What to Include in Your 401(k) Strategy to Maximize Tax Benefits

A well-crafted 401(k) strategy is the cornerstone of a financially secure retirement. By leveraging tax benefits, you can grow your savings more efficiently and reduce your tax burden. Whether you’re just starting out or fine-tuning your retirement plan, understanding how to optimize your 401(k) for tax advantages is crucial. This guide will walk you through contribution strategies, investment allocation, withdrawal planning, and more to help you maximize your 401(k) benefits.

Table of Contents

Understanding the Basics of a 401(k)

A 401(k) is an employer-sponsored retirement plan that allows you to save and invest a portion of your paycheck before taxes are deducted. The primary benefit is tax-deferred growth, meaning you won’t pay taxes on contributions or earnings until you withdraw the funds in retirement.

There are two main types of 401(k) plans:

- Traditional 401(k): Contributions are made with pre-tax dollars, reducing your taxable income now. Withdrawals in retirement are taxed as ordinary income.

- Roth 401(k): Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free.

Choosing between a traditional and Roth 401(k) depends on your current tax bracket and expected future tax situation. Understanding these options is key to maximizing your retirement savings.

Contribution Strategies for Maximum Tax Benefits

To make the most of your 401(k), consider the following strategies:

- Maximize Employer Matching: Contribute enough to get the full employer match—it’s free money and a significant boost to your savings.

- Reach Annual Contribution Limits: For 2024, the IRS allows contributions of up to 23,000 (or 23,000 (or 30,500 if you’re 50 or older with catch-up contributions).

- Increase Contributions Over Time: As your income grows, gradually increase your contributions to keep pace with your retirement goals.

By maximizing contributions, you lower your taxable income and take full advantage of the tax-deferred growth offered by your 401(k).

Pre-Tax vs. After-Tax Contributions

Deciding between pre-tax and after-tax contributions depends on your tax situation:

- Pre-Tax Contributions: Reduce your taxable income now, providing immediate tax savings. However, withdrawals in retirement are taxed as ordinary income.

- After-Tax Contributions (Roth 401(k)): Don’t offer an upfront tax break, but withdrawals in retirement are tax-free, making them ideal if you expect to be in a higher tax bracket later.

A balanced approach, combining both types of contributions, can provide tax diversification and flexibility in retirement.

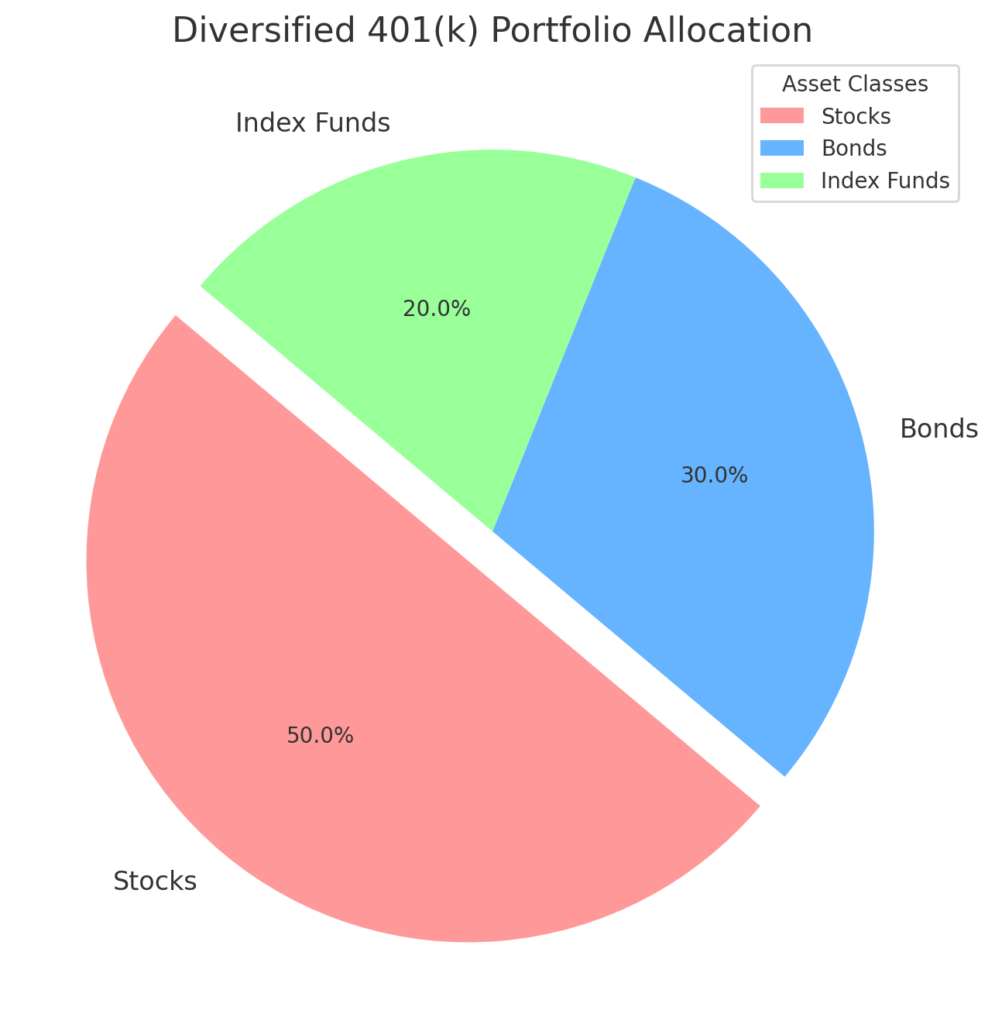

Investment Allocation for Tax Efficiency

Your investment choices within your 401(k) can impact your tax situation. Here’s how to optimize:

- Diversify Your Portfolio: Spread investments across stocks, bonds, and mutual funds to manage risk and maximize returns.

- Choose Tax-Efficient Investments: Opt for low-turnover index funds, which generate fewer taxable events and keep costs low.

- Rebalance Regularly: Adjust your portfolio to maintain your desired asset allocation, but be mindful of potential tax implications.

A well-diversified, tax-efficient portfolio can help you grow your savings while minimizing taxes.

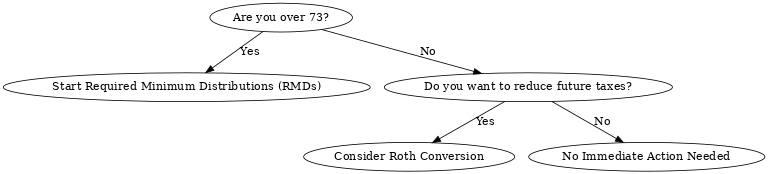

Tax Planning for Withdrawals

Withdrawals from your 401(k) can trigger significant tax consequences if not managed properly. Consider these strategies:

- Required Minimum Distributions (RMDs): Starting at age 73, you must take RMDs, which are taxed as ordinary income. Plan ahead to avoid penalties and minimize tax impact.

- Roth Conversions: Gradually convert traditional 401(k) funds to a Roth account to spread out the tax impact and enjoy tax-free withdrawals in retirement.

By planning your withdrawals strategically, you can reduce your tax burden and make the most of your retirement savings.

Leveraging Employer Contributions

Employer contributions, such as matching or profit-sharing, are a valuable part of your 401(k) strategy. These contributions are tax-deferred, meaning you’ll pay taxes on them when you withdraw the funds in retirement. Ensure you meet the criteria to receive the full match and factor these contributions into your overall retirement plan.

The Role of Tax Credits and Deductions

Tax credits and deductions can further enhance your 401(k) strategy:

- Saver’s Credit: Available to low- and moderate-income individuals, this credit provides a tax break for retirement contributions.

- Tax Deductions: Contributions to a traditional 401(k) reduce your taxable income, lowering your overall tax bill.

Understanding these benefits can help you optimize your tax savings and grow your retirement funds.

Common Mistakes to Avoid

Avoid these common pitfalls to maximize your 401(k) benefits:

- Not Contributing Enough to Get the Full Employer Match: This is essentially leaving free money on the table.

- Ignoring Roth 401(k) Options: Roth accounts provide tax diversification and tax-free withdrawals in retirement.

- Failing to Adjust Contributions Over Time: As your income grows, increase your contributions to keep pace with your retirement goals.

Regularly reviewing your strategy can help you avoid these mistakes and stay on track.

Review and Adjust Your Strategy Regularly

Your 401(k) strategy should evolve with your life circumstances. Changes in income, job status, or financial goals may require adjustments to your contributions, investment choices, or withdrawal plans. Stay informed about tax law changes and regularly review your strategy to ensure it aligns with your retirement goals.

Conclusion

Maximizing the tax benefits of your 401(k) requires a proactive approach. By understanding contribution strategies, balancing pre-tax and after-tax investments, and planning for withdrawals, you can significantly enhance your retirement savings and reduce your tax burden. Start implementing these strategies today to secure a financially stable future.

Ready to take control of your retirement? Share this guide with others, leave a comment with your thoughts, and subscribe for more financial tips. [IRS 401(k) / FinansieraTrading.com]