Why understanding your credit score can save you thousands in interest payments is a topic every financially savvy individual needs to grasp. Your credit score isn’t just a number—it’s the key that unlocks better financial opportunities, lower interest rates, and significant savings over time. Whether you’re applying for a mortgage, an auto loan, or a credit card, lenders use your credit score to determine how much risk they take when lending you money. A higher score means lower risk for lenders and translates to better interest rates and reduced costs for you.

Table of Contents

In this blog, we’ll break down how your credit score impacts your financial life, explore real-life scenarios showcasing the cost of poor credit, and provide actionable steps to boost your score. Understanding your credit score is one of the most effective ways to gain control of your financial future and put more money back in your pocket.

What Is a Credit Score and Why Does It Matter?

- Definition of a credit score and how it’s calculated (FICO vs. VantageScore).

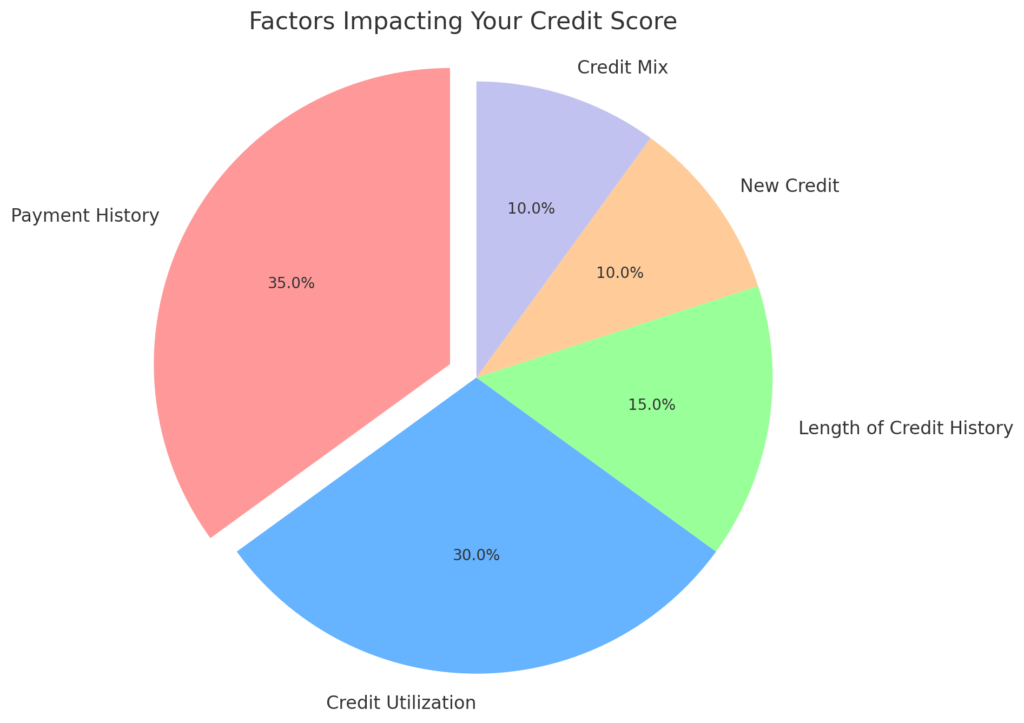

- The factors influencing your credit score (payment history, credit utilization, length of credit history, etc.).

- Why lenders use your credit score to determine risk and set interest rates.

How Your Credit Score Affects Interest Payments

- Explanation of interest rates and how they vary based on credit scores.

- Examples of loan scenarios:

- A person with a credit score of 750 versus 600 taking a $10,000 loan.

- Highlight the difference in interest payments over a 5-year period.

- Mortgage, auto loans, and credit card interest comparisons.

Real-Life Scenarios: The Cost of a Poor Credit Score

- Case study 1: A high-interest mortgage loan.

- Case study 2: Credit card debt at 20% APR.

- Case study 3: Auto loan with higher monthly payments.

- Explanation of how improving credit scores in each scenario could have saved money.

Here’s a table comparing loan costs for different credit score ranges:

| Loan Type | Excellent Credit (750+) | Good Credit (700-749) | Fair Credit (650-699) | Poor Credit (<650) |

|---|---|---|---|---|

| Mortgage (30 years, $250,000) | Interest Rate: 3.0% Total Paid: $379,443 | Interest Rate: 3.5% Total Paid: $404,670 | Interest Rate: 5.0% Total Paid: $483,139 | Interest Rate: 6.5% Total Paid: $567,848 |

| Auto Loan (5 years, $30,000) | Interest Rate: 3.5% Total Paid: $32,737 | Interest Rate: 4.5% Total Paid: $33,566 | Interest Rate: 7.0% Total Paid: $35,820 | Interest Rate: 10.0% Total Paid: $38,247 |

| Personal Loan (3 years, $15,000) | Interest Rate: 6.0% Total Paid: $16,403 | Interest Rate: 8.0% Total Paid: $16,890 | Interest Rate: 12.0% Total Paid: $17,975 | Interest Rate: 18.0% Total Paid: $19,620 |

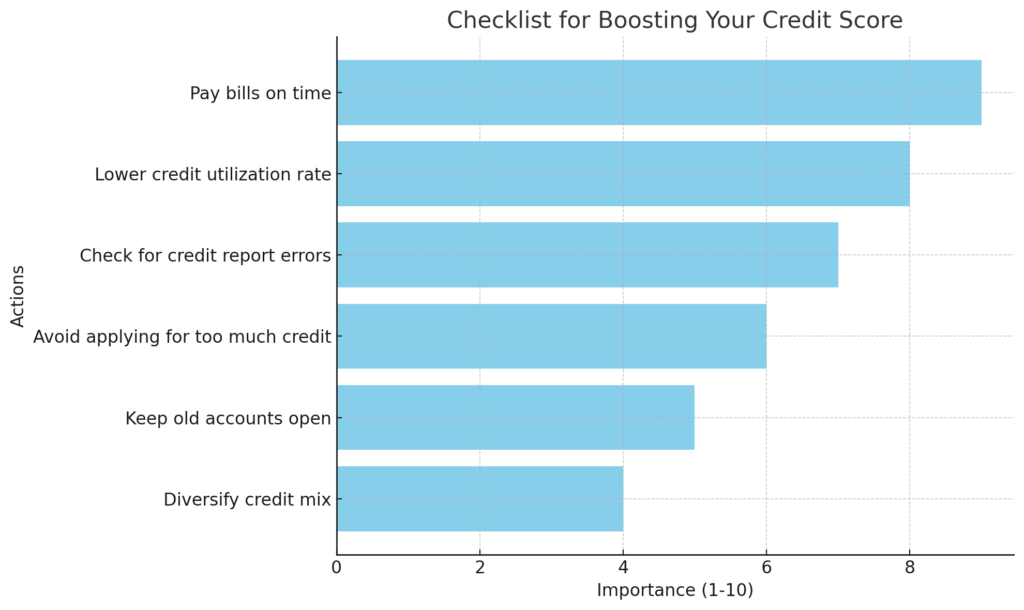

How to Improve Your Credit Score

- Pay Your Bills on Time

- Late payments can drastically lower your score.

- Lower Your Credit Utilization Rate

- Aim for a utilization rate below 30%.

- Check for Errors on Your Credit Report

- Mistakes can unnecessarily damage your score.

- Avoid Applying for Too Much Credit

- Hard inquiries can temporarily lower your score.

- Keep Old Accounts Open

- Length of credit history matters.

Why Understanding Your Credit Score Early Can Lead to Long-Term Savings

- The compounding effect of better credit habits over decades.

- How early action can increase access to better financial products.

- Savings on interest rates across various types of credit over a lifetime.

Frequently Asked Questions (FAQ)

- What’s a good credit score range?

- Generally, 700-749 is good, 750+ is excellent.

- How often should I check my credit score?

- At least once per year or before applying for major loans.

- Does checking my own credit score hurt it?

- No, soft inquiries don’t affect your score.

- How quickly can I improve my credit score?

- Significant improvements can be seen within 6-12 months with consistent effort.

Conclusion

Understanding your credit score isn’t just about knowing a number—it’s a powerful tool that can save you thousands in interest payments over time. For example, improving your credit score from 600 to 750 can reduce the interest rate on a $250,000 mortgage by 1-2%, saving you over $50,000 throughout the loan’s term. Similarly, a higher credit score can significantly lower credit card APRs, freeing up money for savings or investments.

By consistently paying bills on time, lowering credit utilization, and monitoring your credit report for errors, you can unlock financial opportunities that might otherwise seem out of reach. A good credit score doesn’t just save you money—it gives you access to better financial products, lower insurance premiums, and even improved job prospects in some industries.

Ultimately, understanding your credit score and taking steps to improve it is one of the smartest financial decisions you can make. Start today, and you’ll not only save thousands in interest payments but also build a stronger financial future.