Why Tracking Your Expenses Is the Secret to Building Wealth might sound like a simple concept, but it’s a game-changer for anyone serious about achieving financial success. Every dollar you earn has the potential to either bring you closer to your goals or slip away unnoticed. By keeping a close eye on your spending habits, you gain control over your finances, identify unnecessary expenses, and make smarter decisions about where your money goes.

Studies reveal that people who consistently track their expenses are more likely to stick to budgets, avoid debt, and build substantial savings over time. Whether your goal is to pay off debt, save for a dream home, or invest in the future, tracking your expenses is the first and most crucial step in your wealth-building journey. In this article, we’ll explore why expense tracking is so impactful, how to get started, and how this small habit can transform your financial life.

Table of Contents

The Importance of Expense Tracking

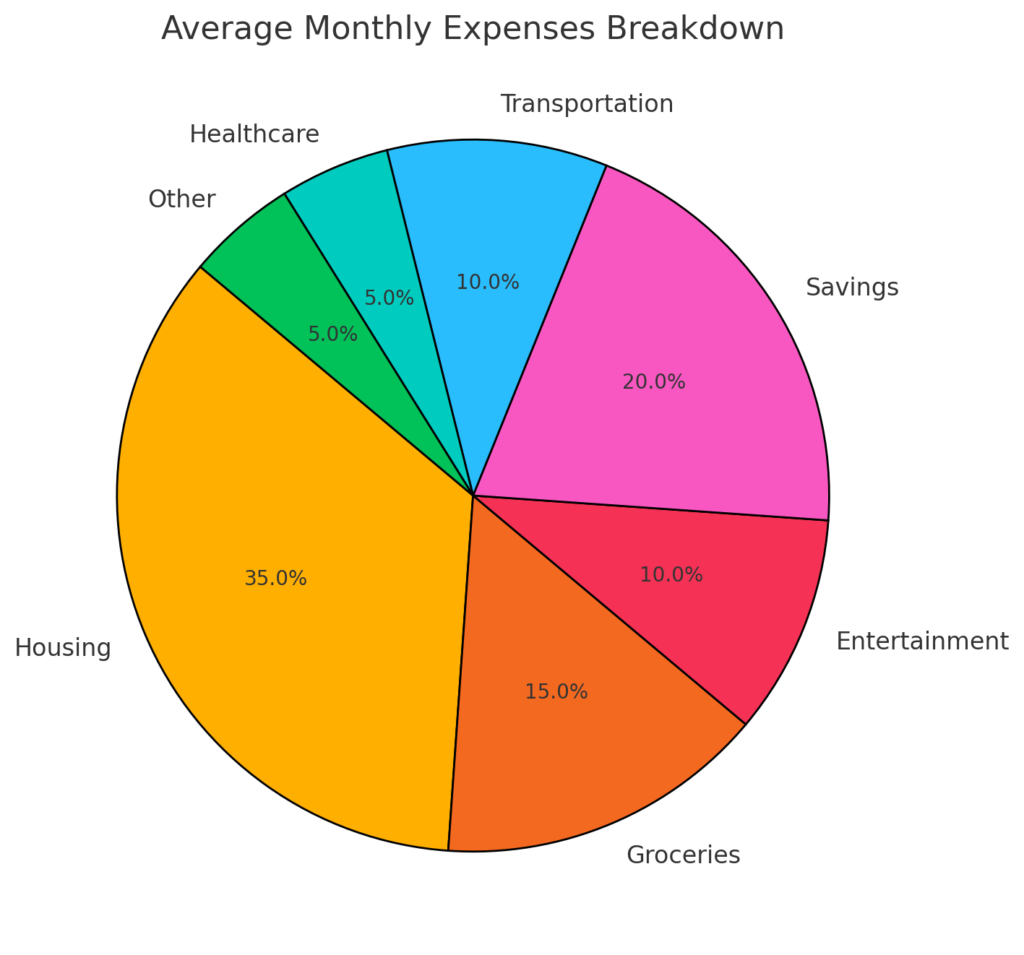

Tracking your expenses is more than recording numbers—it provides insights into your spending patterns and highlights areas where you can cut costs. Here’s why it matters:

- Increases Awareness: Knowing where your money is going prevents overspending.

- Helps Set Realistic Budgets: By analyzing past expenses, you can create achievable budgets.

- Reduces Financial Stress: Financial clarity lowers anxiety about unexpected expenses.

The Psychological Shift: From Spending to Saving

Tracking expenses helps cultivate a saving mindset. When you see how small purchases accumulate, you’re more likely to prioritize needs over wants.

- Example: That $5 coffee every day? It adds up to $1,825 annually.

- Behavioral Change: Awareness encourages better financial habits, like cooking at home instead of dining out.

Tools and Techniques for Effective Expense Tracking

Gone are the days of manual logging. Today’s technology makes expense tracking seamless.

- Budgeting Apps: Tools like Mint or YNAB help automate expense categorization.

- Spreadsheets: For detail-oriented individuals, spreadsheets allow customization.

- Bank Statements: Many banks provide categorized monthly spending summaries.

| App Name | Key Features | Pricing |

|---|---|---|

| Mint | Expense tracking, budgeting, and bill reminders | Free |

| YNAB (You Need A Budget) | Detailed budgeting, goal tracking, and proactive planning | $8/month (after free trial) |

| PocketGuard | Spending limits, savings goals, and automatic categorization | Free (Premium: $3.99/month) |

| Personal Capital | Investment tracking, net worth analysis, and retirement planning | Free (Wealth management fees may apply) |

| Goodbudget | Envelope budgeting system for families or individuals | Free (Premium: $7/month) |

How Tracking Expenses Contributes to Building Wealth

Expense tracking plays a pivotal role in achieving financial goals:

- Identifying Wasteful Spending: Pinpoint subscriptions or habits that don’t add value.

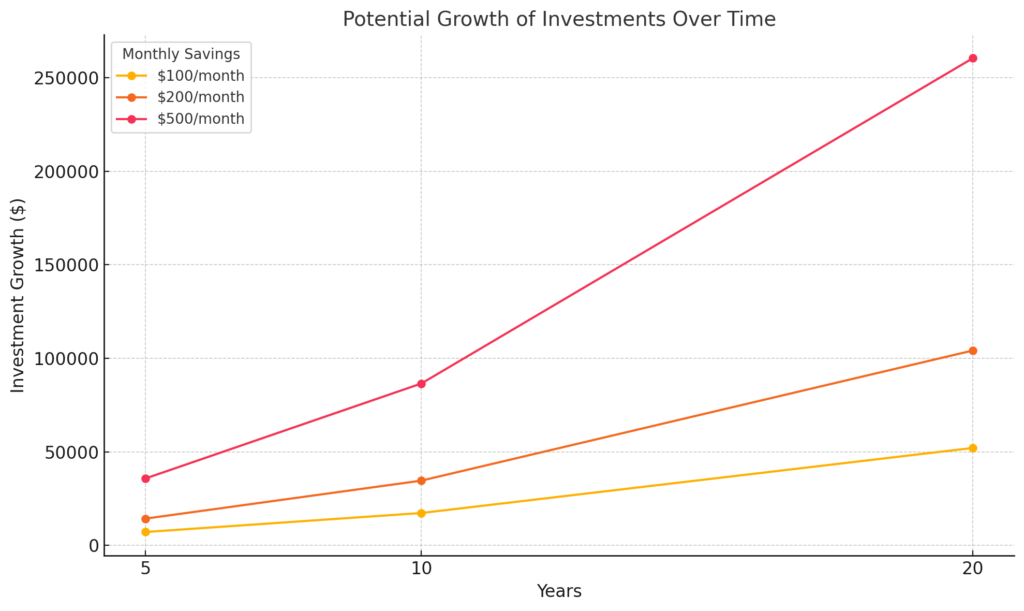

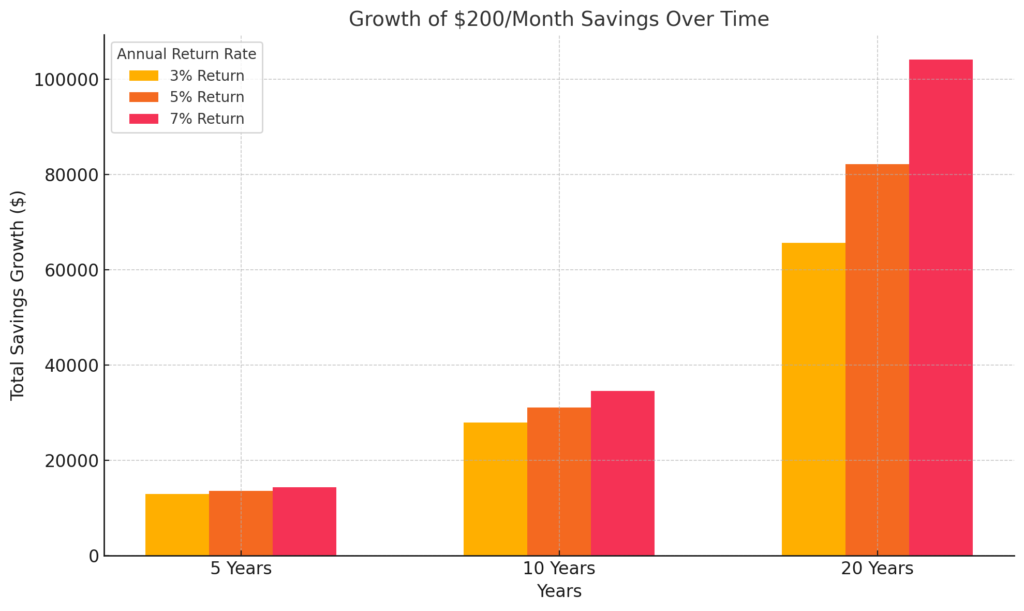

- Redirecting Savings to Investments: Use the money saved for investments with compounding benefits.

- Reaching Long-Term Goals: Whether it’s buying a house or retiring early, expense tracking ensures you’re on track.

Column Suggestion:

| Expense Type | Potential Cuts | Savings Redirected To |

|---|---|---|

| Dining Out | Cook at home | Emergency Fund or Roth IRA |

| Subscription Services | Cancel unused ones | High-Yield Savings Account |

| Impulse Purchases | Budget beforehand | Stock Market or Mutual Funds |

Common Mistakes in Expense Tracking (and How to Avoid Them)

Even seasoned budgeters make errors in tracking expenses.

- Mistake 1: Forgetting Small Purchases: Solution—track every cent, even minor buys.

- Mistake 2: Inconsistent Tracking: Solution—dedicate 5 minutes daily to log expenses.

- Mistake 3: Ignoring Categories: Solution—review spending patterns monthly and adjust as needed.

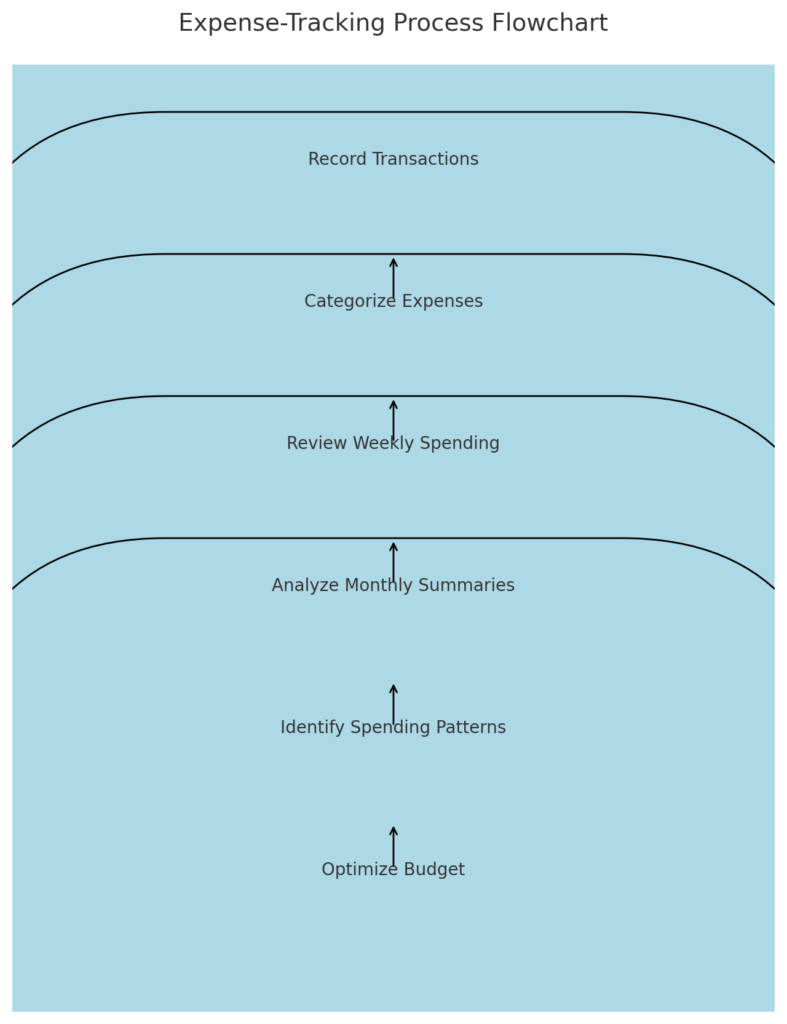

How to Start Tracking Your Expenses Today

Getting started is easier than you think:

- Choose Your Method: Pick an app, spreadsheet, or notebook.

- Track Everything: Record every expense for one month.

- Analyze and Adjust: Look for trends and make changes to align spending with goals.

- Set Milestones: Celebrate small wins, like saving $500 or cutting dining costs by 20%.

Success Stories: Real-Life Examples of Wealth Building

- Case Study 1: A couple reduced dining-out expenses by $200/month and invested it in index funds, growing their portfolio by $15,000 in five years.

- Case Study 2: A single professional tracked expenses and realized she was spending $300/month on unused subscriptions. Redirecting that to a retirement account earned her an additional $3,600 in two years.

The Role of Discipline and Consistency

Tracking expenses isn’t a one-time task; it requires ongoing commitment.

- Set reminders to review budgets weekly.

- Update your expense records regularly.

- Involve family members in the tracking process for collective accountability.

Conclusion

Why Tracking Your Expenses Is the Secret to Building Wealth is not just a catchy phrase—it’s a proven strategy backed by financial experts and successful wealth builders. Studies show that individuals who consistently track their expenses save 20-30% more than those who don’t. For example, reallocating $300 monthly from unnecessary spending to investments can grow to over $100,000 in 20 years, assuming an average annual return of 7%.

By regularly tracking your expenses, you not only uncover hidden spending habits but also gain the power to redirect those funds toward wealth-building opportunities like savings accounts, stock portfolios, or real estate. Without this foundational step, achieving financial freedom becomes significantly harder.

Start tracking your expenses today, leverage tools and techniques that work best for you, and witness how this small habit can transform your financial future. Remember, Why Tracking Your Expenses Is the Secret to Building Wealth lies in its ability to create clarity, discipline, and actionable insights for long-term prosperity. [FinansieraTrading.com]