What to Include in Your Monthly Budget to Stay Debt-Free

What to include in your monthly budget to stay debt-free is a question that many individuals ask when striving for financial stability. Without a clear budget, it’s easy to overspend, fall into debt, and struggle to achieve your financial goals. A well-planned monthly budget helps you stay in control of your finances by tracking your income, managing expenses, and ensuring you’re prepared for unexpected costs. Whether you’re looking to pay off existing debt, build savings, or simply gain financial confidence, understanding what to include in your budget is crucial. In this blog post, you’ll discover essential budget categories and practical tips to help you stay on track and live debt-free.

Table of Contents

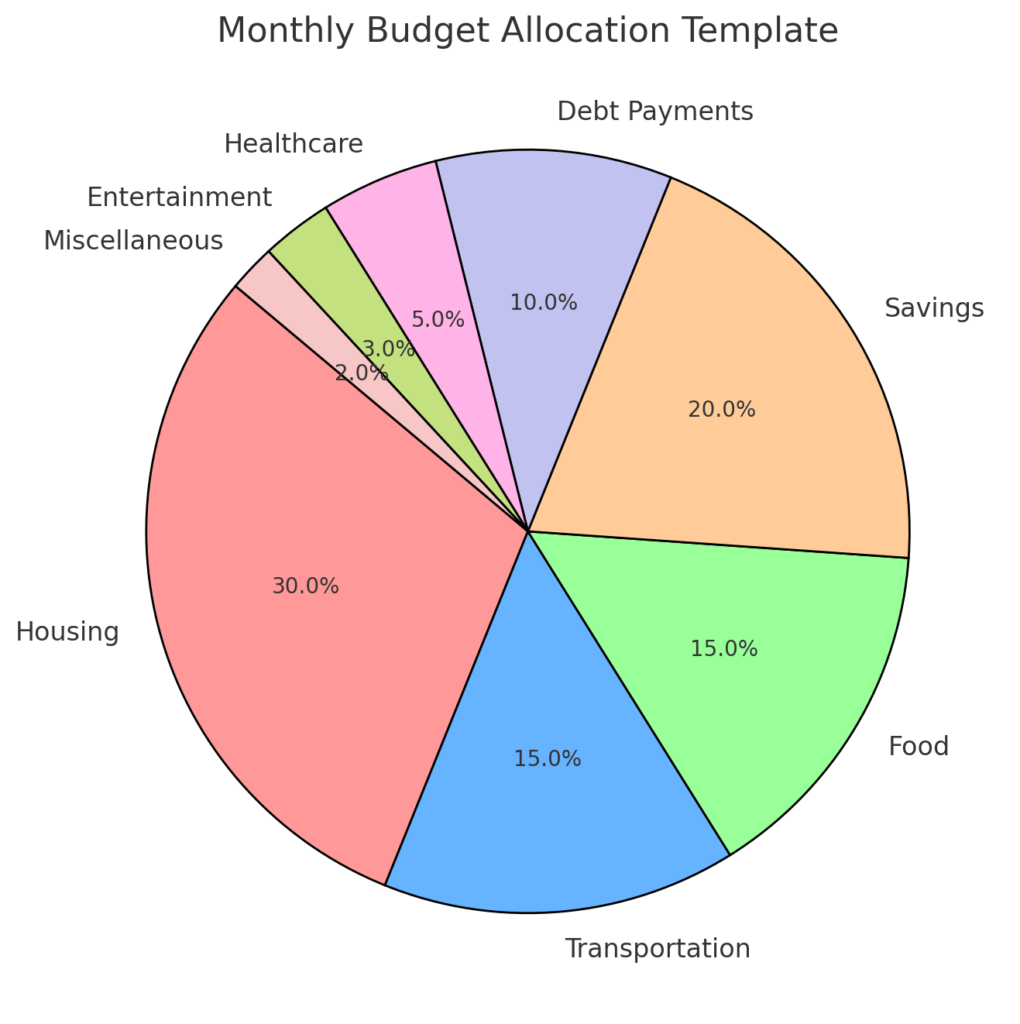

Essential Categories to Include in Your Monthly Budget

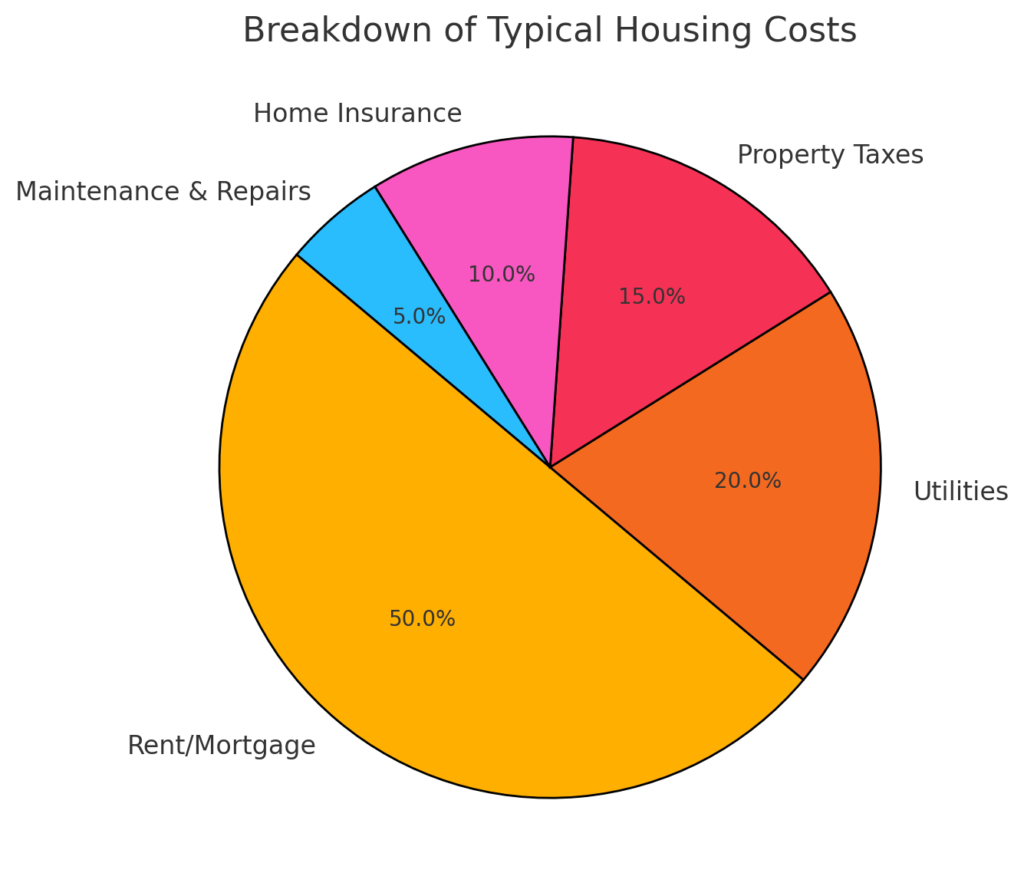

1. Housing Costs

Housing expenses are usually the largest portion of your budget. This includes:

- Rent or mortgage payments

- Property taxes

- Home Insurance

- Utility bills (electricity, water, gas, internet)

- Maintenance and repairs

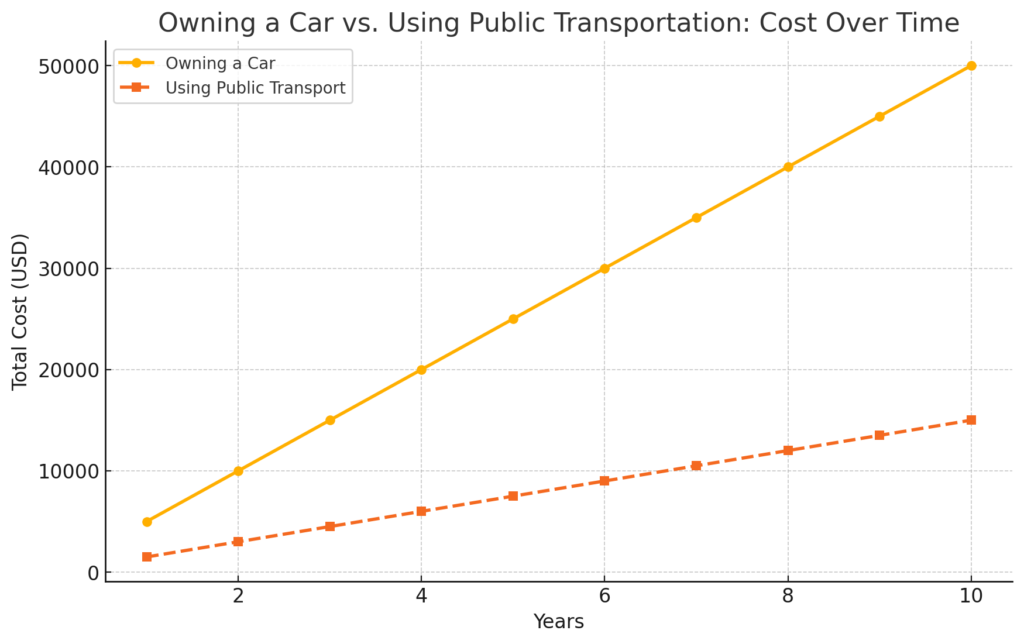

2. Transportation Expenses

Reliable transportation is crucial for work and daily life. Your budget should include:

- Car loan or lease payments

- Gasoline or public transportation fares

- Insurance

- Maintenance and repairs

- Registration and licensing fees

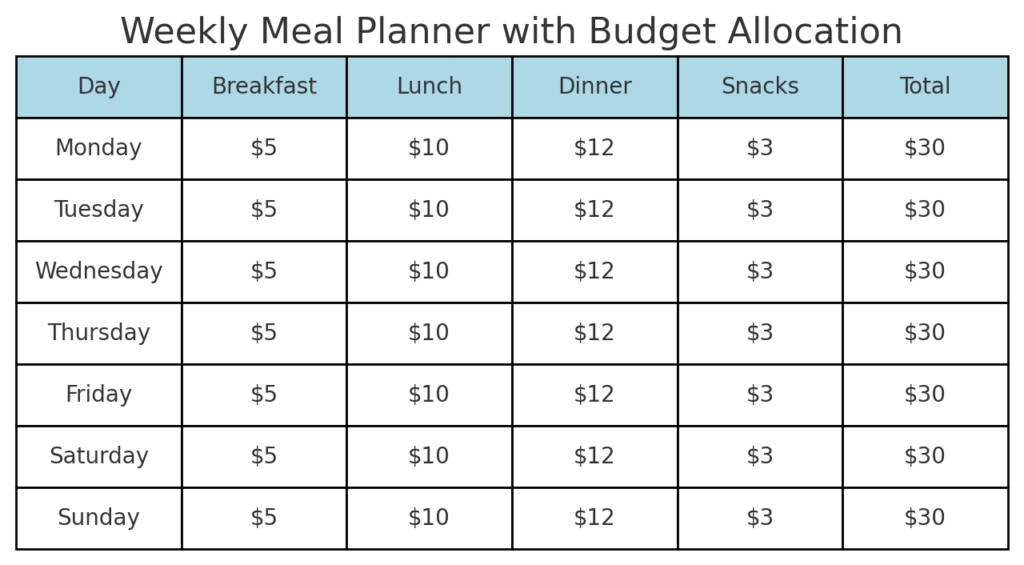

3. Food and Groceries

Proper meal planning helps you stay within your food budget while maintaining a healthy diet. Include:

- Grocery shopping expenses

- Dining out budget

- Meal planning and preparation

- Snacks and beverages

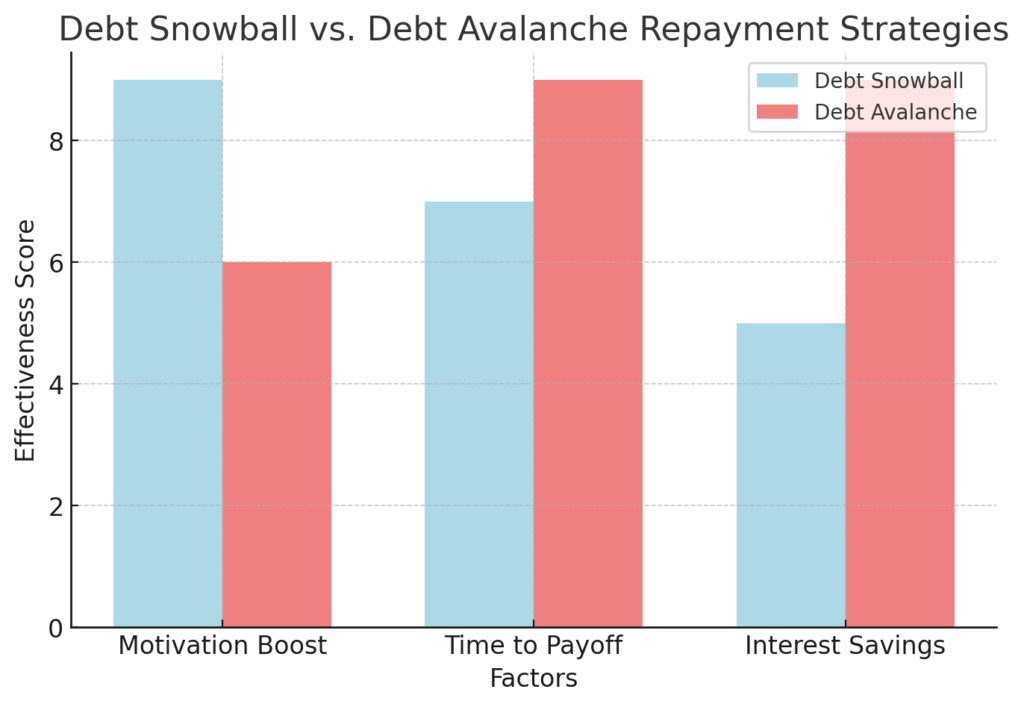

4. Debt Repayments

If you have any outstanding debts, allocating funds toward paying them off is essential. This includes:

- Credit card payments

- Student loans

- Personal loans

- Auto loans

5. Savings and Investments

Building an emergency fund and investing in your future is crucial for financial stability. Include:

- Emergency fund contributions

- Retirement savings (401(k), IRA, etc.)

- Investment accounts

- Short-term savings goals (vacations, home upgrades)

6. Healthcare and Insurance

Unexpected medical expenses can derail your budget. Be sure to allocate money for:

- Health insurance premiums

- Out-of-pocket medical costs (doctor visits, prescriptions)

- Dental and vision care

- Emergency medical expenses

7. Personal and Discretionary Spending

Having a set amount for personal spending helps you enjoy life while staying within your budget. This can include:

- Entertainment

- Hobbies

- Clothing and accessories

- Subscription services

8. Education and Skill Development

Investing in education can enhance career growth and financial stability. Allocate funds for:

- Courses and certifications

- Books and learning materials

- Tuition fees (if applicable)

9. Giving and Charitable Contributions

Supporting charities or religious institutions can be a rewarding aspect of your budget. Consider setting aside funds for:

- Regular donations

- Special charitable events

- Volunteering costs

10. Miscellaneous and Unexpected Expenses

Always have a buffer in your budget for unexpected costs that may arise. This includes:

- Home repairs

- Car emergencies

- Appliance breakdowns

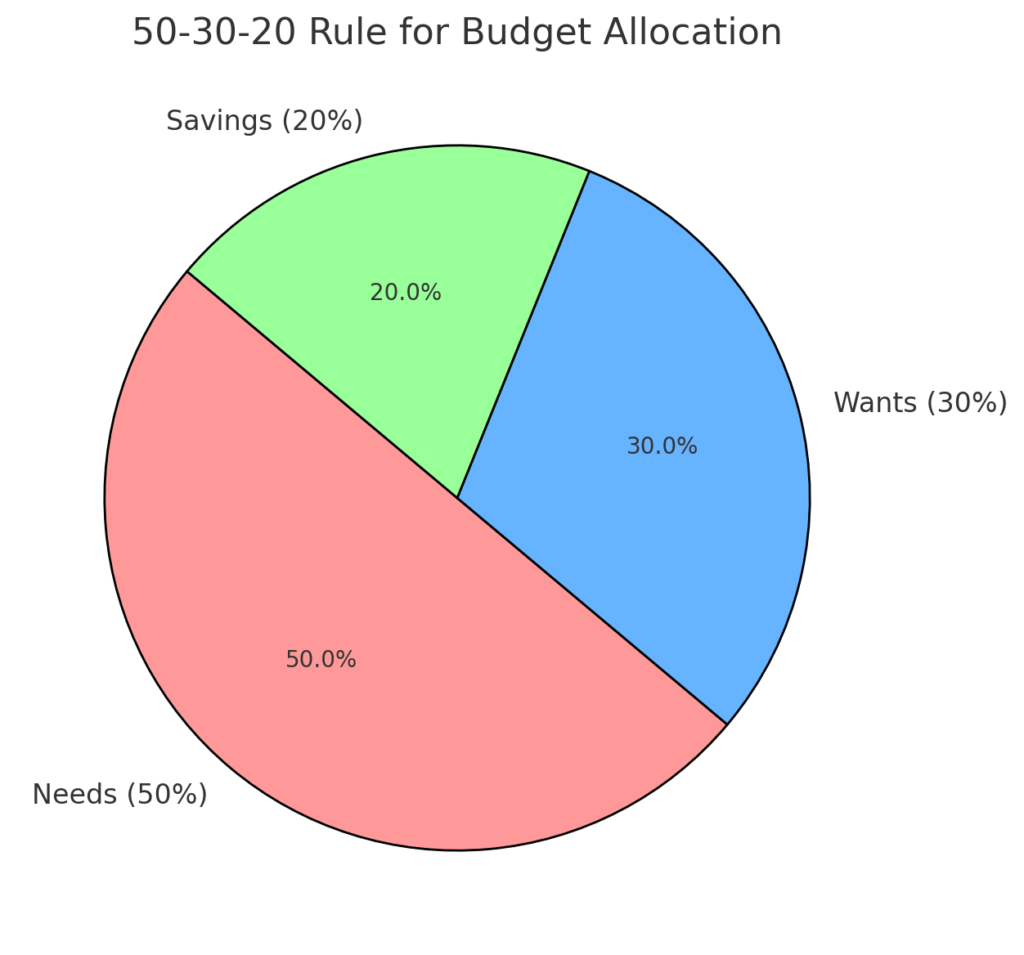

How to Stay Debt-Free with Your Budget

- Track Your Expenses: Use budgeting apps to monitor spending habits.

- Prioritize Needs Over Wants: Focus on essentials before discretionary spending.

- Adjust Budget Regularly: Review and refine your budget as financial circumstances change.

- Stick to a Debt Repayment Plan: Consistently pay off high-interest debts first.

- Build an Emergency Fund: Save at least 3-6 months’ worth of living expenses.

What to Include in Your Monthly Budget to Stay Debt-Free; Conclusion

In conclusion, knowing what to include in your monthly budget to stay debt-free is essential for achieving long-term financial health. By incorporating key expenses such as housing, transportation, savings, and debt repayments, you can create a realistic and sustainable plan. Staying committed to your budget and regularly reviewing it will help you avoid unnecessary debt and stay on track with your financial goals. Remember, consistency is key, and every small effort brings you closer to a debt-free life.

If you’re ready to take control of your finances, start today by reviewing your current budget and making adjustments where needed. Share your budgeting journey in the comments below and explore our other finance-related articles to stay informed and inspired. A well-planned budget isn’t just about cutting costs—it’s about creating a secure and stress-free financial future. [FinansieraTrading.com]