custody services.

- Global Presence: While headquartered in the United States, Fidelity has a global presence, serving clients in multiple countries and regions around the world.

- Continuous Evolution: The financial services industry is dynamic, and Fidelity continues to adapt and evolve its product and service offerings to stay competitive and meet the changing needs of its clients.(FinansieraTrading.com)

It’s important to note that the specific products and services offered by Fidelity Investments may evolve and expand over time. For the most up-to-date information, individuals and institutions interested in Fidelity’s offerings should visit the official Fidelity website or contact Fidelity directly to discuss their specific financial needs and goals.