What to Include in a High-Yield Savings Account Strategy: Maximize Your Savings in 2025

High-yield savings account strategies are the cornerstone of smart financial planning in 2025. With interest rates fluctuating and inflation impacting purchasing power, knowing how to optimize your savings is more critical than ever. This comprehensive guide will walk you through the best strategies to grow your savings, highlight top high-yield savings accounts, and provide actionable tips to ensure your money works harder for you.

Table of Contents

Why a High-Yield Savings Account Strategy is Essential in 2025

High-yield savings accounts (HYSAs) offer significantly higher interest rates than traditional savings accounts, making them a must-have tool for savvy savers. In 2025, the top HYSAs offer annual percentage yields (APYs) ranging from 4.75% to 6.35%, far exceeding the national average of 0.43%. However, simply opening an account isn’t enough. To truly benefit, you need a well-rounded strategy that includes:

Comparison of Top High-Yield Savings Accounts in 2025

| Bank Name | APY (Interest Rate) | Monthly Fees | Minimum Balance Required | Best For |

|---|---|---|---|---|

| Ally Bank | 4.20% | None | $0 | Overall best savings account |

| Marcus by Goldman Sachs | 4.15% | None | $0 | High APY and no fees |

| American Express HYSA | 3.90% | None | $0 | Reliable customer service |

| Discover Bank | 4.00% | None | $0 | No withdrawal limits |

| SoFi Bank | 4.00% | None | $0 | No minimum balance |

| CIT Bank | 4.05% | None | $100 | Best for tiered savings |

| Synchrony Bank | 3.85% | None | $0 | Flexibility and ATM access |

Researching the Best Rates: Use comparison tools to find accounts with the highest APYs and minimal fees. For example, Pibank and Openbank currently offer 4.75% APY, while credit unions like DCU offer rates as high as 6.17% on smaller balances.

Understanding Fees and Requirements: Some accounts require minimum balances or have hidden fees. For instance, Fitness Bank requires a $100 minimum balance and tracks your daily steps to qualify for its highest rate.

Diversifying Your Savings: While HYSAs are great for emergency funds or short-term goals, consider diversifying into certificates of deposit (CDs) or money market accounts for long-term growth.

Automating Savings: Set up automatic transfers to ensure consistent contributions to your HYSA.

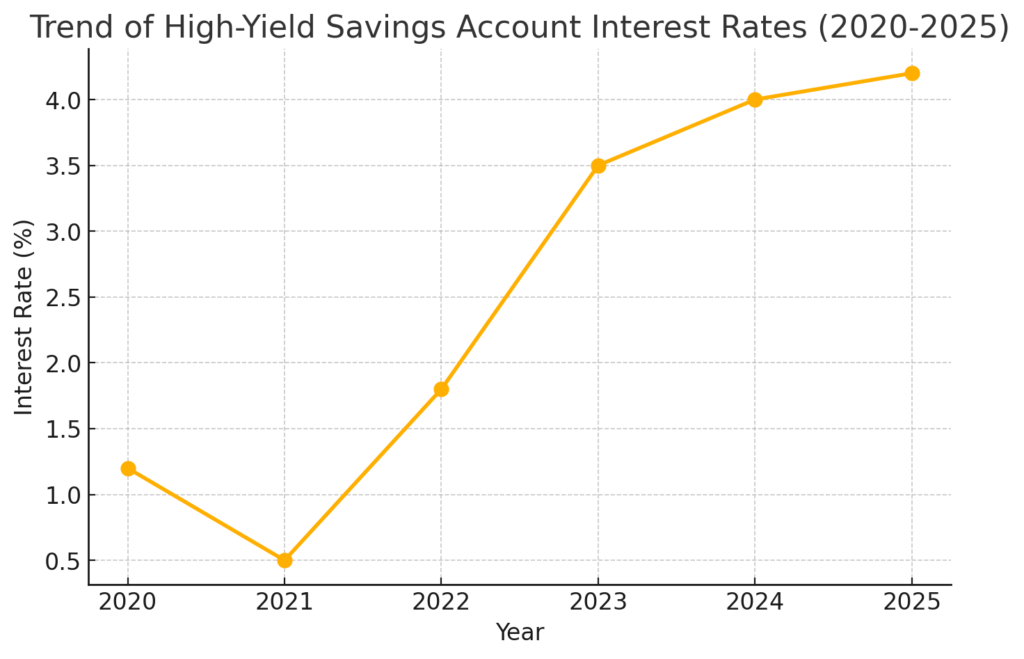

Monitoring Rate Trends: With the Fed expected to cut rates further in 2025, staying informed about rate changes can help you decide when to switch accounts or lock in higher rates with a CD.

Trending Insights on High-Yield Savings Accounts

Recent trends show a surge in interest in HYSAs as savers look for ways to combat inflation and grow their money safely. Articles from Forbes, Investopedia, and CNBC highlight the importance of choosing accounts with no fees, strong digital tools, and competitive rates. For example, SoFi offers a combined checking and savings account with a 4.20% APY and a $300 bonus for setting up direct deposits, making it a popular choice for tech-savvy savers. [FinansieraTrading.com]