Why Millennials Are Redefining Retirement (And What You Can Learn from Them)

Millennials are revolutionizing the concept of retirement, breaking away from the traditional “work until 65” model to embrace a more flexible, balanced, and purpose-driven approach. This generation is prioritizing experiences, financial independence, and mental well-being over the rigid structures of the past. By adopting innovative strategies like micro-retirements, side hustles, and early investments, Millennials are creating a new blueprint for retirement that future generations can learn from.

In this article, we’ll explore how Millennials are redefining retirement, the key trends driving this shift, and actionable lessons you can apply to your own life.

Table of Contents

The Rise of Micro-Retirements

One of the most groundbreaking trends among Millennials is the concept of micro-retirements—short, intentional breaks from work that allow individuals to recharge, pursue passions, or explore new opportunities. Unlike traditional retirement, which often comes at the end of a long career, micro-retirements are taken throughout one’s working life.

A 2023 report by the Pew Research Center found that 72% of Millennials believe taking extended breaks from work is essential for mental health and personal growth. This trend is fueled by the rise of remote work, freelance opportunities, and the gig economy, which provide the flexibility to step away from traditional employment temporarily.

Financial Independence: A Core Goal

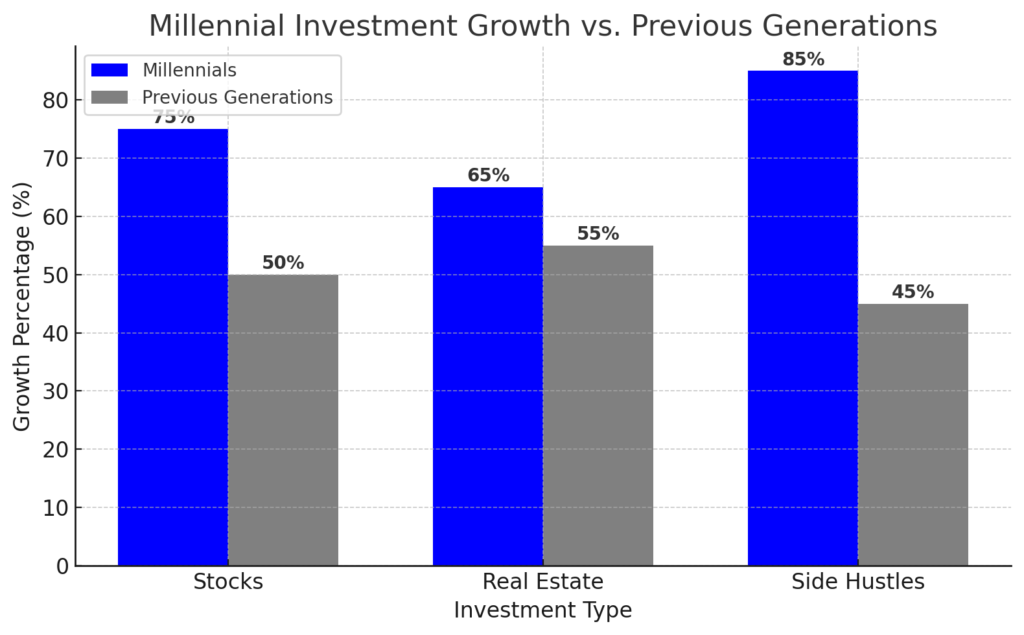

Millennials are also redefining retirement by focusing on financial independence rather than waiting for a traditional pension. Many are leveraging side hustles, passive income streams, and early investments to build wealth.

For example, platforms like Robinhood and Acorns have made investing more accessible, allowing Millennials to grow their savings even with limited initial capital. Additionally, the rise of the FIRE movement (Financial Independence, Retire Early) has inspired many to save aggressively and retire decades earlier than previous generations.

According to a study by Bank of America, 63% of Millennials are actively investing in stocks, real estate, or other assets to secure their financial future. This proactive approach to money management is a key lesson for anyone looking to achieve financial freedom.

The Role of Technology and Burnout

The modern workplace, driven by technology and an “always-on” culture, has contributed to rising burnout rates among Millennials. Many are seeking alternative paths, such as remote work, freelance opportunities, or even temporary exits from the workforce.

A 2023 survey by Deloitte revealed that 64% of Millennials feel burned out at work, with many citing long hours and lack of work-life balance as primary factors. This has led to a growing demand for flexible work arrangements and mental health support in the workplace.

For more insights on workplace burnout and how to combat it, check out this comprehensive guide by the American Psychological Association: APA Guide to Managing Burnout.

What Can You Learn from Millennials?

- Prioritize Well-Being: Millennials’ emphasis on mental health and work-life balance offers a valuable lesson for all generations. Incorporating regular breaks and setting boundaries can lead to greater productivity and satisfaction.

- Embrace Flexibility: Whether through remote work or micro-retirements, flexibility is key to adapting to the modern workforce.

- Plan Financially: Millennials’ focus on financial independence underscores the importance of saving and investing early. Tools like HSAs and socially responsible investments can help secure a stable future.

The Future of Retirement

As Millennials continue to challenge traditional norms, organizations must adapt to retain talent. This includes offering flexible work arrangements, promoting mental health initiatives, and rethinking career progression models. By embracing these changes, businesses can create a more inclusive and sustainable work environment.

In conclusion, Millennials are not just redefining retirement—they are reimagining what it means to live a fulfilling life. Their approach offers valuable insights for individuals and organizations alike, paving the way for a more balanced and resilient future. [FinansieraTrading.com]