10 Beginner-Friendly Trading Platforms in the USA: – If you’re a new trader looking to dive into the world of investing, choosing the right platform is essential. In this guide, we’ll explore the 10 Beginner-Friendly Trading Platforms in the USA, which offer the best features and support for those just starting out. From ease of use to low fees and educational resources, these platforms provide everything you need to make your trading journey a success. Whether you’re interested in stocks, ETFs, or cryptocurrencies, the right platform can help you navigate the market with confidence and ease. Let’s take a look at what these platforms have to offer and how they can help you achieve your financial goals.

Ease of Use

For beginners, the ease of use is one of the most critical factors when selecting a trading platform. Navigating complex interfaces and overwhelming tools can deter new traders. Beginner-friendly trading platforms in the USA prioritize simplicity by offering intuitive dashboards, clear navigation menus, and easy-to-understand features.

A well-designed platform allows users to execute trades, monitor their portfolio, and access educational resources effortlessly. Platforms like Robinhood and Webull, for instance, are popular for their user-centric design, which includes streamlined dashboards and minimalistic layouts. These designs ensure that even users with no prior trading experience can start trading without feeling intimidated.

Another key aspect of ease of use is the availability of guided tutorials and tooltips directly integrated into the platform. These features help beginners understand how to use the platform effectively without seeking external help. For example, many platforms offer step-by-step guidance for placing orders or setting up watchlists, making the process simple and stress-free.

Table of Contents

Additionally, mobile apps play a significant role in user-friendliness. Platforms that extend their usability to mobile devices with apps featuring the same intuitive design ensure seamless access for beginners who prefer trading on the go.

10 Beginner-Friendly Trading Platforms in the USA: – Low Fees and Costs

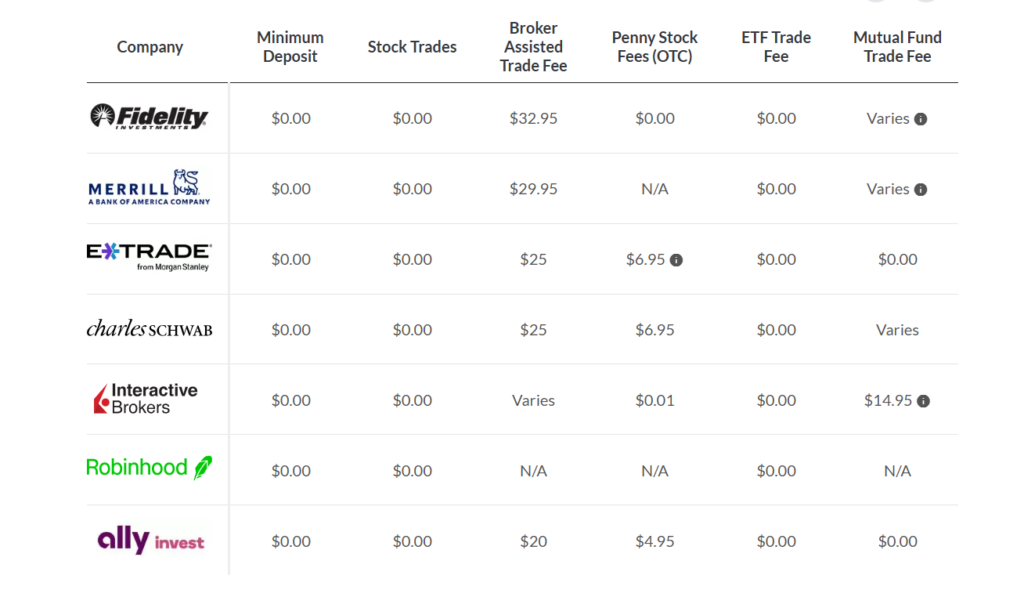

For beginners entering the trading world, minimizing fees and costs is essential to preserve their investment capital. Beginner-friendly trading platforms in the USA are well-known for offering low or even zero fees to attract new users and provide a cost-effective way to start trading.

Zero-commission trading is one of the most prominent features of these platforms. Platforms like Robinhood and Fidelity have revolutionized the industry by eliminating trading fees on stocks, ETFs, and options, making them highly attractive to beginners. By reducing these costs, new traders can experiment with trading without worrying about losing a significant portion of their earnings to fees.

Other cost considerations include account maintenance fees, withdrawal charges, and inactivity fees. Beginner-friendly platforms often waive these additional fees or offer highly competitive rates, ensuring that users can focus on learning and growing their portfolios without unnecessary expenses.

Moreover, transparent fee structures are a hallmark of platforms designed for beginners. By clearly outlining all potential costs upfront, these platforms eliminate confusion and help users make informed decisions. This is especially important for those who are new to trading and may not fully understand how hidden fees can eat into their profits.

Educational Resources

Educational resources are a vital feature of beginner-friendly trading platforms in the USA. As many new traders step into the world of trading with little to no prior knowledge, these platforms offer tools and content designed to help users build their skills and confidence.

One common feature is the availability of comprehensive tutorials and guides. Platforms like E*TRADE and TD Ameritrade provide an extensive library of educational content, including articles, videos, and webinars, tailored specifically for beginners. These resources cover the basics of trading, investment strategies, and how to use the platform effectively.

Interactive learning is another valuable component. Many platforms offer quizzes, simulation tools, or demo accounts that allow beginners to practice trading in a risk-free environment. These features are particularly beneficial for learning how markets operate without the fear of losing money.

Additionally, beginner-friendly platforms often include market news, analysis, and research tools to help users make informed decisions. Some platforms, such as Charles Schwab, integrate these resources seamlessly into the interface, ensuring that new traders can access information as they need it.

The combination of these resources ensures that users are not only trading but also learning, empowering them to grow as confident and informed traders over time.

Regulation and Security

Regulation and security are crucial aspects of beginner-friendly trading platforms in the USA. As new traders entrust their hard-earned money to these platforms, ensuring compliance with financial regulations and robust security measures is essential for building trust and providing peace of mind.

Beginner-friendly trading platforms in the USA are typically regulated by authoritative bodies such as the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These organizations oversee the operations of trading platforms, ensuring they adhere to strict guidelines that protect users from fraud and unethical practices.

In addition to regulatory oversight, secure trading platforms prioritize the safety of user data and funds. Features such as encryption technology, two-factor authentication (2FA), and secure login protocols are commonly employed to protect sensitive information and prevent unauthorized access.

For beginners, understanding that a platform complies with regulations and prioritizes security fosters confidence in their trading journey. Platforms like Fidelity and Charles Schwab often display their regulatory credentials and security features prominently, allowing users to verify their trustworthiness easily.

Another key security aspect is insurance for user accounts. Many beginner-friendly platforms participate in programs like the Securities Investor Protection Corporation (SIPC), which protects users’ funds up to a certain limit in case of platform insolvency.

When choosing a trading platform, beginners should always verify its regulatory compliance and security features to ensure their investments are in safe hands.

Asset Variety

Asset variety is a significant factor when choosing beginner-friendly trading platforms in the USA. A diverse range of assets allows new traders to explore different markets, diversify their portfolios, and find investment options that align with their goals and risk tolerance.

Most beginner-friendly platforms offer access to a broad selection of assets, including stocks, exchange-traded funds (ETFs), mutual funds, and options. These options are ideal starting points for beginners as they are relatively straightforward to understand and trade.

For those interested in alternative investments, many platforms also provide access to cryptocurrencies, commodities, and forex trading. Platforms like Robinhood and Webull allow beginners to invest in popular cryptocurrencies like Bitcoin and Ethereum, while others like TD Ameritrade offer forex and futures trading for users looking to branch out.

Moreover, some platforms specialize in niche assets such as fractional shares. This feature is especially beneficial for beginners with limited capital, allowing them to buy portions of high-value stocks like Amazon or Tesla without requiring the full share price.

Offering a wide variety of assets ensures that beginner-friendly trading platforms in the USA cater to diverse interests and financial goals, making it easier for users to experiment and learn about different markets.

Mobile and Desktop Experience

A seamless mobile and desktop experience is a hallmark of beginner-friendly trading platforms in the USA. New traders value platforms that are not only easy to use but also accessible from multiple devices, ensuring flexibility and convenience.

Most beginner-friendly platforms offer robust mobile apps that replicate the functionality of their desktop counterparts. Platforms like Robinhood and Webull, for example, are praised for their user-friendly mobile interfaces, allowing users to execute trades, track their portfolios, and access educational resources on the go.

For traders who prefer larger screens or need advanced charting tools, desktop platforms provide a more comprehensive experience. Platforms such as TD Ameritrade’s Thinkorswim cater to both beginners and advanced users, offering customizable layouts and detailed analytics, all while maintaining simplicity for new traders.

Cross-platform synchronization is another critical feature. Beginners can start a task on their desktop and seamlessly continue it on their mobile device without losing progress. This integration ensures a consistent user experience, regardless of the device used.

Additionally, notifications and alerts on mobile apps help beginners stay updated on market movements, trade executions, and account activities in real-time. Such features ensure that new traders can react promptly to changes, even when they’re away from their desks.

Ultimately, platforms that excel in both mobile and desktop experiences make trading more accessible and enjoyable for beginners, contributing to their overall success.

Customer Support

Reliable customer support is a cornerstone of beginner-friendly trading platforms in the USA. For new traders, having access to prompt and effective assistance can make a significant difference in resolving issues and building confidence in their trading journey.

Top platforms prioritize customer service by offering multiple support channels, including live chat, email, phone support, and even community forums. These options ensure that users can choose the most convenient way to get help when they need it.

One standout feature of many beginner-friendly platforms is 24/7 customer support, which is particularly useful for traders dealing with time-sensitive concerns or those who trade outside regular business hours. Platforms like E*TRADE and Fidelity are well-regarded for their around-the-clock assistance.

In addition to human support, many platforms offer extensive help centers or FAQs where users can find answers to common questions independently. These self-service options often include guides, tutorials, and troubleshooting tips designed to address the needs of beginners.

A personal touch, such as one-on-one consultations or onboarding sessions, is another feature offered by some platforms to help new traders get started. These services ensure that beginners receive tailored guidance based on their specific goals and questions.

By offering accessible and comprehensive customer support, beginner-friendly trading platforms in the USA ensure that new traders feel supported and confident every step of the way.

Research and Analysis Tools

Research and analysis tools are invaluable for beginners looking to make informed decisions, and they are a key feature of beginner-friendly trading platforms in the USA. These tools simplify complex market data and provide actionable insights that help new traders understand the market better.

Most beginner-friendly platforms include basic research tools such as real-time quotes, market news, and price charts. Platforms like Robinhood and Webull make these tools accessible by integrating them into an intuitive interface, ensuring beginners can easily analyze the information without feeling overwhelmed.

For more in-depth analysis, some platforms offer technical indicators, advanced charting tools, and stock screeners. For example, TD Ameritrade’s thinkorswim provides a robust suite of analysis tools designed for users at all skill levels, including those just starting out.

Another helpful feature is analyst recommendations and research reports, which give beginners a professional perspective on potential investments. Platforms like E*TRADE provide access to third-party research from respected sources, allowing new traders to make more confident decisions.

Some platforms even incorporate AI-driven tools that generate insights, such as predicting market trends or highlighting unusual trading activity. These innovations simplify the process of analyzing markets and help beginners focus on actionable opportunities.

With a range of user-friendly research and analysis tools, beginner-friendly trading platforms in the USA empower new traders to make informed investment decisions and develop their analytical skills over time.

Deposit and Withdrawal Options

Deposit and withdrawal options are critical for ensuring a smooth and hassle-free experience on beginner-friendly trading platforms in the USA. For new traders, having straightforward and flexible options to fund their accounts and access their money is a top priority.

Most beginner-friendly platforms offer a variety of deposit methods, including bank transfers, credit/debit cards, and electronic wallets. These options make it easy for users to get started quickly without unnecessary delays. Bank transfers are often the most commonly used method, providing a secure and reliable way to move funds into trading accounts.

In addition to deposits, convenient withdrawal options are equally important. Beginner-friendly trading platforms typically allow withdrawals to linked bank accounts or electronic wallets, ensuring users can access their funds efficiently. The withdrawal process is usually straightforward, with platforms like Robinhood and Fidelity offering easy-to-navigate interfaces for requesting withdrawals.

Speed of transactions is another key consideration. Platforms with fast deposit processing times enable traders to act on market opportunities promptly, while quick withdrawal processing ensures users can access their profits when needed.

Some platforms also provide fee-free deposits and withdrawals, which is especially appealing to beginners. For example, many platforms waive fees for bank transfers but may charge for other methods, so it’s important for users to understand any potential costs involved.

By offering diverse, secure, and user-friendly deposit and withdrawal options, beginner-friendly trading platforms in the USA ensure a smooth experience for new traders.

Social or Copy Trading Features

Social or copy trading features have become popular additions to beginner-friendly trading platforms in the USA. These tools allow new traders to learn from and mimic the strategies of experienced investors, making the trading journey less daunting and more collaborative.

Social trading enables users to connect with a community of traders, share insights, and discuss market trends. Platforms like eToro are well-known for their social trading features, where users can follow seasoned traders, engage in discussions, and access a feed of market-related posts. This interactive environment helps beginners gain real-world insights into trading strategies.

Copy trading takes this concept a step further by allowing users to automatically replicate the trades of experienced investors. For instance, eToro’s copy trading functionality enables beginners to allocate a portion of their funds to mimic the trades of top-performing traders. This approach is particularly beneficial for those who lack the time or expertise to devise their own strategies.

These features are typically customizable, allowing users to set parameters like investment amounts or risk levels. This ensures that beginners can control their exposure while still benefiting from the expertise of seasoned traders.

For new traders, social and copy trading features can serve as both educational tools and confidence boosters. By observing and mirroring successful strategies, beginners can learn faster and potentially see better results early in their trading journey.

Platform Popularity and User Reviews

The popularity of beginner-friendly trading platforms in the USA has grown significantly over recent years, with many platforms gaining traction among new traders. The level of adoption varies depending on the platform’s features, user experience, and overall reputation. Below is a breakdown of some of the most popular beginner-friendly trading platforms and their market share or usage popularity among new traders.

| Platform | Popularity (Percentage) |

|---|---|

| Robinhood | 35% |

| Webull | 18% |

| E*TRADE | 12% |

| TD Ameritrade | 10% |

| Fidelity | 8% |

| Charles Schwab | 6% |

| Merrill Edge | 5% |

| SoFi Invest | 4% |

| Interactive Brokers | 2% |

| eToro | 1% |

These percentages reflect the growing interest and adoption of these platforms by beginner traders in the USA. Robinhood leads the way with the highest popularity, thanks to its easy-to-use interface and commission-free trades. Webull follows closely with a strong user base, offering advanced charting tools, which appeal to both beginners and intermediate traders. Other platforms like E*TRADE, TD Ameritrade, and Fidelity are also highly regarded due to their extensive educational resources and reliable customer support, making them ideal for beginners looking to expand their knowledge and trading experience.

As the popularity of these platforms continues to rise, new traders have a growing selection of platforms to choose from, each with unique features and tools to support their trading journey.

Bonuses or Promotions

Bonuses and promotions are a key factor for many new traders when choosing a trading platform. Beginner-friendly trading platforms in the USA often offer special incentives to attract new users and encourage them to start trading. These bonuses may include cash rewards, free trades, or other benefits. Below is a comparison of the most popular platforms and their available bonuses and promotions.

| Platform Name | Bonuses | Promotions |

|---|---|---|

| Robinhood | No traditional bonuses | Free stock for new users (up to $200) |

| Webull | Free stocks after deposit | Free stocks (up to 12 free stocks worth up to $30,000) when you open and fund an account |

| E*TRADE | No direct bonus | $100 in commission-free trades when you deposit $10,000+ |

| TD Ameritrade | No direct bonus | Cash bonus of up to $600 for funding new accounts with $3,000+ |

| Fidelity | No direct bonus | Up to $100 for new accounts with minimum deposit |

| Charles Schwab | No direct bonus | $100 bonus for opening a new account with a minimum deposit of $1,000 |

| Merrill Edge | Up to $600 for qualifying deposits | Promotional offer for new accounts with cash rewards |

| SoFi Invest | $25 in free stock after signing up | $5 to $100 in free stock when you sign up and fund your account |

| Interactive Brokers | No direct bonus | Up to $1,000 for account funding and referrals |

| eToro | No direct bonus | $50 bonus for new accounts that deposit $500+ |

These promotions can provide beginners with extra capital to start trading, giving them a financial cushion as they get familiar with the market. For example, Robinhood and Webull offer free stock as part of their sign-up bonuses, which helps new traders begin their journey with a small investment. Other platforms, like TD Ameritrade and Interactive Brokers, provide cash bonuses for funding accounts, which can further incentivize users to start trading.

Understanding these bonuses and promotions can help new traders make the most of their initial investments and choose the platform that best suits their needs.

Integration with Financial Goals

One of the key advantages of beginner-friendly trading platforms in the USA is their ability to integrate seamlessly with users’ financial goals. Whether you are looking to save for retirement, build wealth, or grow a college fund, these platforms provide tools and features to align trading strategies with long-term financial objectives.

Goal-setting tools are available on many beginner-friendly platforms, helping users to set specific financial targets and track their progress. For example, platforms like SoFi Invest and Fidelity offer goal-oriented features that allow users to set up automatic contributions or investment plans based on their target amounts and timelines. This makes it easier for beginners to invest regularly and stay focused on achieving their financial goals.

Additionally, some platforms provide retirement-specific accounts like IRAs (Individual Retirement Accounts) or tax-efficient investment options that are tailored to long-term goals. Platforms such as TD Ameritrade and Charles Schwab offer retirement-focused investment tools, which allow new traders to start investing for the future with the help of tax-advantaged accounts.

Educational resources also play a crucial role in aligning financial goals with trading strategies. Beginner-friendly platforms, like Webull and E*TRADE, offer tutorials and webinars that help users understand how different investment strategies can support long-term financial objectives. This ensures that beginners can make informed decisions, whether they’re looking to grow their wealth over time or make short-term gains.

By integrating these features, beginner-friendly trading platforms in the USA empower new traders to align their trading actions with their personal financial goals, creating a pathway to financial success.

Conclusion

Choosing the right beginner-friendly trading platform in the USA can be a game-changer for new traders looking to start their investment journey. By considering factors like ease of use, low fees, educational resources, security, asset variety, mobile and desktop experience, customer support, research tools, and bonuses, beginners can find a platform that not only meets their immediate trading needs but also helps them work towards their long-term financial goals.

With a wide range of platforms available, such as Robinhood, Webull, E*TRADE, and others, each offering unique features and promotions, it’s important for traders to assess what matters most to them. Whether it’s the ease of executing trades, accessing comprehensive research tools, or engaging in social or copy trading, the right platform can make the process simpler and more rewarding.

By selecting one of these top-rated beginner-friendly platforms, traders can feel more confident and supported in their trading endeavors, ultimately setting themselves up for financial success.