What to Include in Your Financial Goals for 2025 and beyond is the foundation for building a secure and prosperous future. Are you prepared to navigate the financial challenges and opportunities that lie ahead? As the economy evolves, setting clear and strategic financial goals becomes more critical than ever. Whether you aim to boost your savings, manage debt effectively, or plan for retirement, having a well-structured financial roadmap can make all the difference. In this guide, we’ll walk you through the essential components to include in your financial goals, offering practical strategies to help you achieve financial stability and success in 2025 and beyond.

The Importance of Setting Financial Goals for 2025 and Beyond Understanding why financial goals matter the first step is toward achieving them. Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals provides clarity and direction, helping you manage your finances effectively and stay motivated. Financial goals give you a roadmap to track progress, make informed decisions, and adjust as needed when circumstances change.

Table of Contents

Key Components to Include in Your Financial Goals

Budget Planning

Budget planning is the cornerstone of effective financial management. It involves tracking your income and expenses to understand where your money is going. By creating a detailed budget, you can identify unnecessary expenditures, allocate funds to priority areas, and ensure you’re saving for future goals. A well-planned budget helps prevent overspending, reduces financial stress, and ensures you live within your means.

Emergency Fund

An emergency fund acts as a financial safety net for unexpected situations such as job loss, medical emergencies, or urgent repairs. Aim to save 3-6 months’ worth of living expenses in an easily accessible account. This fund provides peace of mind, reduces reliance on credit cards or loans during crises, and keeps your long-term financial plans on track even when surprises occur.

Debt Management

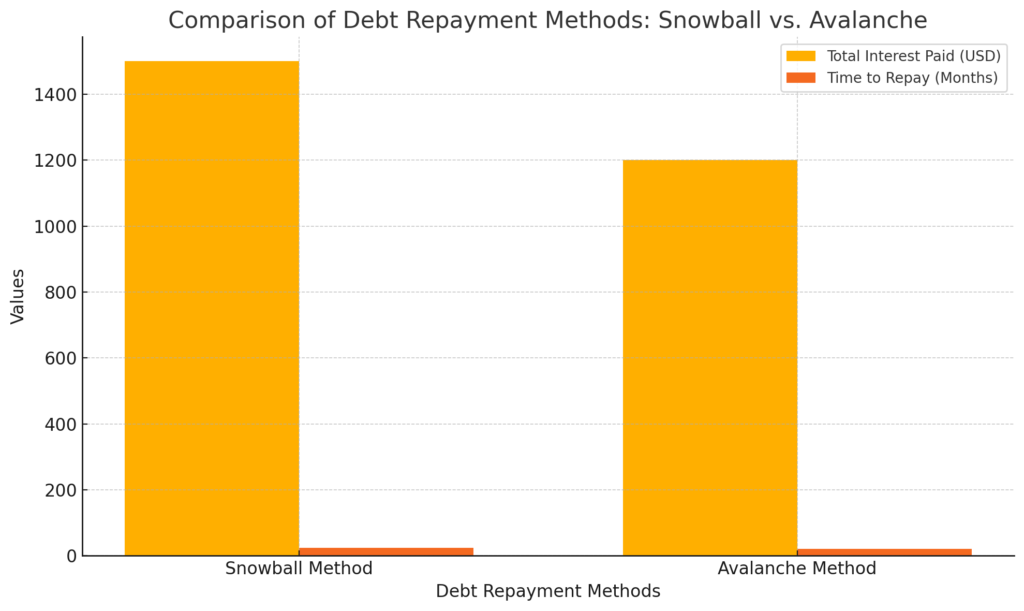

Managing debt effectively is essential for financial health. High-interest debts, like credit card balances, can drain your finances if left unchecked. Consider using strategies like the snowball method (paying off smaller debts first for quick wins) or the avalanche method (focusing on debts with the highest interest rates to save on interest). Regularly review your debt, make more than minimum payments when possible, and avoid accumulating new debt unnecessarily.

Retirement Planning

Planning for retirement ensures you can maintain your desired lifestyle when you stop working. Start by estimating how much you’ll need based on your current expenses, future goals, and expected lifespan. Contribute regularly to retirement accounts like 401(k)s or IRAs, take advantage of employer matches, and review your investments to ensure they align with your retirement timeline and risk tolerance.

Investment Strategies

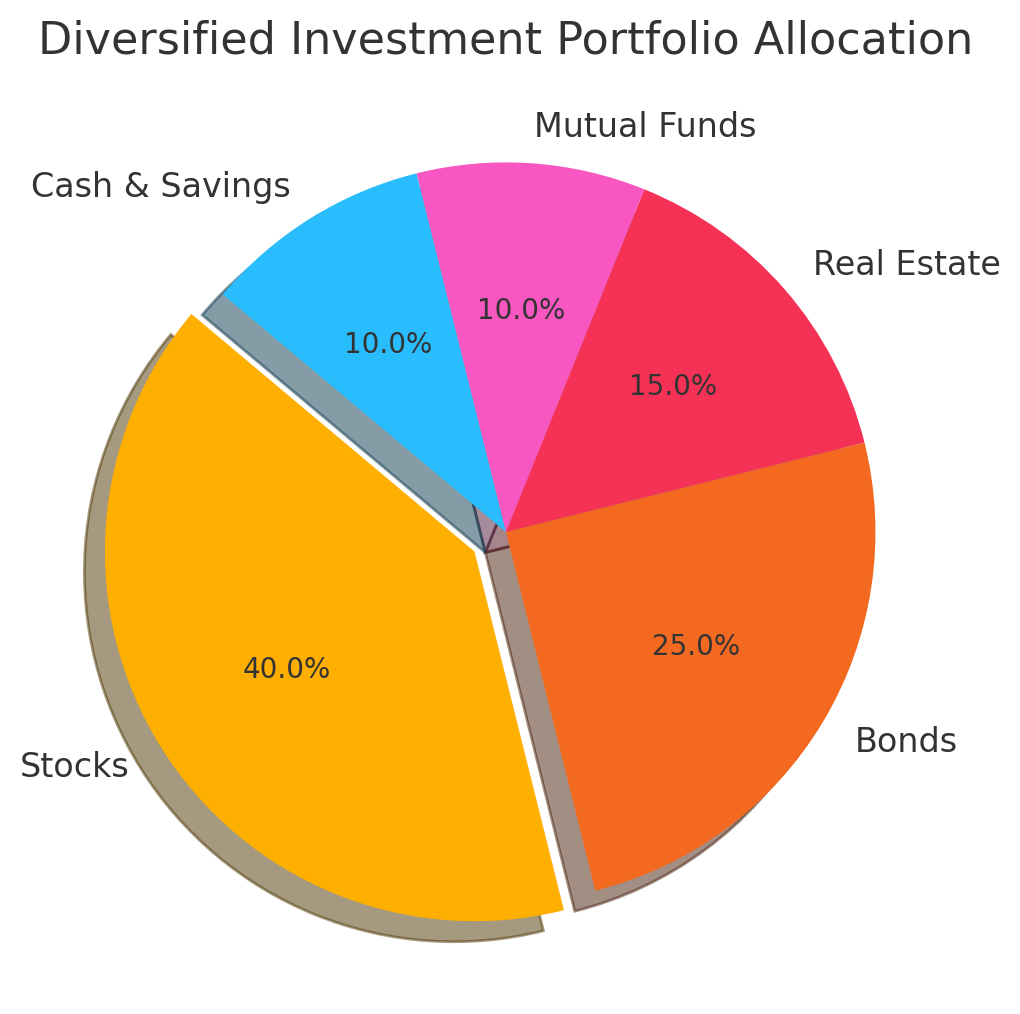

Investing helps grow your wealth over time, outpacing inflation and building financial security. Diversify your investments across different asset classes, such as stocks, bonds, real estate, and mutual funds, to manage risk effectively. Regularly review your portfolio to ensure it aligns with your goals, time horizon, and risk tolerance. Educate yourself on basic investment principles or consult a financial advisor for personalized guidance.

Savings Goals

Setting clear savings goals helps you prioritize financial milestones, whether it’s buying a home, funding education, or planning a dream vacation. Define your goals with specific amounts and timelines. Automate savings contributions to stay consistent and monitor your progress regularly. Having both short-term and long-term savings goals keeps you motivated and financially prepared for life’s opportunities.

Insurance Coverage

Insurance protects you from significant financial losses due to unforeseen events. Review your current policies for health, life, disability, home, and auto insurance to ensure adequate coverage. Consider factors like family needs, income protection, and asset preservation. Adequate insurance provides financial security, reduces out-of-pocket expenses in emergencies, and safeguards your long-term goals.

Tax Planning

Effective tax planning helps you minimize tax liabilities and maximize savings. Understand how different income sources, investments, and deductions impact your tax situation. Strategies like contributing to tax-advantaged accounts, claiming eligible deductions, and planning charitable donations can reduce your tax burden. Stay informed about tax law changes and consult a tax professional for complex situations.

Educational and Career Development

Investing in your education and career growth increases your earning potential and job security. Identify skills that are in demand in your industry, pursue relevant certifications, or consider higher education opportunities. Career development isn’t limited to formal education—networking, attending workshops, and continuous learning all contribute to professional advancement and financial growth.

Philanthropy and Giving Back

Incorporating philanthropy into your financial goals fosters personal fulfillment and community support. Whether through charitable donations, volunteering, or supporting causes you’re passionate about, giving back creates a positive impact. Set a budget for charitable contributions that aligns with your financial capacity and values. This practice not only benefits others but also adds meaning and purpose to your financial journey.

How to Prioritize Your Financial Goals Prioritizing financial goals helps you focus on what’s most important. Start by listing all your goals and categorizing them as short-term, medium-term, or long-term. Evaluate their urgency, importance, and potential impact on your life. Consider using a tiered system to allocate resources effectively. Regularly reassess your priorities as circumstances change, ensuring your financial plan remains relevant and achievable.

Common Mistakes to Avoid in Financial Goal Setting Avoiding common mistakes can significantly improve your financial planning. Common pitfalls include setting vague goals without clear timelines, underestimating expenses, neglecting an emergency fund, and failing to account for inflation. Additionally, not reviewing and adjusting your goals regularly can hinder progress. Learning from these mistakes ensures a more resilient and effective financial plan.

Tools and Resources to Help You Achieve Your Financial Goals Numerous tools can simplify financial planning and help you stay on track. Budgeting apps like Mint or YNAB (You Need a Budget) offer expense tracking and goal-setting features. Financial planning software provides comprehensive analysis, while professional advisors offer personalized guidance. Educational resources, such as Investopedia, provide valuable insights into financial concepts, helping you make informed decisions.

Conclusion: In conclusion, mastering what to include in your financial goals for 2025 and beyond is a journey that starts with thoughtful planning and consistent action. By incorporating essential elements like budget planning, debt management, and investment strategies, you can build a secure and prosperous future. Remember, financial success isn’t about perfection—it’s about progress. Reflect on what you’ve learned today, apply these strategies, and watch your financial confidence grow.

We’d love to hear how you’re setting your financial goals for the future. Share your thoughts in the comments, and don’t forget to explore more insightful articles on NerdWallet for expert financial tips and tools.

Stay proactive, stay informed, and take control of your financial destiny today! [FinansieraTrading.com]