How to create a budget you’ll actually stick to isn’t just a financial goal—it’s a game-changer for achieving lasting stability and peace of mind. If you’ve ever felt overwhelmed by your expenses, struggled to save, or wondered where your money goes each month, you’re not alone. The good news? Budgeting doesn’t have to be complicated or restrictive. In this guide, we’ll break down practical, easy-to-follow strategies that fit your lifestyle, helping you take control of your finances without feeling deprived. You’ll learn how to set realistic goals, choose the right budgeting method, and build habits that make sticking to your budget second nature. Ready to transform your financial future? Let’s dive in.

Why Budgeting Is Essential Budgeting is more than just tracking your income and expenses—it’s about gaining control over your financial future. A budget serves as a roadmap, helping you allocate resources wisely and make informed decisions. It empowers you to:

- Control your expenses: Know exactly where your money is going to avoid unnecessary spending.

- Save for future goals: Whether it’s a vacation, a new car, or retirement, budgeting helps you plan ahead.

- Reduce financial stress: Clear financial goals reduce anxiety about money.

- Prepare for emergencies: Build a safety net to handle unexpected expenses without derailing your finances.

Assessing Your Financial Situation Before creating a budget, it’s crucial to understand your current financial standing. This step sets the foundation for effective budgeting:

- Track income sources: Include all income streams like salary, freelance gigs, side hustles, and passive income.

- List monthly expenses: Categorize fixed expenses (rent, utilities) and variable expenses (groceries, entertainment).

- Identify debt obligations: Include credit card payments, student loans, or personal loans.

- Calculate net income: Subtract total expenses from your income to see your financial balance.

Setting Realistic Financial Goals Financial goals give your budget a purpose. Setting achievable goals keeps you motivated and focused:

- Short-term goals: Examples include saving for a vacation, paying off credit cards, or buying a new gadget.

- Medium-term goals: Think about buying a car, building an emergency fund, or pursuing further education.

- Long-term goals: Plan for retirement, homeownership, or starting a business.

Choosing the Right Budgeting Method The right budgeting method depends on your financial habits and goals:

| Budgeting Method | Description | Ideal For | Advantages | Disadvantages |

|---|---|---|---|---|

| 50/30/20 Rule | Divides income: 50% for needs, 30% for wants, 20% for savings/debt. | Simple, beginner-friendly budgeting. | Easy to implement, flexible, encourages savings. | Can overlook small expenses, less detailed. |

| Zero-Based Budgeting | Allocates every dollar a purpose, balancing income with expenses. | Detailed financial management enthusiasts. | Precise tracking, great for financial discipline. | Requires regular updates, time intensive. |

| Envelope System | Manages cash in envelopes for specific categories to control spending. | People preferring physical cash control. | Limits overspending provides tangible expense control. | Challenging in a cashless society, less convenient. |

- 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Simple and effective for beginners.

- Zero-Based Budgeting: Every dollar you earn is assigned a job, ensuring income minus expenses equals zero. Great for detailed planners.

- Envelope System: Use cash envelopes for specific spending categories to physically control spending, ideal for managing discretionary expenses.

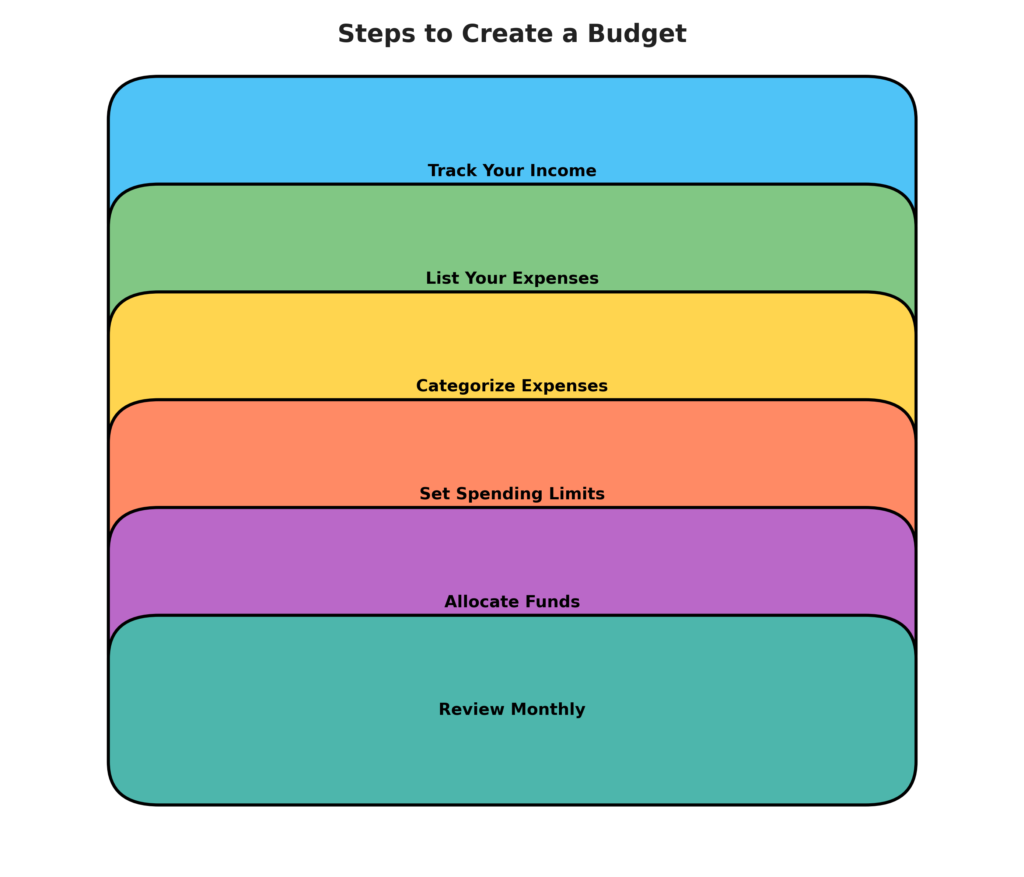

Creating Your Budget Step-by-Step Here’s how to build a budget that works:

- List all income sources: Know exactly how much money you have to work with.

- Categorize expenses: Group spending into categories like housing, transportation, food, entertainment, and savings.

- Set spending limits: Determine reasonable limits based on your income and financial goals.

- Allocate funds: Prioritize essentials and savings before discretionary expenses.

- Review and adjust monthly: Life changes, so should your budget. Regular reviews keep it relevant.

Tips for Sticking to Your Budget Consistency is key. Use these tips to stay on track:

- Automate savings and bill payments: Reduce the risk of late fees and missed savings opportunities.

- Review your budget regularly: Monthly check-ins help you adjust for unexpected expenses.

- Use budgeting apps: Apps provide real-time tracking and spending insights.

- Allow flexibility: Budgeting isn’t about perfection; it’s about progress. Adjust as needed.

- Celebrate small wins: Reward yourself when you hit milestones to stay motivated.

Common Budgeting Mistakes to Avoid Avoid these pitfalls to ensure your budget’s success:

Comparison of Budgeting Methods

- Setting unrealistic goals: Make goals achievable to avoid frustration.

- Ignoring irregular expenses: Plan for occasional costs like car maintenance or medical bills.

- Failing to track spending consistently: Regular tracking prevents overspending.

- Not reviewing and adjusting: Life changes, and so should your budget.

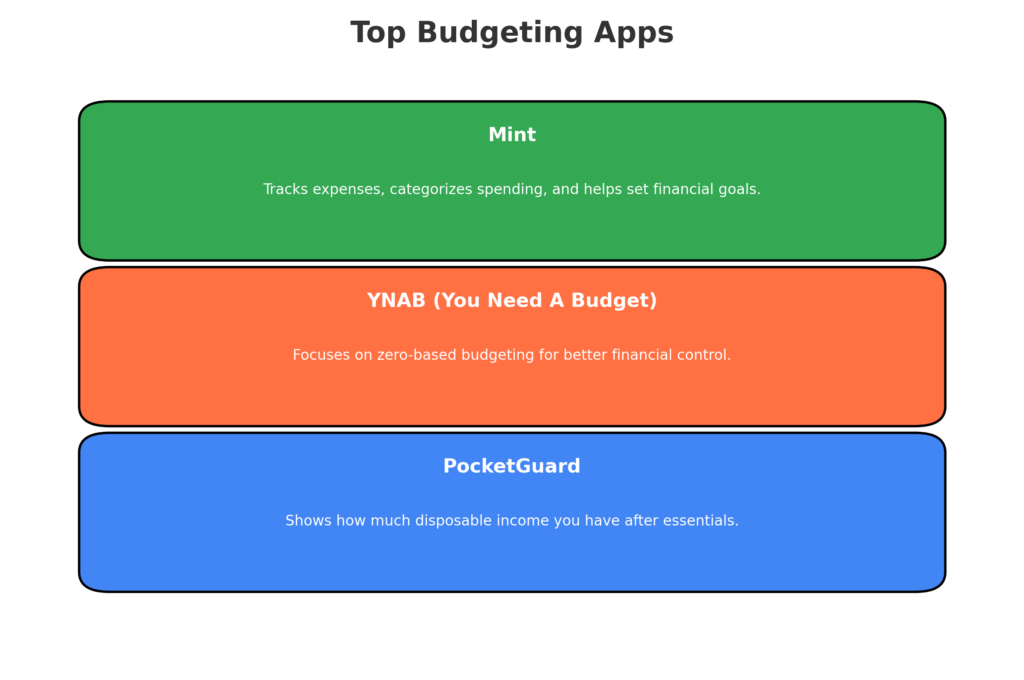

Tools and Apps to Help You Budget Technology can simplify budgeting. Consider these apps:

- Mint: Offers expense tracking, budgeting tools, and financial goal setting.

- YNAB (You Need A Budget): Focuses on zero-based budgeting, perfect for detailed planning.

- PocketGuard: Shows how much disposable income you have after essentials, helping you avoid overspending.

When to Adjust Your Budget, your budget isn’t set in stone. Adjust it when:

- You change jobs: Income fluctuations require spending adjustments.

- You move to a new city: Different cost-of-living impacts your budget.

- Major life events occur: Marriage, a new baby, or starting school affect your finances.

- Emergencies happen: Unexpected expenses may require reallocation of funds.

Benefits of Consistent Budgeting Budgeting regularly leads to lasting financial health:

- Financial independence: Control your money instead of letting it control you.

- Stress reduction: Clear plans reduce financial anxiety.

- Better decision-making: Informed choices lead to smarter spending.

- Achieving goals: Consistency turns dreams into reality.

Conclusion

In conclusion, creating a budget you’ll actually stick to is a journey that starts with small, consistent steps. By applying the practical strategies discussed, you can take control of your finances, reduce stress, and work toward your financial goals with confidence. Remember, the key to budgeting success is flexibility and regular review. Don’t be discouraged by setbacks; instead, learn from them and adjust your budget accordingly.

Are you ready to take charge of your financial future? Start today by reviewing your income and expenses, setting realistic goals, and choosing a budgeting method that fits your lifestyle. Share your budgeting experiences in the comments below or explore more…