Why Budgeting Isn’t Just About Saving It’s About Financial Freedom, and this mindset shift can transform how you view and manage your money. While many associate budgeting with cutting back or living frugally, it’s actually a powerful tool to achieve the life you’ve always envisioned. A well-planned budget not only helps you save but also allows you to invest in your goals, eliminate debt, and build long-term wealth.

Financial freedom doesn’t come from random savings but from intentional choices that align with your aspirations. Whether you’re planning for a dream vacation, buying your first home, or securing an early retirement, budgeting gives you control over your finances and the confidence to achieve these milestones. In this post, we’ll explore why budgeting is a cornerstone for financial freedom and how it can improve your life.

Table of Contents

Understanding the Essence of Budgeting

Budgeting isn’t merely about restricting expenses. It’s a strategic approach to managing your income and expenses to meet both short-term needs and long-term financial goals. By organizing your finances, you gain control, reduce financial stress, and create a clear path to financial independence.

Key benefits of budgeting:

- Clarity on income and expenses.

- Freedom to spend on priorities.

- A structured way to achieve long-term goals.

Why Budgeting Isn’t Just About Saving

Many people associate budgeting with limitations, but it’s about empowerment. When you set a budget:

- You prioritize spending: Allocate money for things that matter, like paying off debt, building an emergency fund, or investing.

- You track progress: Understand where your money is going and make necessary adjustments.

- You reduce financial stress: A budget provides a safety net, ensuring you’re prepared for unforeseen circumstances.

Steps to Build a Budget That Aligns With Financial Freedom Goals

- Assess Your Income and Expenses:

Calculate your monthly income and categorize your expenses into fixed, variable, and discretionary categories. - Set Financial Goals:

- Short-term: Build an emergency fund.

- Long-term: Save for retirement or invest in assets.

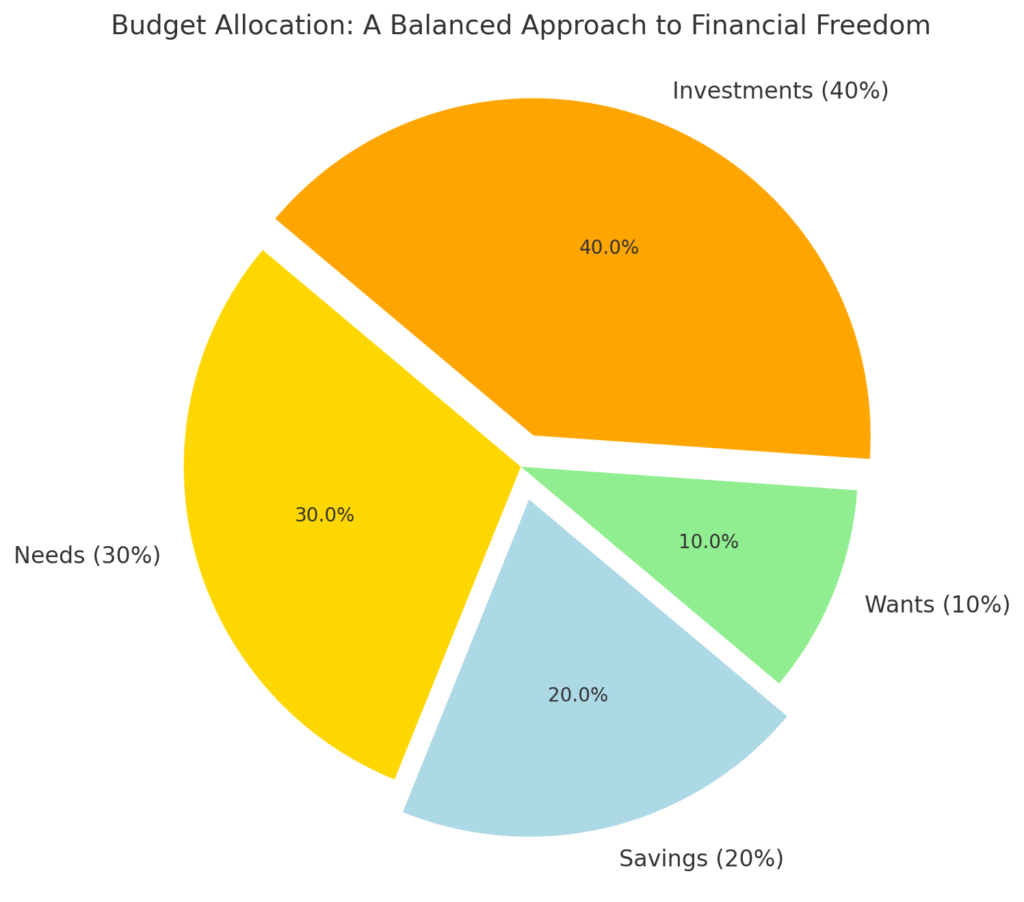

- Follow the 50/30/20 Rule:

Allocate 50% of your income for essentials, 30% for wants, and 20% for savings and debt repayment. - Track and Adjust:

Use budgeting apps or spreadsheets to monitor your spending and refine your plan as needed.

Overcoming Common Budgeting Challenges

- Impulsive Spending: Stick to a plan and remind yourself of your financial goals.

- Unrealistic Budgets: Create a budget that reflects your actual lifestyle.

- Lack of Consistency: Set reminders or use tools to maintain discipline.

Column suggestion:

Create a table comparing “Common Budgeting Mistakes” and “Solutions.”

| Mistake | Solution |

|---|---|

| Impulse buying | Create a spending cap |

| Overestimating income | Base budget on average earnings |

| Ignoring savings | Automate savings contributions |

Achieving Financial Freedom Through Budgeting

Financial freedom is the ability to make life choices without financial constraints. Budgeting helps by:

- Creating a roadmap to pay off debt.

- Building wealth through consistent savings and investments.

- Providing flexibility to pursue dreams like starting a business or early retirement.

Conclusion

Why Budgeting Isn’t Just About Saving It’s About Financial Freedom, as it empowers you to turn your financial aspirations into reality. Studies show that individuals who actively budget are 33% more likely to achieve their financial goals compared to those who don’t. Budgeting doesn’t just keep your finances organized—it provides a roadmap to eliminate debt, grow your savings, and invest strategically.

By creating a budget tailored to your goals, you can make smarter decisions about where to spend, save, and invest your money. For instance, allocating just 20% of your income to savings and investments can compound into significant wealth over time. Why Budgeting Isn’t Just About Saving It’s About Financial Freedom because it gives you the confidence and resources to live life on your terms. Start today and take control of your financial future.