5 Safe Investment Options for Risk-Averse Investors provide a reliable way to grow your wealth without exposing yourself to unnecessary risks. If you prioritize stability over high returns, understanding these low-risk investment avenues is essential. Whether you’re saving for retirement, building an emergency fund, or simply seeking peace of mind, these options can help you achieve financial growth with minimal volatility. From high-yield savings accounts to government-backed securities, each choice offers unique benefits tailored to conservative investors. In this guide, we’ll explore the best strategies to safeguard your capital while ensuring steady, predictable returns, making your financial journey stress-free and rewarding.

Why Choose Safe Investments?

Before diving into the options, let’s understand why safe investments matter. For risk-averse investors, the priority is preserving capital while earning modest returns. These investments reduce the anxiety of market fluctuations and offer predictable income streams.

1. High-Yield Savings Accounts

High-yield savings accounts are an excellent starting point for risk-averse individuals. These accounts offer higher interest rates compared to traditional savings accounts, and they are insured by the FDIC (Federal Deposit Insurance Corporation), making them a safe choice.

Benefits:

- FDIC insured up to $250,000.

- No risk of losing your principal.

- Liquid access to funds.

Here’s a comparison table showcasing the interest rates of regular savings accounts versus high-yield savings accounts:

| Account Type | Average Interest Rate | Liquidity | Risk Level |

|---|---|---|---|

| Regular Savings Account | 0.2% | High (Funds accessible anytime) | Extremely Low (FDIC insured) |

| High-Yield Savings Account | 4.0% | High (Funds accessible anytime) | Extremely Low (FDIC insured) |

2. Certificates of Deposit (CDs)

Certificates of Deposit are fixed-term investments that offer guaranteed returns. They are suitable for individuals willing to lock in their money for a specific period in exchange for higher interest rates.

Features:

- Fixed interest rates for the term of the CD.

- FDIC insured for up to $250,000.

- Penalties may apply for early withdrawal.

3. Treasury Securities

Treasury securities, such as Treasury bonds, notes, and bills, are backed by the U.S. government, making them one of the safest investment options.

5 Safe Investment Options for Risk-Averse Investors: Types of Treasury Securities:

- Treasury Bills: Short-term, maturing in a year or less.

- Treasury Notes: Medium-term, maturing in 2-10 years.

- Treasury Bonds: Long-term, maturing in 10+ years.

Benefits:

- Backed by the U.S. government.

- Exempt from state and local taxes.

| Feature | Treasury Bills (T-Bills) | Treasury Notes (T-Notes) | Treasury Bonds (T-Bonds) |

|---|---|---|---|

| Maturity Period | Short-term (4 weeks to 1 year) | Medium-term (2 to 10 years) | Long-term (10 to 30 years) |

| Interest Rate | Lower (approx. 3-4%) | Moderate (approx. 4-5%) | Higher (approx. 4.5-6%) |

| Interest Payments | Paid at maturity | Paid semi-annually | Paid semi-annually |

| Use Case | Ideal for short-term liquidity | Suitable for mid-term goals | Best for long-term investment goals |

| Risk Level | Extremely Low (backed by U.S. Gov.) | Extremely Low (backed by U.S. Gov.) | Extremely Low (backed by U.S. Gov.) |

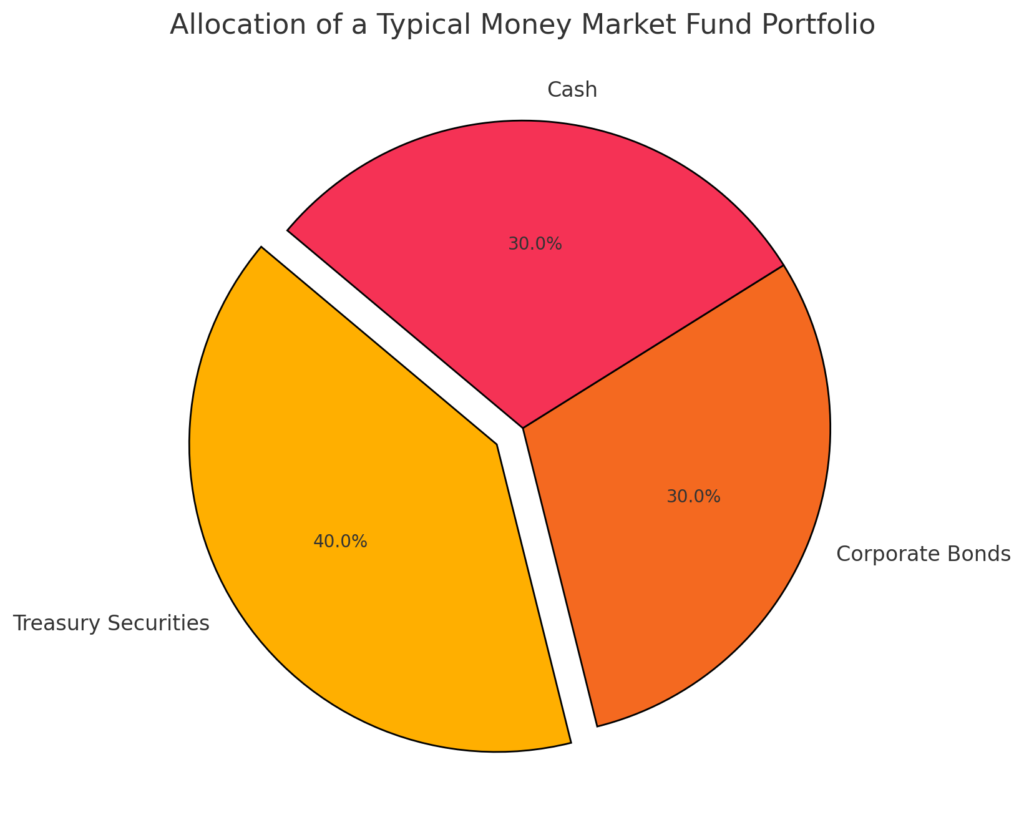

4. Money Market Funds

Money market funds invest in short-term, high-quality debt securities and offer a safe alternative for parking cash. They provide better returns than traditional savings accounts while maintaining liquidity.

Advantages:

- Low-risk investment.

- Instant access to funds.

- Higher yields than savings accounts.

5. Fixed Annuities

Fixed annuities are insurance products that provide regular payouts over a specific period. They are ideal for individuals seeking a stable income during retirement.

Key Points:

- Guaranteed income stream.

- Tax-deferred growth on investments.

- Flexible payout options.

[FinansieraTrading.com]

Conclusion

When it comes to building a secure financial future, making informed decisions is crucial for risk-averse investors. The 5 Safe Investment Options for Risk-Averse Investors—High-Yield Savings Accounts, Certificates of Deposit (CDs), Treasury Securities, Money Market Funds, and Fixed Annuities—offer a combination of stability and modest returns. For instance, a high-yield savings account can provide an annual interest rate of up to 4.5%, while CDs often offer rates ranging from 3% to 5% depending on the term length. Treasury securities, backed by the U.S. government, ensure unparalleled safety, and money market funds typically yield around 2%–3% annually with high liquidity. Fixed annuities, on the other hand, are an excellent option for retirees, offering guaranteed payouts to secure long-term financial stability.

By diversifying your portfolio with these options, you can mitigate risks and ensure your capital works effectively without unnecessary exposure to market volatility. These 5 Safe Investment Options for Risk-Averse Investors are tailored to meet the needs of individuals seeking peace of mind while growing their wealth. Always evaluate your financial goals and consult a professional advisor to craft a plan that best aligns with your risk tolerance and investment horizon.