Why Passive Income Is the Secret to Retiring Comfortably in Any Economy

Passive income has emerged as the ultimate financial strategy for achieving retirement security, especially in today’s unpredictable economic climate. With rising inflation, market volatility, and the ever-changing job landscape, relying solely on traditional savings or a 401(k) is no longer enough. Passive income offers a sustainable solution, allowing individuals to generate consistent cash flow with minimal effort, ensuring financial stability regardless of economic conditions.

In this article, we’ll explore the latest trends, proven strategies, and actionable tips to help you build a robust passive income portfolio. Whether you’re planning for retirement or looking to achieve financial independence, this guide will provide the insights you need to succeed.

Table of Contents

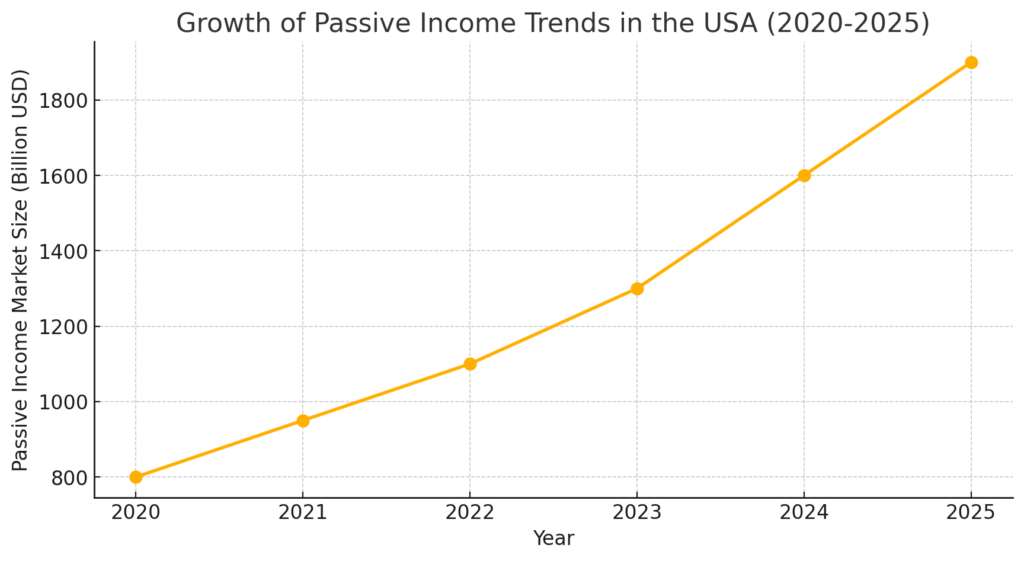

The Growing Popularity of Passive Income in 2025

The concept of passive income has gained significant traction in recent years, with more people seeking ways to diversify their income streams. According to a 2025 report by Forbes, over 60% of Americans are now exploring passive income opportunities, from real estate investments to digital entrepreneurship.

One of the key drivers of this trend is the rise of technology. Platforms like Fundrise for real estate crowdfunding and Robinhood for stock investments have made it easier than ever for individuals to start building passive income streams. Additionally, the gig economy and the shift toward remote work have created new opportunities for creating digital products, such as online courses, eBooks, and affiliate marketing.

Top 5 Passive Income Strategies for 2025

Here are the most effective passive income strategies to consider in 2025:

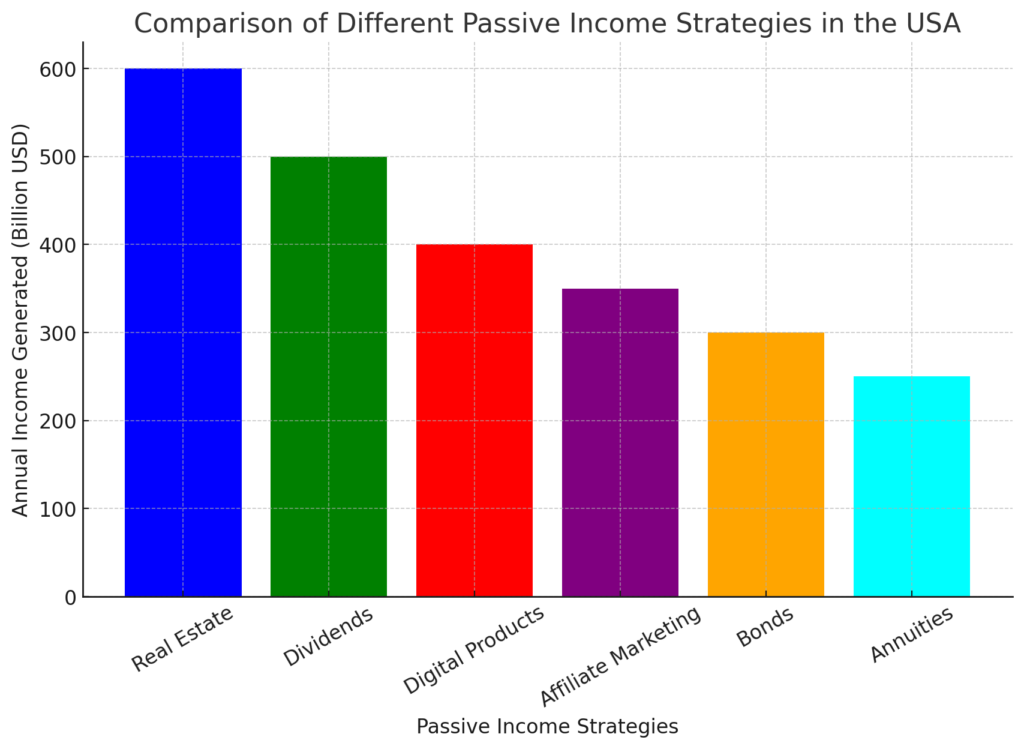

- Real Estate Crowdfunding

Real estate remains one of the most reliable sources of passive income. Platforms like Fundrise and Crowdstreet allow you to invest in large-scale property projects with as little as $500. These investments generate income through rental yields and property appreciation. - Dividend-Paying Stocks

Investing in dividend-paying stocks is a time-tested strategy for generating passive income. Companies like Apple, Microsoft, and Johnson & Johnson consistently pay dividends, providing a steady income stream. Reinvesting dividends can also compound your wealth over time. - Create Digital Products

The digital economy is booming, and creating digital products like eBooks, online courses, or stock photography can generate recurring revenue. Platforms like Udemy and Amazon Kindle Direct Publishing make it easy to reach a global audience. - Affiliate Marketing

Affiliate marketing is a low-cost, high-reward strategy for earning passive income. By promoting products through your blog, YouTube channel, or social media, you can earn commissions on every sale. Popular affiliate programs include Amazon Associates and ShareASale. - High-Yield Savings Accounts and Bonds

For risk-averse investors, high-yield savings accounts and bonds offer a safe way to earn passive income. With rising interest rates, these options are becoming more attractive.

Why Passive Income Works in Any Economy

Passive income streams are uniquely resilient to economic volatility. For example:

- Rental Income: Even during recessions, people need housing, making rental income a stable source of cash flow.

- Dividend Stocks: Many companies continue to pay dividends regardless of market conditions.

- Digital Products: Online courses and eBooks can generate revenue even during economic downturns, as people seek to upskill or entertain themselves.

Take the example of John, a 45-year-old engineer who invested in dividend-paying stocks and a rental property. By the time he retired, his passive income streams were generating enough to cover his living expenses, allowing him to enjoy his retirement without financial stress.

How to Get Started with Passive Income

- Assess Your Skills and Interests: Identify what you’re good at—whether it’s writing, teaching, or investing—and leverage those skills to build your passive income streams.

- Diversify Your Portfolio: Don’t rely on a single income stream. Combine investments in real estate, stocks, and digital products to minimize risk and maximize returns.

- Leverage Technology: Use AI tools and automation to streamline your passive income projects, reducing the time and effort required to manage them.

- Start Small and Scale Up: Begin with low-cost strategies like affiliate marketing or digital products and reinvest your earnings to grow your portfolio over time. [FinansieraTrading.com]