What to include when calculating real trading costs can make or break your trading strategy. Have you ever wondered why your trading profits don’t always match your expectations? The answer often lies in the hidden and overlooked expenses that silently eat into your gains. From obvious charges like brokerage commissions to less apparent costs such as slippage and currency conversion fees, every detail counts. In this blog, we’ll break down the essential components you need to consider when calculating real trading costs, helping you make smarter, more profitable trading decisions. Whether you’re a novice or an experienced trader, understanding these costs is key to maximizing your returns and staying ahead in the dynamic world of trading.

Table of Contents

Understanding Real Trading Costs

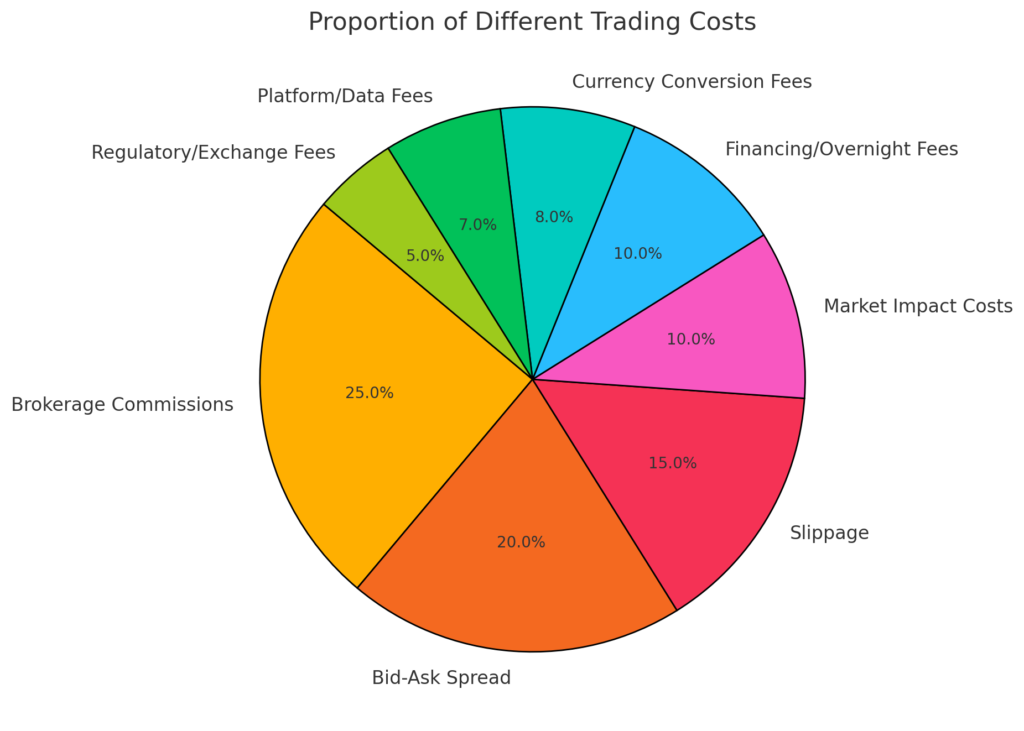

Real trading costs go beyond just the commission fees. They encompass both visible and hidden expenses that can significantly impact profitability. Knowing all cost elements ensures traders make informed decisions and accurately assess their true earnings.

Key Components of Real Trading Costs

- Brokerage Commissions

Brokerage commissions are fees charged by brokers for executing trades. These can be fixed (a flat fee per trade) or variable (based on trade volume or value). Understanding your broker’s fee structure is vital, as high commissions can erode profits, especially for active traders. - Bid-Ask Spread

The bid-ask spread is the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). This spread represents a hidden cost because traders effectively “lose” the difference when entering and exiting positions, particularly in less liquid markets. - Slippage

Slippage occurs when a trade is executed at a different price than expected, often due to market volatility or delayed order execution. For example, placing an order at $50 but having it filled at $50.10 results in slippage. Over time, slippage can add up, significantly impacting overall trading costs. - Market Impact Costs

Large trades can influence market prices, causing the price to move unfavorably as the order is executed. This is known as market impact cost. It’s particularly relevant for institutional traders or those dealing with large volumes in illiquid markets. - Financing or Overnight Fees

These are fees charged for holding leveraged positions overnight. Brokers apply interest rates on the borrowed amount, which can vary depending on the asset and market conditions. Traders using margin accounts should monitor these fees closely to avoid unexpected costs. - Currency Conversion Fees

When trading assets denominated in foreign currencies, brokers often charge a conversion fee. This cost can add up, especially for traders frequently dealing in international markets, affecting the profitability of cross-border trades. - Platform and Data Fees

Many brokers charge for access to advanced trading platforms, real-time data feeds, and premium analysis tools. While these tools can enhance trading strategies, it’s essential to weigh their costs against the potential benefits they provide. - Regulatory and Exchange Fees

Regulatory bodies and exchanges impose mandatory fees on certain trades. These fees are typically small but can accumulate over time, particularly for high-frequency traders. Understanding these charges helps in precise cost calculation.

How to Calculate Total Trading Costs

- Add up all the cost components mentioned above to get a comprehensive view of total trading expenses.

- Example: If you paid $10 in commissions, $5 in slippage, $3 in conversion fees, and $2 in regulatory fees for a single trade, your total trading cost would be $20.

Steps to Calculate Total Trading Costs

| Step Number | Step | Description |

|---|---|---|

| 1 | Identify All Cost Components | List all potential trading costs, including visible fees like commissions and hidden costs such as slippage and currency conversion fees. |

| 2 | Gather Data on Each Cost (Commissions, Spreads, Fees, etc.) | Collect accurate data for each cost category from broker statements, trading platforms, and market data sources. |

| 3 | Calculate Individual Costs for Each Component | Compute the actual cost incurred for each identified component using the gathered data. |

| 4 | Sum Up All Costs to Get Total Trading Costs | Add up all individual costs to determine the total trading expenses for a specific period or trade. |

| 5 | Analyze and Compare Costs for Optimization | Review the total costs, identify areas where expenses can be reduced, and compare with industry benchmarks or different brokers. |

Comparing Costs Across Brokers

- Evaluate brokers not just on their advertised fees but also on hidden costs like spreads, slippage, and financing fees.

- Use demo accounts to test trading conditions before committing real funds.

Strategies to Minimize Trading Costs

- Use limit orders instead of market orders to reduce slippage.

- Trade during peak liquidity hours to minimize bid-ask spreads.

- Choose brokers with transparent, competitive fee structures.

Importance of Regular Cost Reviews

- Periodically review your trading expenses to identify areas where you can cut costs.

- Adjust your trading strategy as needed to remain cost-efficient, especially when market conditions or broker policies change.

Conclusion

In conclusion, mastering what to include when calculating real trading costs is a journey that begins with small, actionable steps. By implementing the strategies outlined above, you can make more informed decisions, minimize hidden expenses, and enhance your trading profitability. Remember, consistency is key—regularly reviewing and adjusting your cost calculations will keep you ahead in the dynamic trading environment.

We’d love to hear your thoughts! Share your experiences in the comments below, and if you found this guide helpful, consider sharing it with fellow traders. For more expert insights, check out related articles or subscribe for updates to stay informed on the latest trading strategies.

“Every informed decision you make brings you closer to financial success. Keep learning, keep growing.” [FinansieraTrading.com]