What to include in a 5-step plan for financial independence before 50 isn’t just a question—it’s the blueprint to achieving a life of freedom and flexibility decades ahead of the traditional retirement timeline. Imagine waking up every day knowing that your financial obligations are covered, and your time is truly your own. Whether you’re aiming to retire early, switch careers without stress, or simply have more control over your life, this guide will walk you through the essential steps to make that dream a reality. From setting clear financial goals to mastering smart investing, you’ll discover actionable strategies that can help you build wealth and reach financial independence before you hit 50. Ready to take control of your financial future? Let’s dive in!

Table of Contents

1. Define Your Financial Goals and Timeline

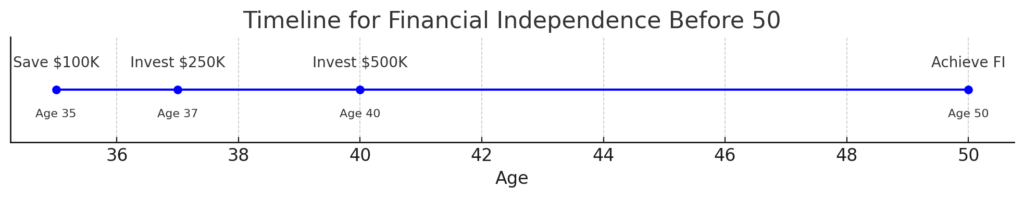

Before embarking on the journey to financial independence, it’s crucial to define what financial independence means to you. Do you want to retire early, or simply have the freedom to choose how you spend your time?

- Determine Your “FI Number”: Calculate the amount of money you’ll need to sustain your lifestyle without working. Use tools like online retirement calculators to estimate.

- Set a Timeline: Decide by what age you want to achieve financial independence. Having a clear timeline helps you stay motivated and track progress.

2. Create a Budget and Optimize Expenses

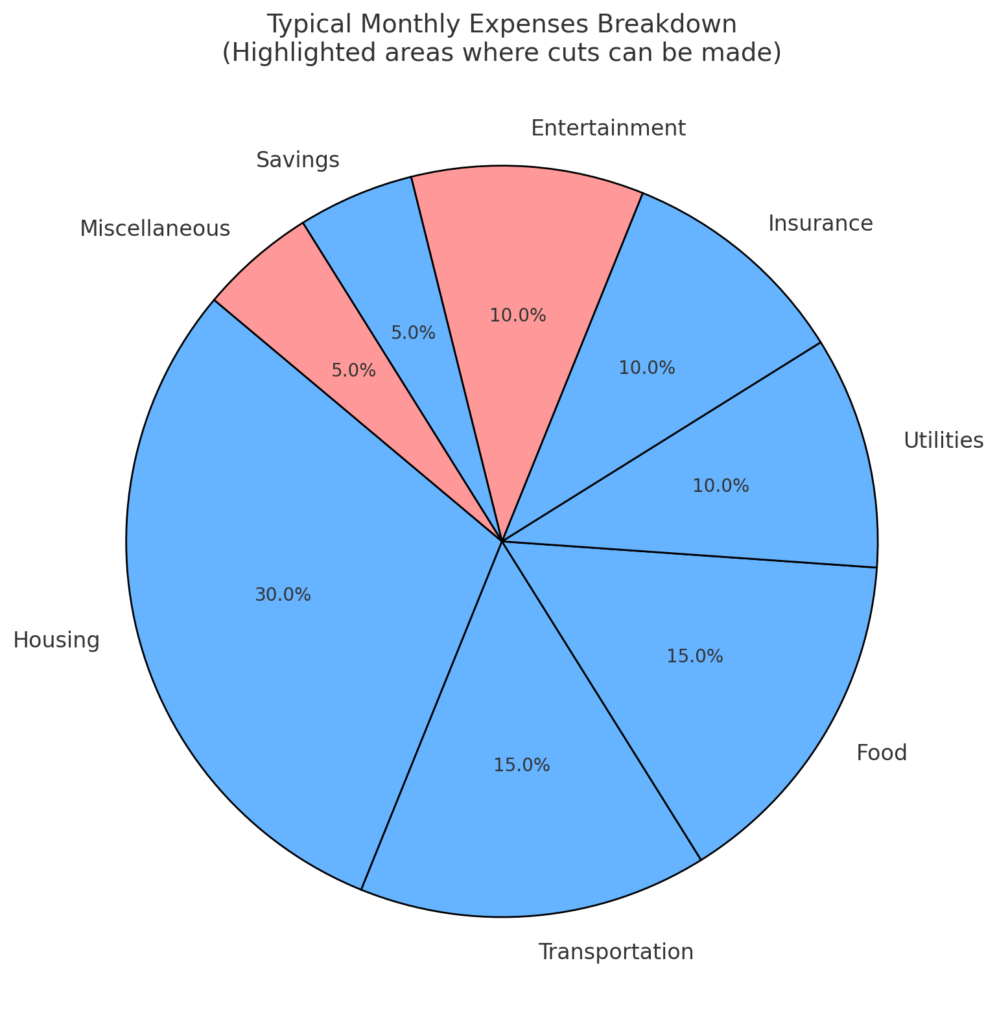

Budgeting is the foundation of financial independence. Understanding where your money goes allows you to allocate more towards savings and investments.

- Track Your Spending: Use budgeting apps like Mint or YNAB to monitor your expenses.

- Identify Areas to Cut Costs: Look for non-essential expenses to reduce, such as dining out or subscription services.

- Embrace Frugality: Adopt a minimalist mindset to prioritize needs over wants.

3. Increase Your Income Streams

While cutting expenses is vital, increasing your income accelerates your journey to financial independence.

- Invest in Your Career: Pursue promotions, negotiate raises, or acquire new skills to boost your primary income.

- Side Hustles: Consider freelance work, consulting, or starting an online business.

- Passive Income: Invest in real estate, dividend-paying stocks, or peer-to-peer lending platforms.

Side Hustle and Passive Income Ideas:

| Side Hustle/Passive Income Source | Description |

|---|---|

| Freelance Writing | Write articles, blogs, or content for websites and get paid per project or word. |

| Graphic Design | Create logos, marketing materials, or social media graphics for businesses. |

| Online Tutoring | Teach subjects online through platforms like VIPKid or Wyzant. |

| Dropshipping | Sell products online without holding inventory, using third-party suppliers. |

| Affiliate Marketing | Earn commissions by promoting other companies’ products on your website. |

| Dividend Investing | Invest in stocks that pay regular dividends for a steady income. |

| Real Estate Rentals | Purchase property to rent out for monthly passive income. |

| Peer-to-Peer Lending | Lend money to individuals or businesses via online platforms and earn interest. |

| Selling Digital Products | Create and sell eBooks, courses, or templates online for recurring revenue. |

| YouTube Channel | Monetize video content through ads, sponsorships, and affiliate links. |

4. Invest Wisely for Long-Term Growth

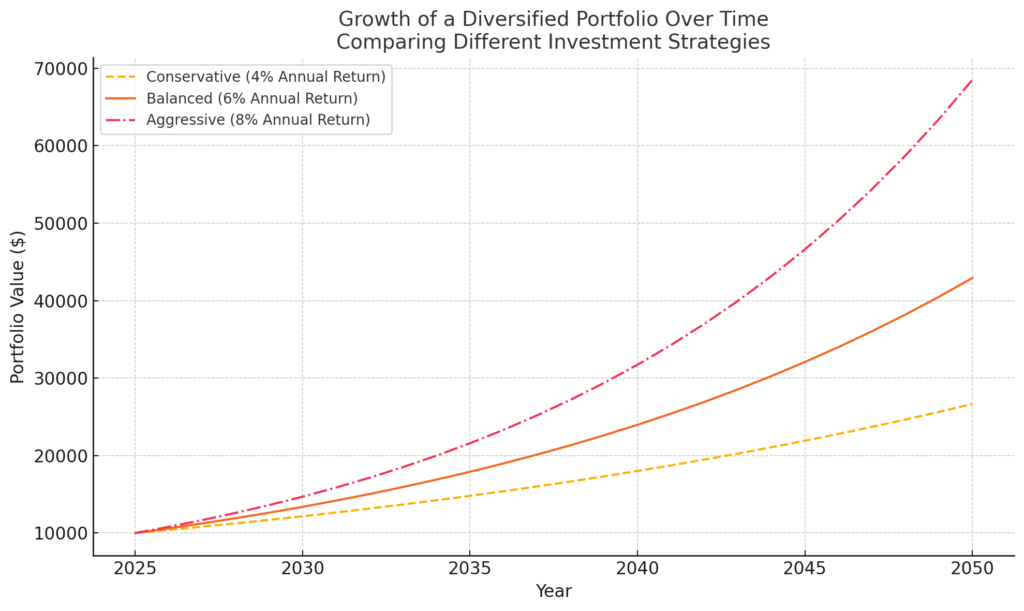

Investing is the key to growing your wealth and achieving financial independence.

- Diversify Your Portfolio: Spread your investments across stocks, bonds, and real estate to reduce risk.

- Maximize Tax-Advantaged Accounts: Contribute to 401(k)s, IRAs, and HSAs to save on taxes and grow your wealth faster.

- Adopt a Long-Term Mindset: Avoid trying to time the market. Consistency and patience are crucial.

5. Monitor Progress and Adjust Your Plan

Achieving financial independence requires ongoing evaluation and adjustments.

- Review Regularly: Check your budget and investment performance quarterly.

- Adjust for Life Changes: Be flexible and update your plan if you have major life changes like marriage, children, or relocation.

- Stay Informed: Keep learning about personal finance through books, podcasts, and reputable financial websites.

Conclusion

In 2025, achieving financial independence before 50 is more attainable than ever with the right strategies and mindset. By following this 5-step plan for financial independence before 50—setting clear goals, budgeting wisely, diversifying income streams, investing smartly, and regularly reviewing your progress—you can secure your financial future and enjoy the freedom to live life on your terms. The key is consistency and staying informed about evolving financial trends.

For more in-depth strategies, check out this comprehensive guide on financial independence.

If you found this guide helpful, consider subscribing to our newsletter for more expert tips on achieving early retirement and financial freedom. Don’t forget to share this post with friends and family who might benefit from a solid financial independence plan.

Remember, your journey to financial independence starts with a single step—start today and take control of your future! [FinansieraTrading.com]