Why You Should Start Planning for Retirement in Your 20s and 30s

Retirement might feel like a far-off milestone when you’re in your 20s or 30s, but the truth is, the earlier you start planning, the better off you’ll be. With the power of compound interest, smart investments, and disciplined saving, young adults can build a financial safety net that ensures a comfortable and stress-free retirement. This blog will explore why starting early is crucial, provide actionable steps to get started, and share trending insights to help you stay ahead.

Table of Contents

The Power of Starting Early: Why Your 20s and 30s Matter

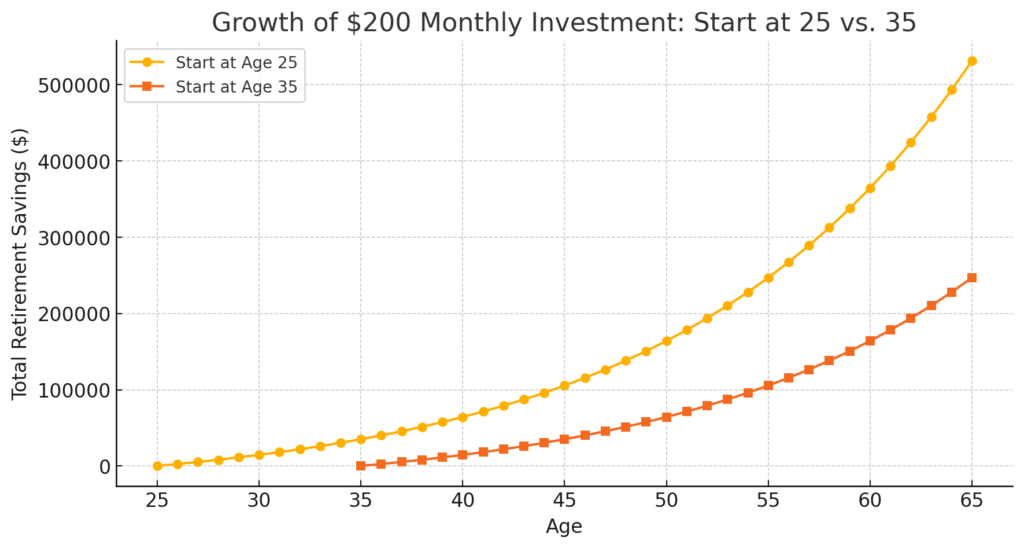

When it comes to retirement planning, time is your greatest ally. The earlier you start, the more you can leverage the power of compound interest. For example, if you begin saving 200amonthatage25withanaverageannualreturnof7200amonthatage25withanaverageannualreturnof7500,000 by age 65. Wait until 35, and you’d need to save nearly double that amount to reach the same goal.

According to a recent study by Fidelity Investments, millennials who started saving in their 20s are on track to replace 85% of their pre-retirement income, compared to just 50% for those who wait until their 40s. This stark difference highlights the importance of early action.

Trending Insights: What Experts Are Saying

Recent articles and blogs have emphasized the growing trend of young adults taking retirement planning seriously. A popular post on Forbes highlights how millennials and Gen Z are prioritizing financial independence, with many opting for Roth IRAs and employer-sponsored 401(k) plans. Meanwhile, CNBC reports that young adults are increasingly turning to robo-advisors and index funds to grow their retirement savings passively.

Another trending topic is the rise of FIRE (Financial Independence, Retire Early), a movement that encourages aggressive saving and investing to achieve financial freedom as early as possible. While FIRE may not be for everyone, its principles underscore the value of starting early.

Why You Should Start Planning for Retirement in Your 20s and 30s; Actionable Steps to Start Planning Today

- Set Clear Goals: Determine how much you’ll need for retirement based on your desired lifestyle and expected expenses. Use online retirement calculators to get a realistic estimate.

- Automate Savings: Set up automatic transfers to your retirement accounts to ensure consistent contributions.

- Diversify Investments: Spread your investments across stocks, bonds, and other assets to minimize risk and maximize returns.

- Maximize Employer Benefits: Take full advantage of employer-matched retirement plans, as this is essentially free money.

- Stay Informed: Regularly review your retirement strategy and adjust as needed to stay on track.

Why This Matters Now More Than Ever

With rising life expectancies and uncertain social security benefits, relying solely on traditional retirement plans is no longer viable. Starting early not only secures your future but also provides peace of mind and financial flexibility.

As Vanguard, one of the world’s leading investment firms, states, “The earlier you start saving, the more time your money has to grow.” This simple yet powerful advice is a cornerstone of successful retirement planning.