Why Debt Consolidation Could Be the Key to Financial Freedom in 2025

In an era of rising inflation, soaring interest rates, and mounting debt, achieving financial freedom feels like an uphill battle for many Americans. However, debt consolidation is emerging as a powerful solution to help individuals regain control of their finances and pave the way toward a debt-free future. This comprehensive guide explores how debt consolidation works, its benefits, and actionable tips to help you make informed decisions. By the end of this article, you’ll understand why debt consolidation your key to financial freedom in 2025 could be.

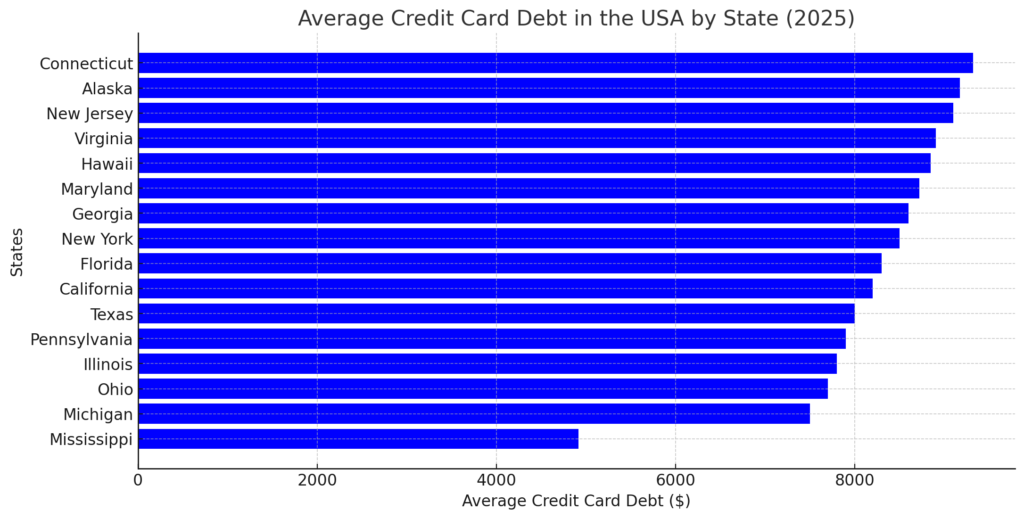

The Growing Debt Crisis in America

In 2025, the average American household carries over 8,000 in credit card debt, with interest rates reaching a staggering 238,000 in credit card debt, with interest rates reaching a staggering 23400 expense without borrowing money. This financial strain has made debt consolidation a lifeline for those seeking relief from high-interest debt.

Table of Contents

What Is Debt Consolidation?

Debt consolidation involves combining multiple debts into a single loan or payment plan, typically with a lower interest rate. This strategy simplifies your finances by replacing multiple due dates and varying interest rates with one manageable monthly payment. There are two primary methods:

- Debt Consolidation Loans: These personal loans allow you to pay off existing debts and replace them with a single loan at a lower interest rate.

- Debt Management Plans (DMPs): Offered by nonprofit credit counseling agencies, DMPs negotiate lower interest rates and create a structured repayment plan tailored to your financial situation.

How debt consolidation works, check out this comprehensive guide by the (CFPB): CFPB Debt Consolidation Guide.

Top Benefits of Debt Consolidation

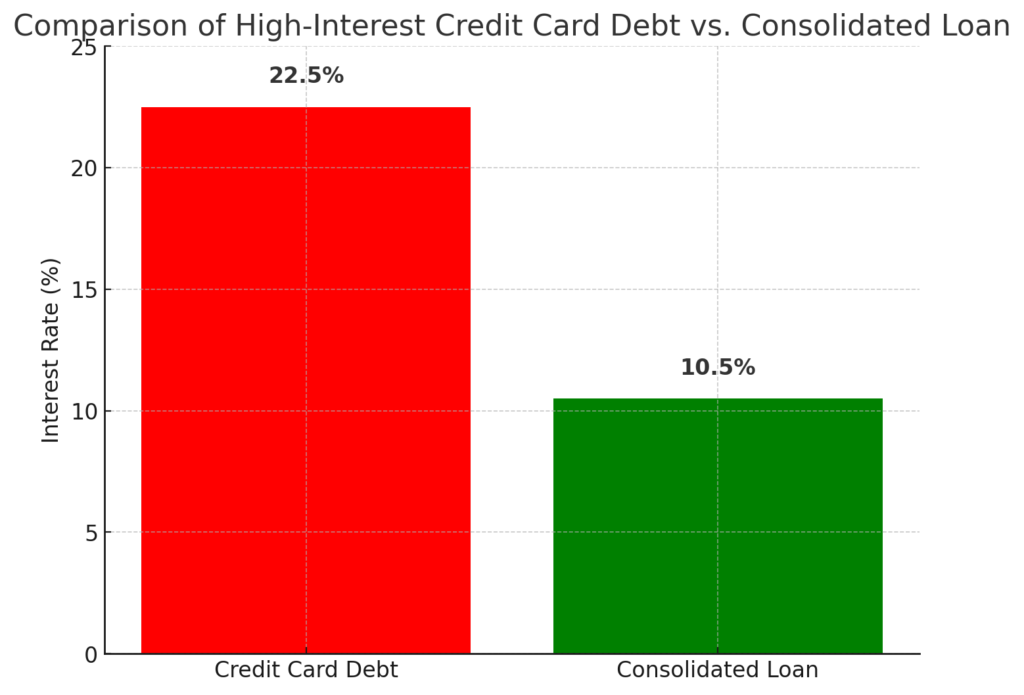

- Lower Interest Rates: By consolidating high-interest debt into a single loan with a lower rate, you can save thousands of dollars over time.

- Simplified Payments: Managing one payment instead of multiple bills reduces stress and minimizes the risk of missed payments.

- Improved Credit Score: Consistently making on-time payments and reducing your credit utilization can boost your credit score over time.

- Faster Debt Repayment: With lower interest rates, more of your payment goes toward the principal balance, helping you pay off debt faster.

When Does Debt Consolidation Make Sense?

Debt consolidation is most effective for individuals who:

- Have a total debt amount between 10,000 and10,000 and 50,000.

- Possess a credit score above 680.

- Have a stable income and a debt-to-income ratio below 45%.

However, it may not be the best option for those with unstable income or poor credit scores, as they may face higher interest rates or difficulty qualifying for loans.

Alternatives to Debt Consolidation

If debt consolidation isn’t the right fit for you, consider these alternatives:

- Balance Transfer Credit Cards: Transfer high-interest debt to a card with a 0% introductory APR for temporary relief.

- Debt Settlement: Negotiate with creditors to reduce the total amount owed, though this can negatively impact your credit score.

- Budgeting and Financial Planning: Create a strict budget to prioritize debt repayment and avoid accumulating new debt.

Pro Tips for Successful Debt Consolidation

- Compare Lenders: Shop around for the best interest rates and terms before committing to a debt consolidation loan.

- Avoid New Debt: Once you consolidate, focus on paying off your existing debt and avoid using credit cards unnecessarily.

- Build an Emergency Fund: Save at least $1,000 to cover unexpected expenses and prevent reliance on credit cards.

- Seek Professional Help: If you’re overwhelmed, consult a nonprofit credit counseling agency for personalized advice.

Why Debt Consolidation Is the Key to Financial Freedom

Debt consolidation isn’t just about paying off debt—it’s about regaining control of your financial life. By simplifying payments, reducing interest rates, and improving your credit score, debt consolidation empowers you to break free from the cycle of debt and build a brighter financial future. [FinansieraTrading.com]