Why Ignoring Your Credit Report Can Wreck Your Financial Future

Have you ever considered how much your credit report influences your financial well-being? Ignoring it might seem harmless, but it can quietly lead to denied loan applications, sky-high interest rates, and even missed job opportunities. Your credit report is more than just numbers on a page—it’s a reflection of your financial health.

In this blog, we’ll uncover the hidden risks of neglecting your credit report, show you how it can impact your future, and provide simple, effective strategies to stay in control of your financial destiny.

Table of Contents

The Importance of Your Credit Report

Your credit report is a detailed record of your credit history, including information about your borrowing behavior, repayment history, and outstanding debts. It plays a crucial role when applying for loans, renting apartments, or even securing a job.

- Lenders use it to determine your creditworthiness.

- Landlords assess your reliability as a tenant.

- Employers gauge your financial responsibility, especially in industries like finance.

Understanding the details in your credit report empowers you to make informed financial decisions and maintain a healthy financial profile.

How Ignoring Your Credit Report Can Lead to Financial Problems

Neglecting your credit report can open the door to several financial issues:

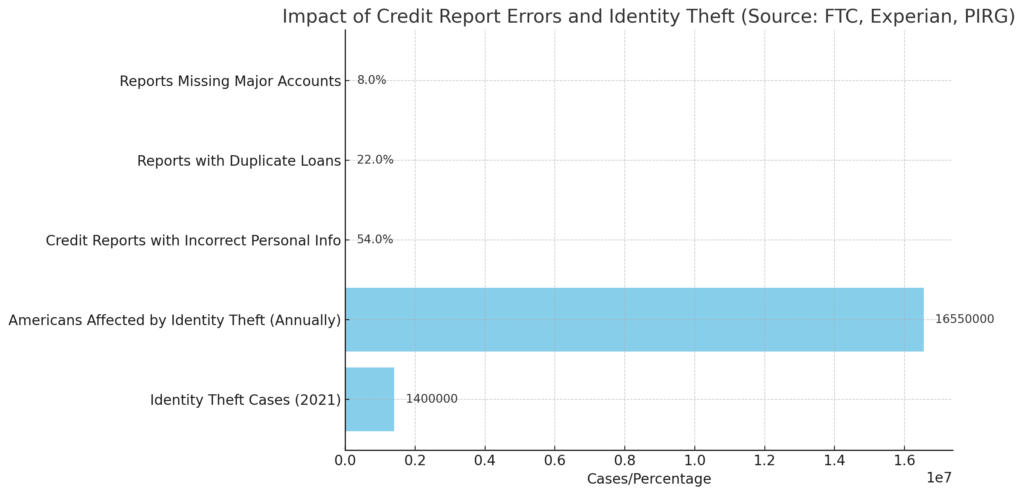

- Missed Errors: Mistakes in your credit report, like incorrect account information or payment history, can lower your credit score, making it harder to get approved for loans.

- Identity Theft Risks: If you don’t monitor your report, fraudulent activities like unauthorized accounts or suspicious transactions can go unnoticed, causing long-term damage.

- Higher Interest Rates: A low credit score due to unchecked errors or fraud can lead to higher interest rates on loans and credit cards, costing you more money over time.

- Loan and Credit Denials: Financial institutions may deny your credit applications if they see negative marks you weren’t aware of because you neglected to check your report.

Common Mistakes People Make with Their Credit Reports

Many people unknowingly make mistakes that harm their credit health, such as:

- Not Checking Reports Regularly: Waiting too long between checks can allow errors or fraudulent activities to go unnoticed.

- Ignoring Small Discrepancies: Small inaccuracies can snowball into larger issues, impacting your credit score.

- Failing to Dispute Errors Promptly: Delays in disputing errors can make it harder to correct them.

- Overlooking Signs of Identity Theft: Failing to recognize unusual activities can result in significant financial losses due to fraud.

How to Regularly Monitor Your Credit Report

Staying on top of your credit report is easier than you might think:

- Annual Credit Report: Visit Annual Credit Report to access your free credit report from each of the three major credit bureaus once a year.

- Credit Monitoring Services: Consider subscribing to credit monitoring tools that alert you to any changes or suspicious activities in real time.

- Setting Calendar Reminders: Schedule reminders to review your credit report periodically, ensuring you catch any issues early.

The Long-Term Impact of Ignoring Your Credit Report

Neglecting your credit report doesn’t just create immediate financial risks—it can have lasting consequences:

- Reduced Ability to Secure Loans: A poor credit score limits your borrowing options and can prevent you from qualifying for loans when you need them most.

- Limited Housing Opportunities: Landlords often review credit reports to assess a tenant’s reliability, and a negative report can cost you rental opportunities.

- Impact on Job Prospects: Some employers, especially in financial industries, check credit reports to evaluate a candidate’s financial responsibility.

Tips to Improve and Maintain a Healthy Credit Report

To maintain a strong credit profile:

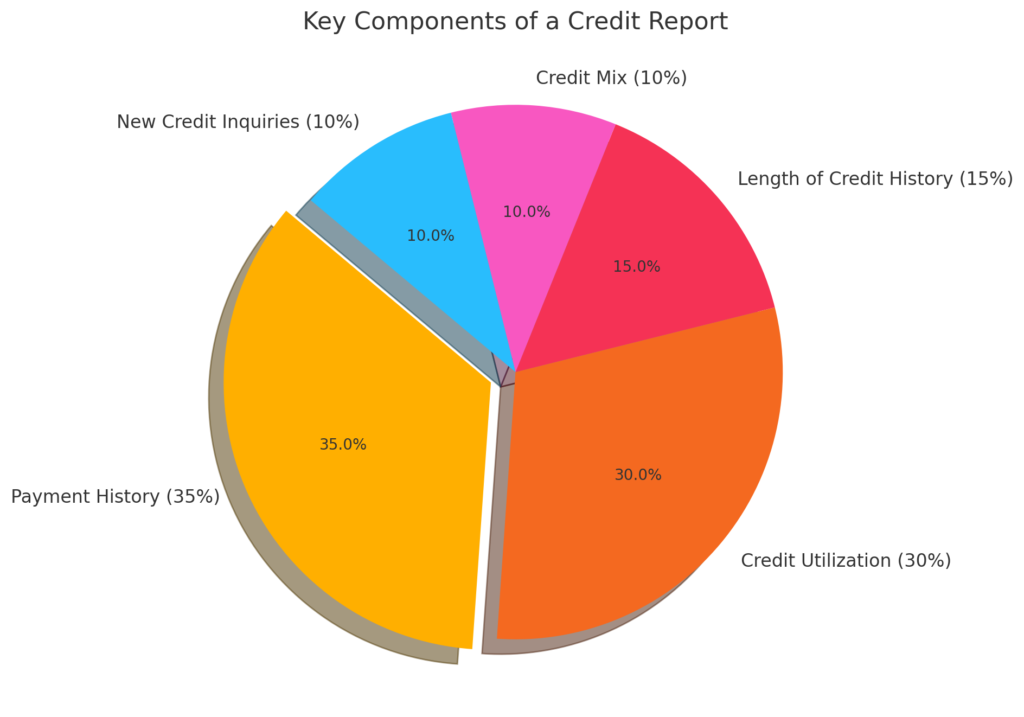

- Pay Bills on Time: Consistently making timely payments boosts your credit score.

- Keep Credit Utilization Low: Aim to use less than 30% of your available credit to show responsible credit management.

- Regularly Review Reports for Accuracy: Checking your credit report helps you spot and correct errors promptly.

- Dispute Errors Quickly: If you find inaccuracies, dispute them with the credit bureau to get them corrected.

- Avoid Unnecessary Credit Inquiries: Too many hard inquiries can lower your credit score; only apply for credit when necessary.

Real-Life Examples of Financial Setbacks from Ignoring Credit Reports

- Denied Mortgage Due to Unnoticed Errors: A young couple was denied a mortgage because of an error on one partner’s credit report. By the time they discovered it, their dream home was already sold to another buyer.

- Identity Theft Leading to Financial Ruin: An individual ignored credit monitoring for years, only to find out that a fraudster had opened multiple accounts in their name, leading to debt collections and a severely damaged credit score.

Conclusion

In conclusion, safeguarding your financial future starts with a simple yet powerful habit—regularly checking your credit report. By staying proactive, identifying errors early, and monitoring for signs of identity theft, you can protect yourself from costly financial surprises. Don’t wait until it’s too late to take control of your credit health.

Ready to secure your financial future? Start today by reviewing your credit report at AnnualCreditReport.com. Share your thoughts in the comments below, and if you found this guide helpful, feel free to share it with others who might benefit. Remember, your financial stability is in your hands—stay informed, stay prepared, and take action now. [FinansieraTrading.com]