What to include in your algorithmic trading setup can be the defining factor between consistent trading success and missed opportunities. Are you equipped with the right tools, strategies, and systems to maximize your trading efficiency? Whether you’re a seasoned trader looking to refine your approach or a beginner eager to dive into the world of algorithmic trading, understanding the essential components of a robust trading setup is crucial.

In this comprehensive guide, we’ll break down the key elements you need to build an effective algorithmic trading system, from reliable hardware to advanced software, data feeds, and risk management techniques. Get ready to optimize your trading performance and make smarter, data-driven decisions.

Table of Contents

Understanding Algorithmic Trading

Algorithmic trading uses computer programs to execute trades based on pre-defined criteria. This approach enhances trading speed, improves accuracy, and reduces the likelihood of human error. Traders rely on algorithms to analyze market conditions, identify trading opportunities, and execute trades automatically.

The benefits of algorithmic trading include the ability to process large volumes of data quickly, eliminate emotional decision-making, and capitalize on market inefficiencies. It’s commonly used in high-frequency trading, arbitrage strategies, and portfolio management.

Core Components of an Algorithmic Trading Setup

1. Reliable Hardware Infrastructure

A strong algorithmic trading setup begins with reliable hardware. Fast processing speeds are critical to execute trades within milliseconds, especially in high-frequency trading environments. Investing in a powerful processor, ample RAM, and a solid-state drive ensures smooth operations.

A stable, high-speed internet connection is equally important to reduce latency and avoid delays in order execution. Additionally, having backup power solutions and redundant internet connections can safeguard against unexpected outages, ensuring uninterrupted trading activities.

2. Advanced Trading Software

The choice of trading software can significantly impact your trading performance. Platforms like MetaTrader and NinjaTrader offer comprehensive features for algorithmic traders, including real-time data analysis, backtesting capabilities, and API integration for custom strategies.

Look for software that is user-friendly, reliable, and compatible with your broker. Advanced analytical tools, charting options, and automated trading functionalities are essential for executing complex strategies with precision.

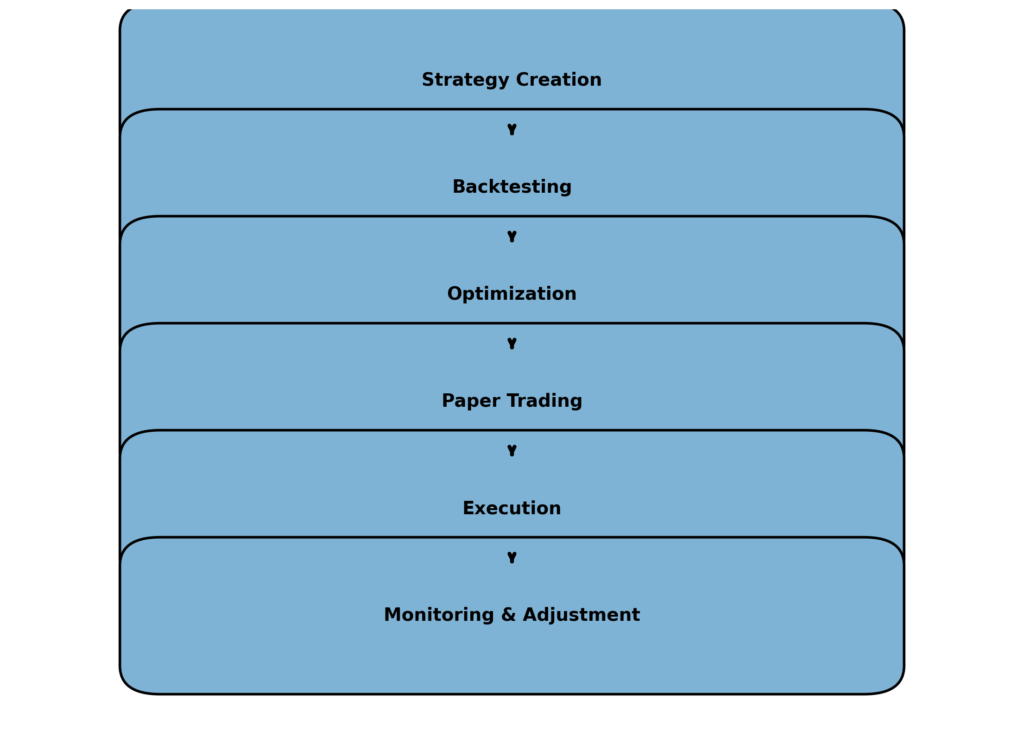

3. Efficient Algorithms and Strategies

Algorithms are the core of algorithmic trading. These pre-programmed instructions dictate how trades are executed based on specific market conditions. Common algorithmic strategies include trend-following, arbitrage, and mean reversion.

Developing efficient algorithms requires a deep understanding of market dynamics, mathematical models, and statistical analysis. Backtesting your strategies using historical data is crucial to assess their effectiveness and optimize performance. Continuous refinement and risk management techniques help in minimizing losses and maximizing gains.

4. Market Data Feed

Access to accurate and timely market data is vital for algorithmic trading. A market data feed provides real-time information on prices, volumes, and market trends, enabling algorithms to make informed decisions.

Traders can choose between real-time and historical data feeds based on their strategy requirements. Real-time data is essential for high-frequency trading, while historical data is valuable for backtesting and strategy development. Partnering with reliable data providers ensures data accuracy and low latency, which are critical for maintaining a competitive edge.

| Features | Real-Time Data | Historical Data |

|---|---|---|

| Latency | Low latency, updates in milliseconds | No latency, data is static |

| Accuracy | Highly accurate for current market conditions | Accurate based on past records |

| Use Case | Ideal for high-frequency and day trading | Used for backtesting and strategy development |

| Cost | Higher due to continuous updates | Lower as it’s archived data |

| Data Volume | Dynamic, constantly changing | Fixed, large datasets |

| Trading Application | Best for live trading decisions | Best for backtesting and analysis |

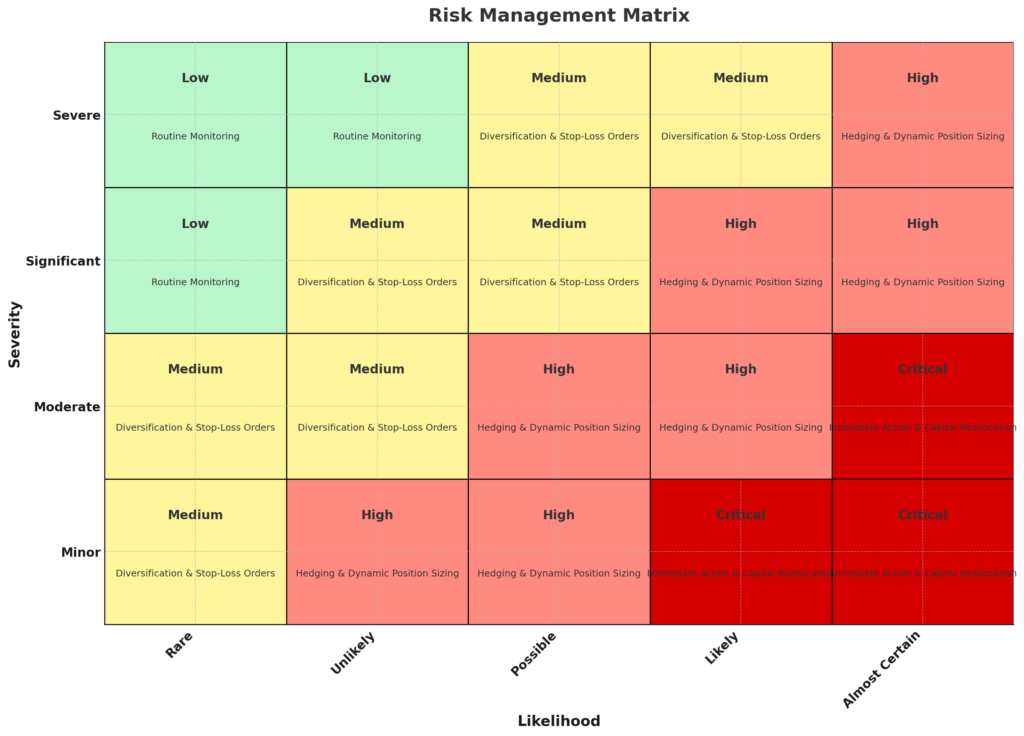

5. Risk Management Tools

Effective risk management is a cornerstone of successful algorithmic trading. Implementing tools like stop-loss and take-profit orders helps in controlling potential losses and securing profits. Diversification strategies reduce exposure to individual assets, mitigating overall risk.

Additionally, continuous monitoring of market conditions and algorithm performance is essential to identify anomalies and make necessary adjustments. Risk assessment models and stress testing can further enhance your ability to manage uncertainties in volatile markets.

6. Regulatory Compliance and Security Measures

Adhering to regulatory requirements and ensuring data security are non-negotiable aspects of algorithmic trading. Different regions have specific regulations governing trading activities, and it’s important to stay compliant to avoid legal issues.

Implementing strong cybersecurity measures protects sensitive information and trading systems from potential threats. Regular audits, secure coding practices, and data encryption are effective ways to safeguard your trading environment. Staying updated on regulatory changes helps in maintaining compliance and mitigating risks.

Optimizing Your Algorithmic Trading Setup

Optimizing your algorithmic trading setup is an ongoing process. Regularly updating software and hardware components ensures peak performance and compatibility with the latest technologies. Analyzing trading performance metrics helps identify areas for improvement and refine strategies.

Incorporating machine learning and artificial intelligence can enhance algorithm adaptability and decision-making capabilities. Continuous learning and adaptation are key to staying competitive in the dynamic world of algorithmic trading.

Conclusion

In conclusion, mastering what to include in your algorithmic trading setup is a journey that begins with small, actionable steps. By implementing the strategies outlined above, you can enhance your trading efficiency, minimize risks, and ultimately achieve greater profitability. Remember, consistency is key—regularly analyzing your performance and updating your setup ensures you stay ahead in the fast-paced trading environment.

We’d love to hear your thoughts on building the perfect algorithmic trading system. Share your experiences or questions in the comments below, and don’t forget to explore related articles on algorithmic trading strategies for deeper insights. If you found this guide helpful, share it with fellow traders and subscribe for more expert tips. [FinansieraTrading.com]

“Success in algorithmic trading isn’t just about having the right tools—it’s about using them wisely and continuously learning.”

For further reading, check out this detailed Investopedia Guide to Algorithmic Trading to deepen your understanding.