What to Include in Your Budget to Pay Off Debt Faster: A 2025 Guide to Financial Freedom

Debt is a reality for millions of Americans, with the average household carrying over $104,215 in debt, including credit cards, mortgages, student loans, and auto loans. If you’re looking to break free from the cycle of debt, creating a strategic budget is your first step toward financial freedom. This comprehensive guide will walk you through the essential elements to include in your budget to pay off debt faster, while also providing actionable tips to maximize your efforts.

Table of Contents

Why a Budget is Your Best Tool for Debt Repayment

A budget is more than just a spending plan—it’s a roadmap to financial stability. By allocating your income wisely, you can prioritize debt repayment while still covering essential expenses. According to a 2025 study by the Federal Reserve, households that follow a structured budget are 3x more likely to pay off debt within five years compared to those who don’t.

Step 1: Assess Your Debt Situation

Before you can tackle your debt, you need to understand it. Start by listing all your debts, including:

- Credit card balances

- Student loans

- Mortgages

- Auto loans

- Personal loans

Include the total balance, interest rate, and minimum monthly payment for each. Tools like NerdWallet’s Debt Payoff Calculator can help you visualize your debt and create a repayment plan.

Step 2: Choose the Right Debt Repayment Strategy

Two proven methods can help you pay off debt faster:

- The Snowball Method: Focus on paying off your smallest debts first while making minimum payments on larger ones. This approach provides quick wins and keeps you motivated.

- The Avalanche Method: Prioritize debts with the highest interest rates first. This method saves you money on interest over time.

Choose the strategy that aligns with your financial goals and personality.

Step 3: Build a Zero-Based Budget

A zero-based budget ensures every dollar has a purpose. Here’s how to create one:

- List Your Income: Include all sources of income, such as your salary, side hustles, and freelance work.

- Categorize Your Expenses: Divide your spending into categories like housing, utilities, groceries, transportation, and entertainment.

- Allocate Funds to Debt Repayment: After covering essential expenses, allocate as much as possible toward debt repayment.

| Category | Planned Amount ($) | Actual Amount ($) | Difference ($) |

|---|---|---|---|

| Income | 4000 | 4000 | 0 |

| Rent/Mortgage | 1200 | 1200 | 0 |

| Utilities | 200 | 210 | -10 |

| Groceries | 500 | 480 | 20 |

| Transportation | 300 | 290 | 10 |

| Insurance | 250 | 260 | -10 |

| Debt Payments | 1000 | 1000 | 0 |

| Savings | 300 | 320 | -20 |

| Entertainment | 150 | 160 | -10 |

| Miscellaneous | 100 | 80 | 20 |

Step 4: Cut Unnecessary Expenses

Reducing discretionary spending can free up significant funds for debt repayment. Consider:

- Canceling unused subscriptions (e.g., streaming services, gym memberships).

- Cooking at home instead of dining out.

- Shopping for discounts and using cashback apps.

For example, cutting 100 in monthly expense scan add 100 in monthly expense scan add 1,200 to your debt repayment fund annually.

Step 5: Increase Your Income

Boosting your income is one of the fastest ways to pay off debt. Explore options like:

- Starting a side hustle (e.g., freelancing, tutoring, or selling handmade goods).

- Selling unused items online.

- Negotiating a raise or switching to a higher-paying job.

Step 6: Automate Payments and Track Progress

Automating your debt payments ensures you never miss a due date. Additionally, tracking your progress can keep you motivated. Use apps like YNAB or Mint to monitor your debt repayment journey and celebrate milestones along the way.

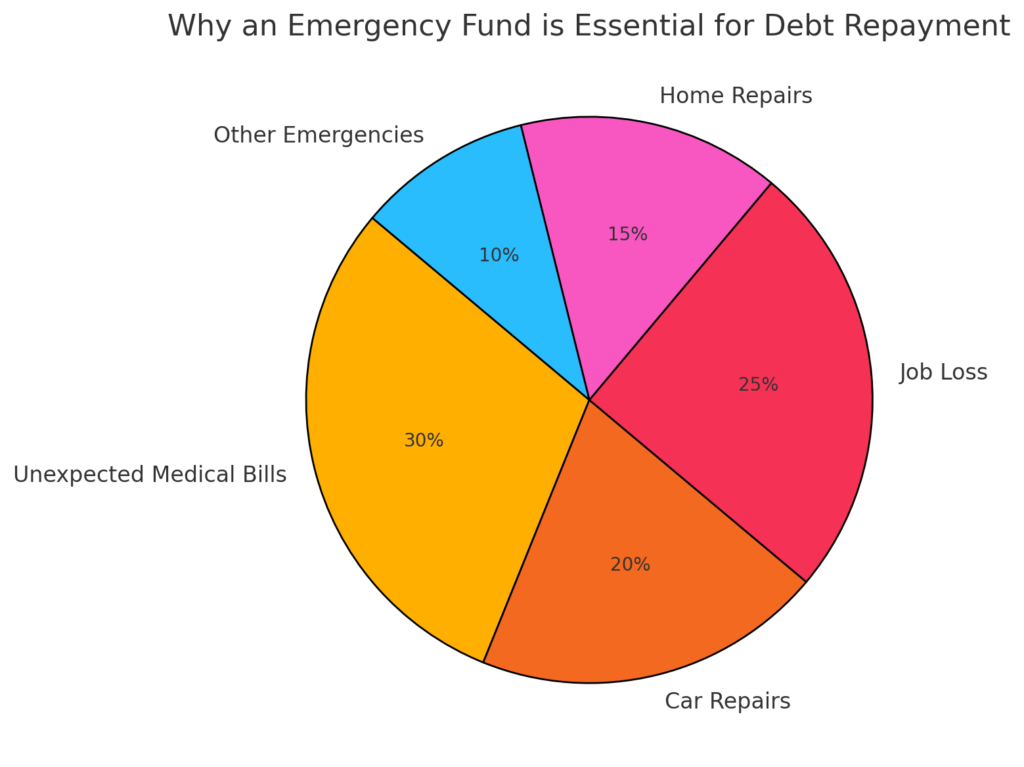

Step 7: Build an Emergency Fund

While focusing on debt repayment, don’t neglect your emergency fund. Aim to save at least $1,000 to cover unexpected expenses without derailing your progress.

Step 8: Seek Professional Help if Needed

If your debt feels overwhelming, consider consulting a financial advisor or credit counselor. They can help you create a tailored debt management plan and negotiate lower interest rates with creditors.

Conclusion

Paying off debt faster is achievable with the right budget and strategy. By understanding your debt, choosing the right repayment method, and making intentional financial decisions, you can take control of your finances and achieve debt-free living. Start today, and your future self will thank you. [FinansieraTrading.com]