How to Profit from Market Volatility: A Comprehensive Strategy Guide

Market volatility is often seen as a double-edged sword—while it can be intimidating, it also presents unique opportunities for profit. Have you ever wondered how experienced investors turn market turbulence into financial gains? The secret lies in a well-crafted strategy that combines risk management, smart asset allocation, and disciplined decision-making. In this blog, we’ll break down the essential components of a winning volatility strategy, offering actionable tips to help you navigate uncertain markets and achieve long-term financial growth. Whether you’re a seasoned trader or a beginner, this guide will empower you to capitalize on market fluctuations with confidence.

Table of Contents

Understanding Market Volatility

Market volatility refers to the rapid and significant price changes in financial markets. It can be triggered by various factors, such as economic data releases, geopolitical tensions, interest rate adjustments, or shifts in investor sentiment. A popular measure of volatility is the VIX (Volatility Index), often called the “fear gauge,” which reflects the market’s expectation of future volatility. By understanding the drivers of volatility, you can better anticipate market movements and adjust your strategy accordingly.

Why You Need a Volatility Strategy

Without a clear plan, market volatility can lead to emotional decision-making, such as panic selling during downturns or overconfidence during rallies. A well-defined strategy helps you stay disciplined, manage risks, and seize opportunities even in unpredictable conditions. It’s not about avoiding volatility—it’s about leveraging it to your advantage.

Key Components of a Profitable Volatility Strategy

Risk Management Techniques

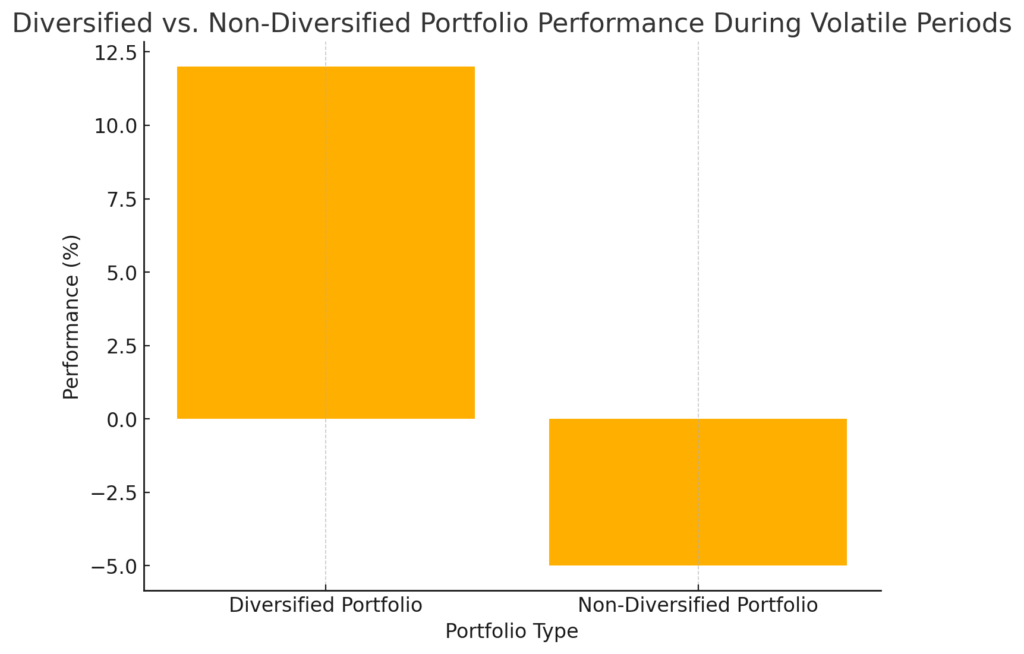

- Diversification: Spread your investments across different asset classes (stocks, bonds, commodities) and sectors to reduce the impact of a single underperforming asset. Diversification acts as a safety net during turbulent times.

- Stop-Loss Orders: Set predefined price levels at which you’ll sell an asset to limit losses. This tool helps you stick to your risk tolerance and avoid emotional decisions.

- Position Sizing: Allocate only a portion of your portfolio to high-risk assets. By controlling the size of each investment, you can minimize the impact of potential losses.

Smart Asset Allocation

- Dynamic Allocation: Adjust your portfolio mix based on changing market conditions. For example, shift toward defensive assets like bonds or gold during high volatility and back to growth assets like stocks during stable periods.

- Safe Havens: Include assets that tend to perform well during market downturns, such as gold, U.S. Treasuries, or cash equivalents. These can provide stability when other investments are under pressure.

Market Timing Strategies

- Trend Following: Identify and invest in assets with strong upward momentum. This strategy aims to capitalize on sustained price movements until signs of reversal appear.

- Contrarian Approach: Go against the crowd by buying undervalued assets during market sell-offs and selling overvalued assets during rallies. This requires patience and a strong understanding of market cycles.

Comparative Table: Trend-Following vs. Contrarian Strategies

| Strategy | Approach | Key Benefit | Risk | Ideal Market Condition |

|---|---|---|---|---|

| Trend-Following | Invests in assets with strong upward trends, riding the momentum. | Captures gains during sustained market movements. | May enter late in a trend, risking reversals. | Strong, clear trends (bull or bear markets). |

| Contrarian | Buys when others are fearful and sells when others are greedy, going against market trends. | Takes advantage of market overreactions for high returns. | Can experience losses if the market doesn’t revert as expected. | Highly volatile markets with frequent sentiment shifts. |

Technical and Fundamental Analysis

- Technical Indicators: Use tools like moving averages, Relative Strength Index (RSI), and Bollinger Bands to identify entry and exit points based on price patterns and trends.

- Fundamental Analysis: Evaluate an asset’s intrinsic value by analyzing financial statements, economic indicators, and industry trends. This approach helps you make informed, long-term investment decisions.

Psychological Preparedness

- Emotional Control: Avoid making impulsive decisions driven by fear or greed. Stay focused on your strategy and long-term goals.

- Patience and Discipline: Resist the urge to overtrade or deviate from your plan during short-term market swings. Consistency is key to success in volatile markets.

Real-World Examples of Successful Strategies

- During the 2008 financial crisis, investors with diversified portfolios and a focus on risk management were better positioned to recover losses compared to those who panicked and sold off assets.

- Trend-following strategies have historically performed well in bull markets, while contrarian approaches have thrived during market recoveries after significant downturns.

Common Mistakes to Avoid

- Overtrading: Excessive buying and selling can lead to high transaction costs and erode returns.

- Neglecting Research: Failing to analyze market conditions or asset fundamentals can result in poor investment decisions.

- Ignoring Strategy Adjustments: Markets evolve, and so should your strategy. Regularly review and update your plan to stay aligned with your goals.

Practical Tips for Ongoing Success

- Continuous Learning: Stay informed about market trends, economic developments, and new investment tools.

- Regular Portfolio Reviews: Periodically assess your portfolio to ensure it aligns with your risk tolerance and financial objectives.

- Stay Updated: Follow reputable financial news sources and seek expert insights to make informed decisions.

Conclusion

Profiting from market volatility isn’t about luck—it’s about having a clear, disciplined strategy. By incorporating risk management, smart asset allocation, and psychological preparedness, you can turn market uncertainty into a source of opportunity. Take the time to review your current approach, identify areas for improvement, and implement these proven techniques.

Call to Action:

What’s your experience with market volatility? Share your insights in the comments below! If you found this guide helpful, don’t forget to share it with others. For more in-depth strategies, check out Investopedia’s / FinansieraTrading.com.