Why retiring early is easier than you think (and how to start now) isn’t just a catchy phrase—it’s a practical reality for those who approach financial independence with a clear plan and commitment. Many people believe that early retirement is only achievable for the wealthy or extraordinarily lucky, but that couldn’t be further from the truth. With the right combination of smart saving, strategic investing, and lifestyle adjustments, retiring earlier than the traditional age is entirely possible, even for the average-income earner.

Think about it: the financial tools and resources available today—like index funds, budgeting apps, and the power of compound interest—have made early retirement more accessible than ever before. This guide will walk you through the common myths, proven strategies, and actionable steps to get started on your early retirement journey today. Whether you’re just beginning to explore this idea or already committed to the goal, you’ll discover how achievable it truly is to live a life of financial freedom.

Table of Contents

Introduction: Why Retiring Early Is Easier Than You Think

For years, the idea of early retirement was reserved for the wealthy. However, today, with better financial tools, widespread knowledge, and actionable strategies, retiring early is easier than you think (and how to start now) is a reality for many individuals. In this post, we’ll dive into what it takes to retire early, debunk myths, and give you a roadmap to achieve your dream.

The Myth of Early Retirement Being Out of Reach

Why This Myth Persists

Many believe early retirement is only for the ultra-rich. This misconception stems from outdated views of money management and a lack of exposure to modern-day financial independence strategies.

Breaking Down Barriers

- Financial Education: Access to resources like financial blogs and podcasts has democratized early retirement planning.

- The FIRE Movement: Financial Independence, Retire Early (FIRE) proves that even average-income earners can achieve early retirement by living frugally and investing wisely.

How Much Money Do You Really Need to Retire Early?

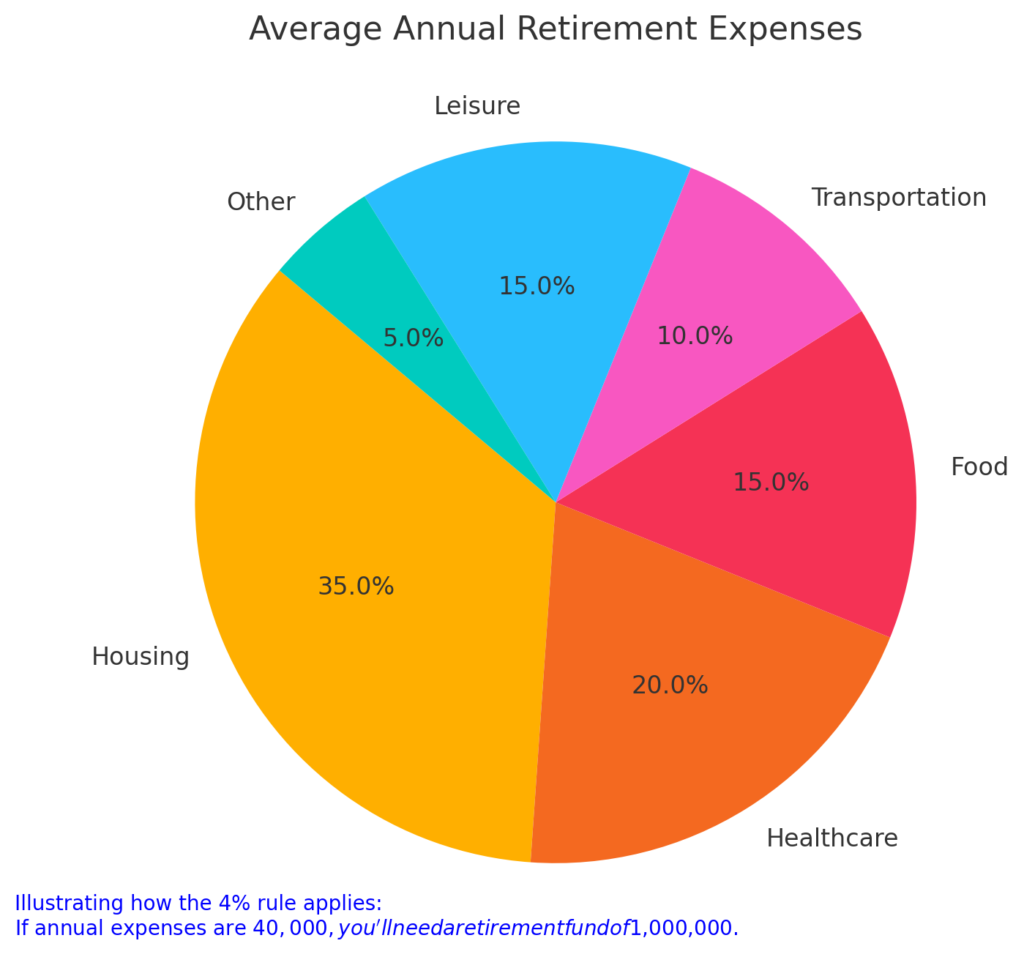

The 4% Rule and Its Importance

- The 4% rule is a widely used guideline to calculate how much money you need for retirement.

- If you plan to withdraw 4% of your portfolio annually, multiply your yearly expenses by 25 to determine your financial independence number.

Example: If your annual expenses are $40,000, you’ll need $1,000,000.

Real-Life Data

- Average annual expenses: $40,000 – $50,000 for most early retirees.

- Savings needed: $800,000 – $1,250,000 based on current trends.

[FinansieraTrading.com]

Steps to Start Your Early Retirement Journey Today

- Set Clear Financial Goals

- Define your “why” for early retirement.

- Calculate your financial independence number.

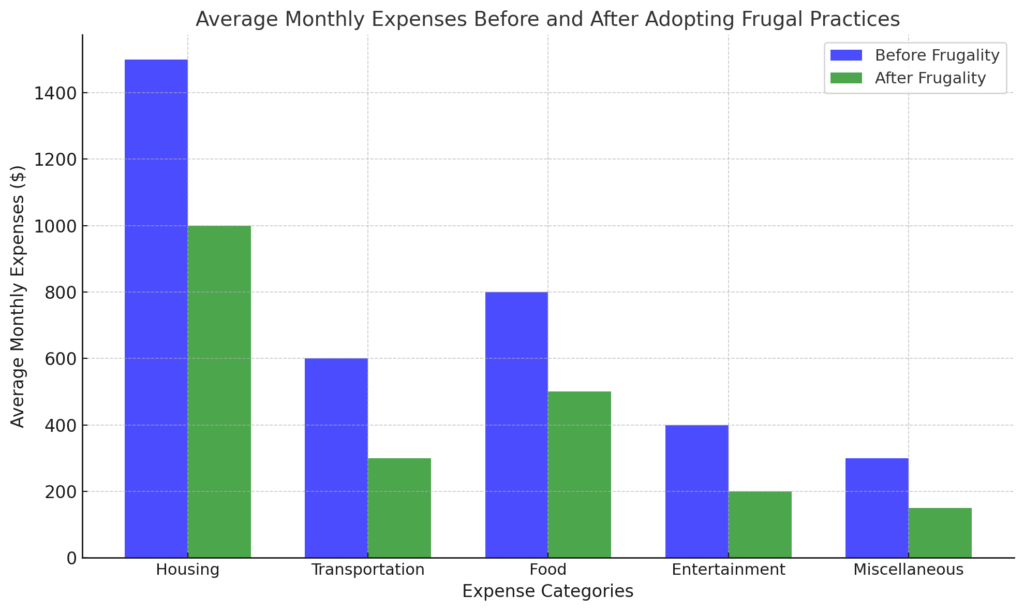

- Reduce Expenses Aggressively

- Embrace frugality: Downsize your home, drive a used car, and cut unnecessary subscriptions.

- Track expenses using budgeting apps.

- Boost Income Streams

- Start a side hustle: Freelancing, blogging, or creating online courses.

- Invest in real estate for passive income.

- Invest Strategically

- Index Funds: Low-cost, diversified, and ideal for long-term growth.

- Dividend Stocks: Regular passive income during retirement.

- Eliminate Debt

- Focus on high-interest debt like credit cards first.

- Use strategies like the snowball or avalanche method.

The Power of Starting Early

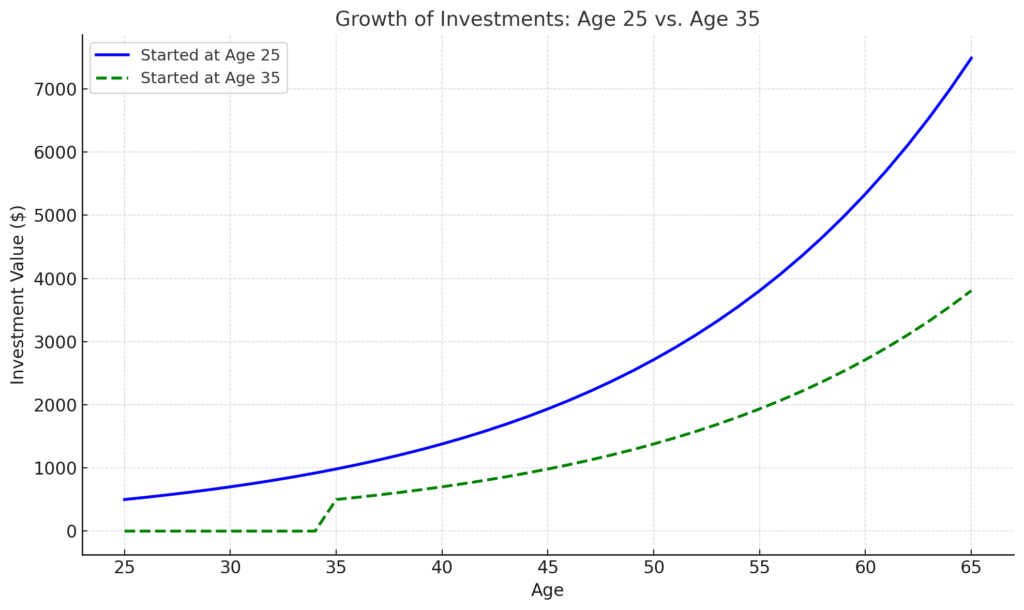

Compounding Interest Is Your Best Friend

Starting early allows your money to grow exponentially over time. Here’s an example:

- Investing $500/month starting at age 25 can grow to over $1 million by 55 (assuming a 7% annual return).

- Waiting until 35 cuts this amount in half.

Common Mistakes to Avoid

- Underestimating Inflation

- Ensure your portfolio accounts for a 2-3% annual inflation rate.

- Failing to Diversify Investments

- Don’t put all your money in one asset class; spread it across stocks, bonds, and real estate.

- Ignoring Healthcare Costs

- Early retirees often overlook the cost of private health insurance. Plan accordingly.

| No. | Common Mistakes | Implications | Solutions |

|---|---|---|---|

| 1 | Underestimating Inflation | Reduced purchasing power over time | Add a 2-3% inflation buffer to your plan |

| 2 | Failing to Diversify Investments | Higher risk of losing investments | Invest in stocks, bonds, and real estate |

| 3 | Ignoring Healthcare Costs | Unplanned medical expenses | Plan for private health insurance |

| 4 | Overlooking Emergency Savings | Struggle during unexpected emergencies | Save 6-12 months of living expenses |

| 5 | Relying on One Income Source | Financial instability if income stops | Create multiple income streams like side hustles |

Conclusion: Why Retiring Early Is Easier Than You Think (And How to Start Now)

Retiring early is no longer just a pipe dream—it’s a realistic goal for those willing to plan and act decisively. By leveraging proven strategies such as reducing expenses, investing wisely, and embracing the power of compounding, you can pave the way to financial independence sooner than expected.

Remember, the 4% rule and consistent investments are powerful tools that make early retirement achievable for average-income earners. For instance, if you save $1,000 monthly starting at age 30 and invest it with a 7% annual return, you could accumulate over $1 million by age 55. Similarly, trimming $500 in monthly expenses and redirecting it toward investments could shave years off your retirement timeline.

Why retiring early is easier than you think (and how to start now) lies in understanding that the steps aren’t overly complicated—it’s about starting small, staying disciplined, and consistently working toward your goals. Every dollar saved, invested, and managed with intention brings you closer to a life of freedom and fulfillment. Take action today and watch your dream of early retirement transform into a tangible reality.