What to Include in a Monthly Financial Checklist for Retirees is essential for maintaining a secure and stress-free retirement. Managing finances after retirement requires careful planning, ensuring your income lasts and supports your desired lifestyle. Without proper financial oversight, retirees may face unexpected challenges that could impact their quality of life.

This guide outlines a step-by-step approach to keeping your financial health in check every month. From budgeting and tracking income to monitoring investments and reviewing estate plans, following this checklist will help you make informed financial decisions. By staying proactive with your finances, you can enjoy retirement with confidence and peace of mind.

Table of Contents

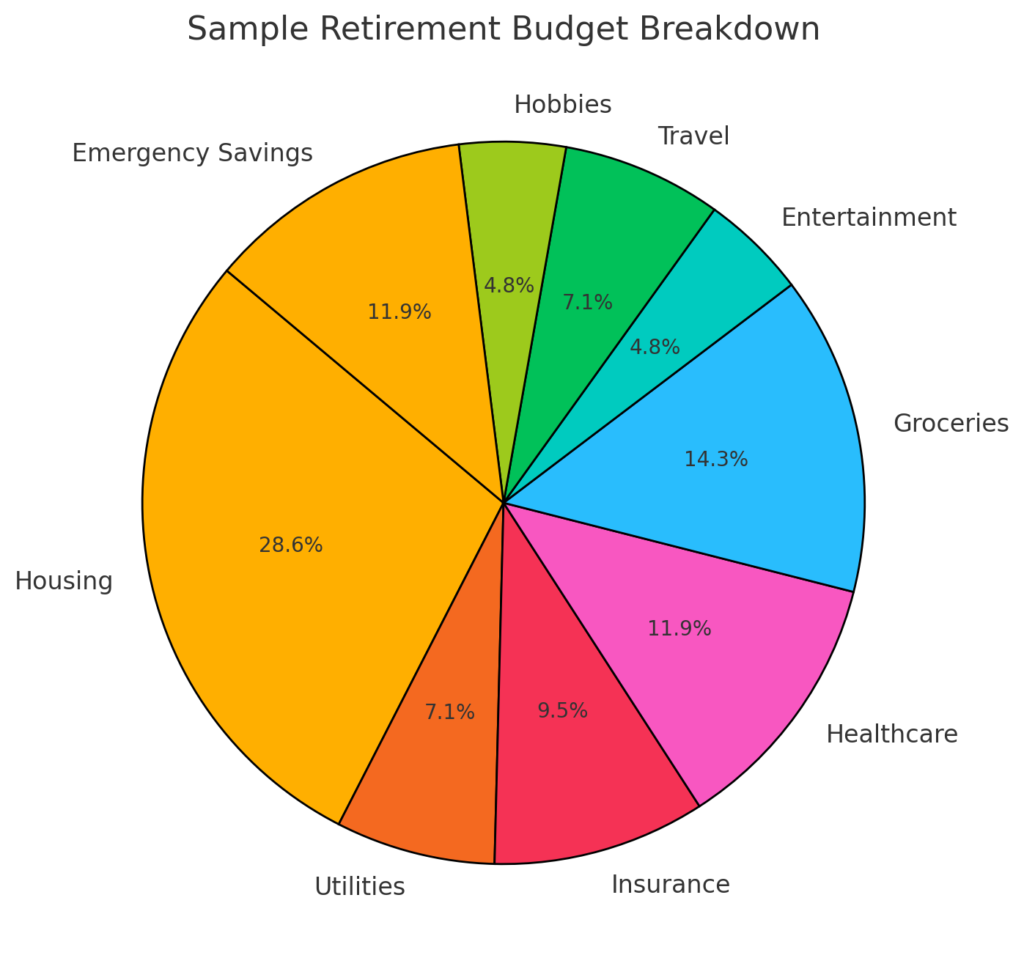

Review Your Monthly Budget

Maintaining a retirement budget is crucial for financial stability. Regularly tracking expenses ensures you live within your means and avoid unnecessary spending. Compare your actual spending with your planned budget to identify areas where adjustments are needed.

- Fixed expenses: Housing, utilities, insurance, and healthcare costs

- Variable expenses: Groceries, entertainment, travel, and hobbies

- Emergency fund review: Ensure you have at least 6–12 months of essential expenses covered

Track Income Sources

Retirees often have multiple income streams, such as Social Security, pensions, annuities, and investment withdrawals. Each month, verify that these income sources are correctly deposited and align with your financial plan.

- Social Security and pension deposits

- Required Minimum Distributions (RMDs) from retirement accounts

- Passive income from real estate or investments

Assess Investment Performance

A well-diversified portfolio helps maintain financial health in retirement. Each month, check your investment accounts to ensure they align with your risk tolerance and financial goals.

- Review stock market trends and portfolio performance

- Adjust asset allocation if needed

- Consult a financial advisor for investment strategy updates

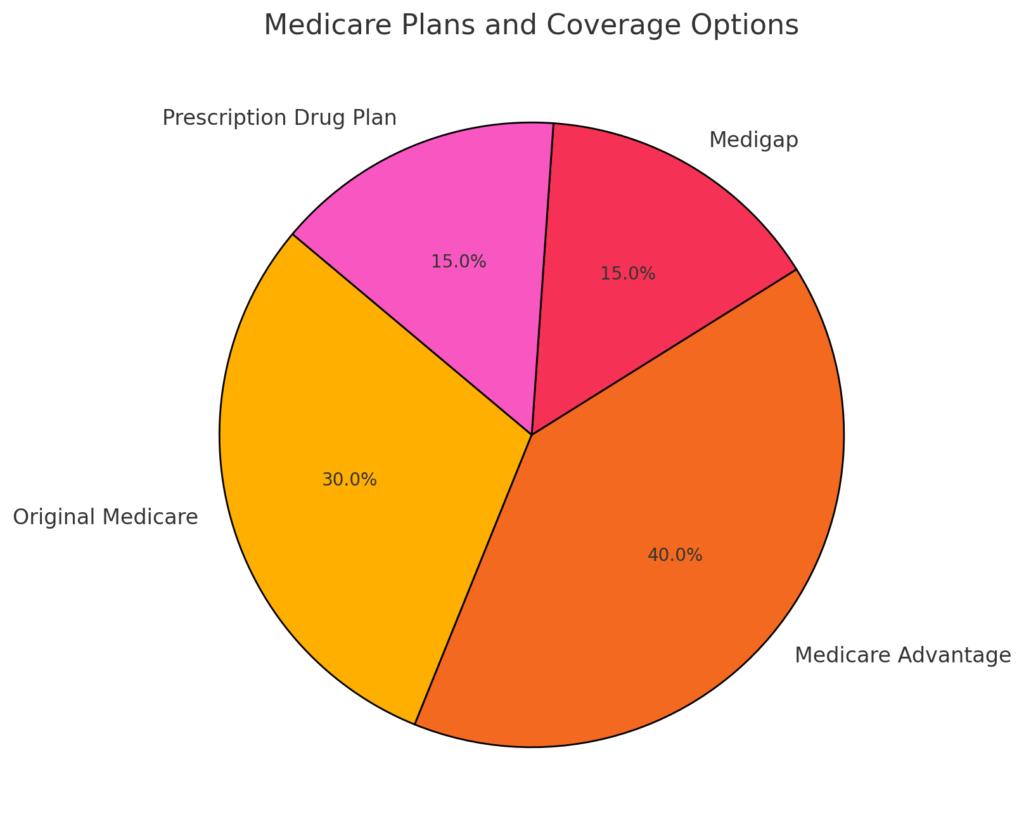

Monitor Healthcare and Insurance Plans

Healthcare expenses can significantly impact a retiree’s budget. Reviewing medical coverage and insurance policies monthly helps avoid unexpected costs.

- Verify Medicare and supplemental insurance coverage

- Track prescription drug costs and discounts

- Check upcoming medical appointments and expenses

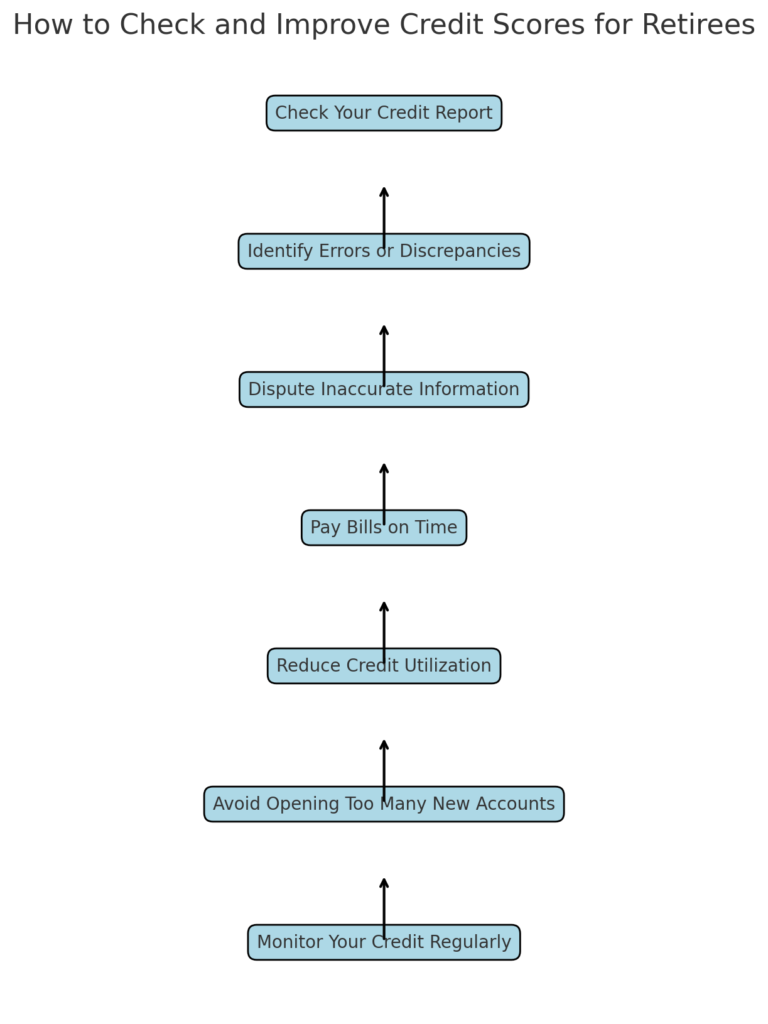

Review Debt and Credit Reports

Debt can burden retirement finances. Monthly credit report reviews ensure financial security and protect against fraud.

- Pay off credit card balances and other debts promptly

- Monitor credit score for unusual activity

- Consider debt consolidation if necessary

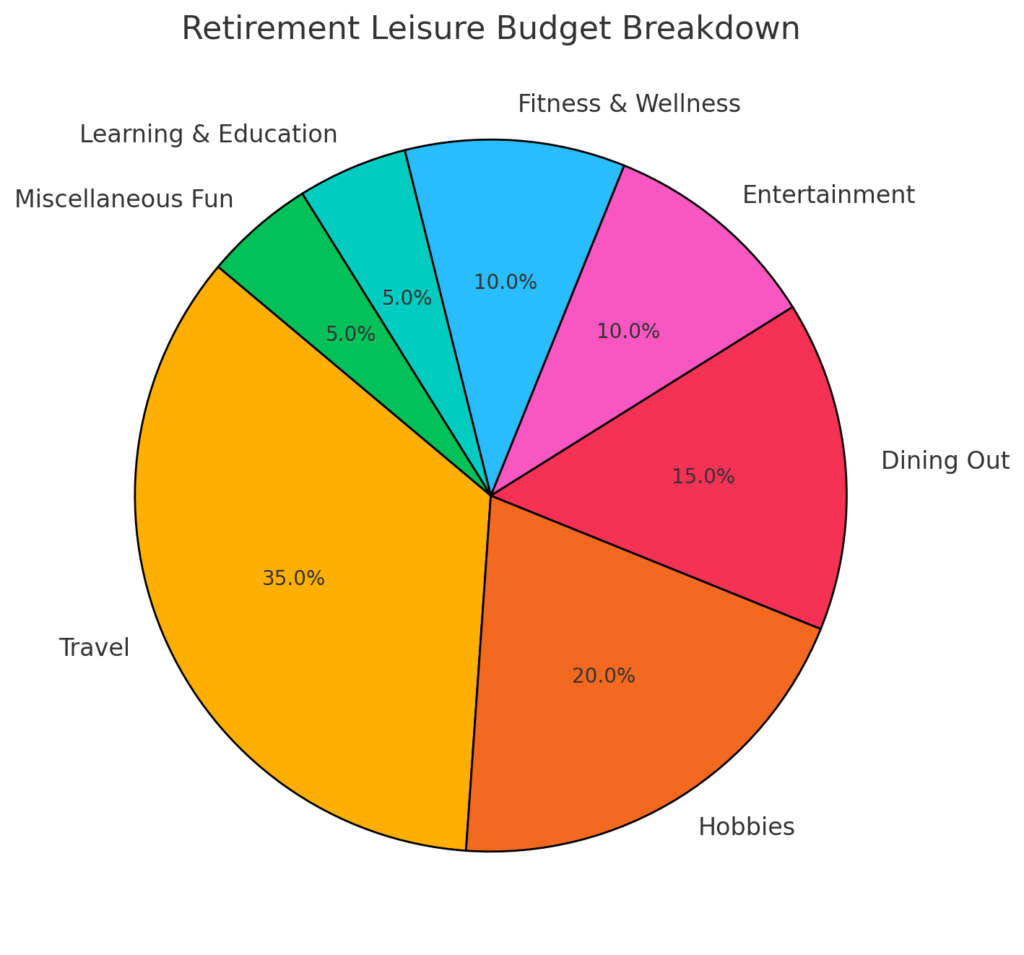

Reevaluate Discretionary Spending

Retirement is about enjoying life while managing expenses wisely. Analyzing discretionary spending ensures you allocate funds to activities that bring value.

- Assess spending on hobbies, travel, and entertainment

- Look for cost-saving alternatives

- Identify unnecessary subscriptions or memberships

Update Estate Planning Documents

Estate planning ensures that your assets are distributed according to your wishes. Monthly reviews keep documents up to date.

- Verify will and trust documents

- Ensure beneficiaries on accounts and insurance policies are current

- Discuss estate plans with family or a legal advisor

Set Monthly Financial Goals

Setting financial goals helps retirees stay on track with their money. Each month, define short-term and long-term financial priorities.

- Build an emergency savings cushion

- Plan for an upcoming major purchase or trip

- Reduce discretionary spending to increase savings

Goal-Setting Tracker for Retirees

| Financial Goal | Action Steps | Target Completion |

|---|---|---|

| Increase Emergency Savings | Allocate 10% of monthly income to savings | 1 Month |

| Reduce Discretionary Spending | Cut down on non-essential expenses like dining out | Ongoing |

| Review and Adjust Investments | Assess portfolio and rebalance investments if needed | Quarterly |

| Pay Off Credit Card Debt | Pay more than the minimum balance on credit cards | 3 Months |

| Maximize Retirement Account Contributions | Contribute the maximum allowed amount to 401(k) or IRA | Yearly |

| Monitor Credit Score | Check credit report and dispute any errors | Monthly |

| Plan for Major Expenses | Budget for upcoming travel or home improvements | 6 Months |

| Review Estate Planning Documents | Ensure wills, trusts, and beneficiary designations are up to date | Yearly |

Final Thoughts

A well-maintained monthly financial checklist ensures retirees stay financially secure and enjoy peace of mind. By consistently reviewing budgets, income, investments, healthcare, and estate planning, retirees can confidently manage their finances and make informed decisions for a comfortable retirement.

Conclusion

Mastering your monthly financial checklist as a retiree is a journey of small, intentional steps. By regularly reviewing your budget, tracking income sources, managing investments, and staying on top of healthcare expenses, you can secure a stress-free retirement. Remember, financial stability in retirement comes from consistency and informed decision-making.

Take charge of your financial future today by implementing these key strategies. If you found this checklist useful, share it with fellow retirees, and explore additional resources on NerdWallet to enhance your financial literacy. Have a question or a tip to add? Leave a comment below—we’d love to hear from you!