Top Dividend Stocks for Passive Income in 2025 are your gateway to financial independence, offering a reliable and consistent way to earn while preserving capital growth. With markets becoming increasingly unpredictable, dividend stocks stand out as a safe haven, providing steady income regardless of economic fluctuations. These stocks allow you to enjoy regular payouts while benefiting from potential stock price appreciation, making them a cornerstone of any smart investment strategy.

Whether you’re a seasoned investor or just starting your journey, understanding the best dividend-paying companies for 2025 can help you build a diversified portfolio that generates income for years to come. In this guide, we’ll break down the top dividend stocks, explore key metrics to evaluate them, and share actionable insights to help you achieve passive income success this year.

Table of Contents

As you plan your investment strategy, focus on the top dividend stocks for passive income in 2025 to secure a sustainable income stream while growing your portfolio’s value. Start today by researching, diversifying, and leveraging tools like DRIPs to maximize your returns. Financial freedom is just a step away with the right dividend investments.

Why Invest in Dividend Stocks?

Dividend stocks are popular among investors for their reliability and consistent payouts. Here are the main benefits:

- Steady Income: Regular dividend payouts act as a source of passive income.

- Potential for Growth: Many dividend-paying companies also show significant stock price appreciation.

- Inflation Hedge: Dividend growth often outpaces inflation rates.

- Reinvestment Opportunities: Dividends can be reinvested to compound returns over time.

Top Dividend Stocks for Passive Income in 2025: Factors to Consider When Choosing Dividend Stocks

To select the best dividend stocks for 2025, evaluate these factors:

- Dividend Yield: The annual dividend payout as a percentage of the stock price.

- Dividend Growth Rate: Consistent increases in dividend payouts over the years.

- Payout Ratio: The percentage of earnings paid as dividends (ideally under 75%).

- Company Stability: Strong financial health and consistent earnings.

- Industry Trends: Choose sectors likely to thrive in 2025, such as technology, healthcare, and energy.

The Top Dividend Stocks for Passive Income in 2025

- Apple Inc. (AAPL)

- Sector: Technology

- Dividend Yield: 0.60%

- Why It’s a Top Pick: Strong financials, consistent growth, and a growing services segment.

- Johnson & Johnson (JNJ)

- Sector: Healthcare

- Dividend Yield: 2.80%

- Why It’s a Top Pick: Reliable earnings, diversified product portfolio, and a 60-year history of dividend growth.

- Exxon Mobil (XOM)

- Sector: Energy

- Dividend Yield: 3.50%

- Why It’s a Top Pick: Stable cash flows, leadership in the energy sector, and potential for growth in renewable energy investments.

- Procter & Gamble (PG)

- Sector: Consumer Goods

- Dividend Yield: 2.50%

- Why It’s a Top Pick: Dominance in consumer products, strong branding, and a 67-year dividend increase streak.

- Coca-Cola (KO)

- Sector: Consumer Staples

- Dividend Yield: 3.10%

- Why It’s a Top Pick: Global market leadership, high brand value, and robust financials.

Chart or Table

| Company | Sector | Dividend Yield | Payout Ratio | Dividend Growth Streak |

|---|---|---|---|---|

| Apple Inc. (AAPL) | Technology | 0.60% | 20% | 10 Years |

| Johnson & Johnson | Healthcare | 2.80% | 55% | 60 Years |

| Exxon Mobil | Energy | 3.50% | 50% | 40 Years |

| Procter & Gamble | Consumer Goods | 2.50% | 65% | 67 Years |

| Coca-Cola | Consumer Staples | 3.10% | 70% | 60 Years |

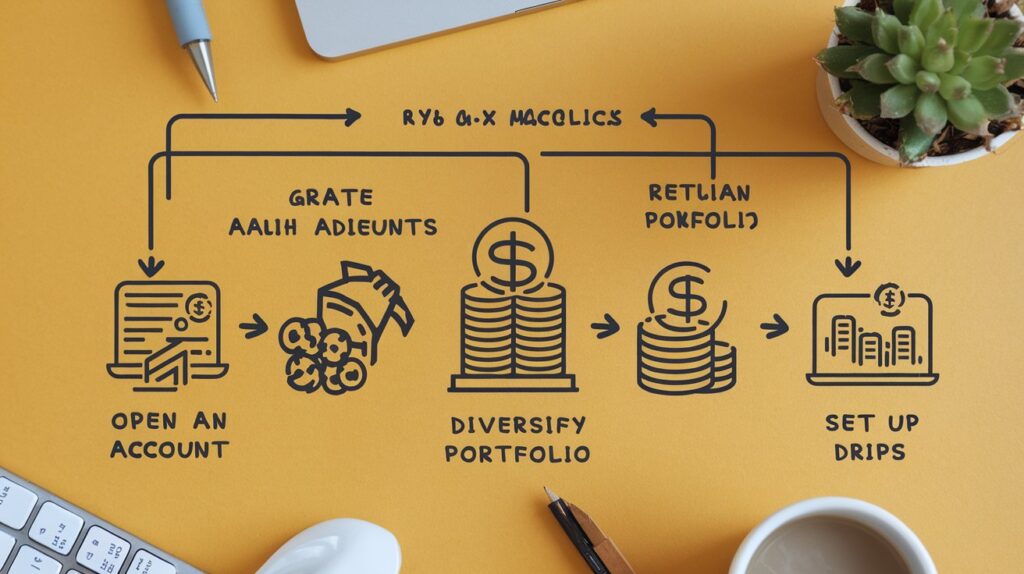

How to Start Investing in Dividend Stocks

- Open a Brokerage Account: Use platforms like Vanguard, Fidelity, or Robinhood.

- Research and Analyze: Evaluate dividend yield, stability, and growth history.

- Diversify: Invest across multiple sectors to minimize risk.

- Set Up Dividend Reinvestment Plans (DRIPs): Reinvest dividends to maximize compounding.

Setting up DRIPs (Dividend Reinvestment Plans) means automatically using the dividends you earn to purchase more shares of the same stock, rather than receiving the dividends as cash. This allows your investment to grow over time through compounding, as you continuously acquire additional shares without incurring extra brokerage fees.

Final Thoughts on Dividend Investing in 2025

Investing in the top dividend stocks for passive income in 2025 is an excellent strategy for building wealth and achieving financial stability. With dividend yields ranging from 0.60% to 3.50%, these stocks provide consistent payouts while also offering growth potential. For example, companies like Johnson & Johnson and Coca-Cola boast decades-long dividend growth streaks, making them reliable choices for long-term investors.

By diversifying your portfolio across sectors such as technology, healthcare, energy, and consumer staples, you minimize risk and position yourself for steady returns. Moreover, reinvesting dividends through DRIPs can significantly amplify your wealth over time.