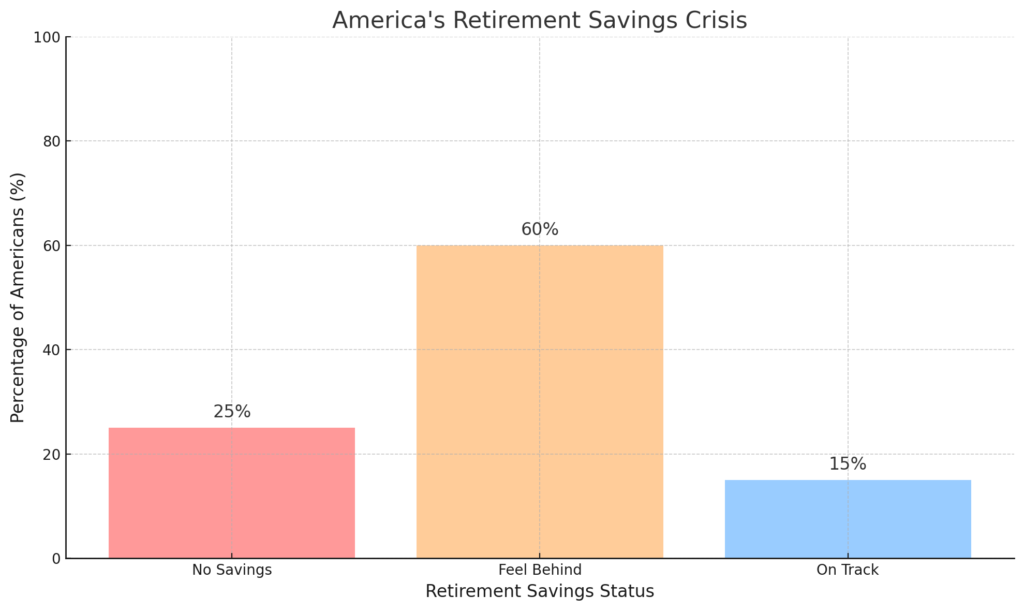

Why Most Americans Fail to Save Enough for Retirement (And How You Can Avoid It) is a financial reality that affects millions of households across the country. Despite increasing awareness about the importance of retirement planning, surveys reveal that nearly 25% of Americans have no retirement savings, and over 60% feel they are far behind their financial goals. These alarming statistics highlight the growing gap between what people plan for and what they actually achieve.

What’s causing this widespread shortfall? Rising costs of living, a lack of financial literacy, and the tendency to delay saving are just a few of the culprits. But the good news is that this trend can be reversed with smart strategies and consistent action. In this blog, we’ll explore why most Americans struggle to save for retirement and provide actionable tips to help you secure a financially stable future. Whether you’re just starting your career or already thinking about retirement, the insights in this article will empower you to avoid common pitfalls and take control of your financial destiny.

Table of Contents

The Retirement Savings Crisis in America

Retirement savings in America have reached alarming levels. A 2023 study by the Federal Reserve revealed that 25% of Americans have no retirement savings at all, while nearly 60% feel they are behind on their retirement goals. This growing crisis demands attention.

Reasons Why Most Americans Fail to Save for Retirement

- Living Paycheck to Paycheck

- Explanation: Around 63% of Americans live paycheck to paycheck, leaving little room for retirement contributions. This cycle is often driven by rising living costs and stagnant wages.

- Tip to Avoid: Track your expenses and set a strict budget that includes a fixed retirement savings amount each month.

- Lack of Financial Literacy

- Explanation: Financial literacy plays a crucial role in retirement planning. Unfortunately, many Americans lack the knowledge to invest wisely or understand compound interest.

- Tip to Avoid: Invest time in learning about personal finance through courses, books, or trusted online platforms.

- Relying Too Heavily on Social Security

- Explanation: Social Security is often viewed as a primary income source for retirees, but it typically replaces only about 40% of pre-retirement income.

- Tip to Avoid: Diversify your retirement income sources with 401(k) plans, IRAs, and other investments.

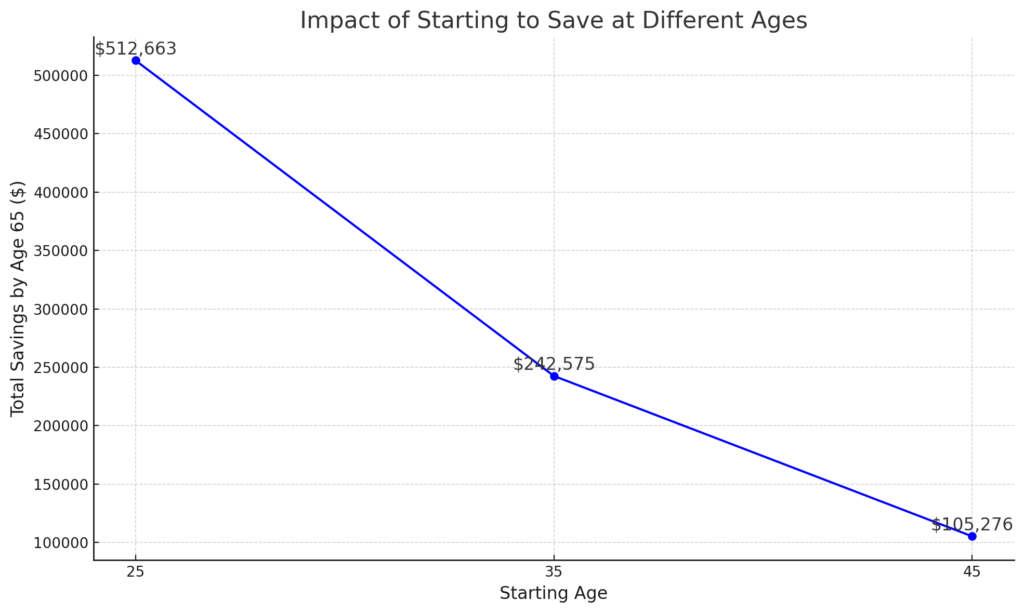

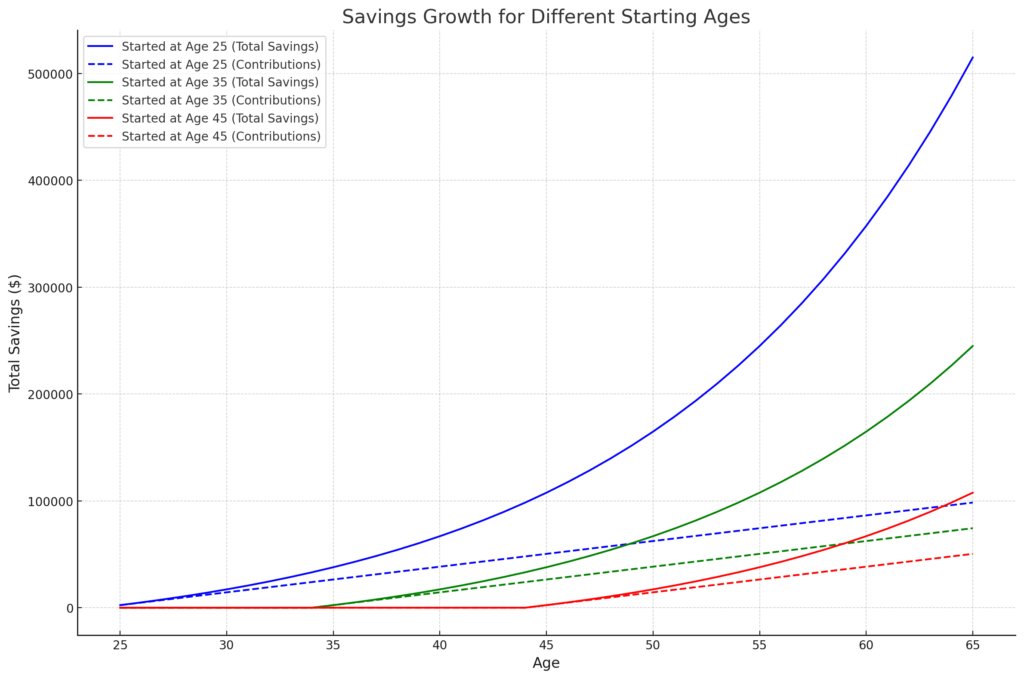

- Delaying Savings Until Later in Life

- Explanation: Many individuals delay saving for retirement, believing they have plenty of time. Unfortunately, this reduces the power of compound interest.

- Tip to Avoid: Start saving as early as possible, even if it’s a small amount. Every dollar counts when compounded over decades.

The Power of Compound Interest and Early Savings

Compound interest is the secret weapon of retirement savings. For example, saving $200 monthly starting at age 25 can grow to over $400,000 by age 65, assuming a 7% annual return. In contrast, starting at age 35 cuts that amount almost in half.

Practical Steps to Secure Your Retirement

- Set Clear Goals

- Determine how much you’ll need to retire comfortably. Use online retirement calculators for precise estimates.

- Contribute to Employer-Sponsored Plans

- Maximize 401(k) contributions, especially if your employer offers matching.

- Open an IRA

- If your employer doesn’t offer a 401(k), consider opening a Roth or Traditional IRA for tax advantages.

- Automate Savings

- Automating contributions ensures consistency and reduces the temptation to skip deposits.

- Minimize Debt

- High-interest debts, such as credit card balances, can erode your ability to save. Prioritize paying these off.

- Diversify Investments

- A mix of stocks, bonds, and other assets can provide a balance of risk and growth.

Common Retirement Savings Mistakes to Avoid

- Underestimating Healthcare Costs

- Healthcare expenses often surge during retirement, and failing to plan for them can drain savings.

- Ignoring Inflation

- Overlooking the impact of inflation can result in falling short of your retirement goals.

- Cashing Out Retirement Accounts Early

- Withdrawing funds early not only incurs penalties but also diminishes long-term growth potential.

Column Suggestion:

Include a table summarizing common mistakes and their solutions.

| Mistake | Impact | Solution |

|---|---|---|

| Ignoring Healthcare Costs | Drains retirement funds | Open an HSA or plan for medical insurance |

| Underestimating Inflation | Erodes purchasing power | Adjust savings goals annually |

| Early Account Withdrawals | Reduces long-term growth | Keep funds invested until retirement age |

How to Stay on Track

- Monitor Progress Regularly

- Schedule annual check-ins to review your savings and adjust as needed.

- Seek Professional Guidance

- A financial advisor can provide tailored advice for your unique goals.

- Stay Disciplined

- Avoid lifestyle inflation as your income grows.

Conclusion

Why Most Americans Fail to Save Enough for Retirement (And How You Can Avoid It) is a challenge that stems from multiple factors like financial illiteracy, delayed savings, and over-reliance on Social Security. Consider this: Social Security only replaces about 40% of pre-retirement income for the average retiree, yet experts recommend needing at least 70%-80% to maintain your standard of living. Additionally, with healthcare expenses for retirees averaging over $300,000 in a lifetime, the importance of proactive planning cannot be overstated.

To ensure you don’t fall into the same trap, start early, automate your savings, and maximize available tools like 401(k)s and IRAs. Remember, the longer you delay, the more you miss out on the power of compound interest. By taking these actionable steps, you can overcome the reasons Why Most Americans Fail to Save Enough for Retirement (And How You Can Avoid It), securing a future that aligns with your financial goals. Don’t wait—start building your financial future today. [FinansieraTrading.com]