Why Passive Investing Beats Active Trading Over Time: A Smarter Approach to Wealth Building

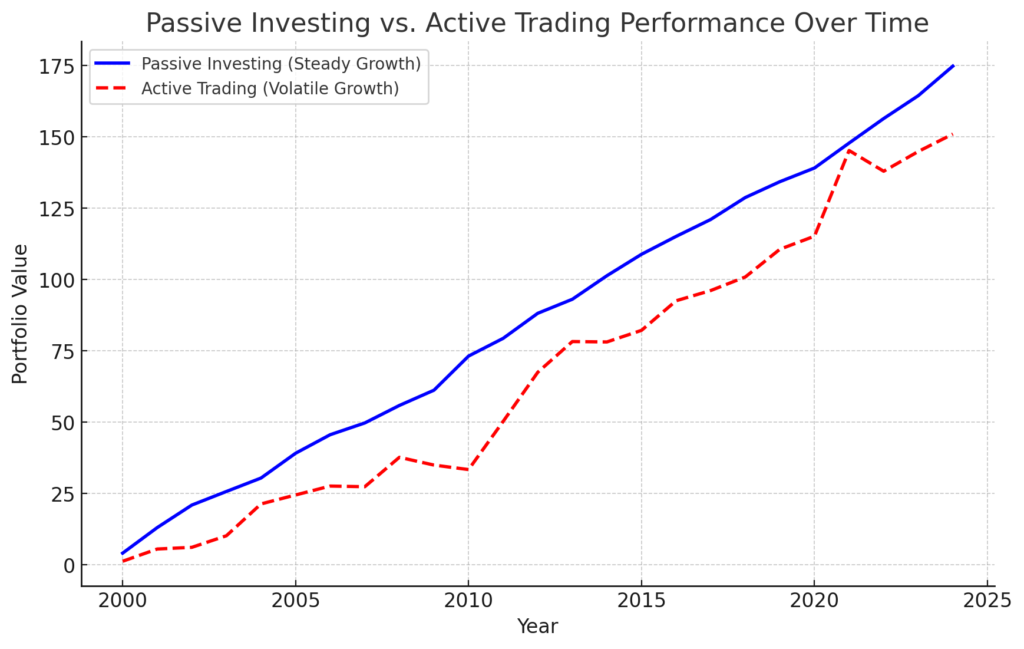

In the world of investing, the debate between passive investing and active trading has been ongoing for years. While both strategies have their place, passive investing has proven to be a more effective and reliable approach for long-term wealth accumulation. Whether you are a beginner investor or a seasoned trader, understanding why passive investing consistently outperforms active trading can help you make smarter financial decisions.

What is Passive Investing?

Passive investing is a strategy that involves buying and holding a diversified portfolio of assets, such as index funds or ETFs (Exchange-Traded Funds), with the goal of tracking the market rather than outperforming it. This approach requires minimal effort and allows investors to grow their wealth over time without frequent buying and selling.

Table of Contents

| Criteria | Passive Investing | Active Investing |

|---|---|---|

| Cost | Lower fees due to minimal trading and management | Higher fees from frequent trades and management |

| Performance | Typically matches market returns over time | Attempts to outperform the market but often fails |

| Risk | Lower risk through diversification and steady growth | Higher risk due to frequent market fluctuations |

| Time Commitment | Minimal time required, long-term focus | Requires constant monitoring and decision-making |

| Tax Efficiency | Fewer taxable events with long-term benefits | Frequent transactions lead to higher tax liabilities |

| Emotional Stress | Less stress due to passive, long-term approach | Higher stress due to market volatility and frequent decisions |

Key Benefits of Passive Investing

1. Lower Costs and Fees

Passive investing comes with significantly lower costs compared to active trading. Index funds and ETFs have minimal management fees because they follow a predetermined market index rather than relying on expensive fund managers. Lower costs mean more of your returns stay in your pocket, helping your investments grow faster.

2. Consistent Long-Term Performance

Studies have shown that passive investments, such as the S&P 500 index, consistently outperform the majority of actively managed funds over extended periods. Many active traders struggle to beat the market consistently, whereas passive investors benefit from steady, compounded growth.

3. Reduced Emotional Decision-Making

Active trading often leads to emotional buying and selling, driven by short-term market fluctuations. Passive investors, on the other hand, follow a disciplined approach by sticking to their investments through market ups and downs, avoiding impulsive decisions.

4. Tax Efficiency

Passive investing generates fewer taxable events compared to active trading. Since passive strategies involve fewer transactions, they result in lower capital gains taxes, allowing investors to maximize their after-tax returns.

5. Diversification for Risk Management

With passive investing, you gain exposure to a wide variety of assets across different sectors, reducing the overall risk. Diversification helps mitigate losses and provides more stable returns over time.

Why Active Trading Falls Short

While active trading can provide short-term gains, it requires constant market analysis, quick decision-making, and higher fees. Many traders struggle to outperform the market consistently, and frequent trades can lead to costly mistakes. Studies reveal that over 80% of active traders fail to beat passive benchmarks in the long run.

How to Get Started with Passive Investing

If you’re looking to build wealth steadily, follow these simple steps:

- Choose Index Funds or ETFs: Look for low-cost funds that track major indices like the S&P 500 or NASDAQ.

- Automate Your Investments: Set up automatic contributions to your investment account to stay consistent.

- Stay the Course: Avoid the temptation to react to short-term market fluctuations and focus on long-term goals.

- Review Periodically: Check your portfolio periodically and rebalance if necessary but avoid excessive changes.

The Future of Passive Investing

As more investors recognize the long-term benefits of passive investing, the trend is expected to continue growing. Financial experts recommend passive strategies as a way to build sustainable wealth with minimal stress and effort.

Why Passive Investing Beats Active Trading Over Time: Conclusion

In conclusion, embracing passive investing as a long-term strategy offers significant advantages overactive trading. From lower costs and consistent returns to reduced risk and emotional resilience, passive investing allows you to build wealth steadily without the stress and unpredictability of constant market monitoring. By investing in diversified index funds and ETFs, you benefit from the overall growth of the market while avoiding the pitfalls of excessive fees and short-term volatility that often accompany active trading.

As financial studies continue to show, the majority of actively managed portfolios fail to outperform their passive counterparts over time. The power of compounding, minimal costs, and a hands-off approach make passive investing a smart choice for individuals looking to secure their financial future with minimal effort. Whether you’re just starting your investment journey or looking to optimize your current strategy, passive investing provides a proven pathway to long-term success.

Now is the perfect time to take control of your financial future. Start by exploring low-cost index funds, setting up automatic contributions, and staying committed to your investment plan. Remember, wealth-building is a marathon, not a sprint, and passive investing can help you reach your financial goals with confidence.

If you found this guide helpful, share it with your friends and family who are looking to simplify their investment approach. Subscribe for more expert insights on making the most of your financial journey. Let us know in the comments – have you experienced the benefits of passive investing in your portfolio? [FinansieraTrading.com]