5 Low-Risk Trading Strategies for New Investors: Starting your trading journey can feel overwhelming, especially with the fear of potential losses. However, by focusing on 5 low-risk trading strategies for new investors, you can minimize risks while learning the ropes. These strategies are designed to provide stability and confidence, helping you make informed decisions and build a solid foundation for long-term trading success.

Why Low-Risk Strategies Matter

New investors often struggle with market volatility and lack of experience. Low-risk strategies help:

Table of Contents

- Protect initial capital.

- Build discipline and good trading habits.

- Reduce emotional decision-making.

5 Low-Risk Trading Strategies for New Investors:

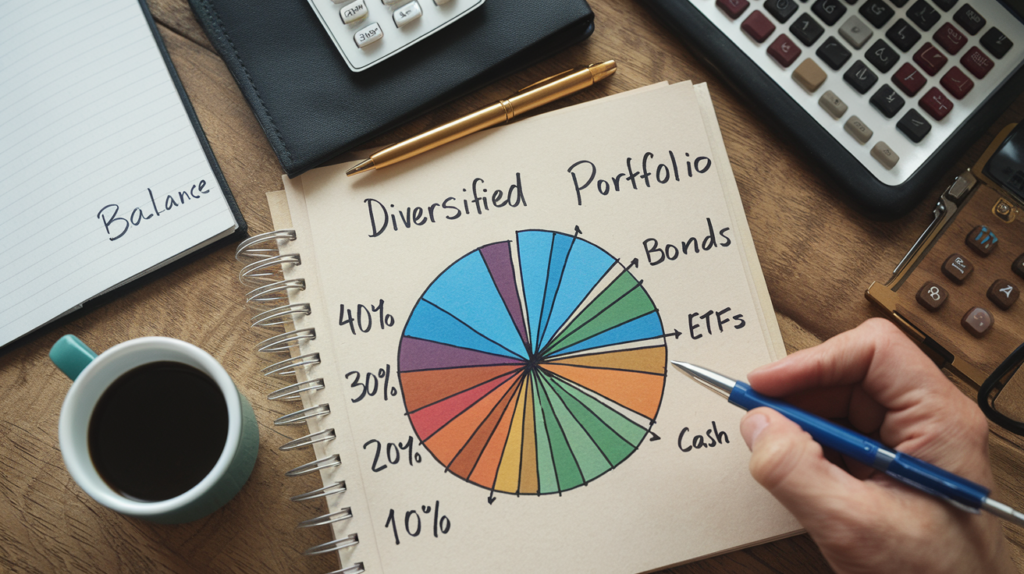

1. Diversification: Don’t Put All Your Eggs in One Basket

Diversification involves spreading your investments across different asset classes, such as stocks, bonds, and ETFs. This approach reduces the impact of a single asset’s poor performance on your portfolio.

Columns for diversification examples:

| Asset Class | Example Investments | Risk Level |

|---|---|---|

| Stocks | Large-cap companies | Medium |

| Bonds | Government bonds | Low |

| ETFs | S&P 500 ETFs | Medium |

2. Dollar-Cost Averaging: Consistent Investment Over Time

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy reduces the impact of market volatility and helps average out investment costs over time.

3. Setting Stop-Loss Orders: Protect Your Downside

A stop-loss order automatically sells your investment when its price drops to a specific level. This tool prevents large losses and ensures you exit losing trades promptly.

- Pro Tip: Set stop-loss levels based on your risk tolerance, usually between 3%-10% below your purchase price.

4. Investing in Index Funds or ETFs: Broad Market Exposure

Index funds and ETFs are excellent for beginners because they provide exposure to an entire market or sector without requiring individual stock analysis. These funds often have lower fees and offer consistent, long-term returns.

- Popular Index Funds for Beginners: S&P 500 ETFs, NASDAQ ETFs.

5. Paper Trading: Practice Without Real Money

Paper trading allows you to test strategies in a simulated environment. This approach helps you understand market mechanics without risking actual money.

Example platforms: TradingView, Thinkorswim.

Final Thoughts

By applying these 5 low-risk trading strategies for new investors, you can build a secure trading foundation. Focus on consistency, discipline, and learning from each trade to grow into a successful investor.