How to start day trading with just $500? Many aspiring traders believe that a substantial amount of capital is necessary to enter the world of day trading, but the truth is, you can start with as little as $500. The key lies in smart strategies, risk management, and selecting the right markets. With the right approach, even a small initial investment can grow over time, allowing you to scale your trading efforts and achieve long-term financial goals. In this guide, we’ll explore essential trading techniques, the best platforms for small accounts, and proven risk management methods to help you navigate the fast-paced world of day trading successfully. Whether you’re new to trading or looking to refine your strategy, this article will equip you with everything you need to get started confidently.

Understanding the Basics of Day Trading

Day trading involves buying and selling financial instruments within the same trading day. Unlike long-term investing, the goal is to make quick profits from short-term price fluctuations. To succeed with just $500, you need a strong understanding of:

- Market Trends and Technical Analysis: Learn how to analyze charts, price action, and indicators to make informed decisions.

- Choosing the Right Trading Platform: Select a platform with low fees, good market access, and strong tools.

- Implementing Risk Management Strategies: Managing your losses and protecting your capital is crucial.

- Staying Updated on Financial News: Market news can impact price movements, so staying informed is vital.

Table of Contents

Choosing the Right Trading Platform

Selecting the right trading platform is crucial when starting with a small budget. Look for platforms that offer:

- Low or No Commission Fees – Helps maximize profits

- Leverage Options – Allows traders to control larger positions with smaller capital

- User-Friendly Interface – Makes trade execution seamless

- Market Variety – Enables trading across stocks, forex, crypto, and options

Best Trading Platforms for Small Accounts (Comparison Table)

| Platform | Commission Fees | Best For | Features |

|---|---|---|---|

| Robinhood | No commission | Beginner traders | Easy interface, free stocks |

| Webull | No commission | Technical traders | Advanced charting tools |

| TD Ameritrade | No commission | Education-focused traders | Extensive resources |

| eToro | No commission | Social traders | Copy trading feature |

Building a Solid Trading Strategy with $500

A successful trading strategy involves:

- Scalping: Making small, frequent trades to capture quick profits.

- Momentum Trading: Taking advantage of stock price trends to make gains.

- Breakout Trading: Identifying key resistance and support levels for big price moves.

- Risk-to-Reward Ratios: Always maintaining a favorable 1:2 or better risk-reward ratio.

Risk-Reward Scenarios and Potential Profit Growth

| Trade Setup | Risk ($) | Reward ($) | Risk-Reward Ratio | Number of Trades | Potential Growth (%) |

| Conservative | 10 | 20 | 1:2 | 50 | 100% |

| Moderate | 15 | 45 | 1:3 | 50 | 200% |

| Aggressive | 20 | 80 | 1:4 | 50 | 300% |

Risk Management Strategies to Protect Your Capital

With only $500, risk management is critical. Key strategies include:

- Using Stop-Loss Orders: Helps prevent large losses and protect funds.

- Setting Profit Targets: Secures gains before market reversals.

- Position Sizing: Never risk more than 2% of your capital per trade.

Position Sizing and Potential Returns

| Account Size | Risk Per Trade (2%) | Maximum Loss ($) | Potential Profit (1:2 R/R) |

| $500 | $10 | $50 (5 consecutive losses) | $100 (5 consecutive wins) |

| $1,000 | $20 | $100 | $200 |

| $5,000 | $100 | $500 | $1,000 |

| $10,000 | $200 | $1,000 | $2,000 |

The Best Markets to Trade with a Small Budget

| Market | Advantages | Risks |

| Forex Trading | High leverage, 24/7 availability | High volatility |

| Penny Stocks | Low-cost stocks, high growth potential | Very risky |

| Crypto Trading | 24/7 trading, big price swings | Market uncertainty |

| Options Trading | Lower capital required, high reward | Can expire worthless |

How to Grow Your Trading Account Over Time

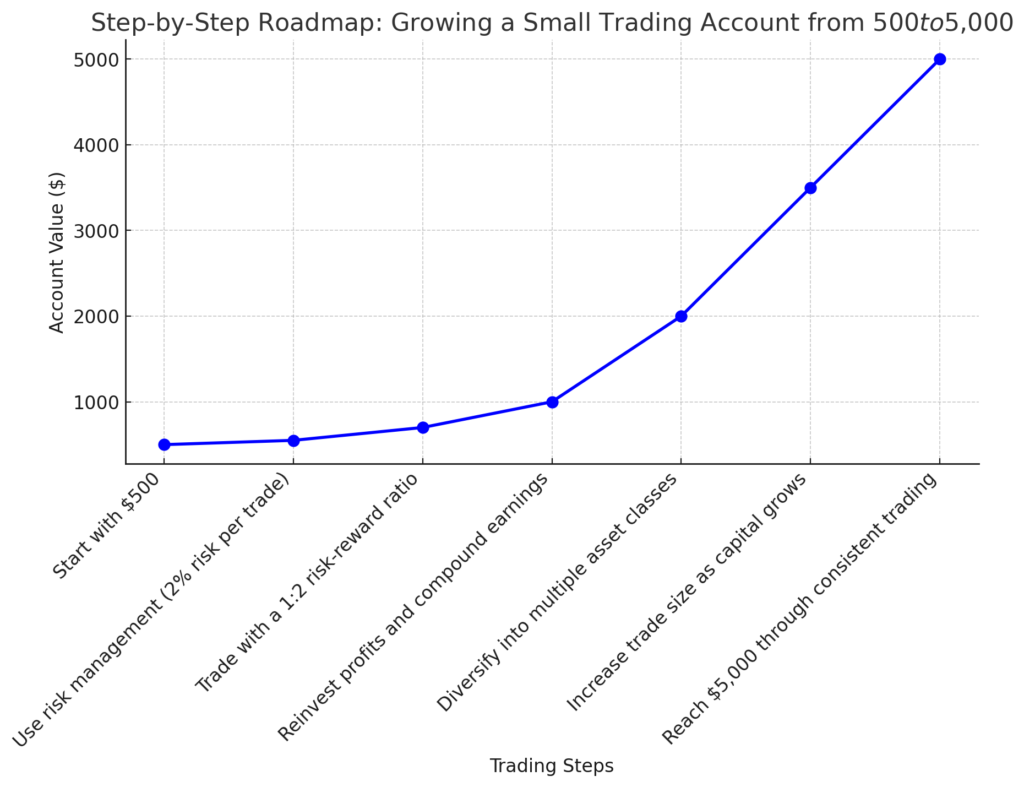

To scale your trading account from $500, follow these steps:

- Reinvest Profits: Compound your gains for exponential growth.

- Diversify Strategies: Explore different trading methods for risk mitigation.

- Keep Learning: Stay updated with market trends and trading news.

- Avoid Emotional Trading: Stick to a well-defined plan to prevent unnecessary losses.

Conclusion

Mastering day trading with just $500 is a journey that begins with small, actionable steps. By implementing the strategies outlined above, you can build a solid foundation and grow your capital over time. Remember, consistency and risk management are key to long-term success. Every effort you make brings you closer to financial independence.

Now it’s your turn—have you started trading with a small budget? Share your experiences in the comments, explore our related articles, and subscribe for more expert trading tips. The road to financial freedom starts with a single trade—why not make yours today?

Learn More About Trading Strategies – A comprehensive guide to various trading strategies and risk management techniques.