Why Relying Only on Social Security Could Be a Financial Disaster

Relying only on Social Security for retirement could be a financial disaster for millions of Americans. While Social Security provides a safety net, it was never designed to be the sole source of income during retirement. With rising living costs, healthcare expenses, and economic uncertainties, depending entirely on Social Security benefits can leave retirees struggling to make ends meet. In this article, we’ll explore why Social Security alone is insufficient, how it impacts retirees, and what steps you can take to secure your financial future.

Table of Contents

The Reality of Social Security Benefits

Social Security was established to supplement retirement income, not replace it. According to the Social Security Administration, the average monthly benefit in 2023 is approximately $1,827. For many, this amount barely covers basic living expenses, let alone healthcare, travel, or emergencies. With inflation and the rising cost of living, the purchasing power of these benefits continues to decline.

Why Social Security Alone Isn’t Enough

- Insufficient Replacement Income: Social Security typically replaces only about 40% of pre-retirement income, far below the 70-80% recommended by financial experts.

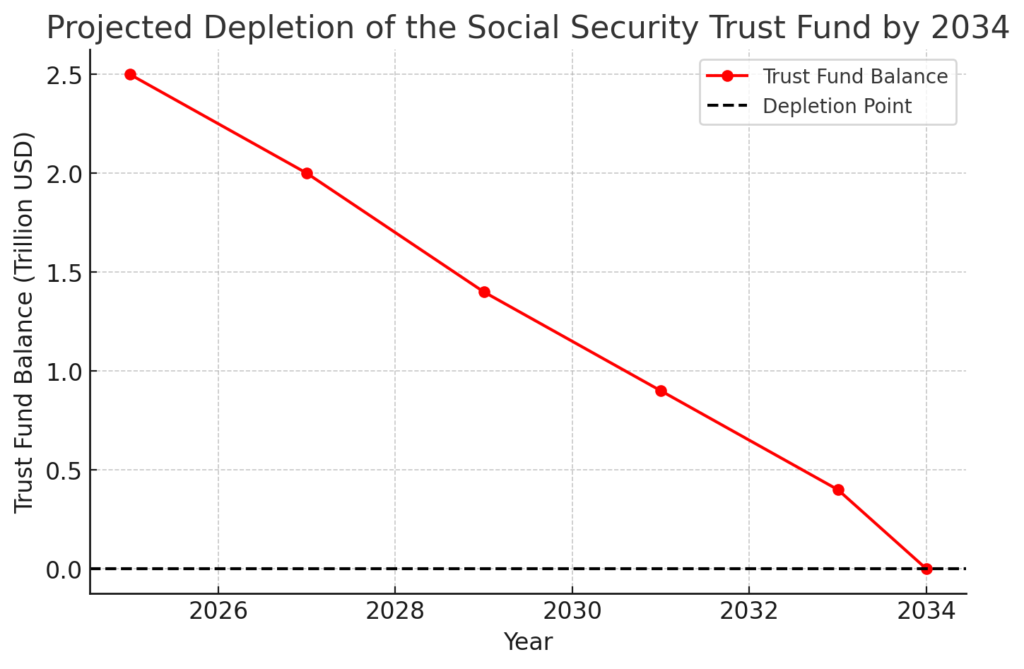

- Unpredictable Future of the Program: The Social Security Trust Fund is projected to be depleted by 2034, potentially leading to reduced benefits unless reforms are implemented.

- Healthcare Costs: Medicare doesn’t cover all healthcare expenses, and out-of-pocket costs can quickly deplete savings.

- Lack of Flexibility: Social Security benefits are fixed and don’t account for unexpected expenses or lifestyle changes.

Steps to Avoid a Financial Disaster

- Start Saving Early: Contribute to retirement accounts like 401(k)s or IRAs to build a robust nest egg.

- Diversify Investments: Explore stocks, bonds, and real estate to grow your wealth over time.

- Delay Social Security: Waiting until full retirement age (or later) can increase your monthly benefits.

- Plan for Healthcare Costs: Consider supplemental insurance or health savings accounts (HSAs) to cover medical expenses.

- Consult a Financial Advisor: A professional can help you create a personalized retirement plan.

Conclusion

Relying only on Social Security could be a financial disaster, but with proper planning, you can secure a comfortable retirement. By understanding the limitations of Social Security and taking proactive steps to diversify your income, you can protect yourself from financial instability. Start today to ensure a brighter tomorrow. [FinansieraTrading.com]