What to Include in Your Weekly Financial Review: How to Stay on Top of Your Finances

Managing your finances can feel overwhelming, but a weekly financial review is a simple yet powerful habit that can transform your financial health. Whether you’re saving for a big purchase, paying off debt, or planning for retirement, a consistent weekly check-in ensures you’re in control of your money. In this comprehensive guide, we’ll walk you through everything you need to include in your weekly financial review, share expert tips, and provide actionable steps to help you achieve your financial goals. Plus, we’ll include trending insights and tools to make the process easier and more effective.

Table of Contents

Why a Weekly Financial Review is Essential

According to a 2023 survey by Bankrate, 56% of Americans don’t have enough savings to cover a $1,000 emergency. This startling statistic highlights the importance of staying on top of your finances. A weekly financial review helps you:

- Track your spending and avoid overspending.

- Monitor progress toward savings and debt repayment goals.

- Identify and address financial issues before they escalate.

- Build confidence and reduce stress about money.

By dedicating just 15–30 minutes each week, you can create a clear financial roadmap and make smarter money decisions.

What to Include in Your Weekly Financial Review

Here’s a step-by-step breakdown of what to include in your weekly financial review to maximize its effectiveness:

1. Track Your Income and Expenses

Start by reviewing your income and expenses for the week. Use budgeting apps like Mint or YNAB (You Need A Budget) to categorize your spending. This helps you identify areas where you can cut back, such as dining out or subscription services.

Pro Tip: Set spending limits for discretionary categories to avoid overspending.

2. Monitor Your Savings Goals

Check your progress toward your savings goals, whether it’s building an emergency fund, saving for a vacation, or contributing to retirement accounts like a 401(k) or IRA. Automating your savings can make this process seamless.

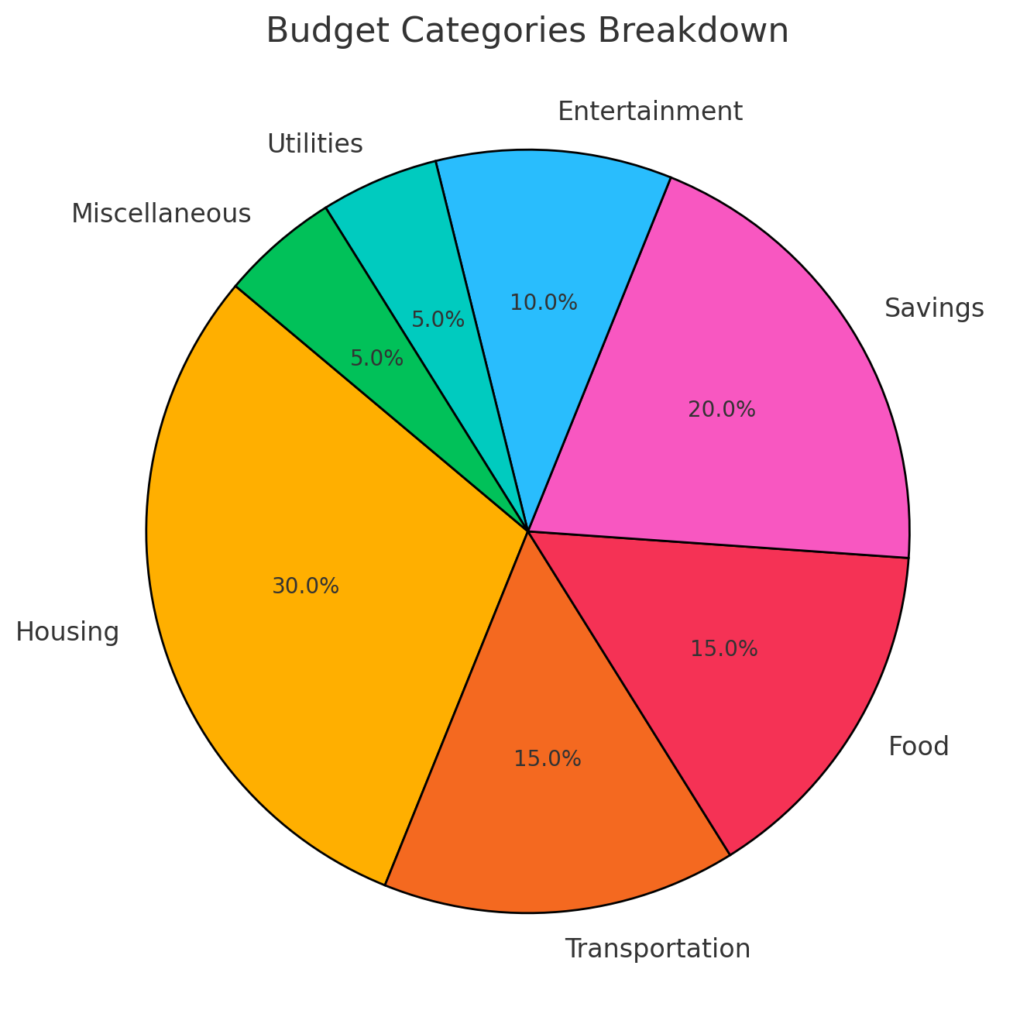

Pro Tip: Aim to save at least 20% of your income each month.

3. Review Your Debt Repayment Plan

If you’re paying off debt, track your progress and adjust your strategy if needed. Prioritize high-interest debt first and consider using the debt snowball or debt avalanche method to stay motivated.

Pro Tip: Allocate any extra income (like bonuses or tax refunds) toward debt repayment.

4. Analyze Your Investments

Take a quick look at your investment portfolio to ensure it’s aligned with your risk tolerance and financial goals. Avoid making impulsive decisions based on short-term market fluctuations—focus on long-term growth instead.

Pro Tip: Rebalance your portfolio annually to maintain your desired asset allocation.

5. Check Your Credit Score

Your credit score plays a crucial role in your financial health. Use free tools like Credit Karma or Experian to monitor your score and address any discrepancies or issues.

Pro Tip: Pay your bills on time and keep your credit utilization below 30% to boost your score.

6. Plan for Upcoming Expenses

Anticipate upcoming bills, subscriptions, or large purchases. This step helps you avoid surprises and ensures you have enough cash flow to cover your obligations.

Pro Tip: Create a monthly budget to plan for recurring expenses.

7. Reflect on Your Financial Goals

End your review by reflecting on your short-term and long-term financial goals. Are you on track to achieve them? If not, what adjustments can you make to get back on course?

Pro Tip: Write down your goals and revisit them regularly to stay motivated.

Trending Insights on Weekly Financial Reviews

Recent articles from Forbes and NerdWallet emphasize the importance of consistency in financial reviews. Many experts recommend pairing your weekly review with a monthly deep dive to get a more comprehensive view of your finances. Tools like Personal Capital and PocketGuard are also gaining popularity for their ability to streamline the review process.

According to The Balance, people who conduct regular financial reviews are 40% more likely to achieve their financial goals compared to those who don’t. This statistic underscores the value of making this practice a habit.

How to Make Your Weekly Financial Review a Habit

- Set a Specific Time: Choose a consistent day and time each week to conduct your review.

- Keep It Simple: Focus on the essentials and avoid overcomplicating the process.

- Celebrate Small Wins: Acknowledge your progress, no matter how small, to stay motivated. [FinansieraTrading.com]