Why managing your money smarter today can save you thousands tomorrow is a financial truth that too many people overlook until it’s too late. Every dollar you spend or save today sets the stage for your future financial stability. Whether it’s avoiding high-interest debt, building an emergency fund, or investing early, small, deliberate actions now can lead to substantial long-term benefits.

Imagine cutting unnecessary expenses, redirecting those funds into savings, and watching your wealth grow over time. It’s not about earning more—it’s about using what you have more effectively. In this blog, we’ll explore practical strategies to help you manage your money wisely, reduce financial stress, and create a future where your hard-earned money works for you. The best part? These steps are simple, actionable, and can be implemented today to secure your tomorrow.

Table of Contents

The Importance of Smart Money Management

Taking control of your finances is more than just budgeting; it’s about aligning your spending with your goals. A smarter approach can help you:

- Avoid high-interest debt

- Grow savings faster

- Make informed investment decisions

- Reduce financial stress

Start with a Budget: The Foundation of Financial Success

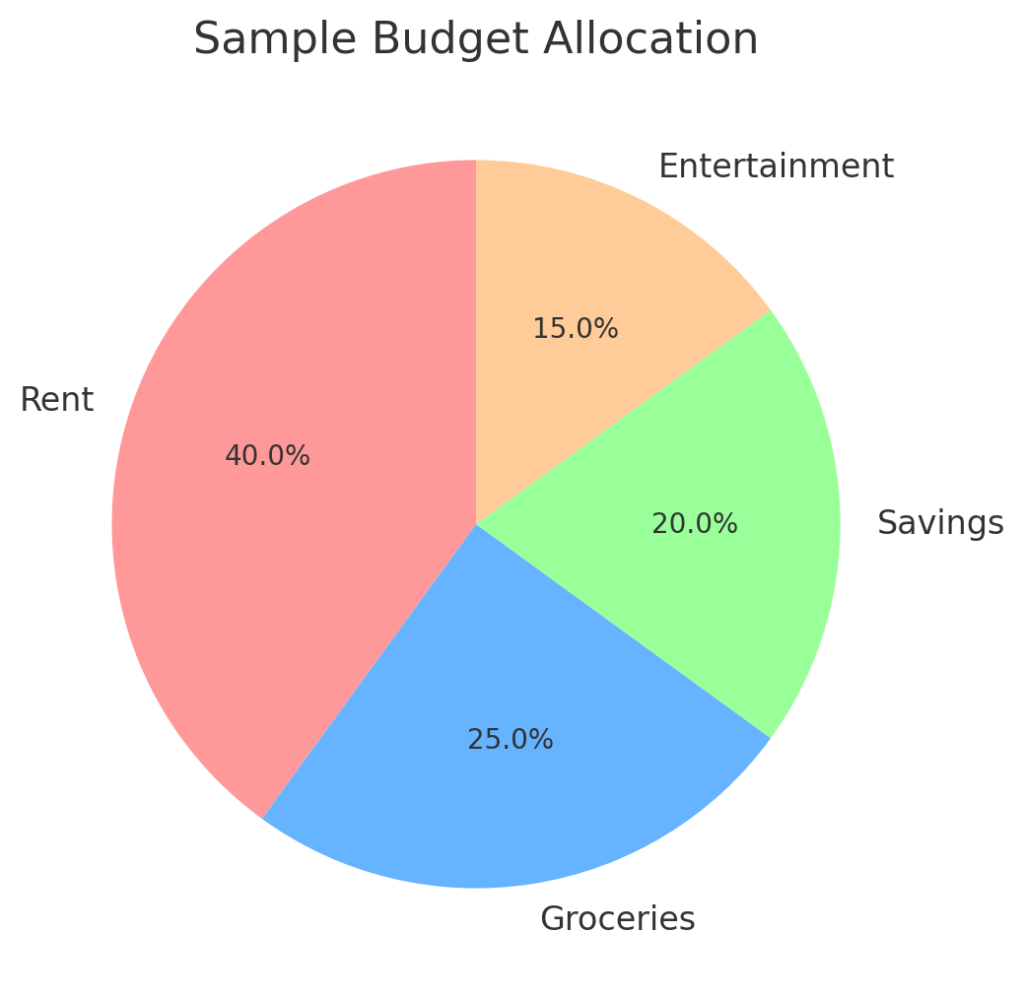

Budgeting is the first step in managing your money smarter. Here’s how to create one:

- Track Your Expenses: Monitor your daily, weekly, and monthly spending to understand where your money goes.

- Set Realistic Goals: Decide what you want to achieve—paying off debt, saving for a home, or investing.

- Categorize Spending: Break down your expenses into fixed (rent, bills) and variable (entertainment, dining out).

Tip: Use budgeting apps like Mint or YNAB to simplify tracking and goal setting.

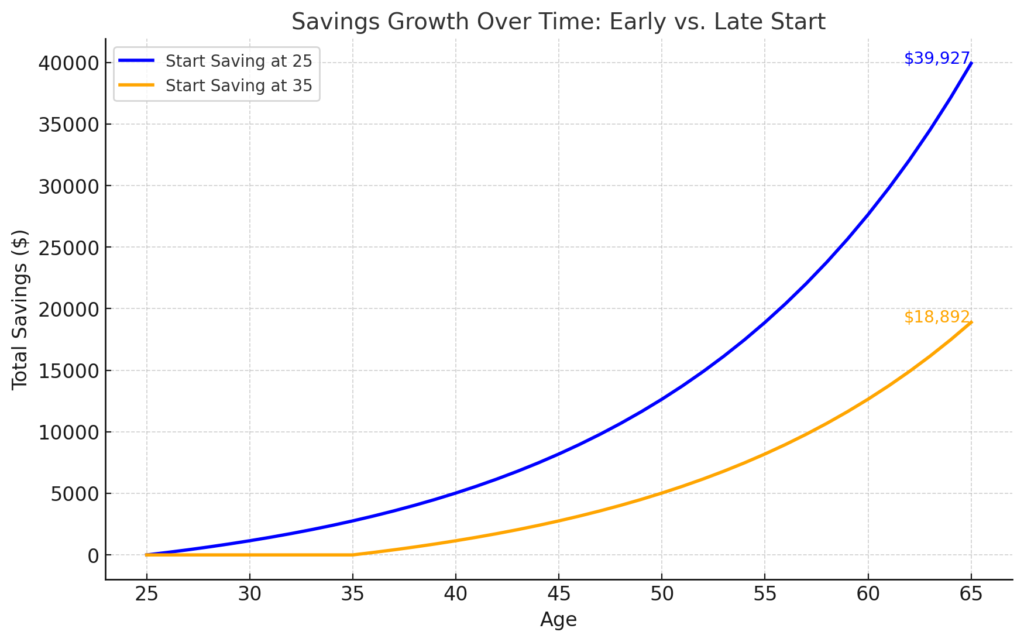

The Power of Compounding: Save Today to Multiply Tomorrow

When you save or invest early, compounding can work wonders. For example:

- Saving $200 monthly at a 7% annual return grows to over $240,000 in 30 years.

- Starting 10 years later cuts your total to just $113,000.

This shows how starting now can significantly boost your future wealth.

A comparison chart showing two savings timelines, one starting at age 25 and another at 35, both growing at 7% interest. Include labels highlighting the difference in total savings over time.

Eliminate High-Interest Debt

Debt can drain your finances, especially if it carries high-interest rates. Prioritize paying off debts like credit cards or payday loans before focusing on savings.

Steps to Tackle Debt:

- List All Debts: Include the amount, interest rate, and minimum payments.

- Use the Snowball or Avalanche Method: Pay off smaller debts first for quick wins (snowball) or focus on high-interest debts (avalanche).

- Negotiate Rates: Ask your creditors for lower interest rates or refinance loans.

Automate Your Savings and Investments

Automation makes managing money smarter and stress-free. Set up systems to:

- Automatically transfer a percentage of your paycheck into savings.

- Contribute regularly to retirement accounts like a 401(k) or IRA.

- Invest in low-cost index funds or ETFs for long-term growth.

Track and Adjust Your Financial Plan

Regularly review your budget, savings, and investments to ensure they align with your goals. Life changes like promotions, new expenses, or financial emergencies may require adjustments.

Tips for Adjustments:

- Increase savings when income rises.

- Rebalance your investment portfolio annually.

- Stay updated on financial tools and tax benefits.

Conclusion: Why Managing Your Money Smarter Today Can Save You Thousands Tomorrow

Managing your money smarter today isn’t just about saving a few dollars; it’s about building a financial system that works for you. Consider this: by saving just $10 a day and investing it at a 7% annual return, you could grow your savings to nearly $150,000 in 30 years. That’s the power of compounding when paired with smart financial habits.

Furthermore, eliminating high-interest debt can save you thousands in unnecessary interest payments. For instance, paying off a $10,000 credit card balance with a 20% interest rate could save you over $2,000 a year. Similarly, automating your savings ensures consistent growth without requiring daily effort.

Why managing your money smarter today can save you thousands tomorrow is not just a catchphrase—it’s a proven financial principle. Whether you’re starting with budgeting, investing early, or cutting unnecessary expenses, every small step you take today will multiply into larger financial benefits tomorrow. By implementing these strategies, you’re not just saving money; you’re building a stable, secure, and stress-free financial future.

Make the decision today because the future of your financial freedom starts now. Why managing your money smarter today can save you thousands tomorrow is the roadmap to turning your goals into reality!

Call to Action: Start applying these tips today to take control of your financial future and reap the rewards tomorrow!