Why most people fail at saving and how you can succeed is a challenge that countless individuals face daily. Despite earning a steady income, many struggle to set aside money due to financial pitfalls such as poor budgeting, impulsive spending, and a lack of financial literacy. The importance of saving cannot be overstated—it provides security, helps achieve long-term goals, and reduces financial stress. In this article, we will uncover the key reasons why saving money is so difficult for most people and provide practical, actionable strategies to help you turn things around. Whether you’re trying to build an emergency fund, save for a dream vacation, or achieve financial independence, you’ll find valuable insights to help you succeed.

The Common Reasons Why Most People Fail at Saving

- Lack of financial literacy

- Poor budgeting habits

- Living beyond one’s means

- Inconsistent income and financial instability

- Impulse spending and lack of discipline

- High debt obligations

- Absence of financial goals and planning

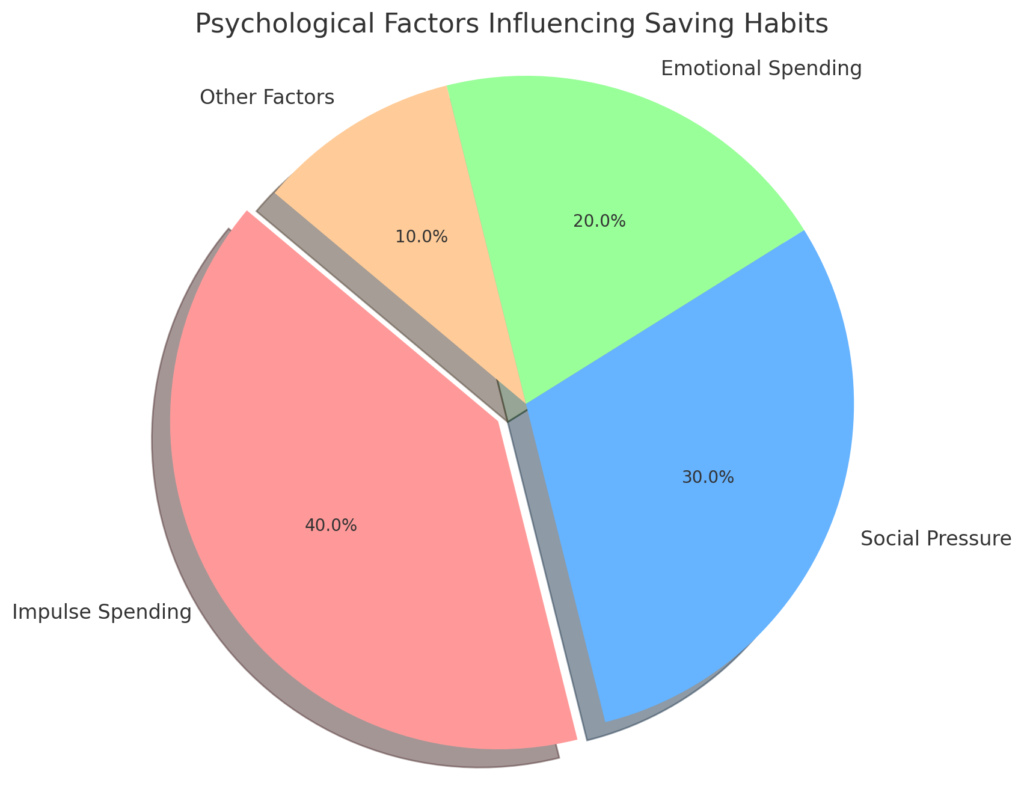

Psychological Barriers to Saving Money

- Instant gratification vs. long-term goals

- Fear of missing out (FOMO)

- Social pressure and lifestyle inflation

- Emotional spending triggers

How You Can Succeed at Saving Money

- Developing a Clear Savings Plan

- Setting SMART financial goals

- Establishing an emergency fund

- Prioritizing needs over wants

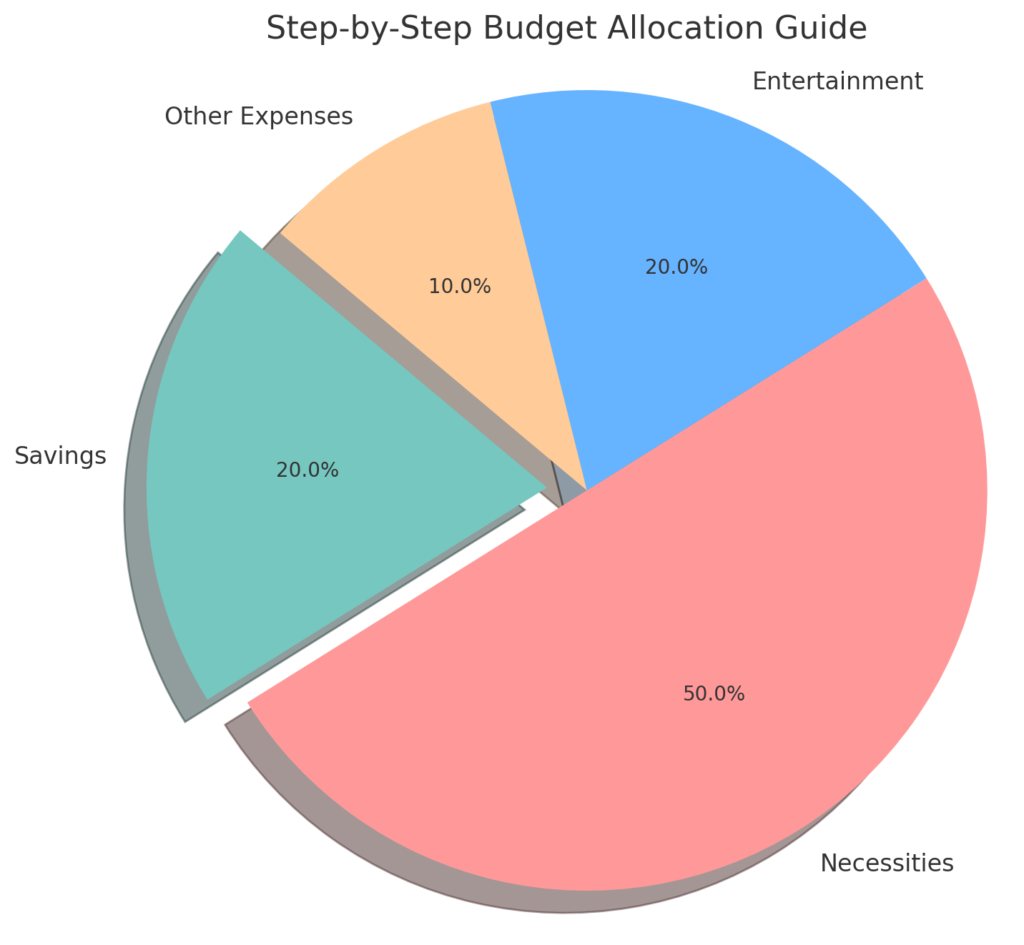

- Creating a Realistic Budget

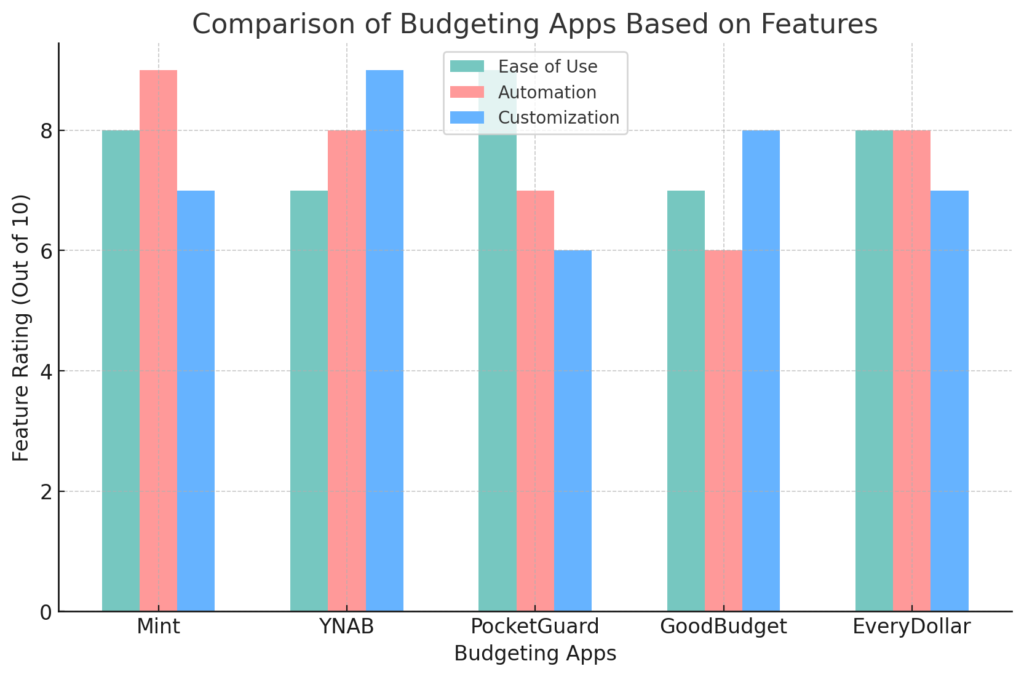

- Using budgeting apps and tools

- Allocating funds for savings first (pay yourself first)

- Tracking spending habits regularly

Practical Tips to Improve Your Saving Habits

- Automating savings contributions

- Using the 50/30/20 budgeting rule

- Taking advantage of employer-sponsored savings plans

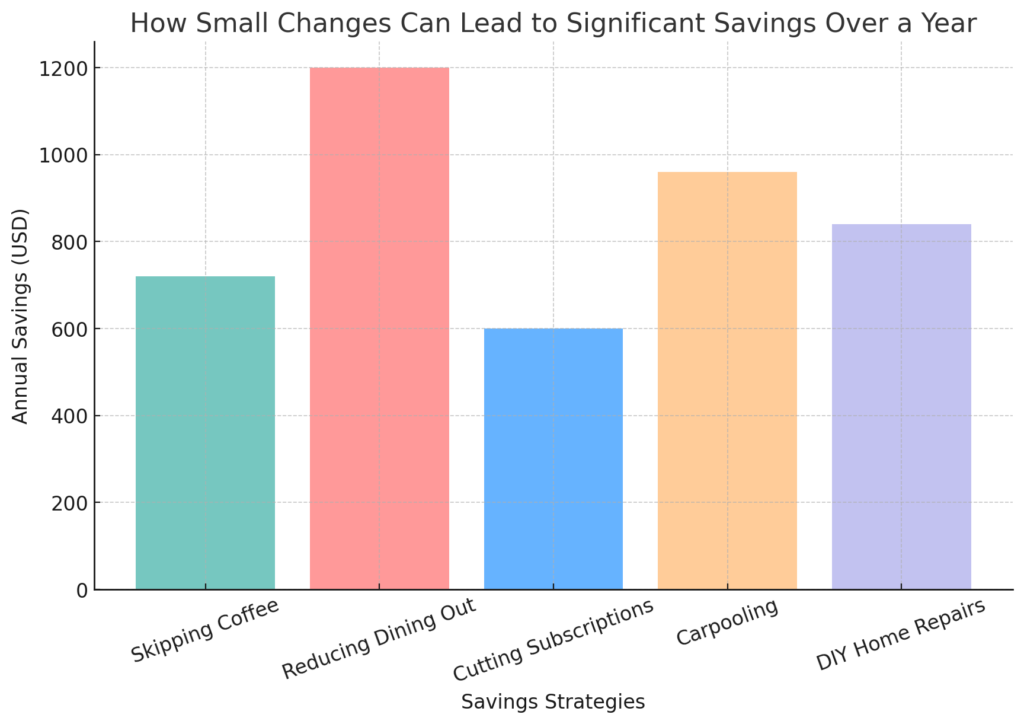

- Cutting down on unnecessary expenses

- Adopting frugal living techniques

Tools and Resources to Help You Save More Effectively

- Recommended budgeting apps like Mint, YNAB, and PocketGuard

- Investment options for long-term savings growth

- Financial advisors vs. DIY financial planning

Building a Mindset for Long-Term Financial Success

- Developing financial discipline

- Staying motivated through progress tracking

- Celebrating small financial wins

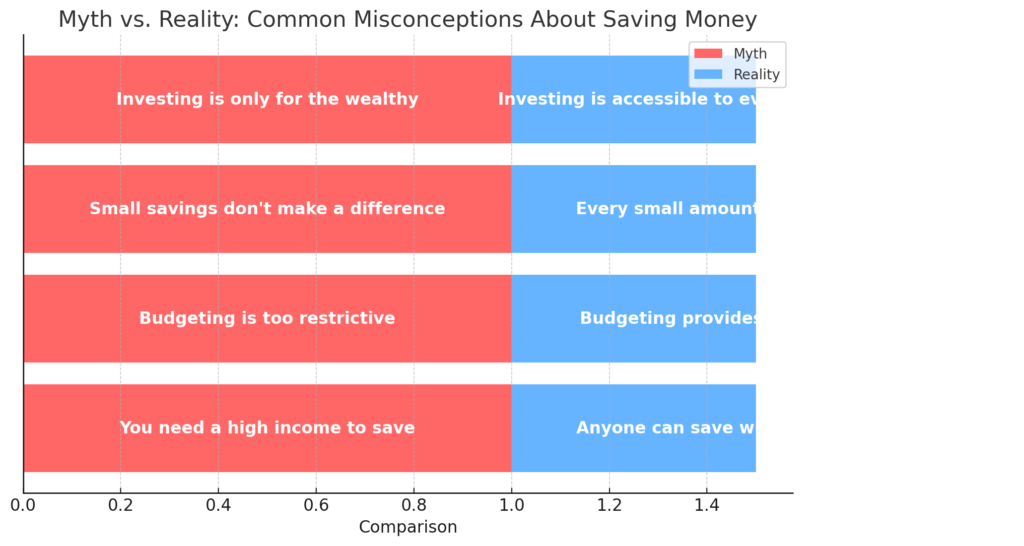

Common Myths About Saving Money Debunked

- “I need a high income to save money”

- “Small savings don’t make a difference”

- “Budgeting is too restrictive”

Conclusion

In conclusion, understanding why most people fail at saving and how you can succeed is crucial to achieving financial well-being. Many individuals struggle due to a lack of financial literacy, impulse spending, and inadequate budgeting, but adopting the right strategies can make a significant difference. By setting clear financial goals, automating savings, and creating realistic budgets, you can build a secure financial future. Remember, saving money is a long-term commitment that requires consistency and discipline. Start small, stay motivated, and gradually increase your savings efforts over time. If you found this article helpful, take action today by reviewing your current savings habits, sharing this post with friends, or exploring additional financial planning resources. Why most people fail at saving and how you can succeed depends on your ability to make informed decisions and stay committed to your financial goals. [FinansieraTrading.com]

Final Thought: Saving money doesn’t have to be complicated. With the right mindset, strategies, and tools, anyone can achieve financial stability and security.