Why Americans are ditching traditional budgeting for these modern tools is a reflection of the fast-paced, tech-driven world we live in today. The days of balancing checkbooks and tracking expenses on spreadsheets are fading into the past. Instead, people are turning to innovative apps and platforms that simplify the budgeting process, offer real-time insights, and help them achieve their financial goals faster. With the rise of these tools, managing money has never been easier or more efficient. This shift isn’t just a trend; it’s a transformation in how Americans approach personal finance. In this article, we’ll explore the key reasons behind this change, the benefits of modern budgeting tools, and how they empower individuals to control their financial future.

Table of Contents

The Decline of Traditional Budgeting

Traditional budgeting methods, such as spreadsheets or pen-and-paper tracking, were once the gold standard. Yet, these approaches often come with significant downsides:

- Time-Consuming: Manually updating budgets can be tedious and error-prone.

- Lack of Real-Time Insights: Traditional methods don’t provide an instant view of spending habits.

- Rigid Structure: They lack the flexibility to adapt to today’s dynamic financial needs.

These limitations have paved the way for innovative budgeting solutions that are more aligned with modern lifestyles.

Modern Budgeting Tools Revolutionizing Personal Finance

Modern budgeting tools offer a seamless, user-friendly, and effective way to manage finances. Here’s why they are gaining popularity:

Automation for Effortless Management

Modern tools like Mint, You Need a Budget (YNAB), and EveryDollar automate the budgeting process. They link directly to your bank accounts and categorize transactions, saving time and effort.

| App | Key Features | Pricing | Compatibility |

|---|---|---|---|

| Mint | Expense tracking, bill reminders, goal setting | Free | Web, iOS, Android |

| YNAB (You Need a Budget) | Budgeting, real-time syncing, debt tracking | $14.99/month or $98.99/year | Web, iOS, Android |

| EveryDollar | Basic budgeting, customizable categories, premium plans | Free (Basic), $79.99/year (Premium) | Web, iOS, Android |

Real-Time Financial Insights

With these tools, you can access real-time data about your spending and saving habits. This immediate feedback enables better decision-making and helps users stay on track with their financial goals.

Goal-Oriented Features

Many tools focus on achieving specific financial goals, such as debt repayment, saving for a home, or building an emergency fund. These goal-oriented approaches resonate with Americans looking to improve their financial health.

User-Friendly Interfaces

Apps are designed with simplicity in mind. Clean layouts, intuitive features, and detailed tutorials ensure that even beginners can navigate them easily.

Why Americans Prefer Modern Tools Over Traditional Methods

Convenience and Accessibility

Mobile apps have made budgeting accessible anytime, anywhere. Users no longer need to sit down with a notebook or computer to manage their finances.

Advanced Features

Modern tools offer features like:

- Spending alerts

- Subscription tracking

- Cash flow forecasting

These advanced capabilities provide a comprehensive view of one’s financial landscape, something traditional methods often lack.

Integration with Other Financial Tools

Many modern budgeting platforms integrate with investment accounts, retirement savings, and credit monitoring services. This all-in-one approach simplifies financial management.

Success Stories: Real-Life Examples of Transformation

Case Study 1: A 35-year-old teacher switched from spreadsheets to YNAB and managed to pay off $10,000 in credit card debt within a year by tracking spending meticulously and reallocating funds.

Case Study 2: A young couple used Mint to save for a wedding. By setting clear goals and receiving real-time spending alerts, they saved $15,000 in just 18 months.

How to Choose the Right Budgeting Tool for You

With so many options, finding the perfect tool can be overwhelming. Consider these factors:

- Cost: Some tools are free, while others have subscription fees. Evaluate your budget before committing.

- Features: Identify which features are most important to you, such as goal-setting or debt tracking.

- Ease of Use: Choose a tool with an interface you find intuitive and easy to navigate.

- Security: Ensure the tool uses advanced encryption to protect your financial data.

Making the Transition: Tips for Success

- Start Small: Test a free tool to get comfortable with the features.

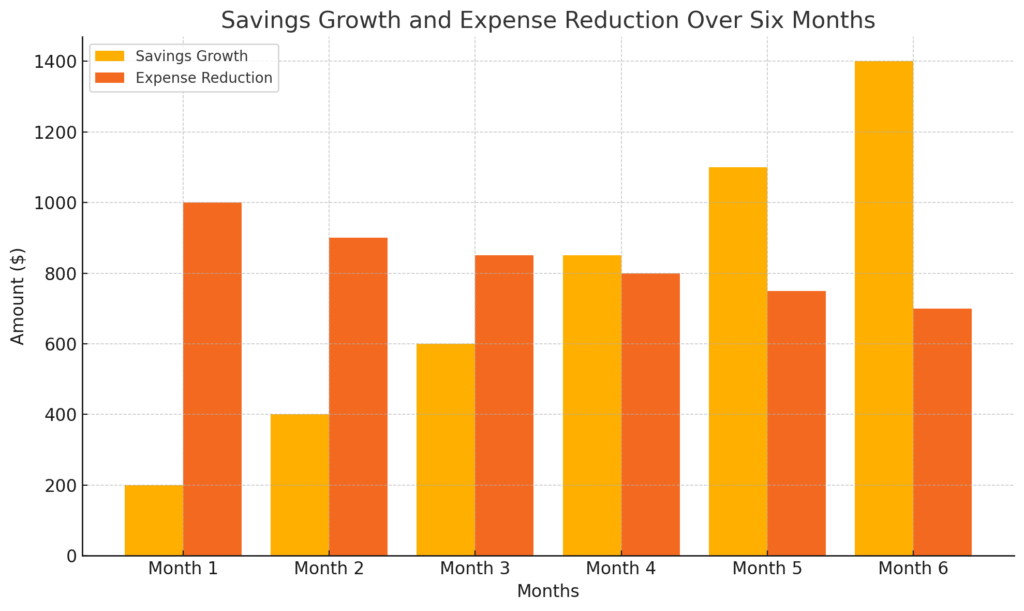

- Set Realistic Goals: Focus on manageable objectives like reducing discretionary spending by 10%.

- Review Regularly: Schedule weekly check-ins to review your financial progress.

- Stay Consistent: Consistency is key to building strong financial habits.

Conclusion

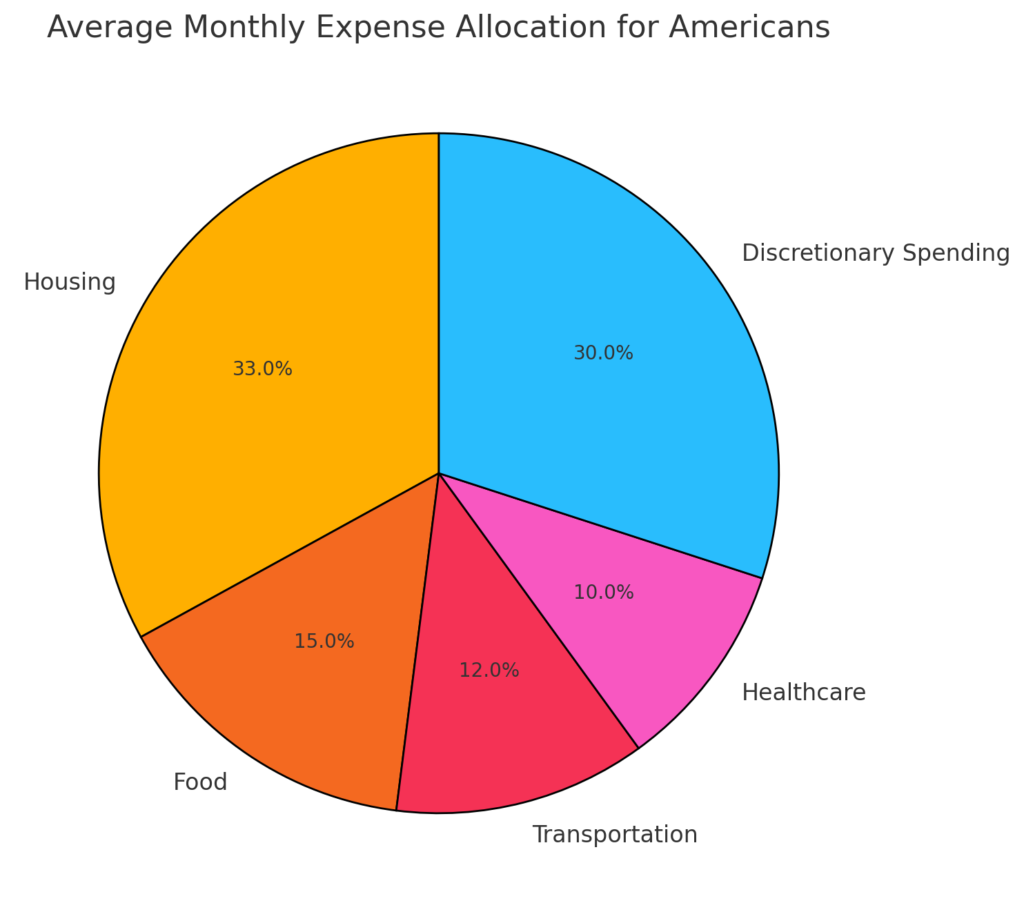

The growing trend of modern budgeting tools is reshaping the way Americans manage their money. With features like automation, real-time insights, and goal-oriented strategies, these tools offer unparalleled convenience and efficiency. According to recent surveys, over 65% of millennials now rely on apps to manage their finances, highlighting the rapid adoption of these solutions.

Why Americans are ditching traditional budgeting for these modern tools can also be attributed to their ability to integrate seamlessly with other financial platforms, such as investment and savings accounts. This not only simplifies money management but also empowers users to make informed decisions. For example, users report saving up to 20% more annually by leveraging subscription tracking and automated savings features.

By embracing these innovative tools, Americans are moving beyond outdated methods and creating financial plans that adapt to their evolving needs. If you’re ready to take control of your finances, now is the perfect time to explore why Americans are ditching traditional budgeting for these modern tools. Start today and join the growing movement towards smarter, more effective financial management. [FinansieraTrading.com]