What to include in your debt repayment plan to stay on track is a question that often arises when tackling financial challenges. A well-structured debt repayment plan isn’t just a list of payments—it’s a blueprint for regaining control over your financial future and reducing the stress that comes with debt. Whether you’re dealing with credit card balances, personal loans, or student debt, having a clear strategy can save you time, money, and frustration.

In this blog post, we’ll walk you through the essential components of a debt repayment plan that works. From prioritizing debts and setting achievable goals to staying consistent and motivated, you’ll gain the tools and knowledge to create a plan tailored to your situation. By the end, you’ll understand not only how to start your journey to financial freedom but also how to stay on track until you achieve it. Let’s get started!

Table of Contents

Why a Debt Repayment Plan Is Essential

A solid debt repayment plan provides clarity and focus, ensuring you know where your money is going and how to tackle your debt effectively. Without a plan, you may feel overwhelmed or end up paying unnecessary interest. This section should highlight the key benefits, including reduced stress, better financial health, and a clear path to becoming debt-free.

Evaluate Your Current Financial Situation

To create a successful debt repayment plan, start by evaluating your current financial standing. Include these steps:

- List All Debts: Categorize debts based on type (credit cards, loans, medical bills, etc.), interest rates, and balances.

- Determine Your Monthly Income: Calculate your total income after taxes to understand how much you can allocate toward debt repayment.

- Track Monthly Expenses: Identify fixed and variable expenses to find areas where you can cut back.

Here’s a table format for the debt list:

| Debt Type | Balance ($) | Interest Rate (%) | Minimum Payment ($) |

|---|---|---|---|

| Credit Card | 5,000 | 18.5 | 150 |

| Student Loan | 15,000 | 4.5 | 200 |

| Car Loan | 12,000 | 6.0 | 250 |

| Personal Loan | 7,000 | 10.0 | 175 |

Prioritize Your Debts

Decide on a repayment strategy that aligns with your goals:

- Snowball Method: Pay off smaller debts first to build momentum.

- Avalanche Method: Focus on debts with the highest interest rates to save on interest.

- Debt Consolidation: Combine multiple debts into one loan with a lower interest rate.

Here is a two-column table comparing the Snowball Method and the Avalanche Method to help you decide which approach works best for your debt repayment strategy:

| Debt Method | Pros | Cons |

|---|---|---|

| Snowball Method | – Quick wins by paying off smaller debts first, which builds motivation and momentum. | – May result in paying more interest over time compared to the Avalanche Method. |

| – Easy to follow and encourages consistency. | – Focuses on balance size rather than interest rates, which might not be cost-effective. | |

| Avalanche Method | – Saves the most money in the long run by targeting high-interest debts first. | – Can take longer to see tangible results, which might discourage some individuals. |

| – Reduces overall interest paid, making it financially efficient. | – Requires more discipline and patience to see initial progress. |

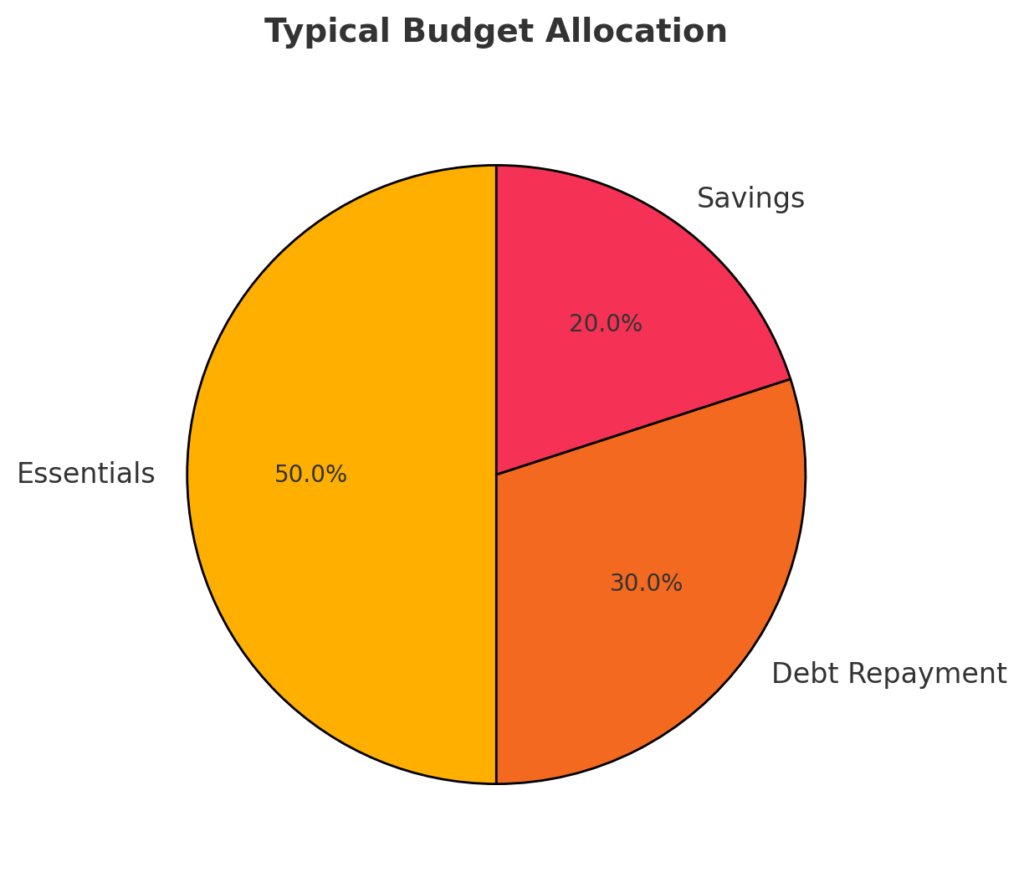

Set a Realistic Budget

Your budget is the backbone of your debt repayment plan. Follow these steps:

- Essential Expenses First: Cover necessities like housing, utilities, and groceries.

- Allocate Debt Payments: Set aside a specific amount for debt repayment each month.

- Emergency Fund Contributions: Save a small amount for unexpected expenses to avoid accumulating more debt.

Set Clear and Achievable Goals

Define what success looks like to you. Examples include:

- Paying off $10,000 of credit card debt in 12 months.

- Becoming completely debt-free in 3 years.

Include actionable tips like breaking larger goals into smaller milestones.

Automate Payments to Stay Consistent

Automation ensures you never miss a payment, which can negatively impact your credit score. Most banks and financial institutions offer auto-pay services. This removes the burden of remembering due dates and keeps you on track.

Review and Adjust Your Plan Regularly

Financial situations can change, so it’s crucial to revisit your plan every few months. Adjust for unexpected expenses, income changes, or new financial goals.

Keep Motivation High

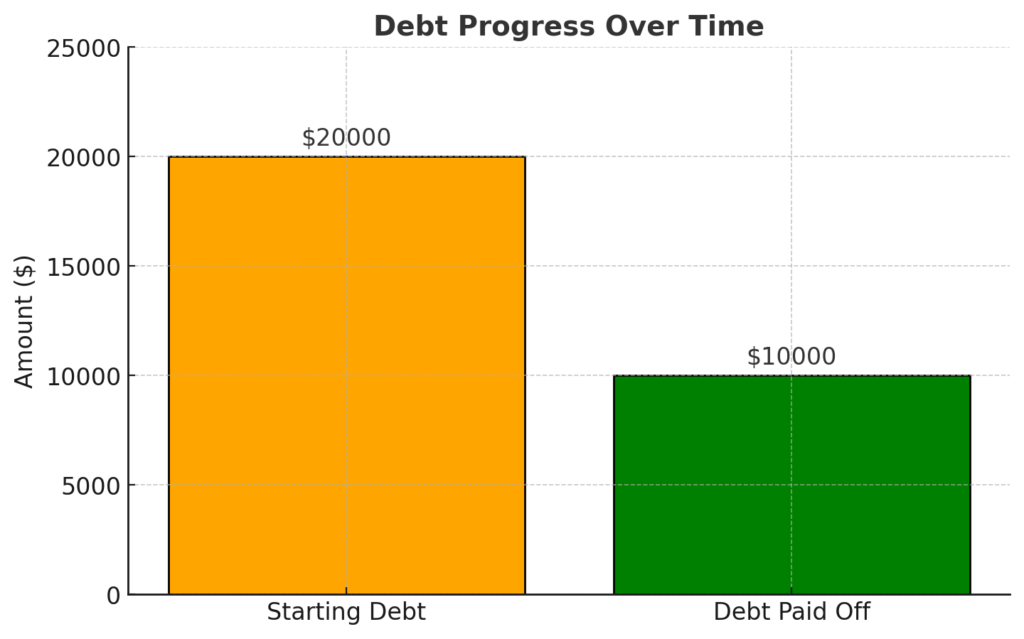

Staying motivated is key to sticking with your plan. Try the following:

- Celebrate Small Wins: Reward yourself when you hit milestones, such as paying off a specific debt.

- Track Progress: Use a visual tracker, like a bar graph, to see your debt shrinking over time.

Tools and Resources to Help You Succeed

Leverage technology to simplify your debt repayment journey. Use budgeting apps, debt calculators, or online tools to stay organized. Some examples include:

- Mint for budgeting

- Debt Payoff Planner for tracking

- Excel or Google Sheets for custom plans

Conclusion

Crafting a detailed and actionable debt repayment plan is the cornerstone of financial success. Knowing what to include in your debt repayment plan to stay on track can make the difference between feeling overwhelmed and being in control of your finances. By listing your debts, prioritizing repayment strategies like the snowball or avalanche methods, and setting clear financial goals, you can create a roadmap that works for you.

For example, if you owe $20,000 across multiple debts and allocate $1,000 monthly toward repayment, using the avalanche method could save you hundreds, if not thousands, in interest payments over time. On the other hand, the snowball method could help you pay off smaller debts quickly, boosting your confidence and motivation.

Remember to automate payments, track your progress regularly, and adjust your plan as needed. Staying consistent and motivated is critical, as it ensures you stick to your goals even when challenges arise.

What to include in your debt repayment plan to stay on track is not just about financial tools and strategies—it’s about mindset, discipline, and perseverance. Start today by evaluating your financial situation, leveraging available tools, and making a commitment to become debt-free. The sooner you act, the closer you’ll be to achieving financial freedom and a stress-free life. [FinansieraTrading.com]