Protect Your Wealth Against Inflation

What to include in your portfolio to beat inflation is one of the most pressing concerns for investors looking to preserve and grow their wealth. Inflation steadily erodes purchasing power, making it essential to invest in assets that can outpace rising costs. If you’re worried about how inflation impacts your savings, you’re not alone. With recent economic fluctuations and rising costs of living, smart investment strategies are crucial now more than ever.

Table of Contents

In this guide, we’ll explore the best inflation-proof investments to help you stay ahead financially. Whether you’re an experienced investor or just starting out, understanding which assets can protect and even grow your wealth during inflationary periods is key. From stocks and real estate to commodities and bonds, we’ll break down the most effective ways to shield your portfolio from inflation’s impact. Ready to secure your financial future? Let’s dive in.

Understanding Inflation and Its Impact on Your Investments

Inflation erodes purchasing power, meaning the same amount of money buys fewer goods and services over time. It is essential to build an investment portfolio that not only preserves capital but also generates returns that outpace inflation. Investors should focus on assets that offer inflation-resistant growth, ensuring financial security in the long run.

Key Inflation Data (U.S. Market)

| Year | Inflation Rate (%) | S&P 500 Return (%) |

|---|---|---|

| 2020 | 1.4% | 16.26% |

| 2021 | 7.0% | 26.89% |

| 2022 | 6.5% | -18.11% |

| 2023 | 4.1% | 24.23% |

The data shows how inflation rates fluctuate and how market investments react to economic conditions. A well-balanced portfolio can help mitigate risks.

Stocks: The Power of Equities in Beating Inflation

Why Stocks Are a Strong Hedge Against Inflation

Historically, equities have consistently outperformed inflation over the long term. Companies can pass rising costs onto consumers, helping maintain profit margins and sustaining investor returns.

Best Sectors to Invest In During Inflation

- Energy and Commodities: Companies dealing in oil, gas, and essential commodities benefit from rising prices.

- Technology: High-margin businesses with pricing power thrive in inflationary periods.

- Healthcare: Non-discretionary industry ensuring stable demand regardless of inflation.

- Consumer Staples: Companies offering essential goods like food and hygiene products have steady revenue streams.

Stock Market Performance vs. Inflation (U.S.)

| Sector | Average Annual Return (%) | Inflation Resistance |

| Energy | 8-12% | High |

| Technology | 10-15% | Moderate |

| Healthcare | 7-10% | High |

| Consumer Goods | 6-9% | Moderate |

Real Assets: Real Estate and Commodities as Inflation Hedges

Why Real Estate Is a Strong Inflation Protector

Real estate values and rental income often rise with inflation. Investing in physical properties or Real Estate Investment Trusts (REITs) ensures asset appreciation over time.

Commodities: Investing in Gold, Silver, and Other Resources

- Gold: A historical safe haven during inflationary periods, often appreciating when the U.S. dollar weakens.

- Silver: Used in industries and as a store of value, making it a strong inflation hedge.

- Oil and Gas: Prices tend to rise during inflationary periods, benefiting investors in energy markets.

- Agricultural Commodities: Wheat, corn, and soybeans increase in price, ensuring stable investment returns.

Bonds and Fixed-Income Strategies

Treasury Inflation-Protected Securities (TIPS)

TIPS are government-issued bonds that adjust their principal value based on inflation. They provide a low-risk way to maintain purchasing power.

Corporate Bonds and Floating Rate Bonds

- Corporate Bonds: Investment-grade corporate bonds offer higher yields, helping combat inflation’s impact.

- Floating Rate Bonds: Interest rates adjust periodically, making them attractive during inflation spikes.

Cryptocurrencies: A Modern Hedge Against Inflation?

Bitcoin and other cryptocurrencies have been considered digital gold, offering potential inflation protection. However, volatility makes them riskier compared to traditional assets.

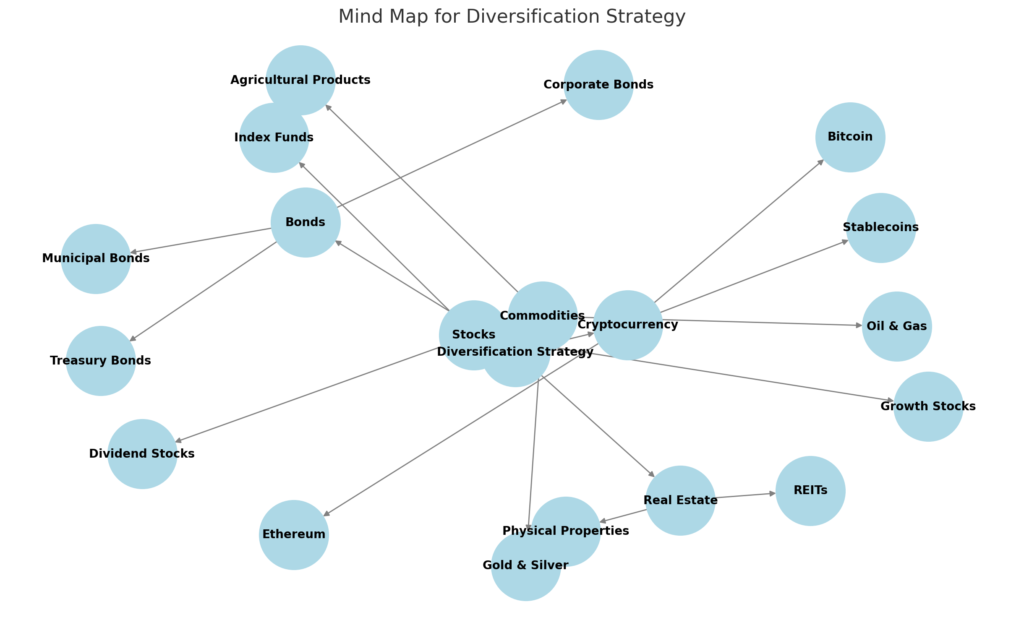

Diversification: The Key to a Resilient Portfolio

A balanced portfolio combining stocks, real estate, commodities, bonds, and alternative investments helps mitigate inflation risks while maximizing returns.

Mind Map for Diversification Strategy

Core Investment Categories:

- Stocks: Growth & inflation hedge

- Real Estate: Asset appreciation

- Bonds: Stability & income

- Commodities: Inflation-resistant assets

- Cryptocurrency: Digital hedge (high risk)

Conclusion: Build a Future-Proof Portfolio

Beating inflation isn’t about quick fixes—it’s about making smart, long-term investment decisions. By incorporating a mix of stocks, real estate, commodities, and fixed-income securities, you can safeguard your financial future against inflation’s impact. Diversification is key to reducing risk while maximizing growth potential.

Understanding how inflation affects different asset classes gives you a competitive edge in securing your financial well-being. The strategies outlined in this post provide a strong foundation to protect and grow your wealth in any economic climate.

Now that you have a roadmap to inflation-proof your portfolio, take action! Evaluate your current investments and consider adjusting them to better withstand economic fluctuations.

Want more expert financial insights? Subscribe to our newsletter for the latest investment tips and trends or share this article with your network to help others navigate inflation with confidence!