Why lifestyle inflation is silently killing your savings is a harsh reality that many individuals face without even realizing it. As incomes grow, it’s tempting to upgrade your lifestyle—buying a bigger house, a fancier car, or indulging in luxury experiences. However, these choices can slowly erode your financial future and hinder long-term wealth building. The cycle of spending more as you earn more can trap you in a paycheck-to-paycheck lifestyle, leaving little room for savings, investments, or emergency funds. In this blog, we’ll uncover how lifestyle inflation sneaks into our lives, why it’s a major financial threat, and practical strategies to take control of your spending habits and secure your financial goals.

What is Lifestyle Inflation?

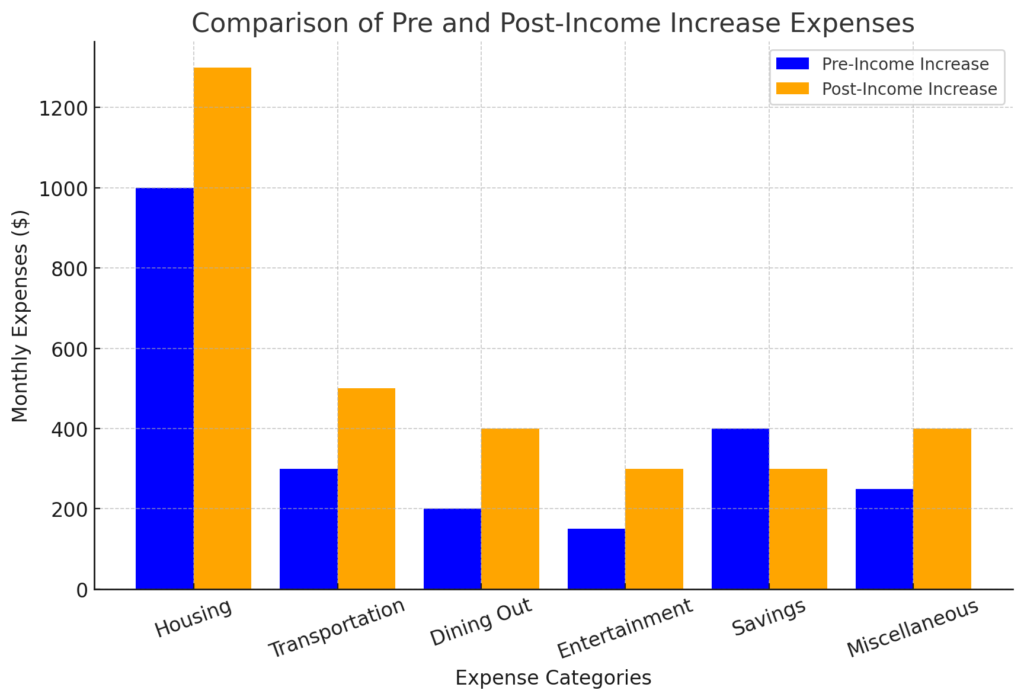

Lifestyle inflation occurs when an individual increases their spending as their income rises. Instead of saving or investing the extra earnings, they indulge in luxuries, such as expensive vacations, dining out frequently, or upgrading gadgets and vehicles. This spending pattern can delay or even derail financial independence goals.

Table of Contents

Signs You Are Experiencing Lifestyle Inflation

- Living paycheck to paycheck despite earning more

- Increased discretionary spending without proper budgeting

- Prioritizing wants over financial goals

- Constant need to upgrade possessions

- Feeling financial stress despite higher income

How Lifestyle Inflation Affects Your Savings

Lifestyle inflation may seem harmless initially, but it has long-term financial consequences. Here are some ways it impacts savings:

- Delayed Financial Goals:

- Buying a house or saving for retirement takes a backseat.

- Increased Debt:

- More spending can lead to credit card debt or loans.

- Reduced Emergency Funds:

- Less focus on building a financial safety net.

- Loss of Investment Opportunities:

- Money that could have been invested is spent on non-essential upgrades.

Why Lifestyle Inflation Is Silently Killing Your Savings

Many people do not realize they are falling into the trap of lifestyle inflation until they struggle financially. With every salary increase, the spending mindset shifts from necessity to luxury, making it harder to return to a frugal lifestyle when needed.

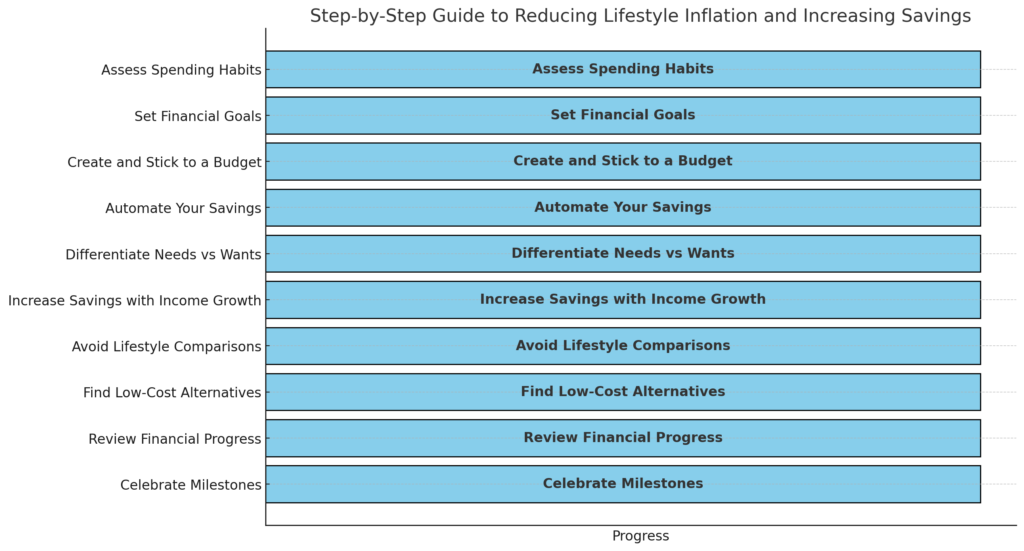

How to Avoid Lifestyle Inflation and Save More

- Set Clear Financial Goals:

- Prioritize savings for retirement, emergency funds, and investments.

- Create a Budget:

- Track spending and set limits to prevent unnecessary expenses.

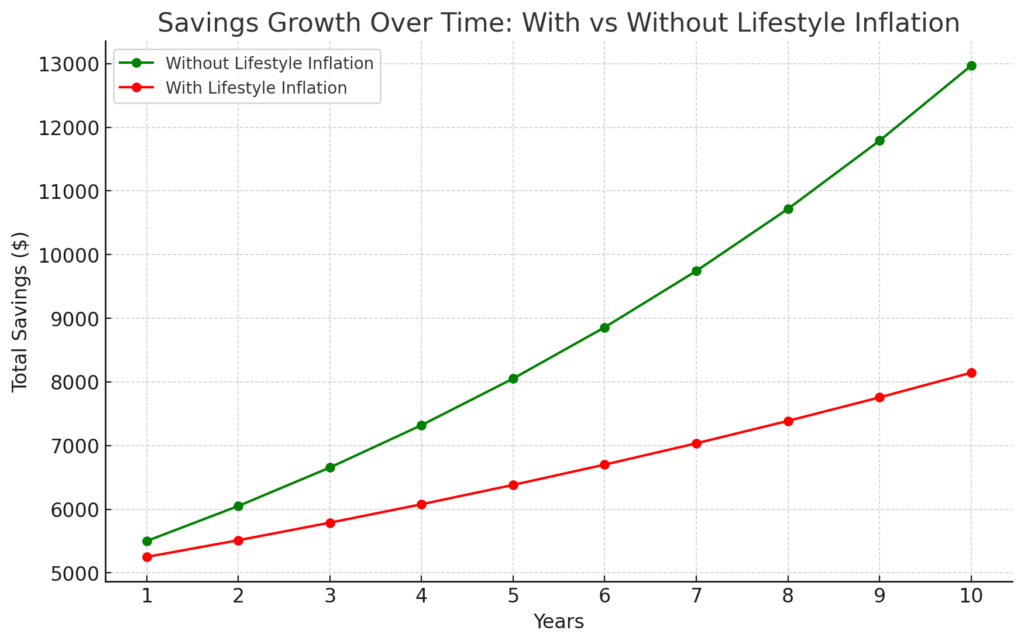

- Increase Savings Rate with Income Growth:

- Allocate a percentage of every salary increase to savings.

- Practice Mindful Spending:

- Differentiate between needs and wants before making purchases.

- Invest Wisely:

- Explore investment opportunities to grow wealth instead of spending.

Practical Tips to Curb Lifestyle Inflation

- Automate savings to stay consistent

- Avoid social comparison and peer pressure

- Limit impulse purchases by following a 24-hour rule

- Regularly review financial goals and progress

- Find satisfaction in frugal living

Why Lifestyle Inflation Is Silently Killing Your Savings; The Psychological Aspects of Lifestyle Inflation

Understanding the psychological triggers behind lifestyle inflation, such as social influence, advertising, and emotional spending, can help break the cycle. Emotional spending often leads to temporary satisfaction but long-term financial regrets.

Conclusion: Take Charge of Your Financial Future

In conclusion, lifestyle inflation is silently killing your savings by creating an illusion of financial progress while actually delaying your long-term goals. By recognizing its signs and implementing the strategies discussed, you can take control of your finances and prioritize financial stability over fleeting luxuries. Whether it’s automating savings, investing wisely, or setting clear financial goals, small steps today can lead to significant results in the future. Remember, curbing lifestyle inflation isn’t about denying yourself enjoyment—it’s about achieving financial freedom and peace of mind.

Now is the time to take action! Evaluate your spending habits, make informed financial choices, and start building a sustainable financial future. Share your thoughts in the comments below and explore our other articles for more financial tips and insights. [FinansieraTrading.com]