What to include in your money management system for long-term success? It’s a question more people are asking as they strive for financial security in an unpredictable economy. Whether you’re looking to pay off debt, grow your savings, or invest for the future, having a structured money management system is the key to achieving your financial goals. In this guide, we’ll break down the essential components of a successful system—from budgeting and saving to investing and debt management—and show you how to create a plan that sets you up for long-term financial success. Get ready to take control of your money and build a secure financial future.

Table of Contents

The Importance of a Money Management System

A comprehensive money management system isn’t just about tracking expenses—it’s about creating a roadmap for financial growth. It helps you allocate resources effectively, avoid debt, and achieve your financial goals.

Key Components of a Money Management System for Long-Term Success

Budgeting: The Foundation of Financial Success

Creating a realistic budget is the cornerstone of any money management system. Track your income, categorize expenses, and ensure you live within your means. Use budgeting apps like Mint or YNAB for better tracking and management.

Emergency Fund: Preparing for the Unexpected

An emergency fund acts as a financial cushion during unforeseen events like medical emergencies or job loss. Aim to save at least 3-6 months’ worth of living expenses in a high-yield savings account.

Saving Strategies: Building Wealth Over Time

Regular saving habits contribute significantly to long-term success. Automate your savings to ensure consistency, and explore options like certificates of deposit (CDs) or money market accounts for better returns.

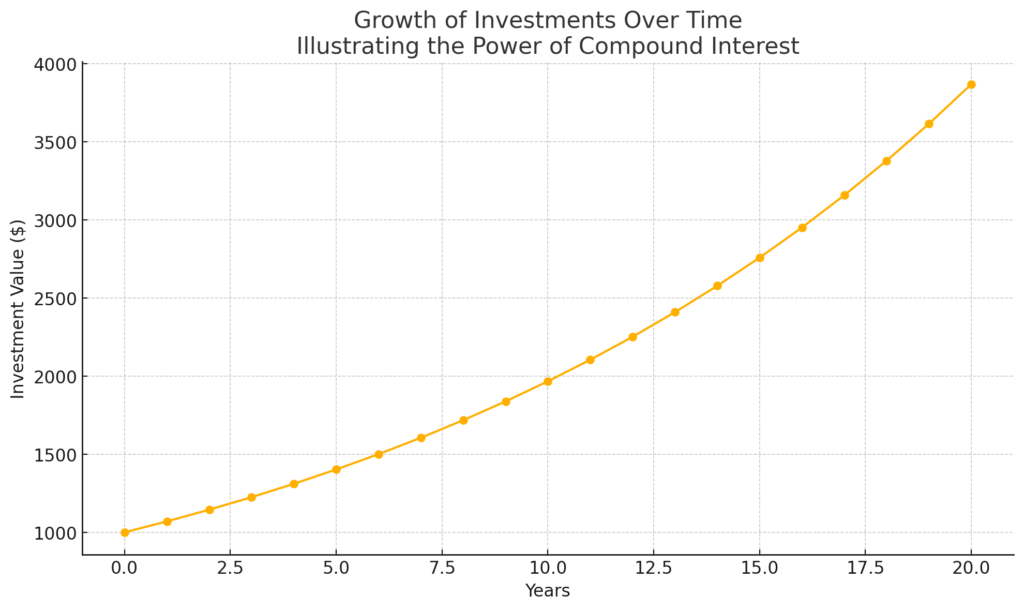

Investing Wisely: Growing Your Money

Investing is key to building wealth over time. Diversify your portfolio across stocks, bonds, and mutual funds to minimize risk. Consider consulting a financial advisor or using platforms like Vanguard or Fidelity.

Debt Management: Reducing Financial Burdens

Effective debt management ensures you don’t get overwhelmed by liabilities. Prioritize high-interest debts and consider strategies like the snowball or avalanche method to pay them off faster.

Financial Goals: Setting and Achieving Milestones

Define clear short-term and long-term financial goals. Whether it’s buying a house, funding education, or planning retirement, having concrete goals keeps you motivated and focused.

Tracking and Adjusting: Staying on Course

Regularly review your financial plan to track progress and make necessary adjustments. Use tools like spreadsheets or financial software to monitor your growth and adapt to changes.

Insurance Coverage: Protecting Your Assets

Insurance is a critical component of financial security. Ensure you have adequate health, life, auto, and property insurance to safeguard against potential losses.

Retirement Planning: Securing Your Future

Start planning for retirement early. Contribute to retirement accounts like 401(k)s or IRAs and take advantage of employer matches to maximize your savings.

Tax Planning: Maximizing Your Income

Understand tax deductions and credits to optimize your income. Consider consulting a tax professional to ensure compliance and identify potential savings.

Financial Education: Continuous Learning for Success

Stay informed about financial trends, tools, and strategies. Attend workshops, read financial blogs, and consider online courses to enhance your knowledge.

Conclusion

In conclusion, building a strong money management system for long-term success in 2025 requires a strategic blend of budgeting, saving, investing, and continuous learning. By implementing these key components, you’ll be better prepared to navigate financial challenges and seize opportunities for growth. Remember, consistency and adaptability are essential—regularly review your plan and adjust as needed to stay on track.

Financial success doesn’t happen overnight, but with dedication and the right tools, you can achieve lasting stability. Take action today: start by setting clear financial goals, automating your savings, and exploring investment opportunities. Ready to dive deeper? Check out our guide on advanced budgeting techniques to refine your strategy further.

If you found this guide helpful, share it with friends or leave a comment with your own tips on managing money effectively. Don’t forget to subscribe for more insights on personal finance strategies, debt reduction strategies, and wealth-building tips tailored for 2025 and beyond. [FinansieraTrading.com]