Why Americans Are Drowning in Debt and How You Can Avoid It is a critical question in today’s economy, where financial pressures are mounting for millions. With the average American household carrying nearly $100,000 in debt, it’s no surprise that debt has become a silent epidemic. From soaring living costs and stagnant wages to the lure of easy credit, the reasons behind this crisis are multifaceted. Yet, while debt can feel overwhelming, it’s not inevitable. By understanding the root causes and adopting proactive financial strategies, you can avoid becoming part of this growing statistic. This article dives deep into why debt has spiraled out of control for so many and offers actionable tips to help you stay financially secure.

Table of Contents

Understanding the Debt Crisis in America

A Snapshot of America’s Debt Problem

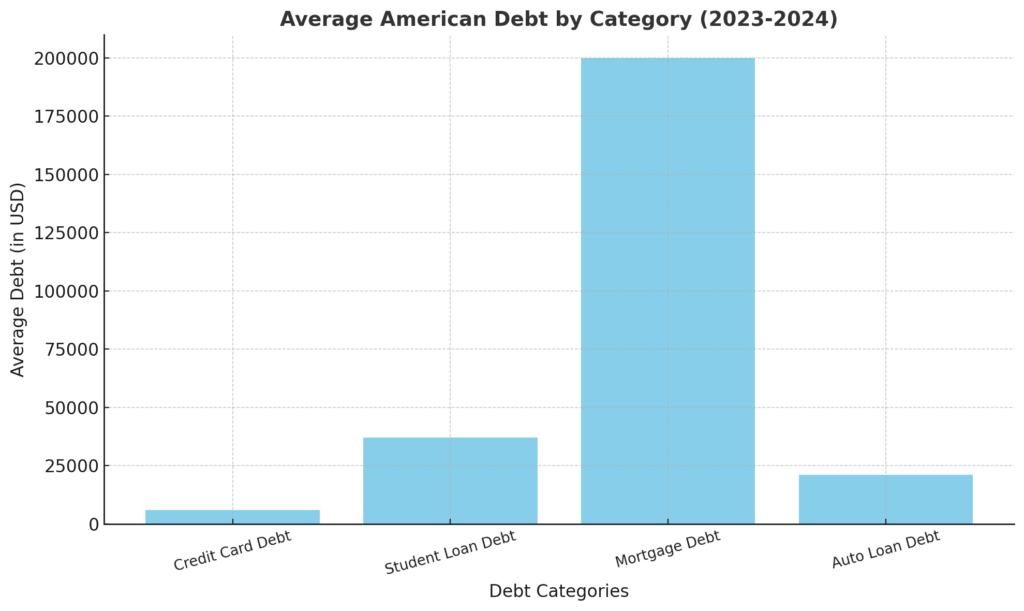

- Credit Card Debt: Americans collectively owe over $1 trillion in credit card balances, with interest rates averaging 20%.

- Student Loans: Total student loan debt exceeds $1.7 trillion, burdening millions of graduates.

- Mortgages and Auto Loans: Housing and car ownership have pushed household debt to all-time highs.

Why Americans Are Drowning in Debt

The Cost of Living Outpaces Wages

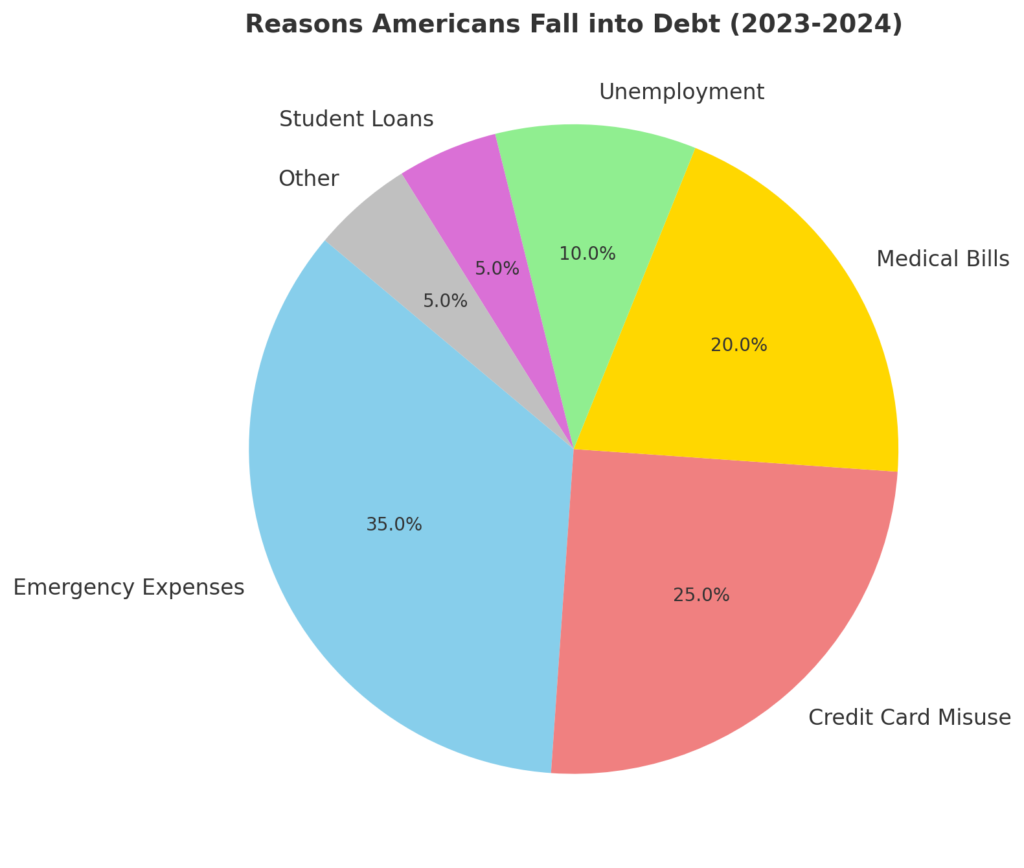

Despite economic growth, wage stagnation has left many struggling to keep up with inflation and rising costs in housing, healthcare, and education.

Easy Access to Credit

The convenience of credit cards and buy-now-pay-later schemes encourages overspending. Marketing tactics often disguise the true cost of borrowing, leading to a cycle of minimum payments and growing interest.

Lack of Financial Literacy

A lack of education on managing money and understanding compound interest often leaves Americans ill-prepared to handle debt effectively.

Emergency Expenses and Medical Bills

With 58% of Americans living paycheck to paycheck, unexpected expenses like medical emergencies or car repairs push individuals into high-interest loans.

The Impact of Debt on Daily Life

Financial Stress

Debt causes significant emotional and mental strain, leading to anxiety, depression, and strained relationships.

Limited Opportunities

High debt-to-income ratios prevent individuals from qualifying for loans, buying homes, or starting businesses.

Long-Term Economic Struggles

Debt often delays retirement savings, leaving Americans vulnerable in their later years.

How You Can Avoid Drowning in Debt

Create a Budget and Stick to It

Track every dollar you earn and spend. Use budgeting apps to automate the process and identify areas where you can cut back.

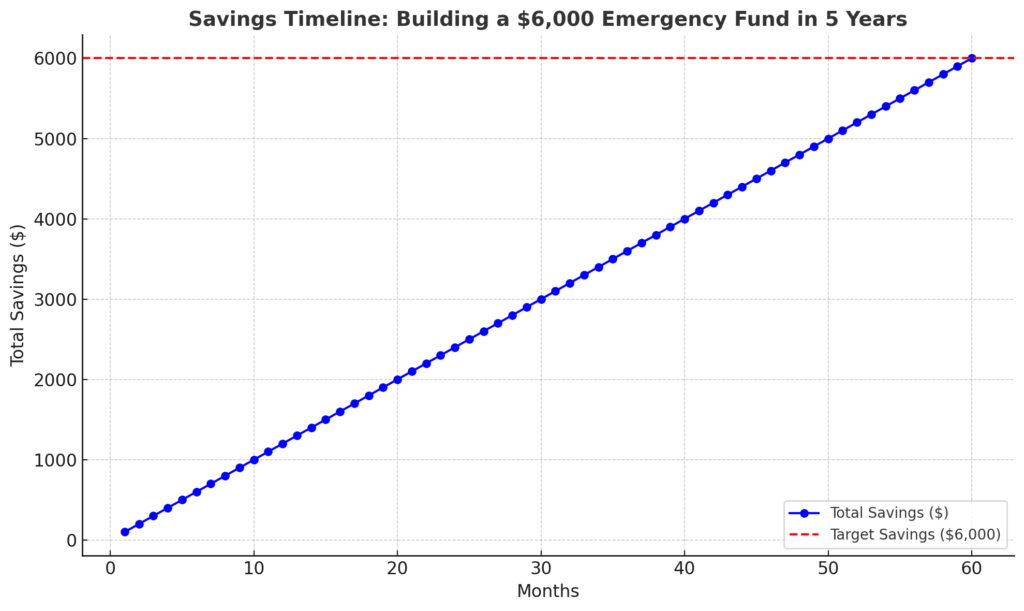

Build an Emergency Fund

Aim to save 3-6 months’ worth of expenses to cover unexpected costs without resorting to loans or credit cards.

Educate Yourself About Finances

Read books, attend workshops, or follow reputable financial blogs to gain insights into smart money management.

Pay Down High-Interest Debt First

Use the debt snowball or avalanche method to focus on eliminating high-interest debts before others.

Limit Credit Card Usage

Only charge what you can pay off in full each month. Avoid carrying a balance to minimize interest costs.

Real-Life Success Stories

Sarah’s Inspiring Journey to Becoming Debt-Free

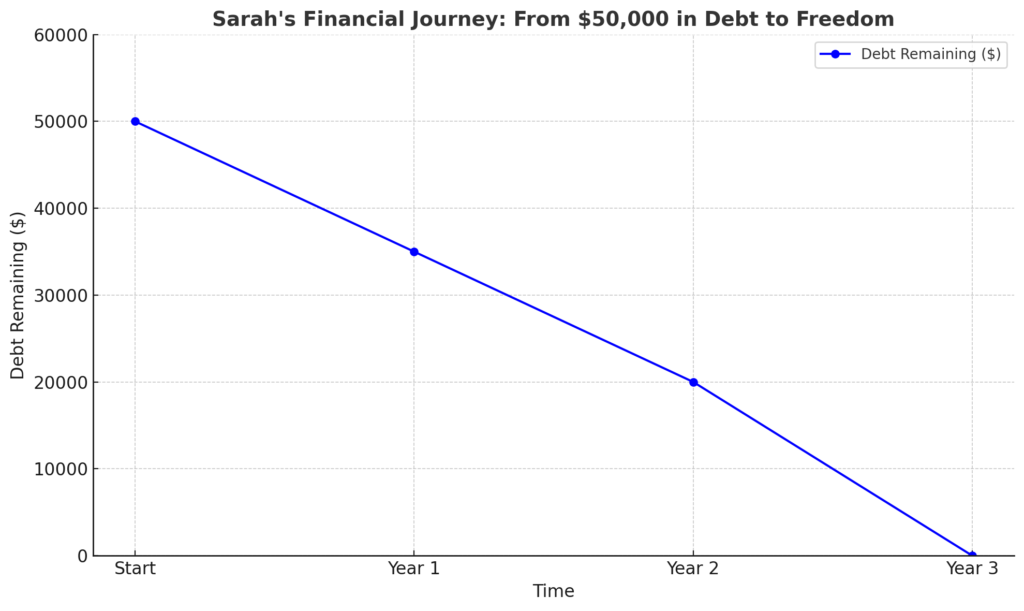

Three years ago, Sarah, a 35-year-old middle school teacher, was drowning in $50,000 of debt. Between credit cards, student loans, and a car loan, she felt trapped. But with determination and a clear plan, she turned her financial life around.

Sarah started by creating a detailed budget, cutting unnecessary expenses, and using the debt snowball method to tackle her debts one at a time. She also picked up a side hustle tutoring students, which added $1,000 monthly to her income, and sold unused items around her house, earning an extra $3,000 over three years.

Staying disciplined, Sarah avoided temptations like expensive dinners and vacations, instead finding budget-friendly ways to socialize. She tracked her progress with a visual chart, which kept her motivated.

In just three years, Sarah paid off all $50,000. “Making that final payment felt like freedom,” she says. Today, she’s saving for her first home and inspiring others with her story. Sarah’s journey proves that with a solid plan and determination, becoming debt-free is possible for anyone.

Tools and Resources for Debt Management

- Debt Calculators: Tools to estimate payoff timelines and interest costs.

- Budgeting Apps: Options like Mint or YNAB to simplify expense tracking.

- Financial Advisors: Professional guidance for complex debt situations.

Here’s a comparison of popular budgeting apps based on their features, cost, and user ratings:

| App Name | Key Features | Cost | User Ratings |

|---|---|---|---|

| YNAB (You Need A Budget) | – Zero-based budgeting approach – Real-time syncing across devices – Goal tracking and detailed reports – Educational resources and workshops | $14.99/month or $109/year after 34-day trial | – iOS: 4.8/5 based on 52K+ reviews – Android: 4.7/5 based on 19K+ reviews |

| Simplifi by Quicken | – Personalized spending plan – Real-time updates on spending – Customizable watchlists for tracking – Investment tracking | $35.88/year (50% off discount included) | – iOS: 4.2/5 based on 3.9K+ reviews – Android: 4.0/5 based on 2.3K+ reviews |

| PocketGuard | – “In My Pocket” feature shows disposable income – Automatic categorization of expenses – Subscription tracking – Bill negotiation services | Free version; Plus is $12.99/month or $74.99/year | – iOS: 4.6/5 based on 7K+ reviews – Android: 3.7/5 based on 2K+ reviews |

| Goodbudget | – Envelope budgeting system – Syncs across multiple devices – Debt payment tracking – Reports on income and spending | Free version; Premium is $10/month or $80/year | – iOS: 4.6/5 based on 12K+ reviews – Android: 3.9/5 based on 19K+ reviews |

| EveryDollar | – Zero-based budgeting method – Expense tracking – Connects to bank accounts (paid version) – Customizable spending categories | Free version; Premium is $17.99/month or $79.99/year | – iOS: 4.7/5 based on 67K+ reviews – Android: 3.9/5 based on 11K+ reviews |

Conclusion

Why Americans Are Drowning in Debt and How You Can Avoid It is not just a personal challenge; it reflects a larger economic and societal issue. Over 77% of households in the U.S. carry some form of debt, with the average American owing $96,371. This financial burden impacts not only individual lives but also the broader economy, as high levels of debt reduce consumer spending, hinder savings, and delay major life goals like homeownership and retirement.

However, the good news is that you can take proactive steps to avoid falling into this cycle. By prioritizing financial literacy, creating a realistic budget, building an emergency fund, and limiting high-interest debt, you can secure a more stable financial future. Remember, Why Americans Are Drowning in Debt and How You Can Avoid It is not a fixed narrative; it’s a wake-up call. With the right tools and strategies, you can break free from the debt trap and build lasting financial resilience.