What to Include in Your Stock Portfolio to Minimize Risk isn’t just a question—it’s a crucial strategy every smart investor should master. In today’s unpredictable market, protecting your investments from unnecessary risk is more important than ever. Whether you’re a seasoned investor or just starting your financial journey, knowing how to build a balanced and diversified portfolio can be the key to achieving long-term growth and financial security. In this blog, we’ll dive into proven techniques like diversification, asset allocation, and selecting safe investments to help you minimize risk and maximize your returns. Ready to take control of your financial future? Let’s get started!

Table of Contents

The Importance of Risk Management in Investing

Understanding risk management is crucial for any investor. Without proper risk mitigation, even the most promising investments can lead to significant losses. This section will explain why managing risk is essential and how it can help preserve your capital.

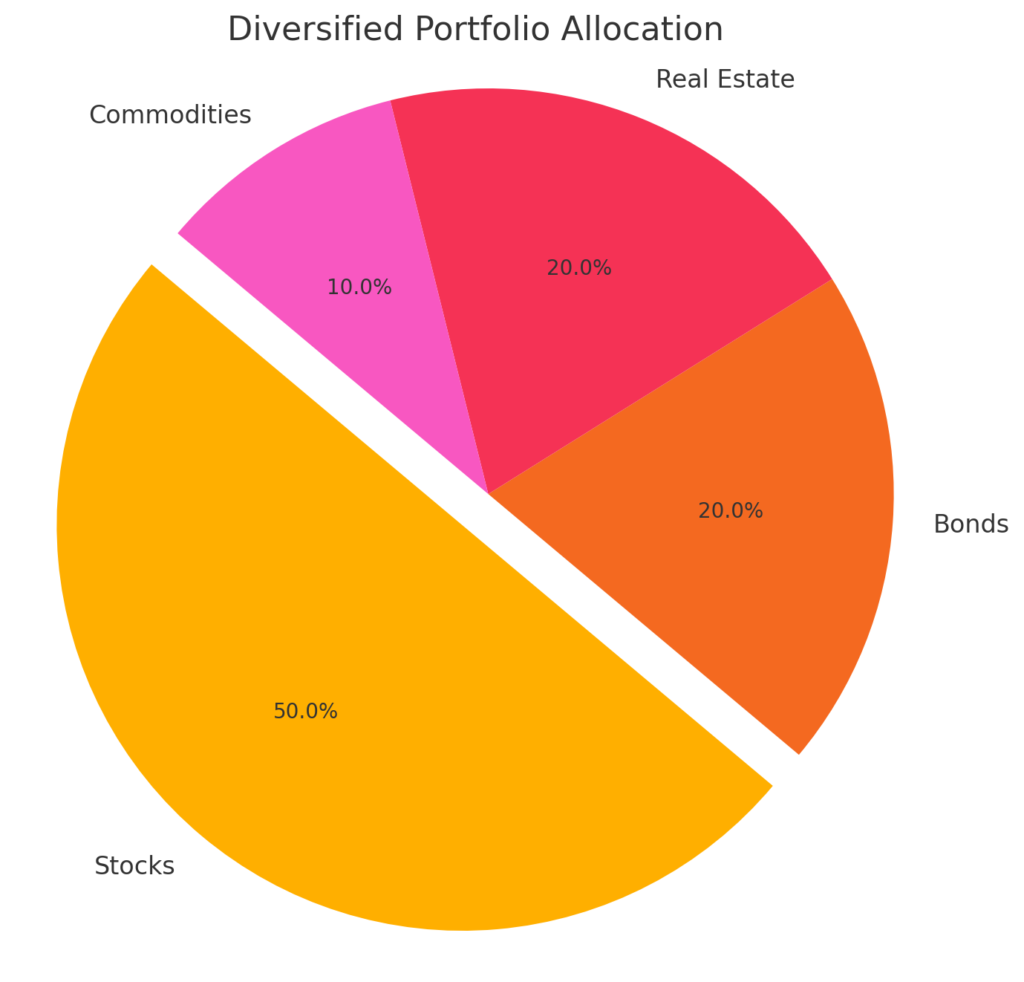

Diversification: The Foundation of a Low-Risk Portfolio

Diversification involves spreading investments across various asset classes to reduce exposure to any single risk. We’ll cover how to diversify effectively, including:

- Stocks: Investing in different sectors and industries.

- Bonds: Including government and corporate bonds.

- Real Estate: Adding real estate investment trusts (REITs) for stability.

- Commodities: Using gold and other commodities as hedges against market downturns.

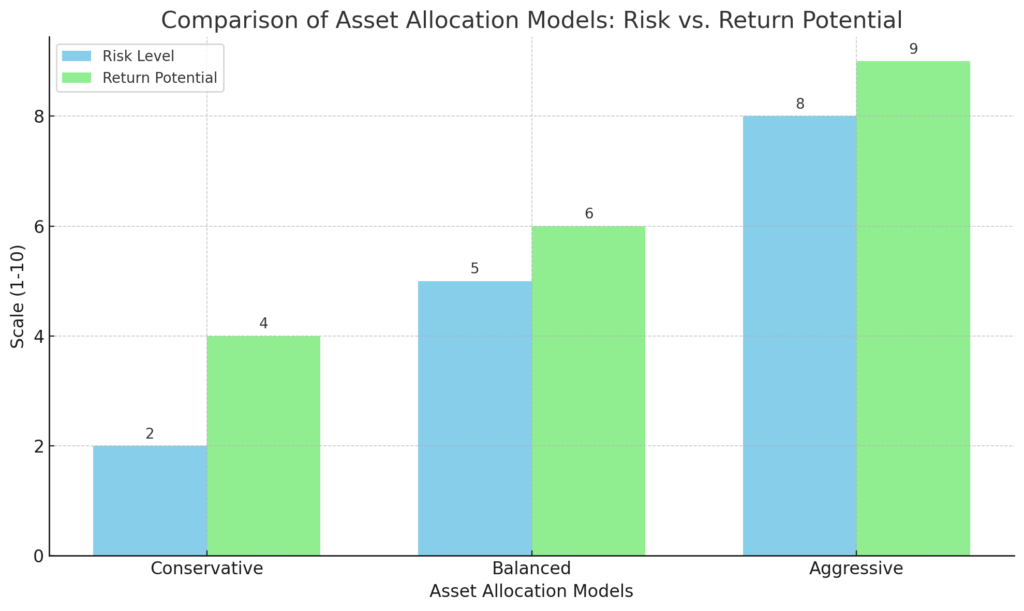

Asset Allocation Strategies to Minimize Risk

Asset allocation refers to how you distribute investments across different categories. This section will discuss:

- Age-Based Allocation: Adjusting risk tolerance based on age.

- Risk Tolerance Assessment: Tailoring allocation to personal comfort with risk.

- Rebalancing: Regularly adjusting allocations to maintain your target risk level.

For a deeper understanding of how to effectively allocate your assets, check out the SEC’s guide on Asset Allocation.

Including Safe Investments to Protect Your Portfolio

Certain investments are known for their stability and can serve as a safety net in your portfolio:

- Blue-Chip Stocks: Reliable companies with a history of steady growth.

- Government Bonds: Low-risk securities backed by the government.

- Dividend-Paying Stocks: Providing steady income even during market dips.

- Certificates of Deposit (CDs): Offering fixed interest with minimal risk.

| Investment Type | Risk Level | Typical Annual Return (%) |

|---|---|---|

| Blue-Chip Stocks | Low to Moderate | 6% |

| Government Bonds | Low | 2% |

| Dividend-Paying Stocks | Low to Moderate | 4% |

| Certificates of Deposit (CDs) | Very Low | 1.5% |

The Role of International Investments in Risk Reduction

Investing internationally can help diversify your portfolio and reduce geographic risk. This section will explore:

- Emerging Markets: Opportunities and risks.

- Developed Markets: Stability and growth potential.

- Currency Risk: How to manage fluctuations in exchange rates.

Using Index Funds and ETFs for Broad Market Exposure

Index funds and ETFs are cost-effective ways to gain exposure to a broad range of assets. We’ll discuss:

- Benefits of Index Funds: Low fees and passive management.

- ETFs for Diversification: Flexibility and variety in one investment.

- Comparing Index Funds vs. ETFs: Which is right for your portfolio?

If you’re looking for top-performing index funds to include in your portfolio, Morningstar provides an expert-curated list of Best Index Funds.

| Feature | Index Funds | ETFs |

|---|---|---|

| Management Style | Passive, tracks a specific index | Passive, tracks a specific index |

| Trading | Bought and sold at end-of-day NAV | Traded throughout the day like stocks |

| Minimum Investment | Often requires a minimum investment | No minimum investment; buy as little as one share |

| Fees | Generally low but may include transaction fees | Lower fees, but may incur brokerage commissions |

| Liquidity | Less liquid due to end-of-day trading | Highly liquid with real-time pricing |

| Tax Efficiency | Less tax-efficient due to capital gains distributions | More tax-efficient due to in-kind transfers |

| Best For | Long-term investors looking for simplicity | Active traders or those seeking intraday flexibility |

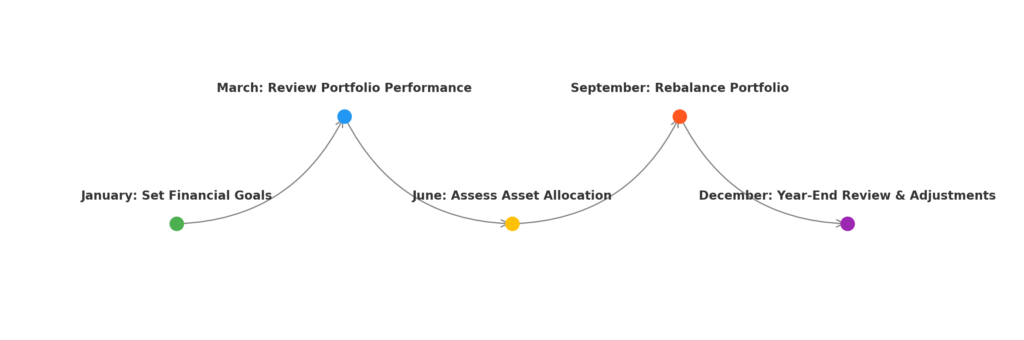

Monitoring and Adjusting Your Portfolio Over Time

Regular monitoring ensures your portfolio stays aligned with your financial goals. This section covers:

- Reviewing Performance: Setting benchmarks and evaluating returns.

- Rebalancing Techniques: Adjusting investments to maintain your risk profile.

- Staying Informed: Keeping up with market trends and economic indicators.

Common Mistakes to Avoid When Building a Low-Risk Portfolio

Even with the best intentions, investors can make mistakes that increase risk. Avoid these common pitfalls:

- Over-Concentration: Putting too much money in one asset or sector.

- Ignoring Fees: How high fees can erode returns.

- Chasing Performance: Why past performance isn’t a guarantee of future results.

Conclusion

In conclusion, knowing what to include in your stock portfolio to minimize risk is the first step towards securing your financial future. By diversifying across various asset classes, implementing strategic asset allocation, and including stable investments like blue-chip stocks and government bonds, you can effectively reduce risk and safeguard your wealth.

Remember, investing is a continuous process. Regularly review and adjust your portfolio to stay aligned with your financial goals and risk tolerance. Don’t let market fluctuations deter you—consistency and informed decisions are key to long-term success.

Ready to take control of your investments? Share your thoughts in the comments below, explore our related articles on building a balanced portfolio, or subscribe for more expert tips to help you navigate the world of investing.

Your financial future is in your hands. Make smart, strategic choices today to build the wealth you deserve tomorrow. [FinansieraTrading.com]