What to include in your research before buying penny stocks can be the difference between a smart investment and a costly mistake. With their potential for high returns, penny stocks attract many investors, but they also come with significant risks. The key to success lies in thorough research and informed decision-making. In this blog, we’ll break down the critical factors you should investigate before purchasing penny stocks, from evaluating company fundamentals to analyzing market trends. Whether you’re a novice or an experienced trader, this guide will help you make confident, well-informed investment choices.

Table of Contents

Understanding Penny Stocks

Penny stocks typically refer to shares of small companies traded at low prices, often under $5 per share. These stocks are usually found on over the counter (OTC) markets, which makes them more volatile and less regulated compared to traditional stocks. They attract investors because of their potential for high returns, but they also come with increased risks such as low liquidity, limited financial disclosure, and susceptibility to price manipulation. Understanding these characteristics will help you determine if penny stocks align with your investment goals.

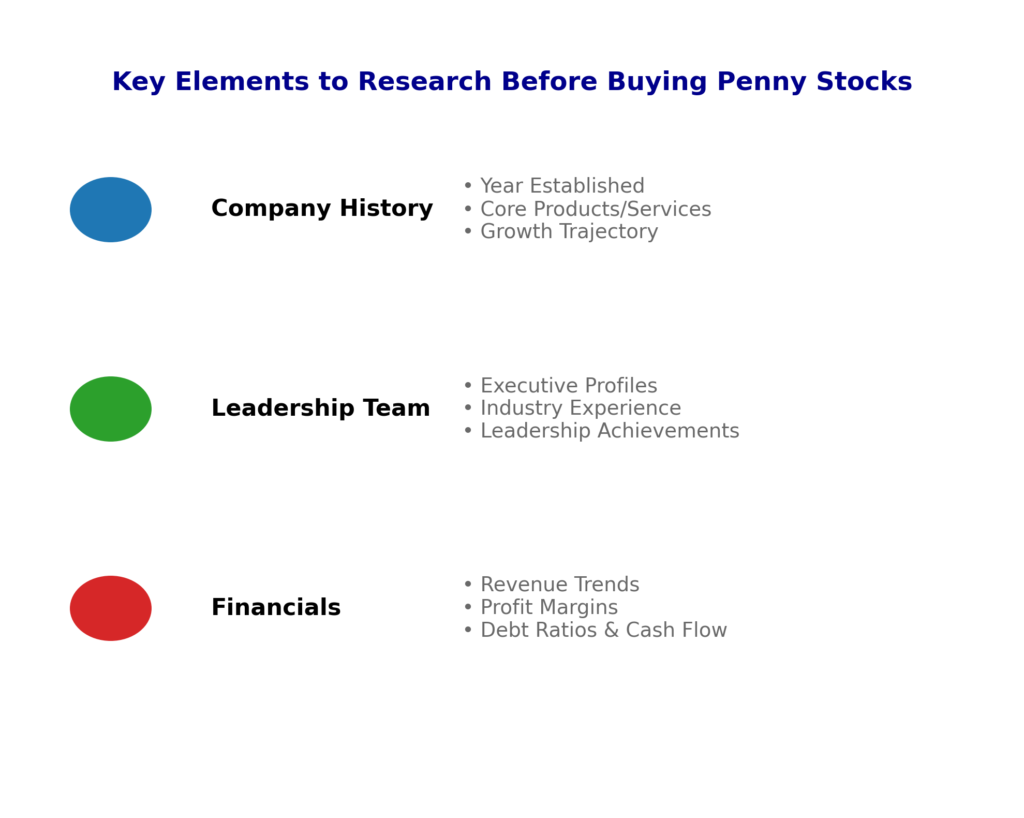

Company Background Check

Before investing, thoroughly research the company behind the penny stock. Look into the company’s history, mission, leadership team, and business model. Investigate how long the company has been operating, its core products or services, and its growth trajectory. Verify their registration with the SEC, review financial reports, and evaluate their revenue streams. A company with a solid track record and transparent operations is more likely to be a stable investment compared to companies with vague or inconsistent information.

Financial Health and Statements

Analyze the company’s balance sheet, income statement, and cash flow statement. Focus on key metrics like revenue growth, profit margins, debt-to-equity ratio, and cash reserves. Consistent revenue streams and manageable debt levels are indicators of financial stability. Also, compare the company’s financial performance with industry benchmarks to understand its competitive standing. A company with strong financial health is better positioned to survive economic downturns and capitalize on growth opportunities.

Market Trends and Industry Analysis

Understanding the broader market and industry trends can help you assess a penny stock’s potential. Research the industry’s growth prospects, current challenges, and emerging opportunities. Analyze trends such as technological advancements, regulatory changes, and consumer behavior shifts. A company operating in a growing industry with favorable trends is more likely to experience long-term success. Comparing how the company performs relative to competitors can also provide insights into its market position.

Stock Price History and Trading Volume

Review the stock’s price history and trading volume to identify trends and patterns. Look for consistent growth, sudden price spikes, or periods of high volatility. High trading volumes often indicate strong investor interest and liquidity, making it easier to buy or sell shares. Conversely, low trading volumes can signal limited market interest, which may pose liquidity risks. Understanding price history helps you identify potential entry and exit points for your investment.

Management Team and Leadership

A company’s leadership can significantly impact its success. Research the backgrounds of key executives and board members, focusing on their experience in the industry, past achievements, and leadership style. Strong management with a proven track record of growing businesses and making sound strategic decisions is a positive indicator. Conversely, frequent leadership changes or management teams with questionable histories can be red flags.

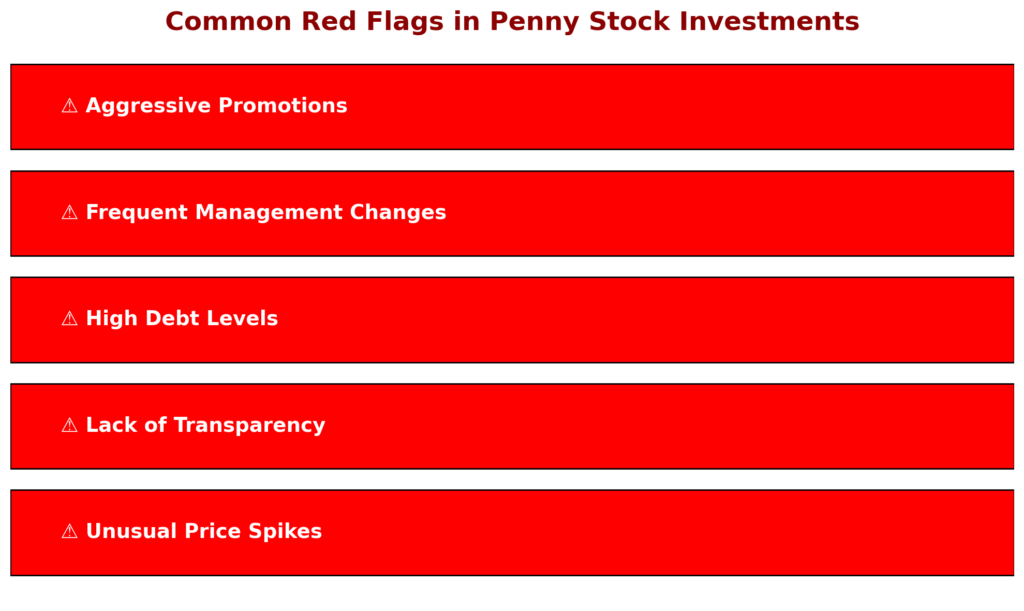

Red Flags to Watch Out For

Be cautious of common red flags in penny stock investments:

- Unusual Price Spikes: Sudden, unexplained increases in stock price may indicate market manipulation.

- Lack of Transparency: Companies that do not provide clear financial information or have inconsistent reporting practices can be risky.

- High Debt Levels: Excessive debt compared to revenue can strain a company’s operations and growth potential.

- Frequent Management Changes: Constant turnover in leadership can signal instability or internal issues.

- Aggressive Promotions: Stocks heavily promoted through email blasts or online ads may be part of pump-and-dump schemes.

Regulatory Compliance and Filings

Ensure the company complies with SEC regulations. Review public filings such as 10-K and 10-Q reports for detailed financial and operational information. These filings provide insights into the company’s revenue, expenses, assets, liabilities, and potential risks. Regulatory compliance indicates that the company follows legal and financial disclosure requirements, reducing the risk of fraud or misinformation.

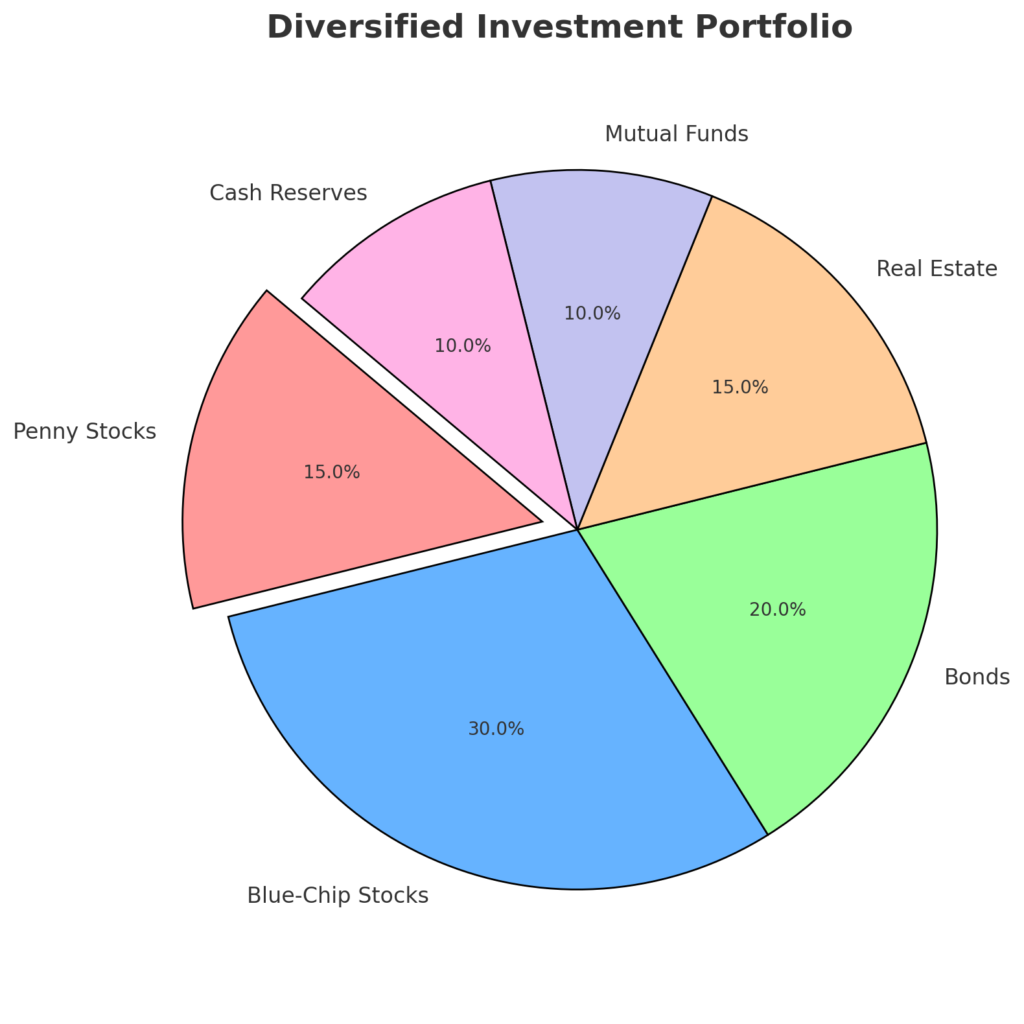

Risk Assessment and Diversification

Evaluate the potential risks involved with the investment. Consider factors like market volatility, liquidity risks, and company-specific issues. Penny stocks are often subject to dramatic price swings due to their low market capitalization and limited trading volume. Diversifying your portfolio by investing in a mix of asset classes can help mitigate the risks associated with individual penny stocks. Spreading your investments reduces the impact of a poor-performing stock on your overall portfolio.

Technical Analysis Tools

Utilize technical analysis tools to study price charts, trends, and indicators. Tools like moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) help identify potential price movements and market trends. Technical analysis provides insights into investor behavior, helping you make informed decisions about entry and exit points. It’s particularly useful for short-term traders looking to capitalize on price fluctuations.

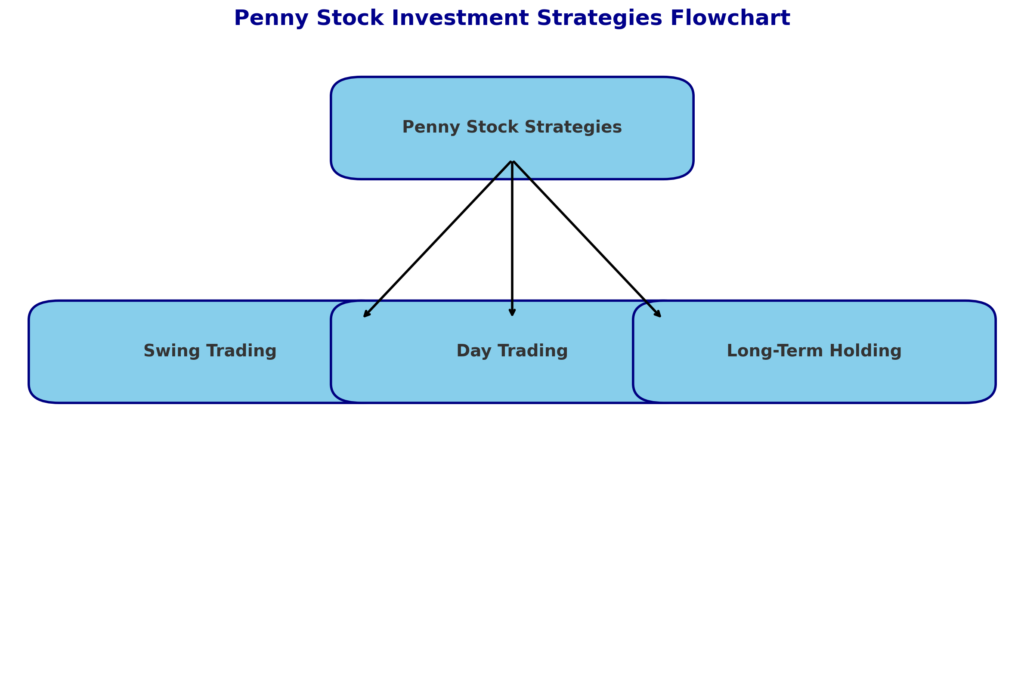

Investment Strategies for Penny Stocks

Consider different strategies such as swing trading, day trading, or long-term holding. Swing trading involves holding stocks for a few days or weeks to capitalize on price swings. Day trading focuses on buying and selling within the same day to take advantage of intraday price movements. Long-term holding involves investing in companies with strong growth potential and holding onto the stocks for an extended period. Choose a strategy that aligns with your risk tolerance, time commitment, and investment goals.

Common Mistakes to Avoid

- Investing Without Research: Relying on tips or hype without doing your own research can lead to poor investment decisions.

- Falling for Pump-and-Dump Schemes: Be cautious of stocks promoted through aggressive marketing campaigns, as they may be manipulated.

- Ignoring Diversification: Putting all your money into a single stock increases your risk. Diversify to spread potential losses.

- Overlooking Exit Strategies: Have a clear plan for when to sell your stocks, whether to lock in profits or minimize losses.

When to Buy and Sell Penny Stocks

Timing is crucial in penny stock trading. Identify entry points when the stock shows signs of upward momentum, strong fundamentals, or positive news. Use technical indicators to confirm trends. Similarly, determine exit points based on profit targets, stop-loss levels, or changes in the company’s outlook. Avoid emotional decision-making; stick to your strategy to maximize gains and minimize losses.

Conclusion:

In conclusion, mastering the art of researching before buying penny stocks is key to making smart investment decisions. By focusing on company fundamentals, financial health, market trends, and risk factors, you set yourself up for more informed and potentially profitable outcomes. Remember, every successful investor starts with diligent research and a strategic approach. Ready to dive deeper? Share your thoughts in the comments, explore related articles, or subscribe for more expert tips. Your journey to smarter investing starts now—make each decision count! [FinansieraTrading.com]

For more detailed investment strategies, visit Investopedia’s Guide to Penny Stocks.