Why Risk Management Is More Important Than Returns in Trading; Risk Management Is the Key to Long-Term Trading Success

In the high-stakes world of trading, where the promise of massive returns often takes center stage, one critical factor separates successful traders from the rest: risk management. While the allure of quick profits can be tempting, neglecting risk management is a surefire way to derail your trading career. This article dives deep into why risk management is more important than returns, offering actionable strategies, trending insights, and expert advice to help you trade smarter and safer.

Table of Contents

The Unmatched Importance of Risk Management

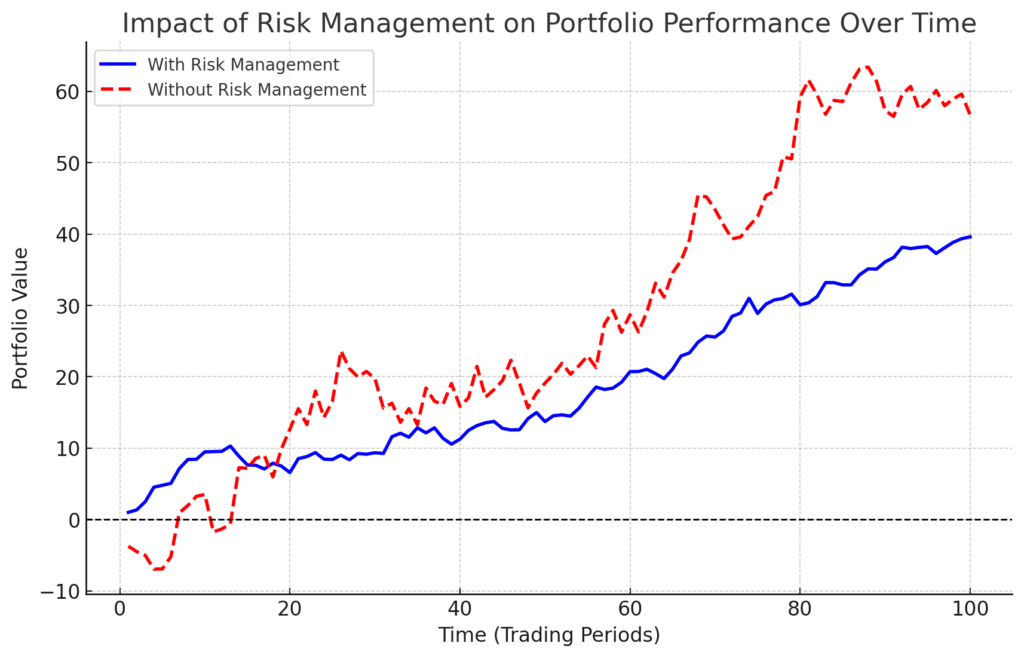

Risk management is the backbone of any successful trading strategy. It involves identifying potential risks, assessing their impact, and implementing measures to mitigate losses. According to a CFA Institute report, 90% of traders who fail do so because of poor risk management, not because they couldn’t generate profits. This statistic highlights the undeniable truth: without proper risk management, even the most profitable strategies can lead to ruin.

| Risk Management Strategy | Description |

|---|---|

| Stop-Loss Orders | Automatically closes a trade at a predetermined loss level to prevent excessive losses. |

| 1% Rule | Risking no more than 1% of total capital on a single trade to ensure long-term survival. |

| Risk-Reward Ratio | Ensuring potential profits outweigh risks, typically maintaining a 1:2 or 1:3 risk-reward ratio. |

| Diversification | Investing in multiple asset classes to reduce exposure to a single market downturn. |

| Hedging | Using options or futures to offset potential losses in the primary portfolio. |

| Position Sizing | Adjusting trade size based on market conditions and capital to manage exposure. |

| Avoid Overleveraging | Preventing excessive leverage to reduce amplified losses and protect capital. |

| Trading Psychology | Maintaining discipline, avoiding emotional decisions, and sticking to a trading plan. |

| Market Analysis | Conducting technical and fundamental analysis to make informed trading decisions. |

| Use of Automated Tools | Using trading bots and AI-powered tools to optimize risk control and execution. |

Why Risk Management Trumps Returns:

- Capital Preservation: Your trading capital is your lifeline. Effective risk management ensures you don’t blow up your account during a losing streak.

- Emotional Control: Trading is as much about psychology as it is about strategy. A solid risk management plan reduces emotional decision-making, which often leads to impulsive and costly trades.

- Consistency: While chasing high returns can be thrilling, consistent, smaller gains compound over time. Risk management helps you achieve this consistency.

- Adaptability: Markets are unpredictable. A well-structured risk management plan allows you to navigate volatility without significant losses.

Trending Insights on Risk Management

Recent discussions on platforms like Investopedia, Seeking Alpha, and Bloomberg emphasize the growing importance of risk management in trading. Traders are increasingly adopting advanced tools like Value at Risk (VaR) and Monte Carlo simulations to quantify and mitigate risks. Blogs like The Trading Blog and BabyPips are also trending with articles that stress the importance of risk-reward ratios, diversification, and disciplined trading.

How to Implement Effective Risk Management

- Set a Risk-Reward Ratio: Aim for a minimum of 1:2, meaning for every dollar you risk, you aim to make two.

- Use Stop-Loss Orders: Automate your exits to prevent emotional decisions.

- Diversify Your Portfolio: Spread your investments across different assets to reduce exposure to any single risk.

- Regularly Review Your Strategy: Markets evolve, and so should your risk management plan.