Real Estate vs. Stocks: Where Should You Invest? This age-old question has sparked debates among investors for decades. Both real estate and stocks are proven investment options, each with unique advantages and challenges. While real estate offers tangible assets, steady cash flow, and long-term stability, stocks provide high liquidity, lower entry barriers, and the potential for substantial growth over time. Choosing the right investment depends on your financial goals, risk tolerance, and how actively you want to manage your investments. In this blog, we’ll dive deep into the pros, cons, and key differences to help you determine whether real estate or stocks are the better fit for your portfolio.

Understanding Real Estate Investments

Table of Contents

What is Real Estate Investment?

Real estate involves purchasing physical property, such as residential homes, commercial buildings, or land, with the goal of earning returns through rent, property appreciation, or resale. It’s a tangible asset that can provide consistent cash flow and long-term growth.

Pros of Real Estate Investment

- Tangible Asset: Real estate offers physical ownership of property, giving a sense of security.

- Cash Flow: Rental properties can generate steady monthly income.

- Tax Benefits: Investors enjoy deductions, including mortgage interest and depreciation.

- Hedge Against Inflation: Property values often rise with inflation, protecting purchasing power.

Cons of Real Estate Investment

- High Initial Costs: Down payments, closing costs, and property taxes can be expensive.

- Illiquidity: Selling a property takes time, making it less flexible than stocks.

- Management Burden: Maintenance, repairs, and tenant issues can be time-consuming.

- Market Risks: Property values can decline during economic downturns.

| Aspect | Rental Property | Stock Market |

|---|---|---|

| Type of Asset | Tangible (Physical property ownership) | Intangible (Shares represent partial ownership) |

| Liquidity | Low – Selling property takes time | High – Stocks can be bought or sold quickly |

| Initial Investment | High – Requires significant capital for down payment, closing costs, etc. | Low – Can start with as little as $100 |

| Cash Flow | Regular – Monthly rental income | Dividends (if applicable) and capital gains |

| Management Effort | High – Requires active involvement in maintenance, repairs, and tenant management | Low – Passive management through ETFs or mutual funds |

| Risk | Moderate – Less volatile but subject to market cycles and location risks | High – More volatile due to market fluctuations |

| Returns Over Time | 4-6% annually, with potential for property appreciation | 7-10% annually, based on historical stock market performance |

| Tax Benefits | Mortgage interest and depreciation deductions | Tax-advantaged accounts (e.g., 401(k), IRA) |

| Hedge Against Inflation | Strong – Property values and rents tend to rise with inflation | Moderate – Stock prices may keep pace with inflation |

| Diversification | Limited – Typically concentrated in one or few properties | High – Can invest across sectors and industries |

Real Estate vs. Stocks: Where Should You Invest? Data Details:

- Liquidity: Stocks can be traded within seconds during market hours, while selling a property can take weeks or months.

- Initial Investment: Real estate often requires 20% of the property value as a down payment, whereas stocks can start as low as $100 or less.

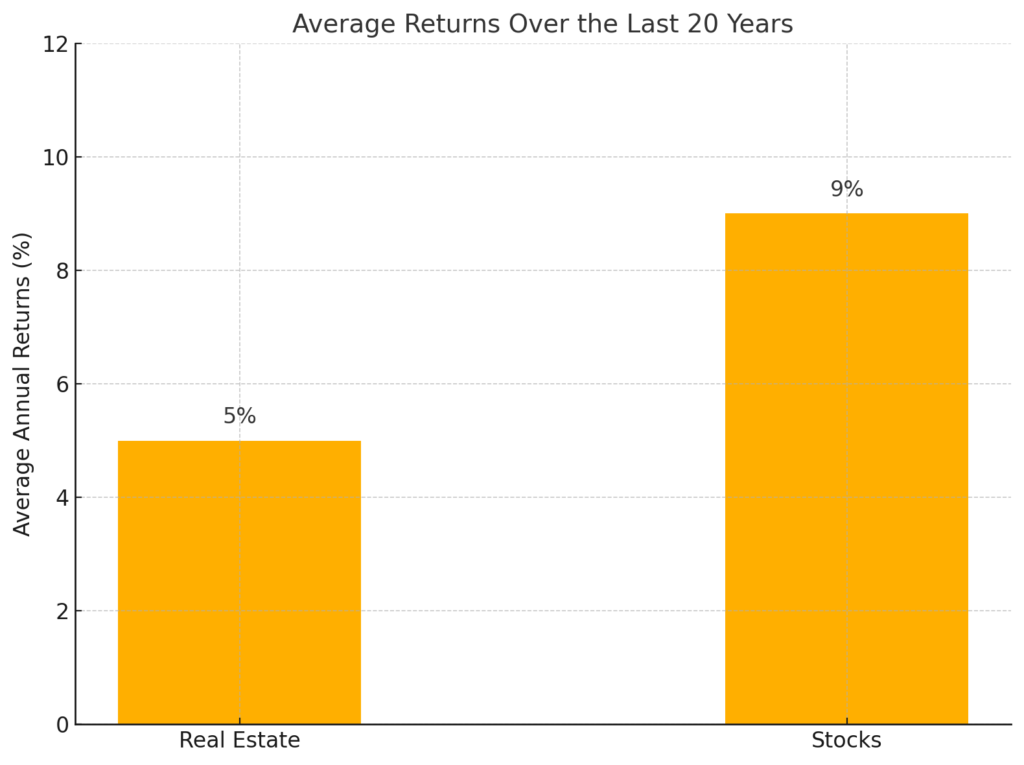

- Returns Over Time: Historical averages show 4-6% for real estate and 7-10% for stocks, adjusted for inflation.

- Hedge Against Inflation: Rental income and property values typically rise with inflation, making real estate a stronger hedge.

Understanding Stock Market Investments

What is Stock Investment?

Stock investment entails purchasing shares of publicly traded companies. These shares represent partial ownership, allowing investors to benefit from company growth through dividends and capital gains.

Real Estate vs. Stocks: Where Should You Invest?: Pros of Stock Investment

- Liquidity: Stocks can be quickly bought or sold, offering greater flexibility.

- Lower Initial Investment: You can start investing with a relatively small amount.

- Diversification: Stocks span various industries and markets, reducing risk.

- Potential for High Returns: Over time, stocks often outperform real estate in growth.

Real Estate vs. Stocks: Where Should You Invest?: Cons of Stock Investment

- Volatility: Stock prices can fluctuate significantly due to market trends and economic conditions.

- Emotional Decisions: Fear and greed can lead to impulsive investment choices.

- No Tangibility: Stocks are intangible assets, which may deter some investors.

- Taxable Gains: Capital gains are taxable, potentially reducing net profits.

(FinansieraTrading.com / cnn)

Real Estate vs. Stocks: Where Should You Invest?: Real Estate vs. Stocks: Key Comparison (Focus Keyword in Heading)

Liquidity and Accessibility

- Real Estate: Limited liquidity, as properties take time to sell.

- Stocks: High liquidity, enabling quick trades during market hours.

Risk and Volatility

- Real Estate: Less volatile but influenced by local market conditions.

- Stocks: High volatility but greater potential for quick gains.

Returns Over Time

- Real Estate: Consistent, with potential for rental income.

- Stocks: Historical data shows higher returns, though subject to market fluctuations.

Maintenance and Management

- Real Estate: Requires active involvement in property upkeep and tenant management.

- Stocks: Passive management through mutual funds or ETFs.

| Aspect | Real Estate | Stocks |

|---|---|---|

| Liquidity | Low – Selling property takes weeks or months | High – Stocks can be traded within seconds during market hours |

| Risk | Moderate – Influenced by local market conditions | High – Subject to market volatility and economic factors |

| Returns | 4-6% annually, with potential for rental income | 7-10% annually, based on historical performance |

| Management | Active – Requires maintenance, tenant management, and repairs | Passive – Can be managed through ETFs, mutual funds, or automated platforms |

Real Estate vs. Stocks: Where Should You Invest?: Factors to Consider Before Choosing

Your Financial Goals

- If you prefer tangible assets and steady cash flow, real estate might suit you.

- If you’re seeking high returns with lower initial investment, stocks may be better.

Risk Tolerance

- Real estate is less volatile but requires patience.

- Stocks can be risky but offer quick scalability and diversification.

Time Commitment

- Real estate demands more active involvement.

- Stocks allow for passive investing through automated platforms.

Conclusion: Real Estate vs. Stocks – The Final Verdict

Choosing between real estate vs. stocks ultimately depends on your investment goals, risk appetite, and financial resources. Historically, the stock market has delivered an average annual return of around 7-10%, adjusted for inflation, over the last century. In comparison, real estate offers more stable returns, averaging 4-6%, along with the potential for steady cash flow from rentals. However, these numbers can vary based on market conditions, location, and economic cycles.

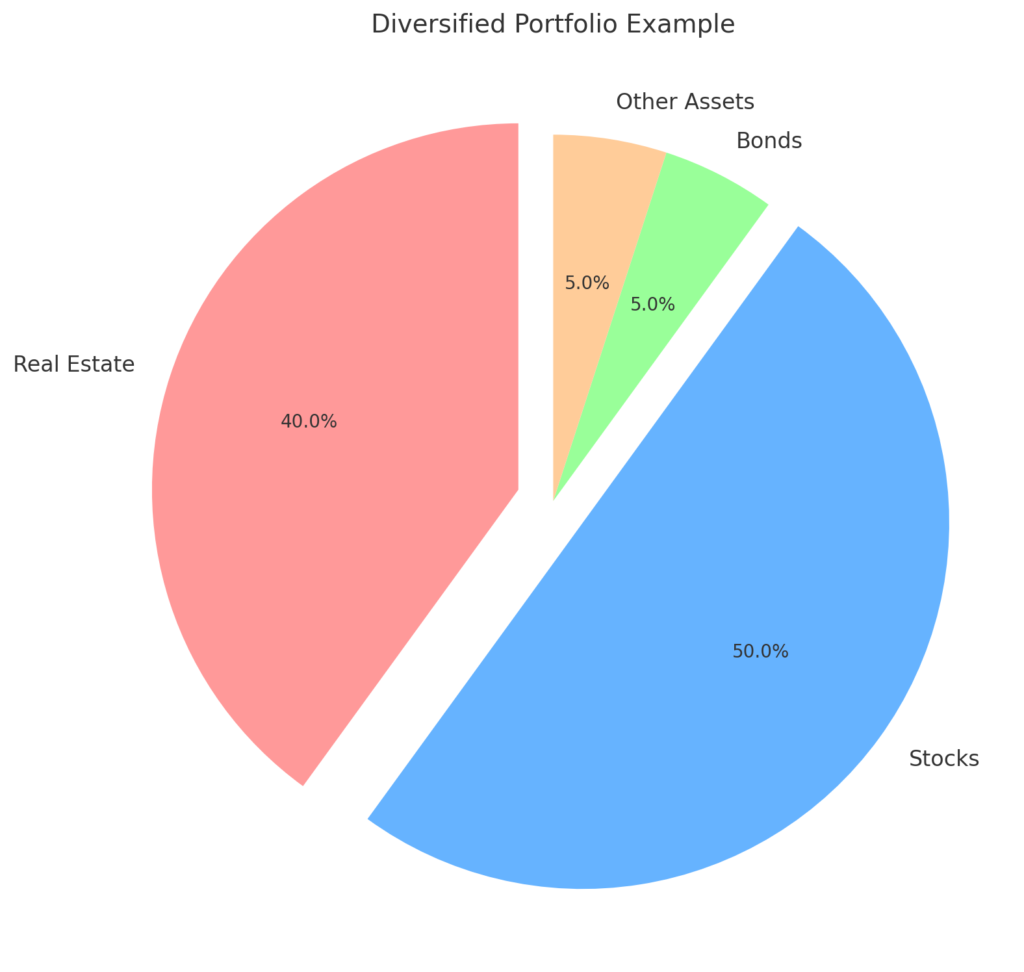

If you value tangible assets, tax advantages, and steady passive income, real estate might align with your goals. On the other hand, if you prioritize liquidity, scalability, and higher long-term growth potential, investing in stocks could be a better fit. A prudent strategy might involve diversifying your portfolio to include both real estate and stocks, balancing their respective strengths and risks.

Remember, whether you lean toward real estate vs. stocks, the key is to research thoroughly, align your investments with your financial objectives, and review your portfolio regularly to stay on track for long-term success.